NicolasMcComber/E+ via Getty Images BTI logo (BTI website)

Investment thesis

Over the course of the last twelve months, SA has published 43 articles on British American Tobacco (BTI) with a buy or strong buy recommendation, just 3 which recommends a hold, and a lonely single article with a sell stance on this stock.

Looking at the numbers only, BTI is a very compelling investment opportunity.

I bought some last year.

Yet, I do think many of the articles do not adequately address the risks to the thesis. I would like to make an attempt to do so with this article.

British American Tobacco’s Financials

I will not repeat much about the 2021 full-year financial results, as a recent article by Librarian Capital does a good job in dissecting it and is presented well.

I concur with Librarian Capital’s conclusion that it is still a buy at the present level. One reason for that is their low P/E of 11.5 based on a share price of GBP 34.09 as of 18th February.

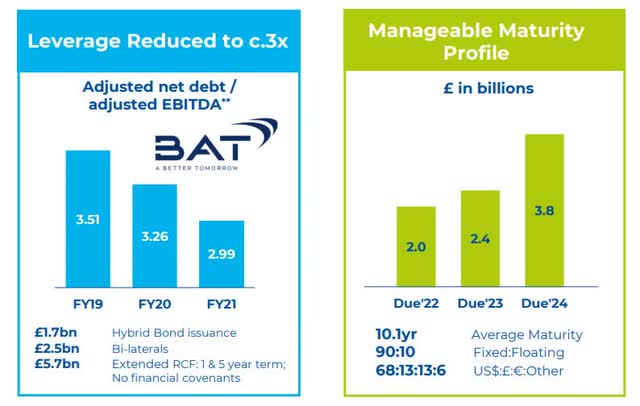

They have also diligently reduced their debt with an average debt maturity close to 10 years and maximum debt maturities of around GBP 4 billion in any one calendar year.

Leverage and maturity (BTI 2021 Presentation Slides)

BTI’s capital return to shareholders

When it comes to returning capital to shareholders, BTI is excellent on two fronts.

Their dividend, which is well covered, has been set at 296 pence for 2022 and is payable in four equal payments throughout the year.

This yields about 6.5%.

On top of this dividend, which most likely will grow steadily at around 5% per year, shareholders will benefit from share buybacks. During their last presentation, they announced a plan to buy back up to GBP 2 billion of their own shares this year. These shares will be held in treasury. Currently, there are 2,294 million shares outstanding. If they succeed in buying back shares at the tune of 2 billion GBP at roughly the present price, it will take out about 59 million outstanding shares, which equates to 2.6% of the ordinary shares.

All this does make BTI fundaments attractive and inexpensive, despite its 31% rise over the last 3 months period.

Risk to the thesis

However, every coin has two sides. The same goes for every potential investment you are considering. As such, there are lots of very good articles here on SA that are convincing, well analyzed, and formulated. Nevertheless, many do purely show you one side of the coin.

There are risks associated with investing in British American Tobacco (BTI), and I think that is one of the reasons the share price is not higher.

New Zealand started the ball rolling in December last year with a ban on the sale of tobacco to its next generation, in a bid to eventually phase out smoking. Anyone born after 2008 will not be able to buy cigarettes or tobacco products in their lifetime, under a law expected to be this year. Their Health Minister Dr. Ayesha Verrall said “We want to make sure young people never start smoking.”

The move is part of a sweeping crackdown on smoking which will also restrict where cigarettes can be purchased. They will no longer be for sale at corner stores and supermarkets. This will reduce the number of sales outlets from 8,000 to about 500. She also said that smoking causes one in four cancers in New Zealand and remains the leading cause of preventable death for its five million-strong population.

In Singapore parliament, they debated this same issue, and a similar ban might be considered.

Nevertheless, cigarettes will still be around for a long time. Despite the World Health Organization’s clear message of its danger and costs to society at large.

There are hopes from the cigarette manufacturers’ point of view that e-cigarettes will substitute cigarettes, as they claim it is “less harmful”. But are there any evidence that a large portion of new e-cigarette users, in fact, fall into the category of people switching from traditional cigarettes to e-cigarettes, or are they mostly new and young users? I have yet to see any such evidence.

It is important because BTI is investing heavily in the growing e-cigarettes and other non-flammable product segments. Their sales have grown exponentially over the last year and are expected to continue to do so. The total number of smokers globally is declining year by year.

Presently, they estimate that they have about 18.3 million customers using their non-flammable products. Their target is to grow this to 50 million customers by 2030.

Not everybody is happy with the transformation from smoking to vaping.

More than 1 billion people around the world still smoke. And as cigarette sales have fallen, tobacco companies have been aggressively marketing new products – like e-cigarettes and heated tobacco products – and lobbied governments to limit their regulation. Their goal is simple: to hook another generation on nicotine. We can’t let that happen.” – Michael R. Bloomberg, WHO Global Ambassador for Noncommunicable Diseases and Injuries

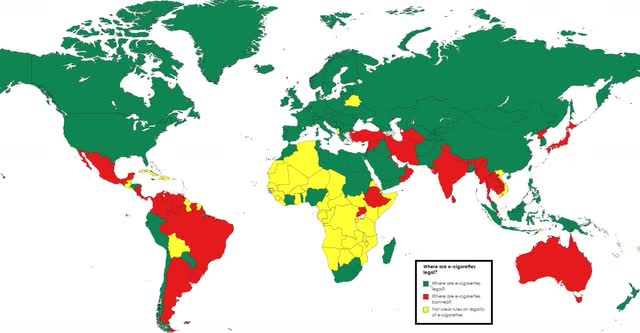

As of July 2021, the World Health Organization reported that 32 countries have banned the sale of electronic nicotine delivery systems. However, there are still large parts of the world that allow the use of e-cigarettes.

Where are e-cigarettes legal? (Data from Global Tobacco Control. Map author)

These risks are not going to play out in the short run. When I say short, I mean next few years.

However, if you invest in BTI, you should be aware that the tail risks here can be larger than in many other companies and industries.

British American Tobacco’s Faster Transformation

Their CEO Jack Bowles has stated that BTI is entering the next phase of their journey, and it is described with a catchphrase of “Faster Transformation”.

Their plan is to reduce the health impact through what they describe as a multi-category approach.

If they really want to transform, they should, in my opinion, be more aggressive in acquiring and investing in businesses that fall into what they describe as “opportunities beyond nicotine”.

They have established a unit called Btomorrow Ventures. It has so far completed 17 small investments since it was launched in 2020, including 9 new investments in 2021. These are in innovative consumer, new sciences, and technology businesses.

One of them is a Canadian publicly-traded company called Organigram Holdings (NASDAQ:OGI), which is focused on research and product development activities of the next generation adult cannabis products. BTI acquired a 19.9% equity stake in the company and with that became the largest shareholder. They have appointed directors and seconded researchers to collaborate with them for future product development.

The most recent development came in January this year when BTI announced the launch of KBio Holdings Limited in the U.S. to accelerate the R&D and production of novel treatments.

In 2021, BTI also made another small investment in a wellness drink start-up called Tru Inc. Tru is described as a provider of functional beverages used for energy, focus, power, and refreshment. The company’s products are infused with vitamins, electrolytes, and antioxidants that are said to enable customers to feel good and perform better.

Let us hope there will be more exciting and larger moves made. They certainly have the financial ability to make some meaningful mergers or acquisitions.

Conclusion

Is BTI expensive or fairly priced now?

This week, I had an interesting exchange of thoughts with a fellow author “Actionable Conclusion” on the last article by Librarian Capital on BTI.

He, like myself, has bought BTI earlier prior to the recent increase in the share price, as seen here on this graph;

BTI share price versus the S&P 500 (Seeking Alpha)

As such, he said he would not advise buying BTI at this multi-year high level. The price has come off somewhat since then.

First of all, I want to point out that I too fall for the well-known anchoring bias. My latest article on DBS Group (OTCPK:DBSDF) highlights the difficulty in putting a “buy” recommendation on some stock that has reached its multi-year high.

But that does not necessarily make it right.

One of my most expensive lessons was selling Microsoft (MSFT) at around $32 because it had been at that level for 10 years. A few months later, it started to climb, and we are now looking at $287 after having seen $340 recently making it a ten-bagger, had I kept it. I am not stating that BTI is, or will have the same trajectory, as MSFT. But the philosophy, and the lesson, are the same.

No doubt, BTI is a very well-run company that is hugely profitable.

It is a buy at the present level.

Having said that, I will monitor their transformation going forward to see how fast and how transformative their moves will be. The reason is that I do think it is probably more important than many investors think it is.

Be the first to comment