AscentXmedia/E+ via Getty Images

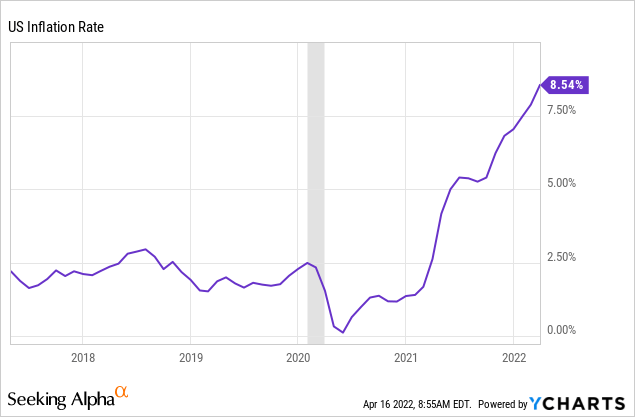

Inflation is spiraling out of control, exceeding 8% recently in the US. That complicates things for investors, as going to cash means accepting a guaranteed loss of purchasing power that is not negligible. Most of the rest of the investment options have drawbacks, such as most bonds having a fixed interest that might not even cover the inflation rate, or additional credit risk as is the case with junk bonds. That leaves equities as the least bad option, but one has to be careful since companies will be affected in very different ways. We went searching for companies that might actually benefit from inflation, and our favorite result is Brookfield Renewable Corporation (NYSE:BEPC).

Brookfield Renewable is one of the largest owners, operators, and builders of clean energy globally, with outstanding growth prospects, and inflation-linked cash flows that are supported by many years of contract life.

We believe Brookfield Renewable will tremendously benefit from inflation for a few key reasons:

1) It is the owner of long-life assets whose replacement cost will increase due to inflation

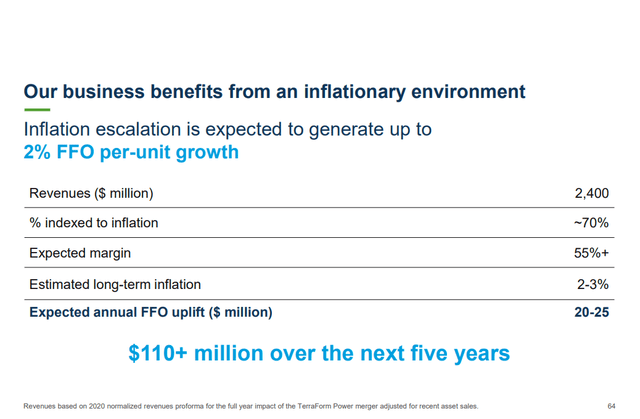

2) Around 70% of its revenue is indexed to inflation

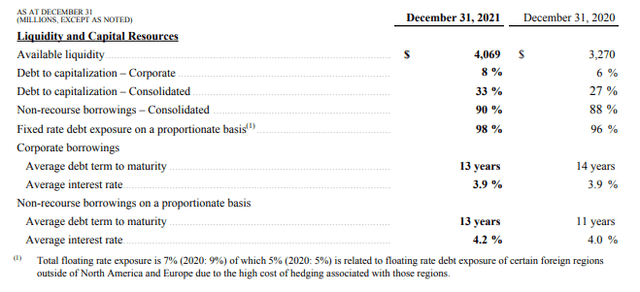

3) One of its biggest fixed costs is interest on its debt, which is more than 90% fixed interest, and of a long-term average duration of 13 years at low interest rates. Brookfield Renewable is therefore paying a negative average real interest rate at current inflation rates!

4) Its assets become more competitive versus traditional energy producing assets whose input fuel increases with inflation (e.g. gas or coal)

5) Its assets that come off contracts and its development assets will be able to renegotiate contracts at higher energy prices rates.

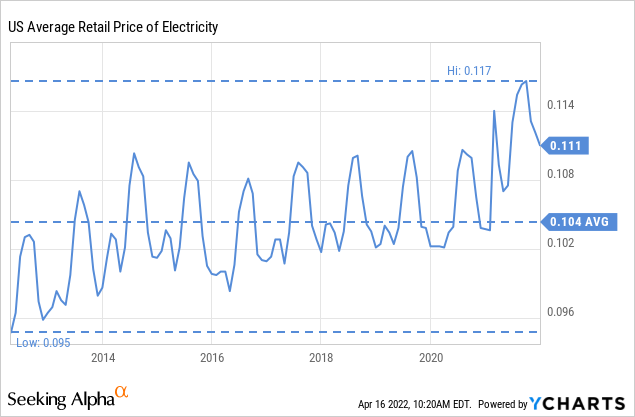

While electricity prices have been trending higher, we prefer Brookfield Renewable’s approach of indexing contracts to inflation. This increase in prices will also benefit Brookfield Renewable when it renegotiates contracts or negotiates its development assets coming online.

Tailwinds from inflation

Brookfield Renewable should benefit from inflation in several ways, the most direct being the 70% of its revenues indexed to inflation. Management shared an estimate of how much annual funds from operation (FFO) would increase with 2-3% inflation. Using the same logic we can estimate that 6-9% inflation would result in an FFO uplift of $60-$75 million. Based on the ~450 million shares outstanding of BEP and BEPC, that would mean an increase of roughly 0.13-0.17 cents per share. At the mid-point 0f 0.15 cents, that would represent a more than 10% increase to the 1.45 FFO per unit reported in 2021.

Brookfield Renewable Investor Presentation

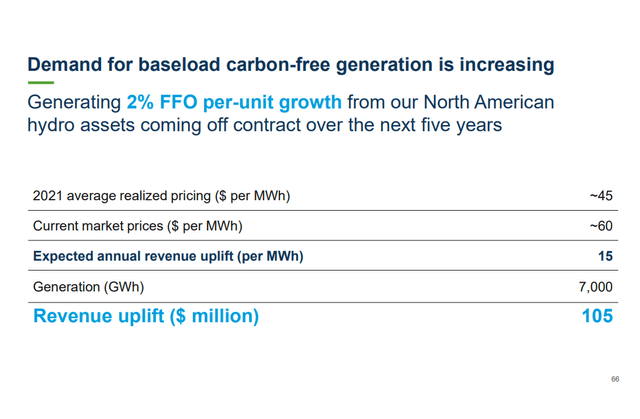

There is another inflation-related lever the company will be able to pull, which is repricing contracts that are expiring over the next few years. The company has a particularly large number of North American hydro assets with contracts expiring over the next five years.

Brookfield Renewable Investor Presentation

We believe hydropower is the premier renewable technology due to its perpetual nature and dispatchability. And while the asset classes of wind and solar are certainly growing faster, the benefits of hydro are rapidly increasing. As decarbonization continues to drive additional demand for carbon-free base-load generation the hydroelectric portfolio will continue to be a meaningful differentiator for the business. Furthermore, the dispatchable or embedded storage benefits of hydro are becoming increasingly beneficial as more intermittent renewables are added to the grid.

One of the reasons that Brookfield Renewable benefits so much from the increase in revenues due to inflation is that the cost side is not particularly affected. Renewable assets do not have the expenses related to an input fuel, such as coal or gas. Brookfield Renewable’s biggest expense is interest, which the company was very wise to structure as fixed-interest with long-term duration. Approximately 90% of the company’s financing is fixed-rate, and only 5% of its debt in North America and Europe is exposed to changes in interest rates. As can be seen below from an annual report extract, the average debt term to maturity is 13 years, with an average interest rate on corporate debt of 3.9% and 4.2% on project level non-recourse debt. The business is therefore well protected against the potential of rising interest rates, and should actually benefit from a negative real cost on debt during periods of high inflation.

Brookfield Renewable Annual Report

Growth Opportunities

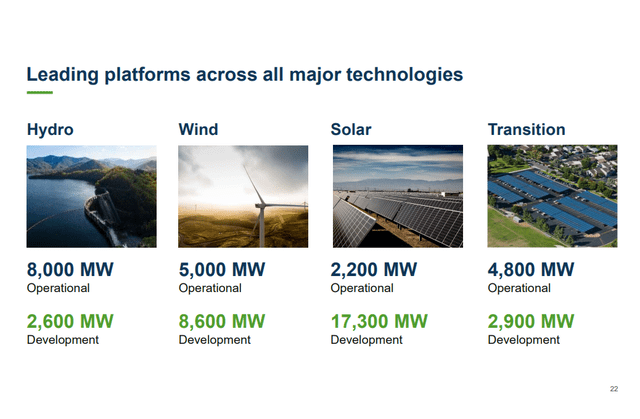

In addition to benefiting from inflation, Brookfield Renewable offers significant real growth, making an investment in the company even more attractive. It currently has an operation portfolio of ~21 GW, and an impressive pipeline of ~62 GW. This means that if the company fully develops its pipeline it can become ~4x bigger. The company can leverage its BBB+ rates balance sheet to finance this growth, and currently has ~$4.1 billion in available liquidity. It is targeting distribution growth of 5-9%.

Brookfield Renewable has leading platforms across all major technologies, of which we particularly value the hydro, which are close to perpetual assets that require little maintenance. Hydro assets also have added embedded value through their “energy storage” capabilities and suitability for base-load energy generation. Below we show the amount of operational capacity the company has for each type of technology, and the amount in the development pipeline. Currently, hydro is the largest technology, but solar is set to become the biggest one thanks to its immense representation in the development pipeline.

Brookfield Renewable Investor Presentation

There is a good chance a large portion, if not all, of the development pipeline will eventually get built, because of the enormous societal push towards reducing carbon emissions to avert the worst effects of climate change, as well as the recent focus on energy independence caused by the war in Ukraine, particularly in European countries so dependent on Russian gas.

Clean energy and electrification are the most impactful steps to achieving net zero. Decarbonization is a global imperative impacting all industries now, which might be creating the greatest commercial opportunity of our time. The number of countries with net-zero commitment has gone from 21 in 2020 to 131 in 2021. Emissions covered by net-zero commitments have increased from 30% in 2020 to 70% in 2021. Similarly companies with net-zero commitments have increased 3x in the last ten years, going from 992 in 2020 to 3,067 in 2021. All these commitments to net-zero means that an enormous amount of capital will be required to be invested in renewable assets, and this places Brookfield Renewable in an excellent position to benefit thanks to its massive renewable energy projects pipeline. Historically Brookfield Renewable has been able to grow its cash flows by 10%+ a year, but with the increased need for renewable assets we believe this growth rate is likely to accelerate in the coming years.

Brookfield Renewable Stock Valuation

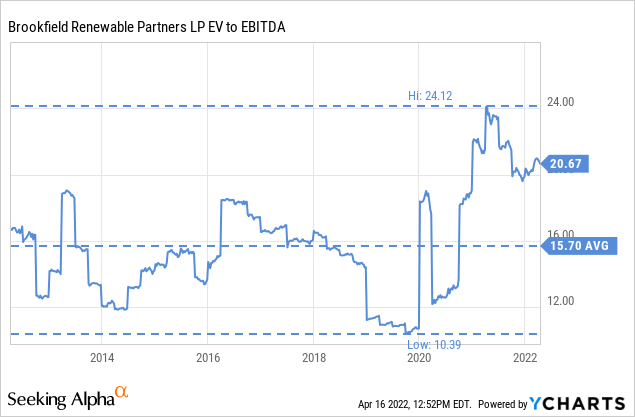

The current valuation is high but not excessive, especially when considering the current macro environment favors the company. It is trading at an EV/EBITDA of ~20x, which is about a third higher than its ten year average of ~15x.

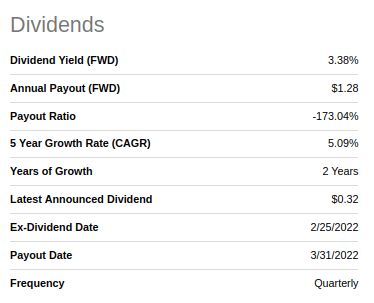

The company currently has a ~3.3% dividend yield, which is lower than its historical average. In the last ten years it has averaged ~6.3%, but we would argue that it was extremely cheap before, rather than say it is expensive now . The interest rates and inflation macro factors have changed in the last few years, and the current setup will benefit the company, so we believe a premium to historical valuation metrics is warranted.

Seeking Alpha

Risks

There are a number of risks to consider before making an investment in Brookfield Renewable, among them:

- Energy production: Some of the energy production assets are variable, there have been years with droughts that significantly impact Hydro production, there can be years with less wind impacting wind energy generation, etc.

- Power prices: A percentage of Brookfield Renewable energy production is sold at market prices, and these prices can sometimes be unfavorable.

- Financing: Brookfield Renewable has significant debt, and it has the risk that it might have problems refinancing certain debt, or that it would be forced to do so at unfavorable rates.

- Deflation: Just as inflation favors the company, deflation would adversely affect funds from operations growth.

- Low fossil-fuel prices: If fossil-fuel prices come down significantly, this could put at risk the cost advantage the company has, and might slow the development of new projects.

Key Takeaway

Brookfield Renewable is a leader across all major renewable energy technologies. It should benefit from the current high-inflation environment, and should be able to provide real growth above inflation to investors. This thanks to the macro trends of net-zero commitments by countries and companies, and to its extensive development pipeline.

Be the first to comment