Drew Angerer/Getty Images News

After successfully absorbing the Celgene deal, Bristol-Myers Squibb (NYSE:BMY) has jumped to new all-time highs. The large cash deal to buy Turning Point (TPTX) suggests the company no longer sees the value in repurchasing their own shares. My investment thesis is less bullish on the stock following the surge to the highs due to the safety trade in drug stocks.

Drug Pipeline

The big story on Bristol-Myers remains the LOE of Revlimid ahead of the offset from the strong drug pipeline of the Celgene drugs. During Q1’22, Revlimid sales were $2.8 billion with sales down 5% YoY due to the entry of generics. The company forecast sales for the drug of only $2.0 billion in Q2 with annual sales of $9.0 to $9.5 billion.

The encouraging news was that total sales for the quarter were up 5% to $11.6 billion. Sales of recent LOEs (primarily Revlimid) were $3.0 billion in the quarter.

In essence, Bristol-Myers now has ~25% of sales in the LOE process, but the biotech has some recent drug approvals that could make up for the loss of Revlimid. Both Opdualag and CAMZYOS have the potential for $4 billion+ peak sales levels to nearly match the current run rate of Revlimid while that cancer drug will maintain a solid revenue stream for years. These new drug approvals only contributed $6 million worth of drug sales in Q1’22.

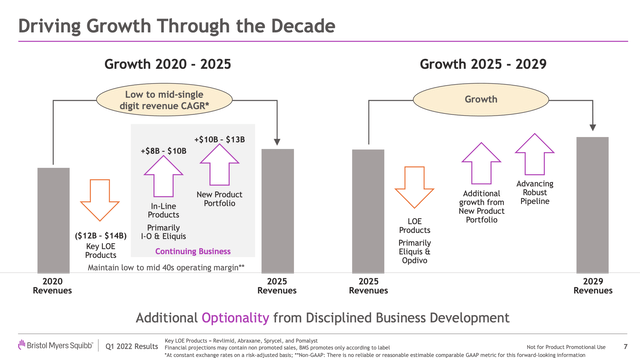

Bristol-Myers continues to forecast the loss of $13 billion in LOE revenues offset by up to $20+ billion in sales from new drugs either already approved or still in the pipeline.

The biggest question remains whether the biopharma can actually produce revenue growth considering Bristol-Myers eventually faces LOE on both Eliquis and Opdivo later in the decade. Analysts forecast revenues topping $50 billion mid-decade with an eventual decline by the end of the decade.

The stock equation quickly changes when running to $80 here. Bristol-Myers isn’t exactly expensive, but the value equation isn’t as out of whack compared to when the stock traded at only $60 with EPS targets in the $7 to $8 range.

Net Payout Yield Signal

Back in February, the company entered into accelerated share repurchase transactions to buy $5 billion of Bristol-Myers Squibb common stock. Now, in June, the company is paying $4 billion in cash to acquire another company.

The big difference between February and June is that stock prices have risen from mid-$60s to nearly $80 now. Possibly, the stock just isn’t as appealing to management at these record levels.

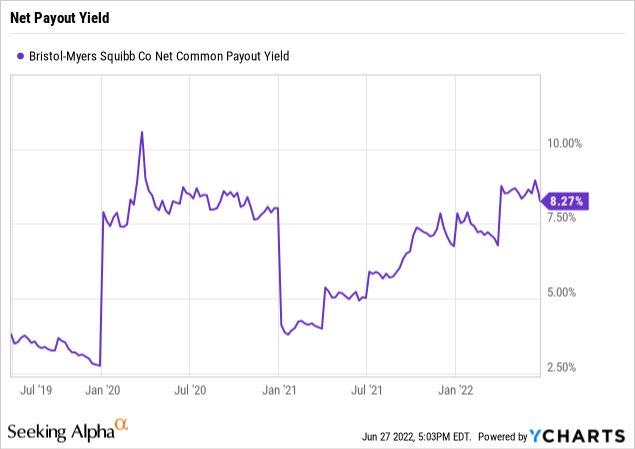

The net payout yield that combines the dividend yield with the net stock buyback yield provides a signal of whether management sees value in the current market cap of the stock and has the financial resources to address the issue. The dividend yield is up at 2.7%, so the impressive net payout yield of 8.3% is due mostly to the stock buybacks for a drug stock with a market cap of $168 billion.

The company has a net debt position of over $30 billion, up from nearly $28 billion in the prior quarter. The debt levels aren’t excessive with the large cash flows of BMY, but the debt plus a $4 billion deal limits the ability to keep share buybacks returning over 5.5% of the market cap via stock buybacks.

A stock with an NPY above 8% is definitely appealing, but one pulling back on share buybacks with the stock at all-time highs shouldn’t be blindly bought for this yield.

Takeaway

The key investor takeaway is that Bristol-Myers is an interesting drug company, but the stock probably has limited upside here. The biopharma has plenty of questions regarding growth needed to justify prices much above the current level. The net payout yield is solid above 8%, but the management team doesn’t appear willing to continue purchasing shares aggressively at the current price. With the stock hitting new highs, investors should probably use the next big rally to cash out.

Be the first to comment