Drew Angerer

Introduction

As a dividend growth investor, I constantly seek additional opportunities to acquire income-producing assets. My current portfolio generates a reliable stream of income. I sometimes add to my current positions when I find them attractive. On other occasions, I start new positions to diversify my holdings further. I am trying to capitalize on the recent volatility to get more income for an attractive price.

One of my favorite sectors is the healthcare sector. Companies in this sector earn money by improving people’s lives. From a financial perspective, people will avoid cutting healthcare expenses for as long as possible. I own shares in medical devices, pharmaceuticals, drug stores, and distributors. In this article, I will analyze one of my current positions: Bristol-Myers Squibb (NYSE:BMY).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Bristol-Myers Squibb Company discovers, develops, manufactures, and markets biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, neuroscience, and Covid-19 diseases. It sells products to wholesalers, distributors, pharmacies, retailers, hospitals, clinics, and government agencies. The company was formerly known as Bristol-Myers Company. The company was founded in 1887 and is headquartered in New York, New York.

Fundamentals

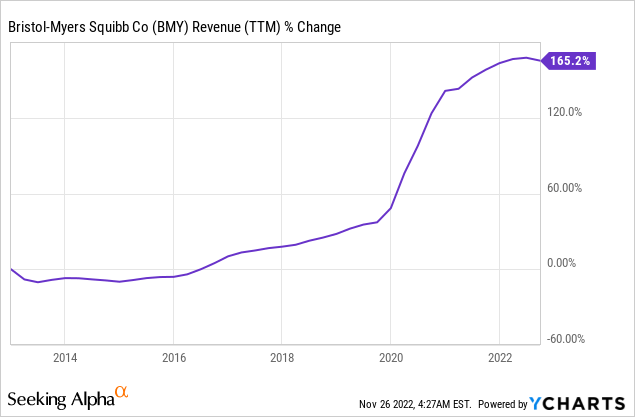

Revenues of Bristol-Myers Squibb increased by 165% over the last decade. The increase in sales results from the company’s drug pipeline and significant acquisitions. The two main acquisitions were Celgene for $90B and MyoKardia for $13B. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Bristol-Myers Squibb to keep growing sales at an annual rate of ~2.5% in the medium term.

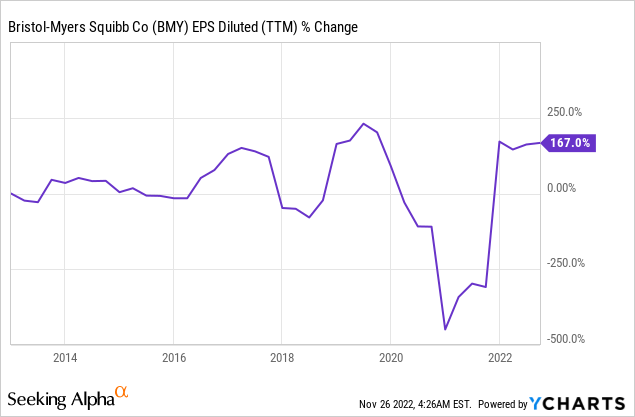

The EPS (earnings per share) has increased similarly over the past decade. The growth in the EPS happened despite the increase in the number of shares as the company managed to cut costs following acquisitions. The cost-cutting measures improved the margins of the company. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Bristol-Myers Squibb to keep growing sales at an annual rate of ~3% in the medium term.

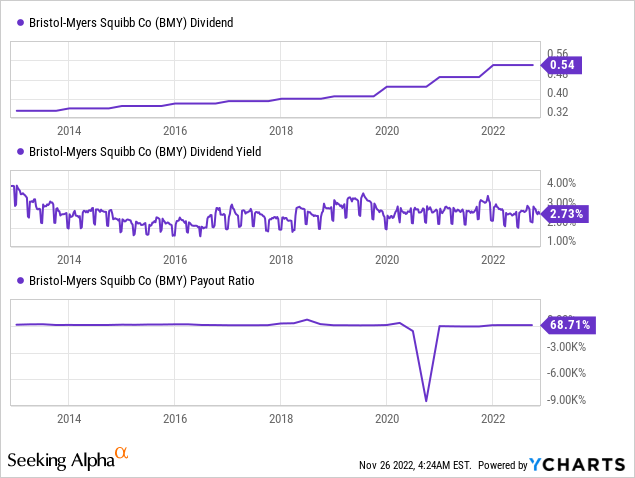

The dividend is another prominent prospect of Bristol-Myers Squibb. The company has increased the dividend for 15 years and hasn’t decreased it for more than 50 years. The current dividend yield stands at 2.73% and is safe as the company pays less than 70% of its GAAP earnings and less than 30% of its non-GAAP earnings. Investors should expect another dividend increase in December as the company is likely to increase its streak, which will likely be mid-single digits, in line with the EPS growth.

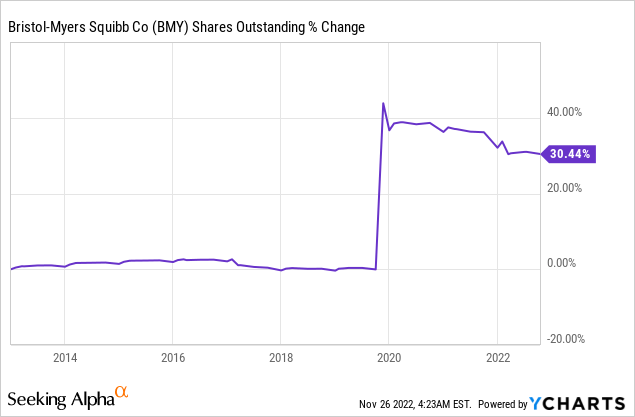

Another form of returning capital to shareholders besides dividend payments is share repurchases. Over the last decade, the number of shares increased by 30% due to the company’s acquisitions which were paid partially using company stock. Since then, the company has been buying back its shares, and over the last three years, it has decreased the number of shares by more than 3%. Buybacks are effective mainly when the valuation is low, as the company buys more shares for less.

Valuation

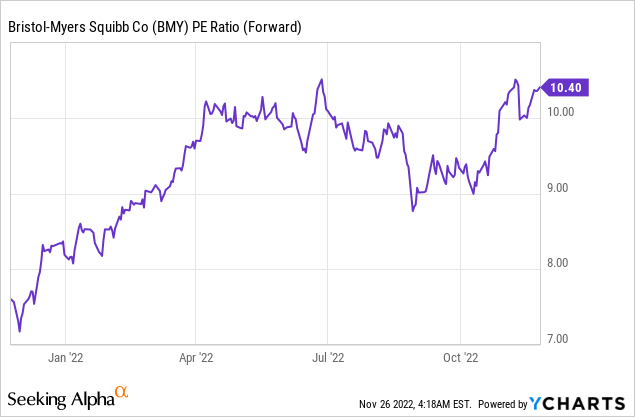

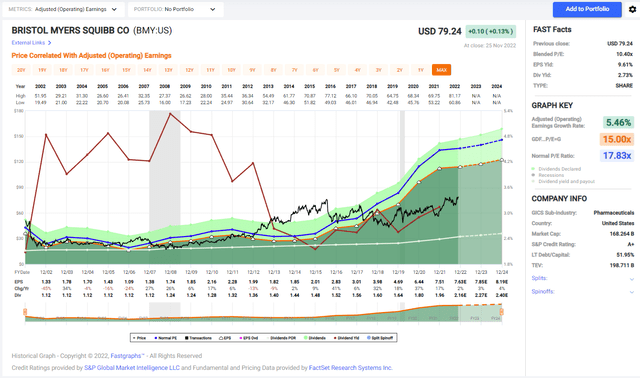

The P/E (price to earnings) ratio of Bristol-Myers Squibb, when taking into account the company’s 2022 EPS forecast, stands at 10.4. In my opinion, this is a low valuation for a company with solid fundamentals. The graph below shows how the P/E ratio increased from less than 7 to 10.4 in the last twelve months. The current valuation is still a decent entry point for a quality company like Bristol-Myers Squibb.

The graph below from Fastgraphs emphasizes how despite the increase in EPS, the share price of Bristol-Myers Squibb remained depressed. You can see how in 2016, there was a disconnection between the blue line and the price line. The current P/E ratio of 10 is significantly lower than the average P/E over the last two decades, which stands at almost 18. Therefore, I believe that the shares are attractive from a valuation perspective.

To conclude, Bristol-Myers Squibb combines great fundamentals with a decent valuation. The company grows its top and bottom line and fuels dividend growth and buybacks. At the same time, it trades far below its average valuation, making it an exciting prospect for dividend growth investors. It will be attractive if the company has future opportunities and limited risks.

Opportunities

The drug Repotrectinib is an extremely promising drug for lung cancer. The FDA has granted a breakthrough therapy designation to Repotrectinib. When Bristol-Myers Squibb acquired Turning Point Therapeutics in 2022, it became the owner of that promising drug. The company relies on the fast approval of this breakthrough therapy.

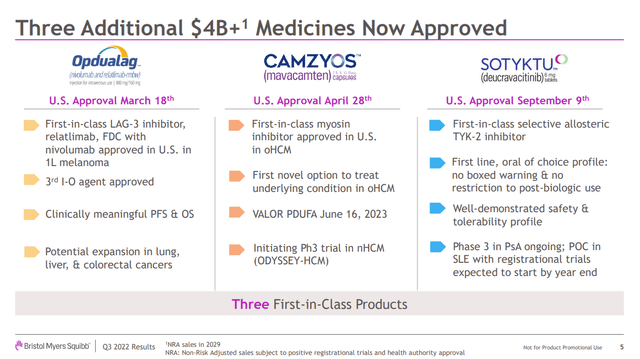

Portfolio renewal is also a significant growth catalyst for Bristol-Myers Squibb. The company is constantly developing new drugs to replace the sales of older drugs. The most promising products that will reach the market in the short term are Opdualag, Camzyos, and Sotyktu. These three products have been approved and are expected to bring $4B in annual sales, which equates to almost 10% of the current sales.

Bristol-Myers Squibb Q3 Results

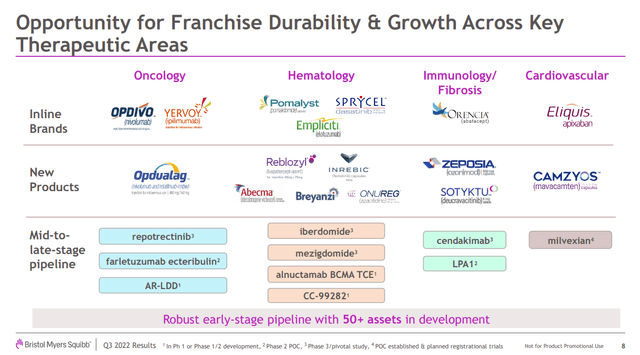

Another opportunity for the company is its diversification. It sells its products across the globe and doesn’t have to rely solely on one or several markets. In addition, it sells drugs for different crucial therapeutic areas: oncology. Hematology, immunology, and cardiovascular. It also enjoys a diversified, balanced pipeline that includes products almost ready to market and early-stage prospects. Diversification makes the company extremely flexible as it invests in different areas and markets.

Bristol-Myers Squibb Q3 Results

Risks

A short-term risk for Bristol-Myers Squibb is the forecasted slow growth in the coming three years. The company and the analysts covering it are well aware of the current products and the ones being launched in the very short term. They are insufficient to propel meaningful growth so that the company may rely on M&A and its long-term early-stage prospects. The risk level is higher when the growth prospects are further away on the timeline.

Another risk for Bristol-Myers Squibb is the competition. The pharmaceutical world is highly competitive with giant companies like Merck (MRK) and Novartis (NVS), as well as many startups. Every failure to launch a product in its pipeline may put the company’s ability to expand in a direction at risk. Therefore, it is a high-risk reward play.

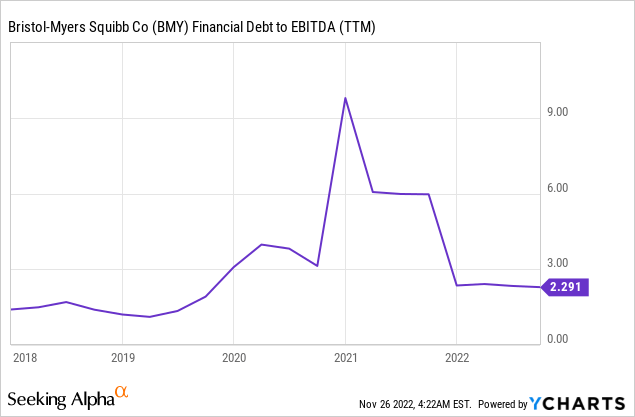

The debt burden is another risk for Bristol-Myers Squibb. The debt level increased by more than 60%, and at the moment, the debt-to-equity ratio stands at 2.3. While the debt level itself is not risky for the company, together with the higher rates, it will be harder for the company to finance additional acquisitions if it strives to grow more through M&A.

Conclusions

Bristol-Myers Squibb is an excellent company from every perspective. The company offers investors solid fundamentals with stable sales and EPS growth even during volatile times. It also returns capital to shareholders by buybacks and dividends making it easy to share the success. The current valuation is also promising as it is lower than average.

Moreover, the company has several growth opportunities in the medium and long term, and it can fuel future growth with its pipeline. The risks seem limited and not very unique to Bristol-Myers Squibb. I believe the shares are a BUY for long-term dividend growth investors at the current price. Shares can be a STRONG BUY if the share price reaches $65-$70 again, as there will be a high dividend yield and even more margin of safety.

Be the first to comment