CHUNYIP WONG

Introduction

Preferred shares have long been a staple for income oriented investors. They pay a dependable, relatively high yield compared to bonds that is pretty much guaranteed as long as dividends on the common get paid. And companies like them because they get treated as equity-like by rating agencies thanks to their structural subordination.

However, that high yield compared to similar bonds is not only compensation for being subordinated but also expresses a compensation for a risk that the holder of the preferred takes should rates change dramatically. This applies to fixed rate preferred only – not to variable rate ones. I will focus on the former, as many income investors like to lock in a reliable yield and dislike being exposed to interest rate volatility and changing income levels. I will first describe those risks and then focus the article on a set of securities from Brookfield that currently seem to offer the best of all worlds and provide an opportunity to lock in adequate yields for the long term.

The Preferred Dilemma

Unlike a bond with a fixed maturity the typical preferred offers a certain yield, has no set termination date but can generally be called at par by the issuer. With relatively stable rates this does not seem to be much of problem. However, should rates move strongly this exposes the holder to a twofold risk.

If rates go down strongly as we have seen in recent years then the issuer can call the bond at par and refinance cheaper. For the preferred holder this unfortunately means that he gets cash which can only be put to work in a low interest rate environment. Basically, he is exposed to reinvestment risk.

If rates go up strongly as we experience it right now the problem is that the preferred (“pref”) is suddenly yielding well below market and there is no incentive for the companies to buy them back at par. To adjust for the low nominal yield the prefs will trade down in price so that the investor can only sell at a loss and is effectively locked into a very low yielding security compared to what is available in the market. With a regular bond the investor would be certain to at least get face value back at maturity and could then take advantage of the higher return environment.

In the current environment, with a normalizing monetary policy, the jury is out where we will end up in a few years’ time. Maybe inflation will prove stubbornly high and we will have a high rate environment like the 70s for a long time. Or the Fed manages to control inflation, quite likely at the cost of a recession, and the 40-year-old trend of declining rates continues once again after a short period of higher rates.

Investment Thesis

Get the best of all worlds with BPO prefs

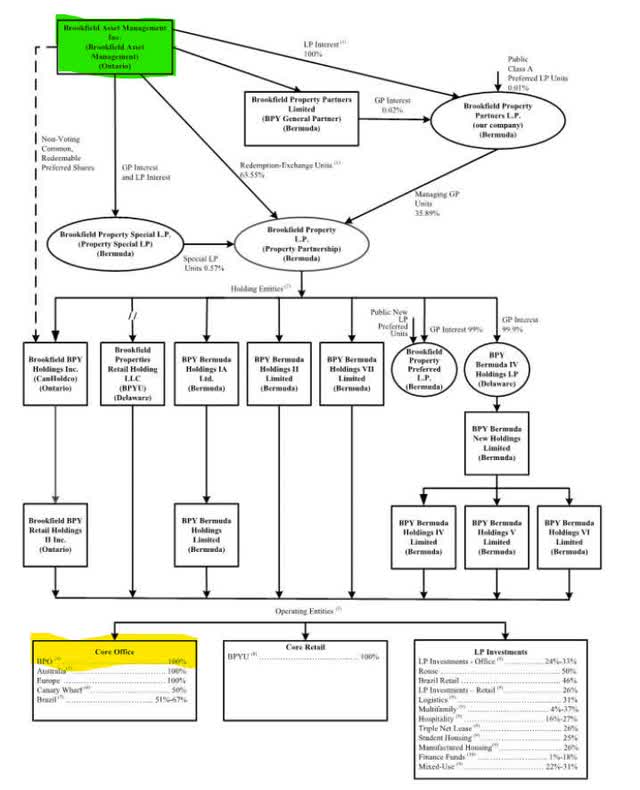

Luckily, not all preferred are created equal and there are some that currently offer an intriguing investment opportunity that should mostly shield the investor from both risks mentioned above. One set of such preferred is hidden deep within the maze that the Brookfield organization is. Brookfield Asset Management Inc. (BAM) is the green controlling entity at the top, and BPO (that holds a collection of office properties) is the issuing entity at the bottom of the chart.

BPO within Brookfield after taking BPY private (20-F filing by Brookfield Property Partners L.P. for 2021)

What makes some of the prefs of that entity so special? In short they do have a regular reset feature that aligns the dividend paid by those prefs to align with the interest rate environment that is prevailing at the reset date. Therefore if we enter a higher for longer environment yields on those securities will adjust their payouts upwards. The benchmark is the 5 year Canadian government bond yield. That rate reset, however, only happens every five years and several of those issues just had their reset when bonds were not as high as they are now. This led to a negative price action that has those issues trading well below par right now.

In addition to a regular reset, those prefs also sport a floor. That is a minimum yield irrespective of where the Canadian government bond trades. This provides also a minimum guaranteed rate of return should the prefs not get called. They might very well be called if we return to a very low interest environment of if we even turn negative but as they trade well below par this also gives a good protection as one can realize strong capital gains in such an event. All those prefs are cumulative.

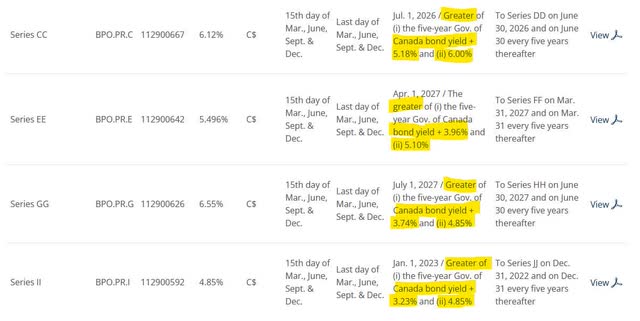

Here is an overview of those preferred securities:

BPO preferred with regular reset and floor (Brookfield web page)

The yield given in the fourth column is based on the current dividend rate at par (CA$25). With that information plus the current trading price we can now calculate several return scenarios for the different issues.

We can calculate the long term minimum yield we lock in at a given price with the following formula: guaranteed yield x25/price

Say we get a 4% guaranteed at $25 par that would mean a $1 dividend. If we only pay $20 we get a guaranteed yield of 4%x25/20 or 4%x1.25 or 5% which is exactly the $1 for the $20 we paid. Potential redemption upside is 25/price-1 or in this case 25%. This we would get on top to our ongoing yield if Brookfield decides to redeem the issue at par.

We can also calculate the current yield by using the yield numbers in the fourth column. This is what we will get for our investment until the next reset date.

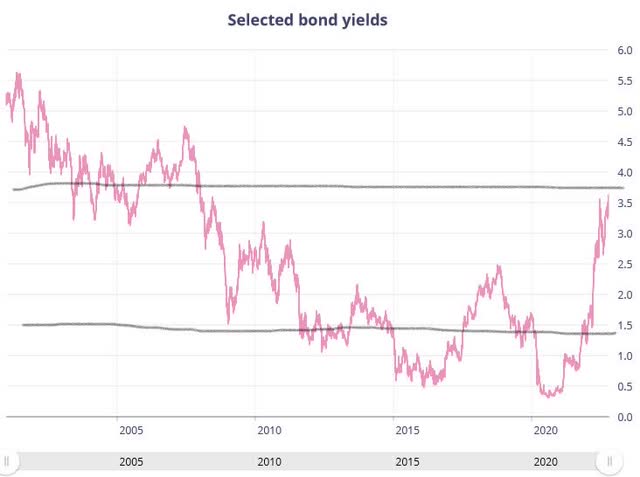

Finally we can also look at what we might get at the next reset date and also what we get with certain assumptions for long run equilibrium rates on the Canadian 5year bond. This is how the Canadian bond trades:

5 year Canadian government bonds yield (Bank of Canada)

As we can see, there was a recent pick up similar to what happened in the U.S. What might be an equilibrium level longer term? Absent of a crystal ball we will have to guess and yours is as good as mine. Personally, my working assumption is that it will return to the 1.5% level shown in the last decade as a conservative outlook and a 3.75% from the early 2000s as my upside scenario. With that data I can now calculate my minimum long term yield, my current yield until next reset, my long term basic assumption and my upside case plus my gain on an early redemption for the different issues to make a decision on which profile I do like the most if at all.

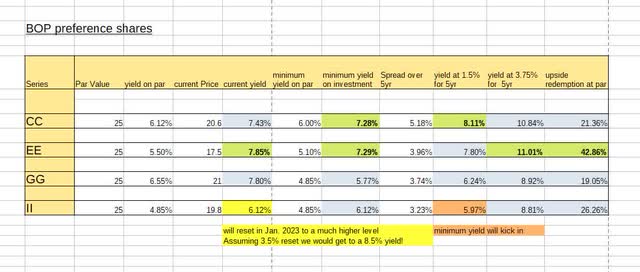

yield table overview (own calculations)

What can be seen from the table is that the current yield is not too different with the exception of issue II, which reprices in January and, therefore, trades already higher in anticipation of this. If we then look at the different scenarios, it seems to me that issue EE comes out on top or very close to it for most of them. It is a bit weaker than CC for the low yield scenario as the spread over the bond yield much lower. However as soon as we get into guaranteed minimum yield territory both CC and EE yield the same but with EE providing a better upside in case of a redemption.

That said, CC has a higher likelihood of being taken out as they are more costly for the issuer. Overall I feel that series EE (TSX:BPO.PRE:CA) currently provides the best opportunity of those preference shares.

Is it a good investment right now?

How good a deal is it? I do actually own the EE issue that I bought during the COVID crisis at lower levels than it currently trades. I do like the regular income it provides me, which unfortunately made me miss the opportunity to sell them close to par. But would I buy more now?

Brookfield describes BPO as follows:

BPO’s profile (Brookfield )

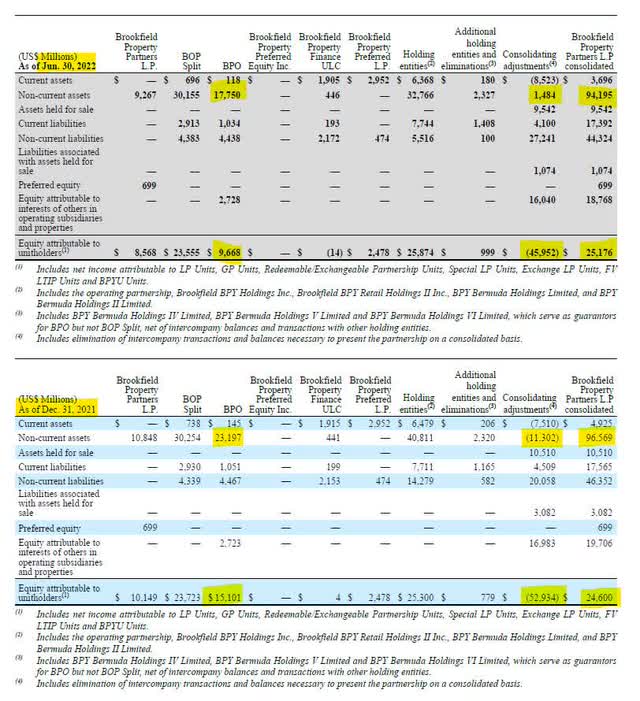

You can find a list of their properties here, and they mostly do seem to be of high quality at top locations. Not all of Brookfield’s trophy office properties are within BPO, though. Some, like Canary Wharf, are outside. Unfortunately, proper financial information is hard to come by. You can view their SEDAR filings here. In their latest filing from August 8th they give us the following data:

Brookfield Property Partners filing from August 8th 2022 (SEDAR)

We see that non-current assets have gone from $23bn to less than $18bn in the last half year and equity of BPO has shrunk from $15bn to below $10bn whereas for the consolidated entity Brookfield Property Partners L.P. the number move much less and for equity even in the opposite direction. Therefore, it seems they made some decisions on the scope of consolidation and in which entity certain assets are located. And fair enough, Brookfield is in the end in total control of those things.

There is little one could do should Brookfield decide to move the highest quality buildings out of BPO. It does, however, seem that preference shares are also guaranteed by several other companies which provides some protection. While Brookfield could theoretically rip off holders of their preferred securities, I consider this extremely unlikely. Although Brookfield is famous for reorganizing their empire, Brookfield also relies heavily on cheap funding and preference shares throughout their different activities.

I am not aware that they have ever not honored their obligations there. Should they do something sinister, rating agencies would not look kindly on this, and consequently Brookfield has a lot to lose but not that much to gain. Therefore, I do believe the risk is more based on the underlying fundamentals of their offices than any potential defraud risk. Just to clarify: I am making those comments on potential shifting of assets not to insinuate in any way that I fear or expect foul play, but rather as an explanation of why I do not try to dig deep into the published results of BPO in those filings, as I believe those can change very easily by means of reorganization which would render such a detailed analysis futile.

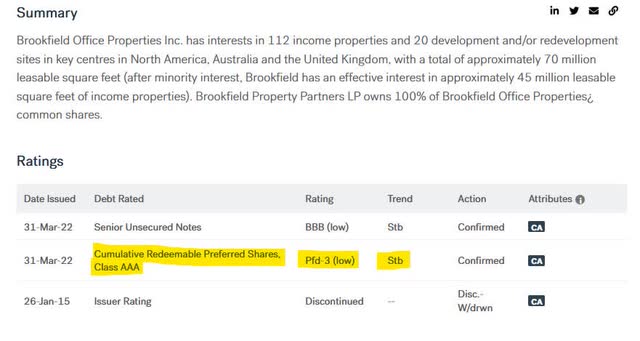

So, how do I come to a conclusion with regards to the risk involved? As we all know offices are in a difficult environment with COVID making work from home a major trend. In short, I do rely on rating agencies to get a much better insight than I could potentially have. BPO prefs get rated by the Canadian market leader DBRS Morningstar.

DBRS rating (DBRS Morningstar)

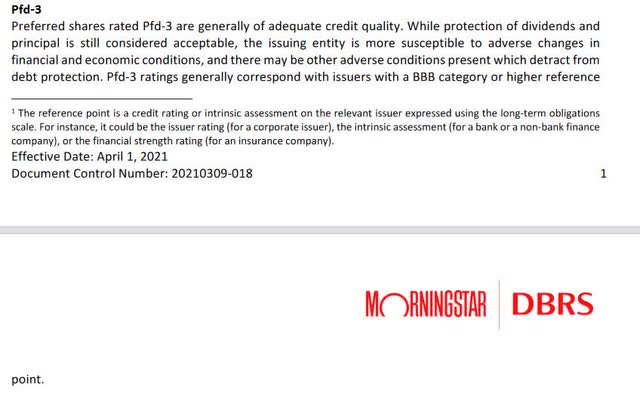

What exactly does Pfd-3 (low) with a stable trend mean? They define their rating as follows:

DBRS preferred rating methodology (DBRS Morningstar)

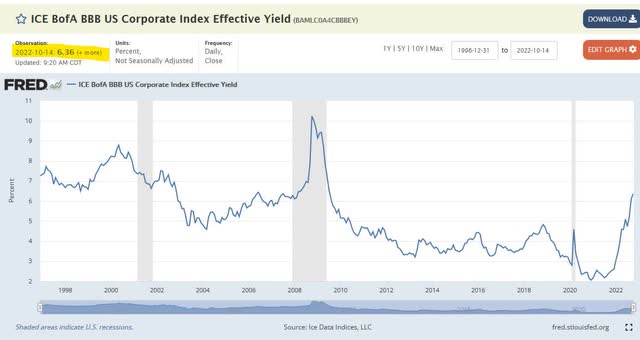

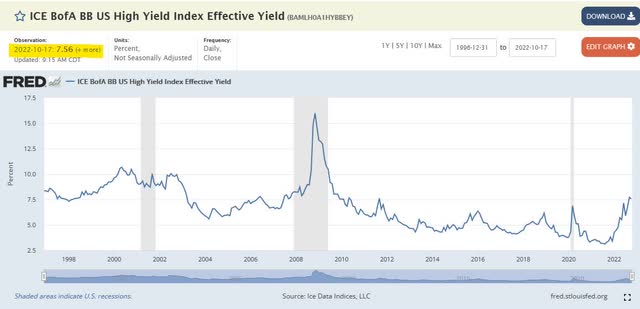

A Pfd-3 (low rating) would therefore correspond to roughly a BBB- long term rating for the issuer. Basically the lowest rank of investment grade. DBRS calls those prefs “generally of adequate credit quality” which sounds somewhat like investment grade and calls pfd-4 “generally speculative”. That would hint towards an investment grade for the prefs. However, as preferred shares are subordinated I would see them rather as BB rated than BBB- (notching down). Because of this I will look at the yield of BBB and BB bonds as my benchmark for how cheap those prefs trade but will chose BB as my main reference point. Luckily the FRED database by the St. Louis Fed provides some excellent data. This is what the yield data for BBB and BB bonds in the U.S. look like.

BBB yield data (Ice data Indices, LLC from fred.stlouisfed.org ) BB yield data (Ice data Indices, LLC from fred.stlouisfed.org )

Currently, BBB bonds yield 6.36% and BB bonds 7.56% at ten year highs. Given that data, the current and expected 7.85% yield of the Series EEs with a minimum of 7.3% and a reset potential in a higher return environment of 11% seems roughly in line to very slightly favorable compared with BB rated bonds. That said, one should also take into account that the duration is potentially forever, the office market tends to be fairly highly levered and volatile and the lack of proper financial data. Let me be clear about this: those preferred are not a high quality issue, and any investor in them takes a sizeable credit risk that might lead to permanent capital losses. In addition, there is some added FX risk due to the issues being denominated in Canadian dollars (see below).

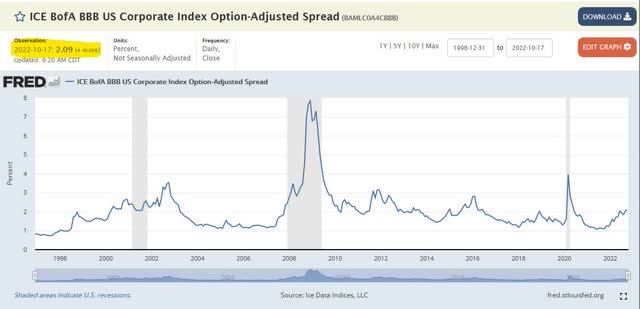

The development in overall yields is strongly driven by the underlying movement in government yields due to the Fed’s aggressive tightening. Option adjusted Spreads have recently even come in a bit for BBs.

BBB option adjusted spreads (Ice data Indices, LLC from fred.stlouisfed.org ) BB option adjusted spreads (Ice data Indices, LLC from fred.stlouisfed.org )

What we can see from the data is that during recessions spreads widened in excess of the level we currently have. I am therefore cautious committing more cash to preferred right now as we have neither seen the end of the rate increase cycle by the Fed nor might we have seen the top of the spread widening. I believe we have a good chance of seeing higher yields for both BBB and BB bonds which should pressure prices for the preferreds as well.

I would therefore rate the EEs as a hold right now and have them on my watch list. My personal targets are a roughly 9% current yield and a guaranteed minimum yield of about 8.5% as I want near equity like returns for the sizeable credit risk I take on with those issues. That would equate to a target price of around CA$15.

price Chart of the Series EE prefs (Seeking Alpha)

As one can see, the prefs have traded at that level in the past, right in the midst of the COVID panic and also once again later in 2020, which is when I bought mine.

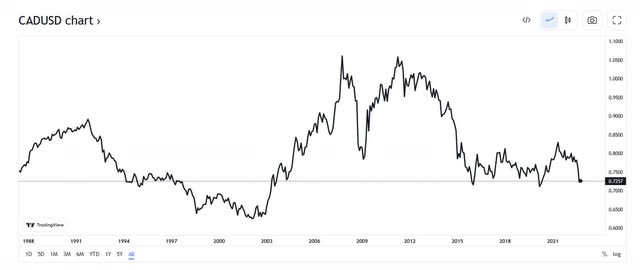

Another thing to be aware of is the FX risk. This is a Canadian dollar denominated security and all its payments are also in CAD. Therefore, for a non-Canadian investor there is additional FX risk (or opportunity). For U.S.-based investors, the current situation looks like this:

long term CAD vs. USD (Trading view)

You can either think it is close to breaking through support thanks to decisive Fed action or take comfort that there is similar upside longer term should it go back to its normal trading range.

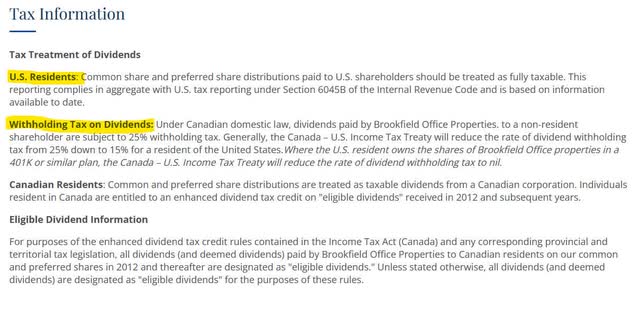

And, finally, there are always taxes. Brookfield has the following to say about this:

tax treatment of BPO preferred (Brookfield)

Please check with your tax advisor.

Better quality prefs within Brookfield to watch

As stated above credit quality of the prefs is questionable (quite possibly junk), and the real estate sector is prone to some cyclicality especially in the office segment. Luckily, there are also similar prefs at other places within the Brookfield maze of things. Like the series 44, 46 and 48 at BAM. Or other issues at the renewable or infrastructure parts of Brookfield. But those trade fairly close to par and are therefore less attractive right now in my opinion.

That said they are generally higher quality with regards to the underlying cash flows and are therefore consequently rated a higher by DBRS at pfd-3 (high) or even pfd-2 (low) compared to the BPO prefs. Which explains why they don’t trade at a similarly high discount. Should we really see a massive recession inclusive of all doom and gloom we might very well see those prefs also trading with larger discounts to par and they might become more interesting for me.

As of now the discount to par does not give me enough of a potential gain in case of a buyback by the company to make me take on the reinvestment risk. I am currently also not willing to lock up my money for a 5-6% yield while we have an uncertain inflation outlook. But they are certainly worth keeping an eye on.

Those kind of prefs with a regular reset and a minimum floor can of course also be found outside Brookfield, and I encourage everyone to look into them in more detail as I feel they can have very interesting payoff profiles.

Summary

Brookfield offers several preferred securities that have a regular reset plus a floor. Some of them start to trade at attractive discounts to par giving an extra return opportunity should they ever be called. I believe the series EE preference shares from BPO start to look attractive being priced in line with BB bonds. That said capital invested in them might be locked up for a long time and I feel risk-reward is not yet enticing enough for me to commit to them right now and I intend to patiently wait for a better entry point down the road. Mind you, those are high risk securities and might eventually lead to sizeable capital losses. Maybe higher rated preference shares with similar characteristics from other Brookfield enterprises (or other companies) might be more suitable for less enterprising investors.

Risks include a rating that is somewhere around the border between investment grade and junk (probably closer to latter), limited financial disclosure, FX risk as well as very low liquidity. Please use limit orders and check your tax situation. These prefs also have a conversion option for a floating security which could be enforced upon investors if enough other investors have already chosen this option (please see “4.2 automatic conversion” at the Schedule B share provisions).

Be the first to comment