LilliDay/E+ via Getty Images

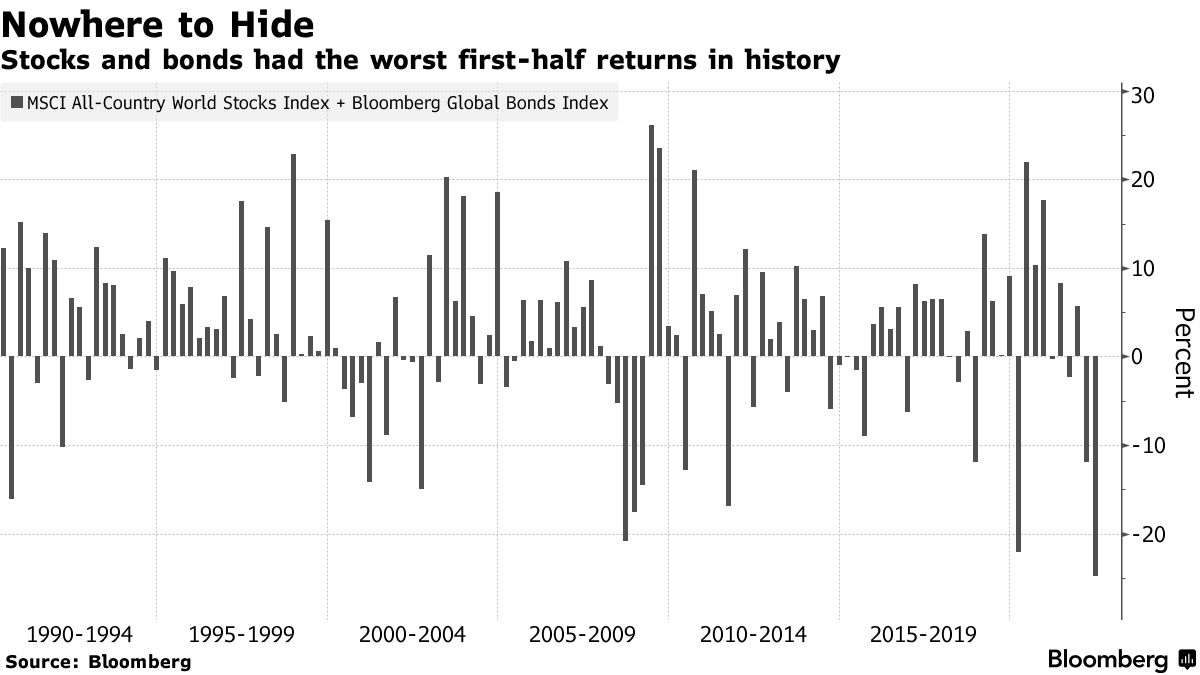

The major market averages just closed out one of the worst first half performances in more than 50 years, but it didn’t stop there. Just about every financial asset you can imagine was crushed with the exception of a select group of commodities. There was really no place to hide. The Nasdaq Composite and Russell 2000 had their worst first halves in history. Now an hour won’t pass by without being reminded in some form that a recession looms on the horizon, inflation is on a runaway train, the Fed is going to raise interest rates endlessly, and my home is going to lose significant value. The parade of doom seems never ending, but there is a light at the end of what I think will be a shorter tunnel than the consensus expects.

Finviz

Yesterday’s personal spending and income report showed a decline of 0.4% in inflation-adjusted spending for May. The decline was due to a sharp drop in the purchase of goods (-1.6%), while spending on services (+0.3%) remained resilient. This has been the pattern for a while now, as consumers indulged on durables at the end of last year before shifting to services as the economy fully reopened. Meanwhile, the Fed’s preferred inflation gauge for May held at 6.3% over the past year, which is down from a high of 6.6% in March, while the core rate that excludes food and energy fell to 4.7% from its March high of 5.3%. I am more convinced that the peak rates of inflation are behind us, which is a positive as we move forward once we can break the back of negative sentiment that persists today.

Bloomberg

I have been arguing with some of my detractors these past several weeks about whether or not we will have a recession this year. The economy contracted 1.6% in the first quarter, due exclusively to a massive trade deficit, resulting from a surge in imports. The trade deficit subtracted 3.2% from GDP. We have that to thank for today’s bloated inventories, which are even larger than originally estimated, according to the latest revision.

Making matters worse is the seismic shift in consumer spending from goods to services as the year has progressed, which means it will probably take the companies holding that inventory longer to work them off. We clearly stole forward growth in the fourth quarter of last year with the economy expanding at a robust 6.9% pace, and we are paying for that now. As the financial markets have declined and financial conditions have tightened, the rate of consumer spending growth is weakening, but that doesn’t guarantee we will see a second-quarter contraction that meets the definition of a recession.

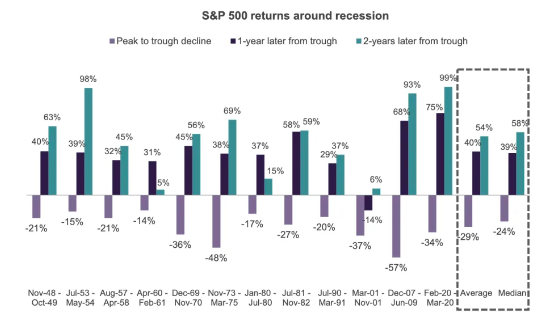

I am an outlier in my steadfast forecast for a continuation of the economic expansion, but at this point I will gladly eat crow to have a recession because it means the worst is behind us and a new recovery can begin. I am less concerned about the accuracy of my economic calls than I am my market outlook, which is what drives portfolio performance. Whether we have a recession or not, I still expect a second-half recovery for the stock market, and a recession in the first half of this year would greatly increase the chances of that happening based on historical precedent.

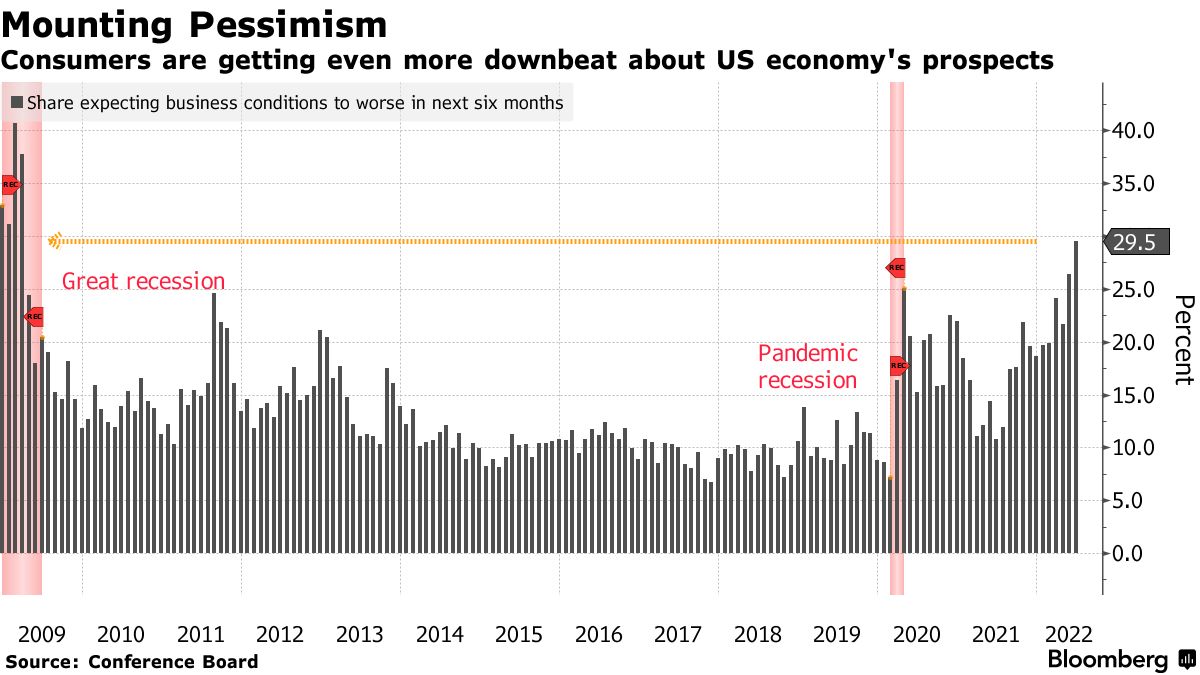

Typically, the stock market bottoms before recessions are over and when we hit peak levels of pessimism. It then starts to rebound to discount the recovery. Some argue that we have yet to see the worst levels of sentiment, which is worse today than at the depths of the pandemic and is consistent with what we saw during the financial crisis of the Great Recession in 2008-2009. I don’t know anyone that would trade today for the summer of 2020 or the 2008-2009 period. There is no comparison.

Bloomberg

The S&P 500 has declined approximately 24% from its January all-time high, which is consistent with the median peak-to-trough decline we have seen during previous recessions. The average one-year forward return from the low is 40% during previous recessions, and we only had one occasion when the return was not positive, which was 2001. In my opinion, this is not 2001, and I’ll have more on that subject come Monday.

Yahoo Finance

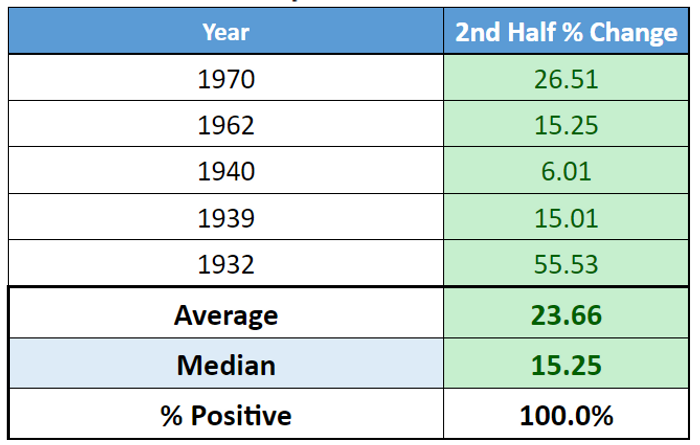

Granted, this year we have seen one of the worst first-half performances for the S&P 500 on record but taking that severity into account is even more encouraging. The market has fallen 15% or more during the first half of the year only five times since 1932, but each time the second half produced positive returns.

Yahoo Finance

I know, this time is different. It’s always different when we are in the heat of the moment. In actuality, it’s never different. It is the same play over and over again with a slightly different cast of characters and storyline that changes just enough to convince the consensus that this time it will be different.

Second-quarter earnings season should produce solid results, but guidance is bound to be weaker than the consensus estimates, yet that is widely expected right now. Corporate managements have no incentive to set expectations at levels they are not confident they can meet, given ongoing macroeconomic headwinds, especially when their stock prices are down 20-80% this year. It is better to lower the bar to levels they know they can beat moving forward, which sets the stage for meaningful outperformance during the second half as the macroeconomic headwinds abate.

It is important to remember that stocks don’t bottom and start going up when the headlines start reporting good news. They bottom in the same way that the market bottoms, which is at the point of peak pessimism and when the news stops getting worse. That is when the selling has exhausted itself. We are now seeing waves of analyst downgrades for companies and sectors, which is a key component of the bottoming process. We want to see it because it helps exhaust the sellers. What I am looking for during earnings season are stocks that start to go up, or simply stop going down, despite bad news.

Be the first to comment