Inna Dodor

Introduction

When last discussing British American Tobacco (NYSE:BTI) and their high dividend yield of 7.23% earlier in 2022, the focus was upon the hidden value in deleveraging, as my previous article highlighted. Despite this helping their dividends in the medium to long-term, sadly for their shareholders based in the United States, it now seems what is essentially tantamount to a stealth dividend cut likely coming in the short-term as the United Kingdom battles with economic issues suppressing its currency.

Executive Summary & Ratings

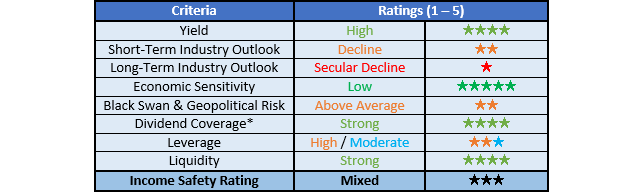

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

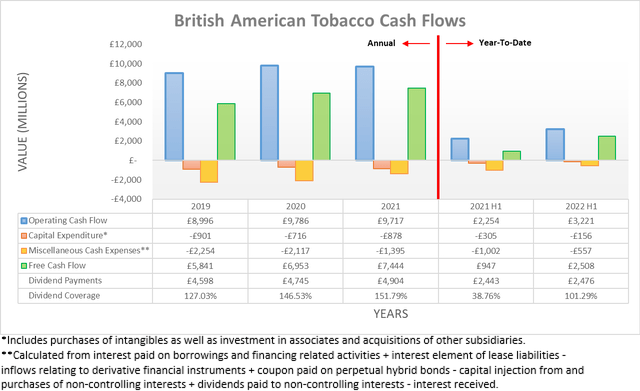

Following their solid cash flow performance during 2021, it seems 2022 started on a strong note with their operating cash flow increasing a massive 42.90% year-on-year to £3.221b during the first half versus their previous result of £2.254b during the first half of 2021. Whilst some may have been driven by temporary working capital movements, which their half-year reports do not disclose, their accrual-based adjusted profit from operations still saw a 7.83% year-on-year increase to £5.645b during the first half of 2022 versus their previous result of £5.235b during the first half of 2021, as per their first half of 2022 results announcement. This indicates that regardless of the timing of cash payments, the start of 2022 saw stronger financial performance than one year prior.

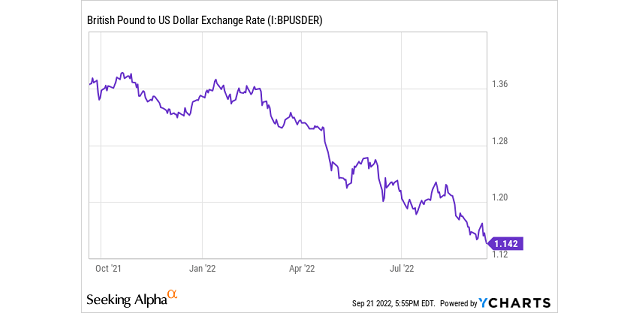

Due to their larger than normal cash infusion, their dividend coverage for the first half of 2022 was 101.29%. Whilst this may not sound too impressive, their cash flow performance is normally heavily weighted towards the second half of the year and as such, their dividend coverage one year prior during the first half of 2021 was only a very weak 38.76%. Ultimately, their full-year 2021 dividend coverage landed at a strong 151.79% thanks to their operating cash flow powering onwards to £9.717b by the end of the year, thereby seeing a weighting of 76.80% towards the second half. Whilst this sounds positive for the income investors that comprise their shareholder register, sadly for the sizeable base in the United States who own their ADRs, they are poised to see what is essentially tantamount to a stealth dividend cut as the GBP plunges versus the USD, as the graph included below displays.

Y-Chart

The GBP started the year around its usual conversion rate to the USD of $1.36, although as the energy crisis and resulting runaway inflation took hold in the United Kingdom, it subsequently lost around 16% of its value with its latest rate now down to only $1.14. Since they are a British company, they declare dividends in GBP, which are subsequently converted to USD at the time of payment to their United States shareholders who own their ADRs. The lower the GBP slides versus the USD, the equally lower their ADR dividends slide in tandem, thereby seeing their sizeable United States shareholder base enduring a dividend cut, unofficially of course.

Unlike in the past when the GBP plunged in early 2020 as the Covid-19 pandemic swept the globe, this recent sell-off is longer and steadier as the United Kingdom battles economic issues. Whilst foreign currency exchange rates are notoriously difficult to predict with accuracy, in my eyes, this is a far more fundamentally driven event than was the case in 2020 that stemmed from a sudden and ultimately short-term systemic market shock. Even if the GBP is now bottomed, it still seems realistic to expect the pressure to continue for the foreseeable future, given the global energy shortage does not have any short-term solutions and inflation is yet to show any signs of taming, thereby leading the Federal Reserve to boost interest rates another 75bps whilst writing this article. In my view, until the Federal Reserve begins easing monetary policy, which is not even on the radar at the moment, the USD will remain strong and thus by extension, the GBP will likely remain weak and markets favor the former in times of distress and uncertainty.

If this outlook comes to pass as I expect, it will mean their shareholders based in the United States will see a lengthy period of lower dividends and not merely a one-off weak quarter, as was occasionally the case during the past few years. Since they are a global company with vast operations within the United States after their acquisition of Reynolds American around five years ago, some investors may feel they can simply offset the weak GBP via boosting their dividends thanks to their earnings benefiting from their United States operations, although there are two issues with this view.

Firstly, their United States adjusted operating profits of £5.887b during 2021 only comprised 52.80% of their total of £11.15b, as per their full-year 2021 results announcement. Since their free cash flow should broadly track this geographical split, they cannot possibly provide a comparable increase to their dividends to completely offset the lower GBP to USD rate.

Secondarily, they have a progressive dividend policy that aims to steadily grow their dividends each year, which differs from a variable policy whereby they fluctuate with their earnings each year. This provides greater clarity for shareholders but in this situation, it also inhibits their flexibility because they cannot instantly pass along the entire benefit of a weaker GBP via increasing their GBP-denominated dividends, at least not safely. If this were attempted during 2023 and 2024 or a later year see the GBP strengthen, it could risk leaving their dividends too large as free cash flow sees its benefit vanish. This essentially means that there is an inherent lag before any benefit from a weaker GBP can be passed along via their dividends in GBP terms, as they would likely want to be certain that the lower rate was the new normal and not merely temporary.

When these variables are wrapped together, it makes for little short-term flexibility at the company level whilst they wait and see how future events unfold. Unfortunately, this leaves their shareholders based in the United States, staring down the barrel of lower dividends during the second half of 2022 and quite possibly throughout 2023 or maybe even longer, as the world enters uncharted territories of energy shortages and high inflation.

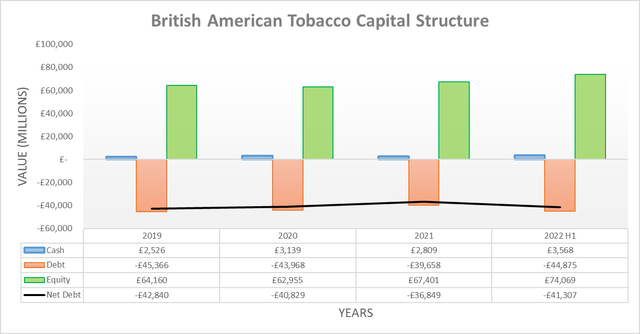

In theory, their free cash flow essentially matching their dividend payments during the first half of 2022 should have resulted in their net debt remaining unchanged. Although, it actually jumped higher to £41.307b, which represents an increase of £4.458b or 12.10% versus its previous level of £36.849b at the end of 2021. Even if including their derivatives and current investments, as practiced by management, their net debt would not be materially different at £40.806b and still comparably higher than its equivalent previous level of £36.302b at the end of 2021.

Whilst £1.256b of this increase stems from their share buybacks, the remainder stems from their USD-dominated debt that saw its GBP carrying value on their balance sheet increase as the currency slid lower. They do not list their debt structure within their half-year report, although if reviewing their 2021 annual report that provides a suitable basis point, they saw £26.179b of their debt denominated in USD, thereby comprising circa two-thirds of their total debt of £39.658b.

When looking ahead into the second half of the year, their stronger free cash flow should help push their net debt lower as their free cash flow exceeds their dividend payments, assuming the current foreign currency exchange rates persist. If the GBP strengthens versus the USD, they would see a double whammy that sends their net debt plunging but obviously, this remains speculative given the economic issues in the United Kingdom.

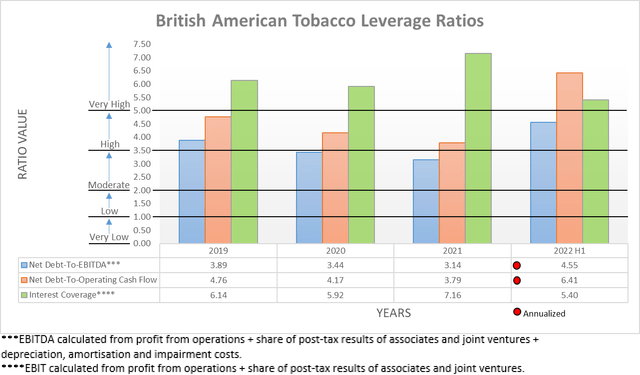

When turning to their leverage, their respective net debt-to-EBITDA and net debt-to-operating cash flow both spiked higher following the first half of 2022 to 4.55 and 6.41, versus their previous results of 3.14 and 3.79 following the end of 2021. This now sees their leverage far higher with their net debt-to-operating cash flow far above the threshold of 5.01 for the very high territory, although as previously mentioned, their cash flow performance is heavily weighted towards the second half of the year and thus skews this comparison.

The full impact upon their leverage will not become clear until their full-year results for 2022 are released early in 2023 to assess the extent their financial performance benefits from the weaker GBP versus the extent their net debt increases. Based upon the estimations from their 2021 results, it seems likely their leverage will increase slightly given their USD-dominated earnings comprised 52.80% of the total, whereas their USD-denominated debt comprised a relatively higher 66% of their total debt. Admittedly, there are other moving parts with various other less important currencies and product pricing in different markets and thus in the meantime, it seems reasonable to continue assessing their leverage based on their results at the end of 2021. This saw their net debt-to-EBITDA of 3.14 within the moderate territory of between 2.01 and 3.50, whilst their net debt-to-operating cash flow of 3.79 is slightly above this point and thus within the lower range of the high territory of between 3.51 and 5.00.

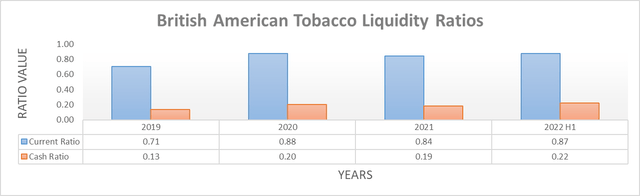

Despite battering their net debt during the first half of 2022, thankfully their liquidity was spared from the weaker GBP with both their current and cash ratios increasing to 0.87 and 0.22 respectively and thus ahead of where they ended 2021 at 0.84 and 0.19 respectively. In this regard, they should continue seeing no material impact from foreign currency exchange rates, especially given the resilient nature of the tobacco industry provides consistent free cash flow. Furthermore, as a very large company they should always be capable of sourcing liquidity if required to refinance debt maturities for the foreseeable future, even if central banks further tighten monetary policy.

Conclusion

Whilst their shareholders in the United Kingdom will not notice less cash flowing into their bank accounts, sadly, the same cannot be said for their sizeable shareholder base in the United States that appear set to endure what is essentially tantamount to a stealth dividend cut as the GBP weakens versus the USD. Unfortunately, they cannot simply lift their dividends in GBP terms to offset this decline and thus given the economic issues in the United Kingdom and the accompanying outlook for tighter monetary policy in the United States, this is likely to be an issue throughout 2023. Despite this setback, the company is still in great shape and does not alter my previous thesis regarding the hidden value in deleveraging in the medium to long-term as these foreign currency exchange rates smooth out, which means that I believe maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from British American Tobacco’s Annual Reports, all calculated figures were performed by the author.

Be the first to comment