Aja Koska/E+ via Getty Images

Investment Thesis

BRP Inc. (NASDAQ:DOOO) is a power sport vehicles manufacturer headquartered in Valcourt, Canada. In this thesis, I will mainly be analyzing its Q3 FY23 results and its future growth prospects. I will also analyze its valuation at current price levels and the stock’s upside potential. I believe a solid growth track coupled with a cheap valuation makes it a great investment opportunity, and I recommend investors to buy DOOO at current price levels.

About DOOO

DOOO is a leading manufacturer and distributor of multiple adventure sports vehicles and marine products. The company’s business can be segregated into four different segments; year-round products, seasonal products, powersports PA&A and OEM engines, and the marine segment. The year-round products segment contributes the majority of the revenue at 47%, followed by seasonal products at 38%, powersports PA&A and OEM engines at 11%, and the marine segment at 4%. The company operates under multiple brands to market products across different segments. They have a network of more than 3250 dealers globally majority being located in the North American region.

Investor Relations DOOO

Q3 FY23 Results

DOOO recently reported solid third-quarter results beating the market EPS and revenue estimates by a massive 108% and 58%. This is one of the best third-quarter results that the company has witnessed with respect to total revenues and retail sales. As per my analysis, the seasonal products segment proved to be the outperformer, with a remarkable 133% increase in the revenues y-o-y. I believe they are on a significant growth track with consistent revenue growth and a considerable increase in market share, especially in the North American region. The following amounts are in Canadian dollars (CAD).

DOOO reported total revenue of $2.7 billion, a significant 71% increase compared to $1.58 billion in the same quarter last year. I believe the primary revenue driver for the company was the increased sales volumes from both year-round and seasonal products, especially side-by-side vehicles (SSV) and personal watercraft (PWC). The increased product pricing and foreign currency rate tailwinds also contributed to the revenue increase. If we look at the segment-wise distribution of the revenue, the seasonal products segment clearly stands out with $1.02 billion in revenue, up a solid 133% compared to the corresponding quarter last year. As per my analysis, the higher demand for PWC and snowmobiles, coupled with a favorable price mix, resulted in this increase. The year-round product segment also experienced strong growth, with revenue of $1.28 billion, up 74% compared to the same quarter last year. I believe this increase can majorly be attributed to easing supply chain constraints that resulted in smoother delivery of SSV and three-wheeled vehicles (3WV). The company witnessed strong demand for products across segments, but they were facing supply chain constraints in the previous quarters that deferred delivery of the products. However, Q3 FY23 experienced an improved global supply chain that led to efficient and timely delivery of products. The powersports PA&A and OEM engines segment reported $0.3 billion in revenue, up 5% compared to the same quarter last year. The marine segment, however, was the underperformer, with the revenue declining 12.8% y-o-y to $0.12 billion. My research suggests that the overall slowdown in the boating industry led to a decline in the volume of boats sold, resulting in a revenue decline for the marine segment.

The company reported a gross profit of $654.7 million, up 59.5% compared to $410.6 million in the same quarter last year. This gives us a gross profit margin of 24.2%. The gross profit margin saw a slight decline from 25.9% to 24.2% y-o-y. I believe the inflationary headwinds resulted in increased commodity and logistics costs that resulted in this decline. But I think the company did a fairly good job in controlling the overall expenses, and in the coming quarters, we can witness improved margins with the global supply chain issues and inflationary pressure expected to ease down. The company reported diluted normalized EPS of $3.64, up $2.16 compared to the same quarter last year.

Overall, the Q3 FY23 results were quite impressive, with significant revenue growth experienced across segments. The company experiencing remarkable growth, and it is reflected in the revised FY23 guidance by them. DOOO revised the FY23 revenue estimates to $9.7-$10.1 billion and diluted normalized EPS in the range of $11.65-$12. I believe the company will achieve these targets given the consistently strong demand experienced by the company and the easing of global supply chain constraints.

Key Risk Factor

Fluctuation in commodity prices: DOOO is highly exposed to the fluctuation in the prices of commodities like steel, aluminum, rubber, and copper. A high percentage of the company’s cost of sales includes the cost of acquiring these commodities for manufacturing. Fluctuation in any of these commodity’s prices could have an impact on their financial performance. They do not engage in any hedging activity to minimize this risk. However, the company hasn’t experienced a material impact of this risk on its performance yet, but this risk should be considered before investing.

Quant Ratings and Valuation

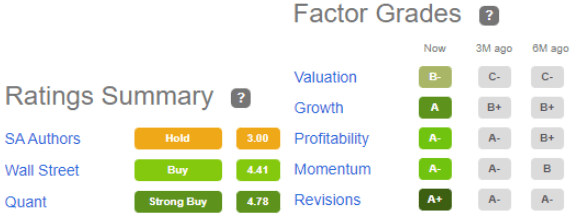

Seeking Alpha

DOOO has a Quant rating of strong buy, which reflects its strong growth potential. It has a B- grade for valuation, which has shown significant improvement over the past six months. I think that the company is undervalued at current price levels. When it comes to growth, the company has an A grade which I think is the right representation of the solid growth that it is experiencing. An A+ grade for revision reflects that the company is consistently exceeding its targets and revising future guidance. The Wall Street rating of buy represents the optimistic view of the analysts for the company’s stock price.

Seeking Alpha

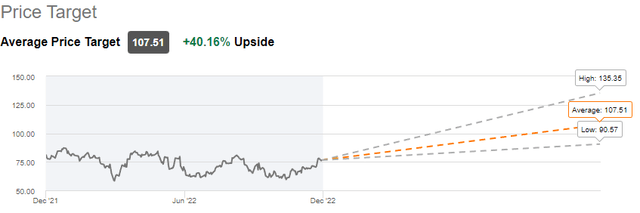

DOOO is currently trading at a stock price of $77, a YTD decline of 12%. It has a market cap of $6 billion. It is trading at a forward non-GAAP P/E multiple of 8.7x compared to the industry standard of 12.65x. This reflects that the company is undervalued at current price levels. For growth companies like DOOO, PEG ratio analysis is considered a better evaluation method. DOOO is trading at a forward non-GAAP PEG multiple of 0.19x compared to the industry standard of 1.37x, with an earnings growth rate estimate of 45%. PEG multiple below 1x is considered good for growth companies and reflects that the company is undervalued. I believe DOOO is highly undervalued at current price levels and has significant upside potential. The Wall Street analysts have an average price target of $107.5, representing a 40% upside from current price levels.

Conclusion

DOOO is on a significant growth track with strong demand across multiple business segments. The outperformance of the seasonal products segment is a big positive for the company. The easing supply chain constraints are expected to boost the company’s performance in the coming quarters. The company is trading at a cheap valuation, and I believe it is a great investment opportunity for value investors. I assign a buy recommendation for DOOO after considering all the growth and risk factors.

Be the first to comment