bombermoon/iStock via Getty Images

Thesis

While there are many ways to invest in the energy transition mega trend, a compounding dividend, predictable inflation resistant funds from operations growth, and best-in-class management team make Brookfield Renewable Corporation (NYSE:BEPC) (NYSE:BEP) worth buying today and holding for the long term.

Energy Transition Tailwinds

To reach global net zero emissions by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around $4 trillion per year. Some analysts even estimate the cumulative investments will surpass $131 Trillion. To put that into context, the United States and Global equity markets are only worth $49 Trillion and $117 Trillion, respectively. Not to mention, since the onset of the Russia-Ukraine war, political support for domestic energy production and energy independence has accelerated, further growing Brookfield Renewable’s total addressable market.

Moving forward, momentum is building around decarbonization objectives and not just for vague and lofty multi-decade goals. Countries are creating actionable 10-year commitments backed by policy, well within my investing timeline. In fact, in the next 8 years the United States is committed to reducing its carbon footprint by 50-52% from 2005 levels.

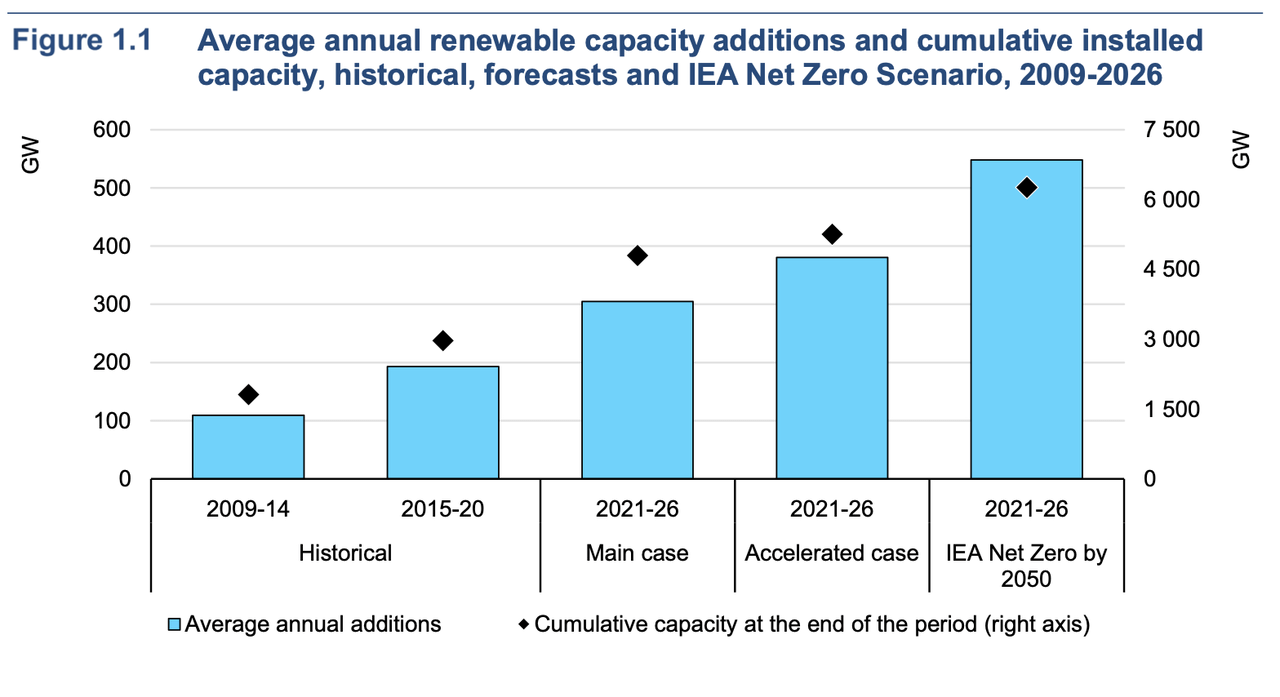

With these commitments in place, it is clear that renewable energy sources will make up a much larger slice of the overall energy generation pie. By 2026, global renewable electricity capacity is forecasted to rise more than 60% from 2020 levels. Brookfield Renewable will help both companies and countries alike meet their decarbonization goals.

International Energy Agency

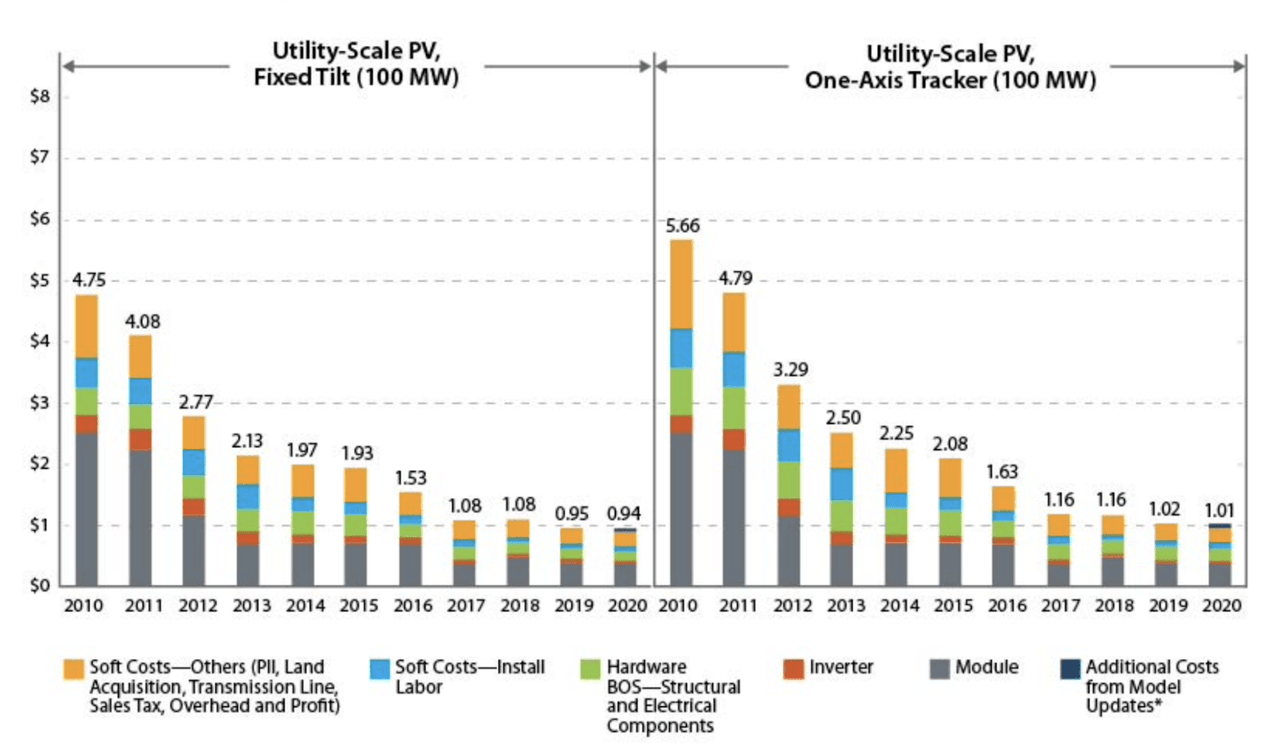

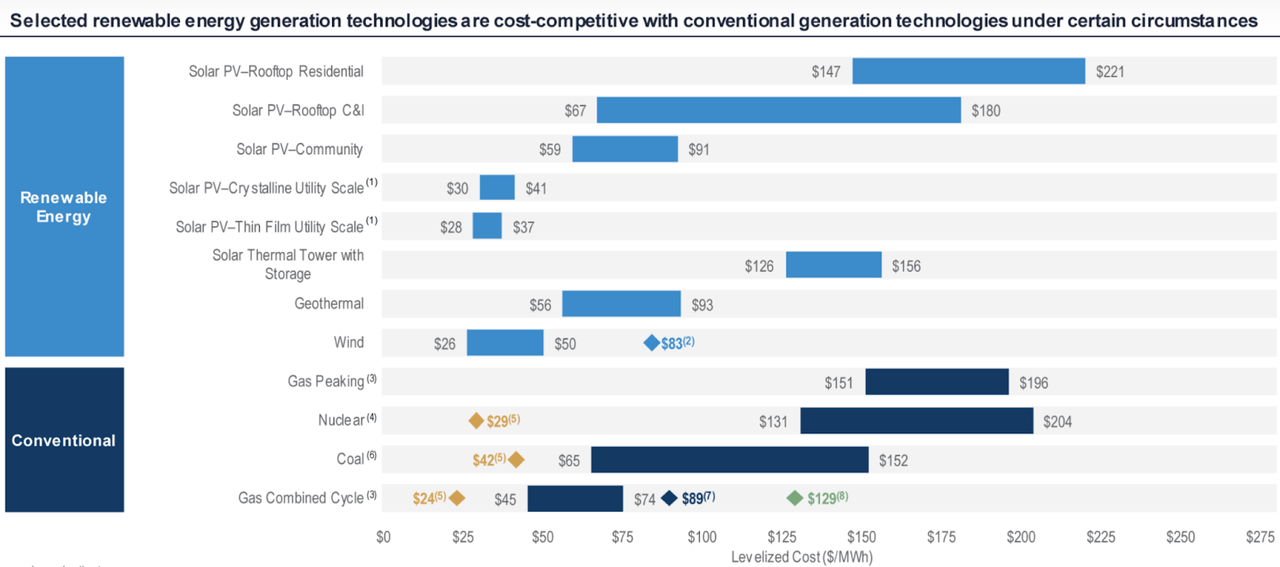

Falling costs for solar panels, wind turbines, and batteries for energy storage should continue to benefit the bottom line of this best in class renewable energy yield company.

The National Renewable Energy Laboratory

Brookfield Renewable’s Growth Prospects

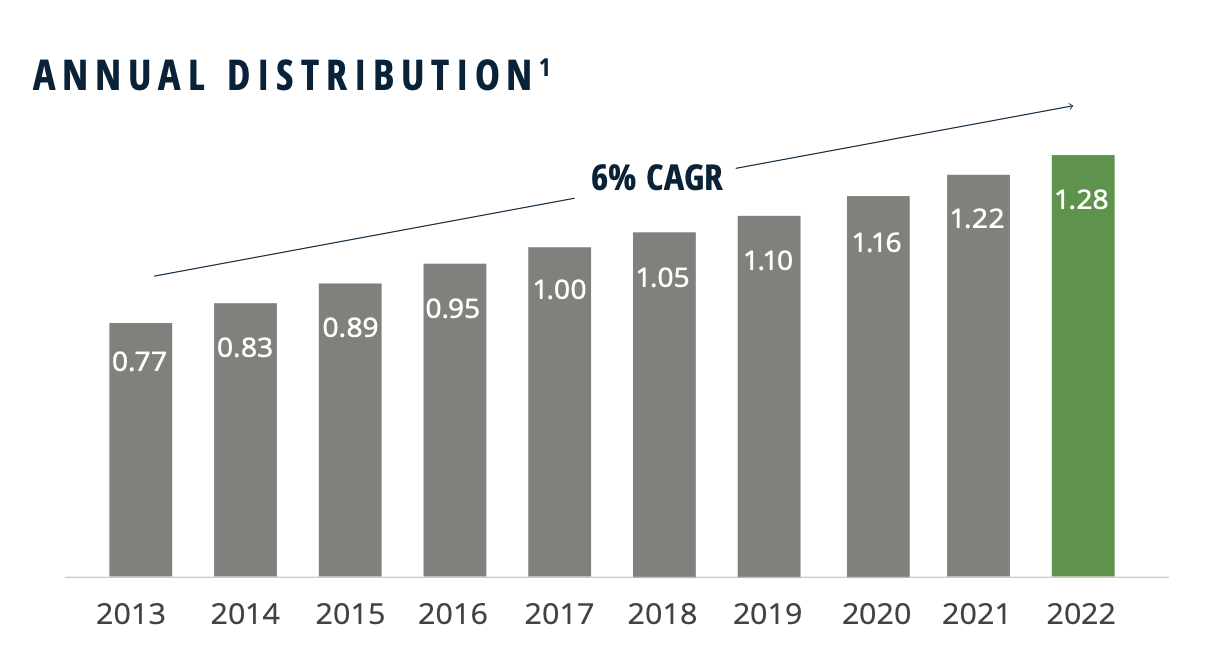

Management guides for 5-9% annual dividend growth and hopes to deliver 12-15% total returns to investors over the long term. For reference, the historical compound annual growth rate (CAGR) of their distribution is 6%, increasing from $0.77 in 2013 to $1.28 in 2022.

Brookfield Renewable

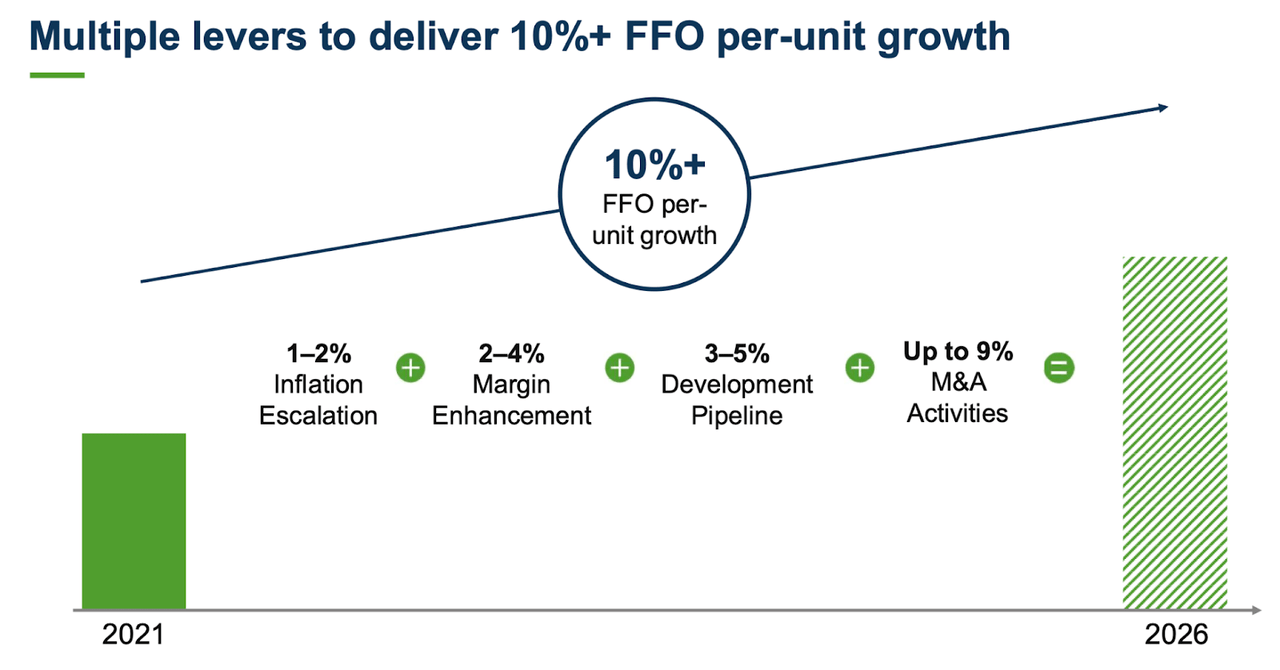

Management hopes to achieve 10-20% FFO growth through 2026 by utilizing inflation escalations in their contracts, margin enhancement strategies, executing on their development pipeline, and through mergers and acquisitions. I believe their goals are achievable. For reference, in the most recent quarter Brookfield Renewable reported FFO of $243 million or $0.38 per Unit, an 18% increase.

What’s more, their revenue is predictable and secure. Brookfield Renewable has an average power purchase agreement of over 14 years. This incredible insight into the future makes me a more confident investor in the business.

Brookfield Renewable

Inflation Resistant Revenue

Around 70% of Brookfield Renewable’s revenue is indexed to inflation. Management believes these escalators will support 1% to 2% annual funds from operations (AFFO) growth. The compounding effect of their inflating revenue streams relative to their low interest debt, should drive meaningful operating leverage across their business. Additionally, Brookfield Renewable has minimum exposure to the rising interest rate environment because of its 98% fixed-rate financing.

Margin Enhancement

Management expects to achieve 2-4% AFFO growth through margin enhancement. BEPC can improve their margins by repowering existing wind farms to maximize wind energy generation from those sites. By the end of 2022, management expects to repower Shepherds Flat wind farm, the largest onshore wind farm in the United States, increasing total energy generation by 25%.

Development Pipeline Execution

In the Q1 2021 earnings call, CEO Connor Teskey stated they have 69,000 megawatts of capacity in the development pipeline. For reference, Brookfield Renewable has 20,700 megawatts of capacity online. If they can execute on the projects in their development pipeline, they will more than triple their capacity. Brookfield’s development pipeline should provide 3% to 5% of additional AFFO growth.

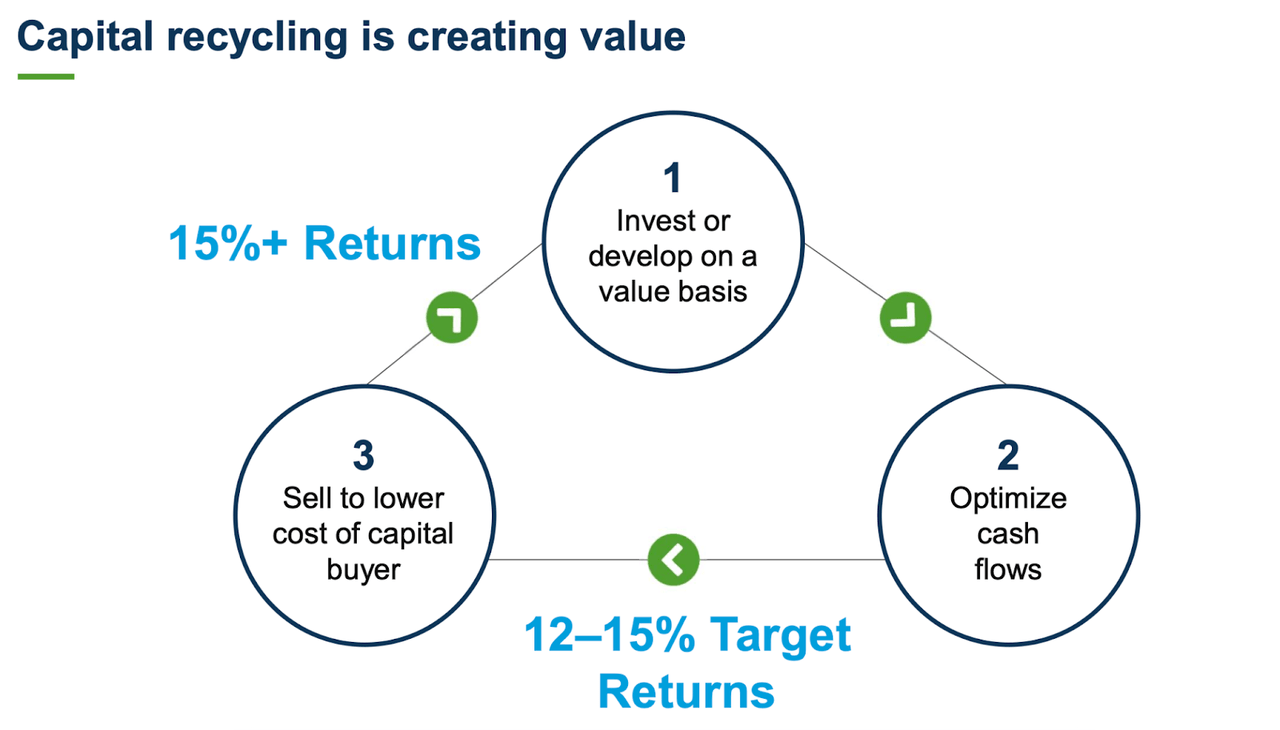

M&A and Asset Recycling

Brookfield Renewable will derive approximately 9% of its growth through mergers and acquisition activity fueled by capital or asset recycling. They buy assets at a lower multiple, manage them well, achieve a payback on their capital and a desired FFO, and sell them at a higher multiple in the future when their target FFO is no longer viable. Their BBB+ investment grade credit rating and connection to Brookfield Asset Management (BAM) allows them to obtain the ample liquidity needed for such a task. They currently have just shy of $4 billion of total available liquidity providing significant flexibility to fund growth.

Asset Recycling (Brookfield Renewable)

A Sharp Management Team

BEPC’s management team has decades of experience owning and operating renewable energy generation assets. They are part of an elite family of well-run, market beating companies including Brookfield Infrastructure (BIP) and Brookfield Asset Management. The CEO of Brookfield Renewable, Connor Teskey, has been with the Brookfield family for over a decade. In addition to his role as CEO, Mr. Teskey is also the head of BAM’s European division. Brookfield Renewable’s close association with Brookfield Asset Management is priceless. With an $83 Billion market cap, BAM is the biggest alternative asset manager in the world. They can feed BEPC’s development pipeline with unique, lucrative opportunities.

BEPC Versus BEP

Brookfield Renewable Corporation and Brookfield Renewable Partners are economically equivalent stakes of the same business and have equivalent dividend or distribution payments on a dollar basis regardless of share price. BEPC typically trades at a slight premium to BEP resulting in a small difference between their percentage dividend yield. Their current yields are 3.75% and 3.78%, respectively.

TradingView

BEPC trades at a premium to BEP because it has a broader investment base. The corporate shares can be held in IRAs, indexes, and pension funds without the tax complications of a master limited partnership (MLP). BEPC is a corporation that issues a 1099 while BEP is a partnership that issues a K-1. Within an IRA, MLP income of over $1,000 annually can be taxable as it is considered unrelated business taxable income (UBTI). Fortunately for investors, BEP has no UBTI so it could be held in an IRA. However, you still have to deal with the extra K-1 form.

To avoid the potentially complicated tax headache of the limited partnership and to take advantage of liquidity from pension and index funds, I recommend paying the small premium to buy shares of BEPC rather than units of BEP. Plus, it is currently only trading at a 2% premium which is historically low. For example, in December 2020 it traded at a 44% premium.

The Fossil Fuel Caveat

While I am a fervent believer in the need for renewable energy, I understand that fossil fuels are necessary now and, for perhaps, decades to come. As seen below, coal and gas are still cost competitive with many renewable energy sources like geothermal, residential solar and rooftop solar. Fortunately for BEPC, wind and utility scale solar, the sectors which they are growing the fastest, are now cheaper than coal and gas.

Energy Generation Costs (Lazard)

Bottom Line

As renewable energy generation costs continue to decline and investment in the clean energy transition accelerates, Brookfield Renewable Corporation will stand to benefit. Investors looking for an inflation resistant growth company with a compounding dividend should consider buying and holding shares of BEPC today.

Be the first to comment