BrianAJackson

Investment Thesis

We were early shareholders of this firm even before the company went public. By that time, Broadmark Realty Capital Inc. (NYSE:BRMK) appeared to be one of the safest bets. The company’s ability to deploy capital in a real estate bull market was second to none. It was one of the few no-leveraged REITs with monthly steady dividend payments usually yielding more than 10%, which had lasted for about ten years.

Since the IPO, things dramatically changed, and we liquidated our position sometime after because we had doubts about the company’s future and the management’s performance. However, we kept the company under the radar to check whether our reservations, which made us leave in the first place, would recede, creating a re-entry point.

In our last report, we explained why we were not interested, even though Broadmark Realty was trading at a discount to its book value. We were proven right after these last earnings. Our analysis reflects that BRMK faces serious performance issues primarily because of poor management decision-making. Nevertheless, we don’t understand why the company insists on distributing a dividend that is far from being covered, destroying its asset value.

The current macro environment creates an arduous scenario for lending companies. Furthermore, BRMK is moving toward a type of loan (Mezzanine) that tremendously increases the stock’s risk profile.

We believe Broadmark’s current future is too obscure, and we would wait for the right shifts. New capable management or an activist should come in and sort things out before approaching the stock again.

The continued urge to pay unsustainable dividends

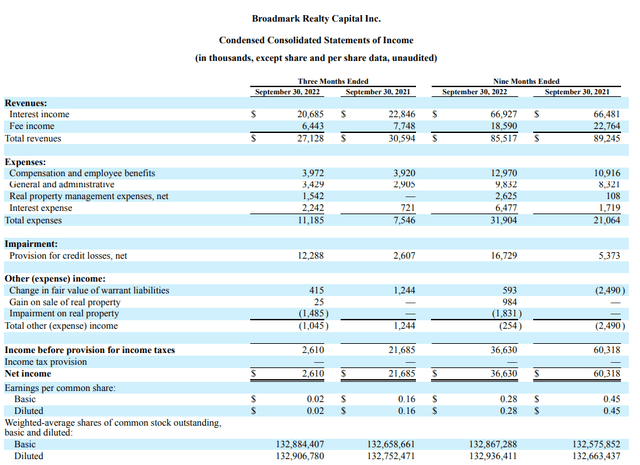

Broadmark has been paying dividends on a monthly frequency of $0.07/share for the past nine months against the average net earnings of $0.03/share. The dividend cover ratio for the past ten quarters has always been less than one, and now this quarter has touched the ridiculous ratio of 0.09.

Some might argue that REITs generally have higher dividend rates to get tax advantages accordingly to the Companies Act. As per regulations, REITs must distribute at least 90% of the pretax income. BRMK’s average monthly pretax income was $0.03/share, of which they were required to pay a minimum of $0.027/share; the company paid 2.6 times that requirement. Even if we look at distributable earnings where we add back all non-cash expenses even though they will be realized in the future, like impairment and provision for loan losses, we get distributable earnings of $0.46/ share YTD, against which the YTD dividend paid was $0.63/ share.

The continued urge to pay more dividends than what they can earn as a company and generate in cashflows is concerning. It only shows that the management is more concerned about the stock’s performance than the company’s value creation. This can also be felt in the latest earnings press release in which, despite all the issues the company faces, the main highlight of the report written in the first line in bold letters was, “Board of Directors Approves $75 Million Stock Repurchase Plan.” This shows how management creates what appears to be a smokescreen to protect the share price. This was at a time when the CEO was leaving, when they reported only $2m in net income, an EPS of .02, and missed revenue expectations. The Giant news was buying back shares, and it did send the stock up at the time of the release; however, the rise did not last long.

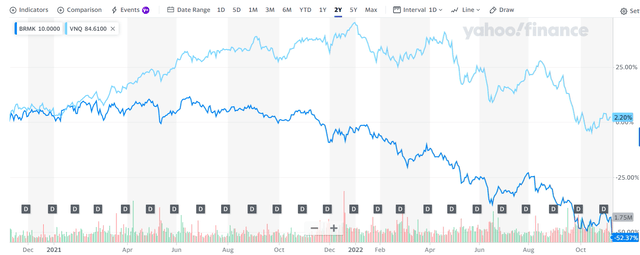

BRMK is the perfect example of a dividend-yield trap where paying unsustainable dividends contributes to destroying the asset value. We can see this with the stock’s performance against the market. As a reference, the graph of BRMK’s performance with Vanguard’s real estate ETF (VNQ) is below. We can see BRMK consistently underperforming.

Capital Allocation

One further issue that needs highlighting is their ability to allocate capital efficiently. We highlighted this in our last report too, and many didn’t agree with this. In this quarter, new loan originations are $123.4m compared to $306.7m in the same quarter last year. Loans repaid during this quarter are 200m giving us a loan origination net off repaid of $-76.6m versus $250.3m of the same quarter last year. This is very alarming for us, as negative net loan originations have been a rare sight even in BRMK’s history.

This capital allocation issue can be further pointed up by the fact that they have initiated a share repurchase program, which was the highlight of the press release. New loans Originations is the primary operating activity of BRMK. If they want to have an additional capital allocation lever, it underlines the uncertainty regarding the new loan’s origination in this challenging macroeconomic environment.

What is alarming is their decision to pursue Mezzanine loans, a 2nd-degree mortgage loan in which the lender provides a subordinate debt in return for higher interest rates and possible equity options. This is the riskiest form of debt, and if the client goes bankrupt, the company could lose all its capital in the transaction.

The only reason that seems logical about pursuing this road is that Management might not be able to deploy their capital through their primary product and more secure form of loan, the “Senior Secured Loans.”

Although the management is signaling that this is not their priority and will not be a big part of their loan portfolio if they face tough times in deploying their capital efficiently, this stance could change quickly. They have already done their first mezzanine loan of $10m, and if they decide to pursue it further, this will affect their business risk profile.

BRMK’s management prides itself on being the lowest leveraged company in the sector, but if they start giving out mezzanine loans, the extra risk incorporated will be more than if the firm decided to take further debt.

Other Highlights from Q3

The situation of the management team at BRMK has been volatile, and that too in an economic downturn when stability would have been really appreciated. The current CFO is leaving as of 1st December, and the CEO was let go on earnings day. The latter highlights a possible disagreement between the management and the board. Now there is a search for new CEO and CFO; we don’t know how long it will take, and during these uncertain times and when the company is not performing near its best, this is really a worrying sign for us.

Management’s stubborn stance on an unsustainable dividend policy is causing the company to take up more and more loans to meet its liquidity needs and to keep paying dividends. To that account, their interest expense has increased from $1.7m in nine months ending September 2021 to $6.4m now in the first nine months of 2022.

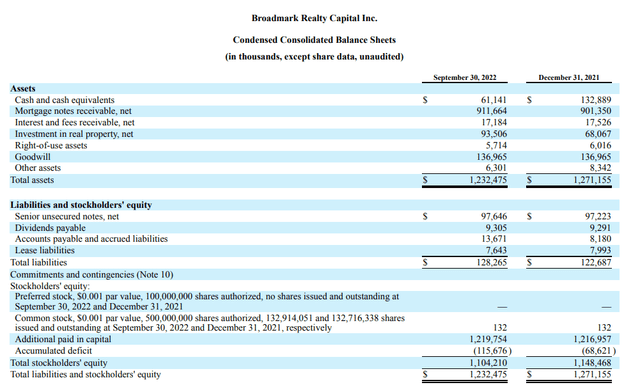

Real property management expenses have been increasing in 2022, and this is because of the $93.51m properties they hold, out of which $33.1m are held for sale and $27.4m are held for use. Impairment on these properties in this quarter is $1.4m compared to $0.35m last quarter. The default rate now is at 19%, but we expect it to increase further with the deteriorating economic conditions as we head into an expected recession.

The liquidity position of Broadmark seems improved from the quarter as their cash balance is up; this is mainly due to the negative net loan origination for this quarter which is also a problem. Cash reported for this quarter is $61.1m. In 21YE, cash was $132.9m, and in 20YE, cash was $223.4m. When we compare the current balance to the previous year’s ends, we can see the impact of dividends. We believe that without negative net loan originations, BRMK would have to turn to its revolving credit facility to meet its liquidity needs.

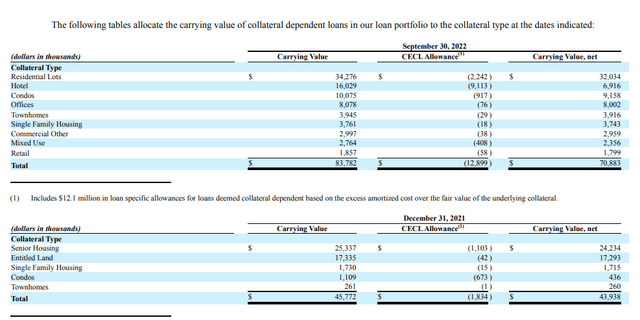

We have highlighted the issue of credit risk that Broadmark faces. In this quarter, our fears are starting to come true as the credit losses now are $12.3m from $2.6m in the same quarter last year, an increase of 373%. Management is claiming that out of this total credit loss, $9.1m is from a hotel, and they are treating it as a non-recurring event as hotels are less than 5% of their portfolio. But we know that all sectors face pressure from the macroeconomic headwinds, and conditions will get even worse if the terminal rates from the FED would be higher than expected and the economic downturn becomes more prolonged and profound.

This issue can be further highlighted by the YTD increase in Collateral dependent loans, which have seen an increase of 83%, from $45.7m at the start of the year to $83.7m now. Almost all the asset classes have seen an increase.

Their loan to values ratio is not reliable anymore, since these loans originated when the real estate sector was in a boom, and the properties were priced very highly.

As it was said in the second quarter earnings call:

“one part of the strategy shift will be that there could be times where we determined that exiting a loan in default or foreclosed property with a principal loss and reinvesting that capital into income-producing loans is the most favorable outcome.”

Even the loan to value of 60 to 65 was not enough to recover the full face value of the loans. This is very alarming, because the market was not discounting the inability of the company to recover the full amount of lent money, and there was a lot of effort and expenses involved in trying to maintain the foreclosure assets. This is why the company has moved toward an aggressive strategy of recovering capital by lowering the asset’s price facing a loss on the properties on the loan origination. This proves that our suggested 30% margin of safety was not naive or over-conservative, but a right-minded assessment of the company’s risk.

Conclusion

We don’t trust the management of BRMK, and they have given us every reason not to. The management has created what appears to be a smokescreen around their performance by continuing to pay unsustainable dividends to attract yield-seeking investors. Even the announcement of the repurchase program in this quarter and the way it was presented as a highlight leads us to believe this was to cover the quarter’s shambolic performance.

What people don’t realize is that when the dividends are unsustainable, and the company is not doing anything to resolve this by either cutting their dividends or by increasing their earning ability, then this can quickly become a yield trap. If they keep paying unsustainable dividends, we don’t believe the position of this company would be able to be turned around.

Uncertainty regarding the position of the executives and their departures in an economic downturn is a real warning sign and should not be ignored. This hints at a structural problem, and these problems surrounding BRMK might be too deep than perceived by the market.

On the valuation side, we think there is a possibility that Broadmark could go further down, below $4 dollars a share, as a dividend cut should be brought at 0.4 per month. At that point, the company would yield around 10%, and it would have a discount of 40.5% versus tangible book value.

Be the first to comment