Moyo Studio/E+ via Getty Images

Overview

Bridgewater Bancshares (NASDAQ:BWB) is the holding company for Bridgewater Bank, headquartered in Bloomington, Minnesota, which is part of the Minneapolis-St. Paul-Bloomington MSA. The bank, which is a full-service, high-performing, and high-growth community bank, is one of the largest banks headquartered in Minnesota, and operates six branches in the greater Twin Cities (Minneapolis/St. Paul/ Bloomington) region, with significant experience and a strong reputation in commercial real estate lending, as well as a niche in multifamily lending. Directors and Executive Officers currently control ~18% of the outstanding shares. The bank was founded in 2005 by a group of banking industry veterans and local business leaders, with expertise in commercial real estate, mostly in multifamily lending. The bank pride itself on an effective operating model, generating one of the lowest efficiency ratios in the industry.

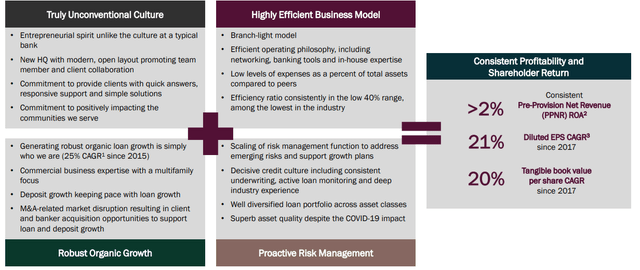

To a certain extent, the management team explains their successful story the best:

- Banking is a people business and culture is very important

- Robust organic growth was driven by M&A related market disruption, allowing BWB to absorb deposits, loan and deposit in its core market at an attractive price

- Efficiency in the business model: a branch light approach drives efficiency

- Risk management: superb asset quality tells the story

Source: Q3 Investor Presentation

From a market exposure perspective, Twin Cities is far superior compared with the rest of the Midwest, reporting 2021 HH income of $86K vs. $64K in the rest of the Midwest. Population growth is expected to achieve 4%, far superior to the 1% expectation in the rest of the Midwest. The Twin Cities area is supported by a highly educated workforce and large investments in scientific research and development. With 180 institutions of higher education, the state is ranked 10th in the nation for the attainment of a bachelor’s degree or higher. Moreover, over time, a significant amount of R&D dollars has flowed into the local market, led by firms such as 3M, Ecolab, among other semiconductor businesses.

Bridgewater has delivered very impressive loan growth over the last five years. Organic asset growth was at 26% CAGR primarily in the Twin Cities market. Most of the bank’s asset growth is organic growth with the exception of one small bank acquisition in 2016. More importantly, the bank expects to achieve at least $5 billion of total assets in the next few years, showing ample runway for growth in the local market.

Bridgewater’s success can be attributable to a number of factors. M&A-related disruptions allow BWB to absorb bankers and clients on an organic basis. The competition within the local market with other mid-cap banks is limited, allowing Bridgewater to grow organically. 40% of PPP loan origination was towards new clients, which significantly lower the client acquisition cost and allow for future cross-selling going forward.

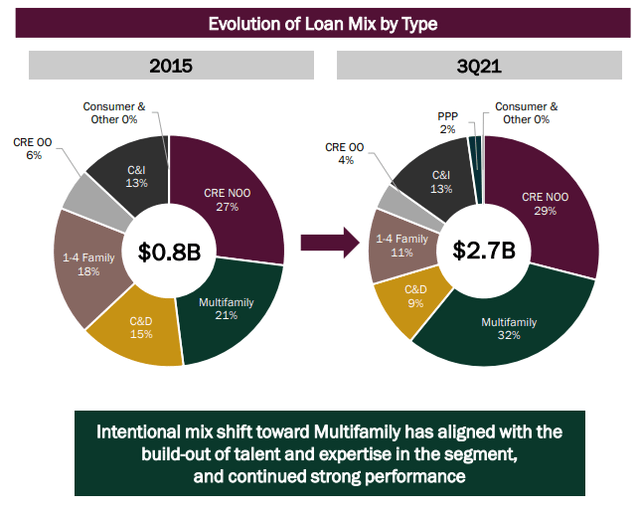

From a capital allocation perspective, the bank has largely pivoted towards an increase in multi-family lending, as the population growth and no charge-off over the past five years show the strength in the local economy and favorable risk/reward dynamics in the sector.

Source: Q3 Investor Presentation

According to the Q3 Investor Presentation, Bridgewater has continued to gain market share in the local market. Ranked by total deposits, Bridgewater improved its position to #9 compared with #17 in 2012. The deposit shares are highly fragmented after the top two, which account for ~58% of the total market. There is significant headroom for Bridgewater to grow in the local market to continue to win market share and be the local bank that service the local market.

Review of Operations

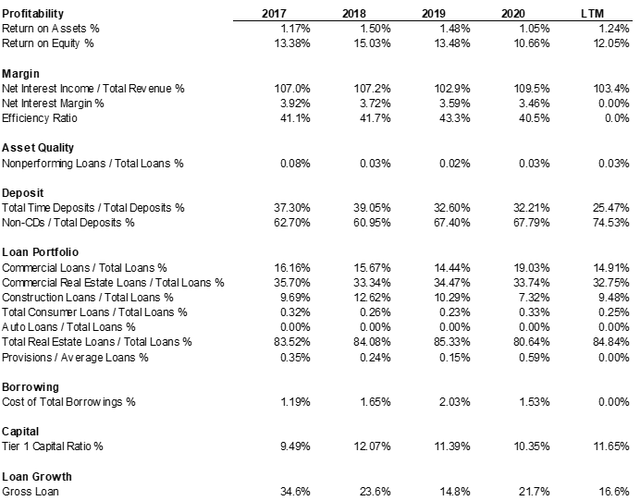

From a profitability perspective, ROA and ROE have been trending positively prior to COVID 19. The efficiency ratio has been consistently running at ~40%, which is far superior to its peers.

The credit quality of the loan portfolio is very strong, showing less than 10 basis points of non-performing loans. Bridgewater clearly benefits from a robust local market with population inflow. Going forward, we expect the strong credit culture to continue. According to the bank, as of Q3 2021, cumulative net charge off since 2017 totaled $632K. The bank’s exposure to hotel and restaurants are limited to a total of $45mm, with only two loan relationships being on the watch list for review and monitor.

Net interest margin has been trending downwards over time, which is largely a reflection of the interest rate environment that the bank is operating in. Despite the challenges, the NIM reported by Bridgewater is, on average, higher than its peers, a manifestation of limited competition at the low economy.

Source: CapIQ, 10-K

Valuation

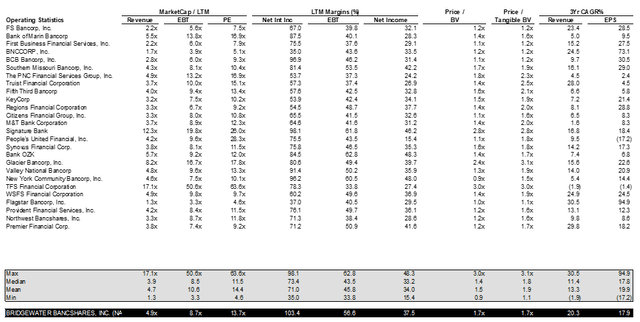

Given the strong credit culture and its growth trajectory, the bank is attractively priced at 1.7x book value and 13.7x P/E. The bank has consistently delivered 20%+ EPS growth over the past five years and the loan book is expected to reach $5 billion in the next few years. There is ample runway for the bank to continue deploying capital given the expectation of local population growth as driven by net positive, skilled labor migration. The management team has outlined capital priority to focus on organic growth, then share buybacks, then M&A and lastly dividend. Bridgewater has tabbed into sub-note and preferred stock market to assist in the growth of the bank. Moreover, the bank has bought back $2mm worth of shares at $16.11 per share.

Source: CapIQ, 10-K

Risk/Reward

From a risk perspective, the majority of the operations are in Twin Cities. If the local economy weakens, then the bank’s performance will suffer. There is a chance of other mid-cap banks moving into the space and heightening the competition, but for any bank to move into the space, they would need local relationships as well as a good deposit base to make it work. Bridgewater is far ahead on that front.

From a reward perspective, U.S. Bancorp (NYSE:USB) and Wells Fargo (NYSE:WFC), which owns ~58% of the total deposit base, are more likely to focus on higher dollar value accounts nationally than the middle market lending that Bridgewater bank is engaged in. As such, the benign local competitive dynamics are likely to persist. Moreover, a rising interest rate environment will help the bank reprice its loan portfolio. Last, but not least, the increasing expectation of net positive population inflow will continue to drive a booming economy in need of housing, food among other necessities, and as the bank that facilitates the local economy, one should expect organic loan growth.

Conclusion

To sum up, Bridgewater will likely outperform given its position in the market, favorable demographic dynamics and a higher rate environment. The existing management has substantial skin in the game and will likely continue to execute and create shareholder value in the long run. Bridgewater is investing in technology to enhance its commercial loan origination platform, continuing to take advantage of its unique position in the local market. The current valuation of 13.7x P/E presents an attractive risk-reward for a bank that can enjoy 20% EPS growth in the next few years.

Be the first to comment