imaginima/iStock via Getty Images

Article Thesis

Oil prices have risen by a lot this year, which provides for a strong macro backdrop for energy companies. European energy names, such as Shell plc (NYSE:SHEL) and BP p.l.c. (NYSE:BP) trade at discounts compared to how American supermajors, such as Exxon Mobil (XOM) or Chevron (CVX), are valued. This provides for a compelling investment proposition in these names, although investors should consider some additional items, such as exposure to Russia and their approach when it comes to green energy. In this report, we’ll pit Shell and BP against each other to see which one is the more appealing pick right here.

How Are BP And Shell Different?

Both companies operate as supermajors, integrated energy companies with diversified operations. These include oil and natural gas production, liquified natural gas generation, refining, chemicals, and energy trading. Both companies have also moved into green energies, electricity generation, EV charging, and other ESG-friendly themes in recent years. Still, their hydrocarbon portfolios are responsible for the vast majority of the profits and cash flows they generate. Shell is the larger company, with a market capitalization of $200 billion, whereas BP is valued at $100 billion. Both companies reside in the UK. Importantly, there is no UK dividend withholding tax for international investors, such as those from the US.

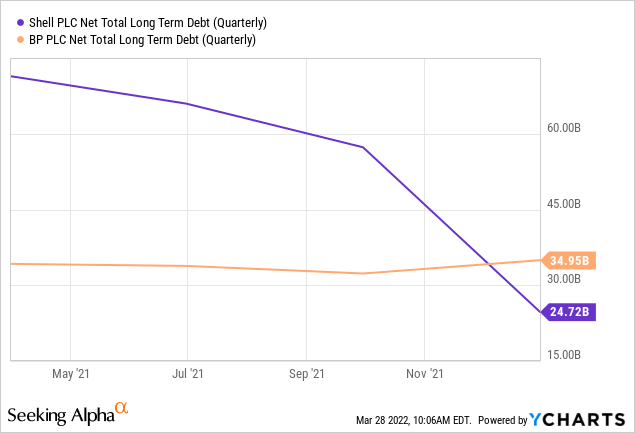

Size is a differing factor, both when it comes to market value, as well as when it comes to profits and cash generation. Shell has generated roughly twice the EBITDA compared to BP last year, which indicates that the market cap difference between the two companies is justified. Shell also uses considerably less leverage compared to BP:

At the end of 2021, Shell’s net long-term debt stood at just $25 billion, whereas BP’s net long-term debt was around 40% higher. When we consider that Shell is the significantly larger company among the two, with higher profits, its lower debt levels are quite telling. Clearly, Shell is the less leveraged and lower-risk pick from a financial perspective. When we include short-term debt and other borrowings, the difference isn’t as large, but Shell remains the company utilizing less leverage. On a net debt/book value basis, Shell’s leverage was 0.31 at the end of 2021, whereas the ratio was 0.41 for BP. Shell also employs less leverage when we look at the net debt/EBITDA ratio, although even BP’s reading isn’t especially high, at just above 1.0.

How Have BP And SHEL Stock Performed?

Not surprisingly, the strong performance of energy commodities, such as natural gas, LNG, and oil, but also gasoline, diesel, etc. has lifted the shares of both companies in recent months. Year-to-date, BP is up 10%, whereas Shell is up 6%. Both companies outperformed the S&P 500 easily, as the index is down 5% year to date. On the other hand, many other energy companies have outperformed SHEL and BP, as the Energy Select Sector ETF (XLE) has risen by a steep 34% in 2022. The underperformance versus the industry by both Shell and BP can be explained by worries about their exposure to Russia. The fact that integrated companies experience less leverage when it comes to rising oil prices compared to E&P pureplays is also an important factor that explains why BP, SHEL, etc. have risen less than companies such as Occidental Petroleum (OXY) — up more than 80% in 2022 alone.

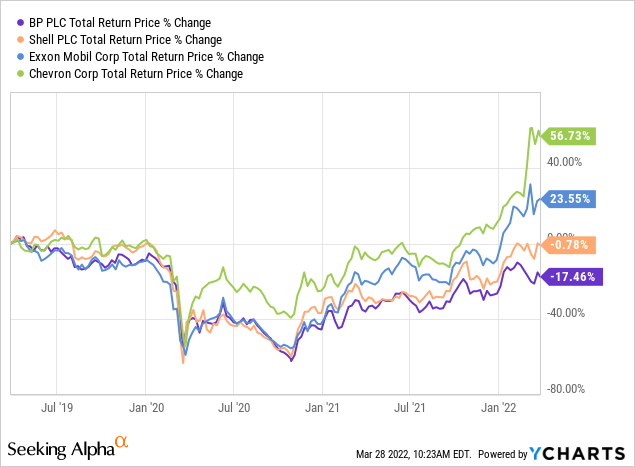

On a longer-term view, both BP and Shell have underperformed their American peers:

Chevron clearly led its peer group over the last three years, with attractive 16% annual returns. Exxon Mobil delivered single-digit returns, while BP and SHEL are actually down over that time frame, even when we account for dividend payments. That naturally is a bad thing for those that bought three years ago. But for someone buying today, the recent underperformance could allow for more pronounced upside potential, as the underperformance has made both BP and Shell cheap relative to the US-based supermajors — which could translate into relative upside potential from multiple expansion.

BP And Shell Stock Key Metrics

Both companies managed to reduce their operating expenses meaningfully in recent years, which has brought down their break-even prices dramatically. This is a trend that can be seen with many other energy companies as well. The 2014 oil price crash has made these companies focus on becoming more profitable with oil prices in a lower range. With oil trading at $100+ today, both companies will be immensely profitable. But even last year, when energy prices were considerably lower, BP and Shell did not perform badly at all.

Shell generated an adjusted net profit of $19.3 billion, which pencils out to an 11x earnings multiple based on last year’s profits. When we consider how low oil and gas prices were last year, relative to where they are today, this seems like a quite inexpensive valuation. Brent traded at just above $50 at the beginning of 2021, and in the high $70s at the end of the year. Today, Brent trades north of $110 per barrel. Even if Brent were to drop by 20% overnight, to $90 per barrel, prices would be way higher than they were last year — and Shell still earned almost $20 billion with last year’s oil prices.

Likewise, BP was quite profitable last year, despite the not very strong commodity price environment. Underlying profit totaled $12.8 billion. That’s less than what Shell earned, but when we account for BP’s lower market capitalization, the company still performed quite well.

Are BP And SHEL Good Long-Term Investments?

BP and Shell have been more vocal about their desire to transition away from hydrocarbons over time, compared to US-based peers. But that will not happen in a couple of years, which means that Shell and BP will continue to have a vast oil and gas footprint for many years. Both companies see liquefied natural gas as an important energy source for the energy transition and have extensive exposure to this theme. Shell had already been involved in the world’s first-ever LNG project in the 1960s and has grown its exposure over the years. With dozens of ships, partially owned and partially chartered, Shell is a major LNG trading player that also holds stakes in floating LNG production assets, regasification plants, and so on. Shell believes that LNG will be a major growth industry over the coming twenty years, forecasting that demand will more than double in that time frame. Shell seeks to shift investments from oil projects to natural gas and LNG projects over the years, due to the better long-term growth outlook for gas and due to the lower CO2 impact. That being said, Shell’s oil exposure is significantly larger than its gas exposure today.

BP is also active in LNG and seeks to expand its business in that space further. It also plans to invest aggressively in green themes such as electric vehicle charging, green fuels, etc. BP’s management believes that these new, green businesses will generate about $10 billion in EBITDA in 2030, which would make them an important part of the company. Importantly, BP does believe that its profits from its hydrocarbon portfolio will not decline in the coming years, despite the fact that some production declines are expected. High-grading of assets and further cost reductions are expected to fully offset some production declines, which is why oil and gas profits are expected to remain stable. This calculation uses fixed oil prices (Brent at $60). With oil prices way above levels seen over the last couple of years, BP’s oil and gas profits should surge this year and beyond, relative to a 2020 baseline.

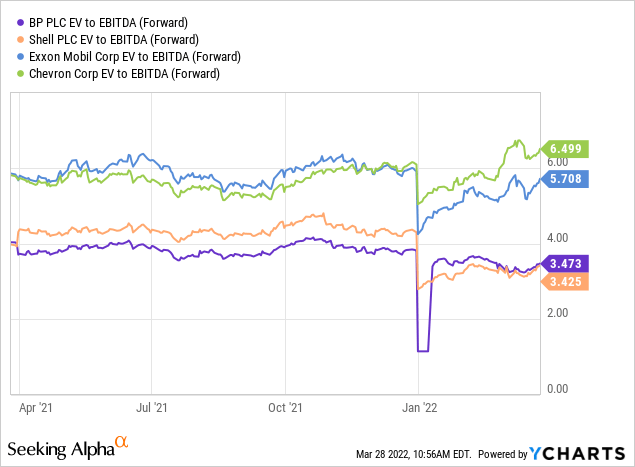

Both companies trade at incredibly cheap valuations of just ~3.5x forward EBITDA. XOM and CVX trade at a premium of 60% and 85%, respectively. To some degree, this can be explained by the Russia exposure of BP and Shell. But when we consider that profit contributions from Shell’s and BP’s assets were less than 10% for each company in 2021, the current valuation discount relative to XOM and CVX does not seem justified.

Both companies will be very profitable this year and will use the proceeds for a combination of dividend growth, buybacks, and further deleveraging. Both companies have guided to mid-single-digits dividend growth in the coming years, which should be easily achievable. With many billions in surplus cash flows, investors can count on further progress in reducing debt levels, and on buyback yields of as much as 10%, depending on the average oil price in the remainder of the year.

Overall, I do believe that both companies make for reasonable long-term investments at current prices. Investors get a dividend yield of around 4% from BP and Shell. On top of that, both companies will offer sizeable buyback yields, a solid dividend growth rate, and exposure to high oil prices. If the valuation ever re-rates closer to where US-based peers are trading, both companies could enjoy massive share price appreciation on top of that.

Is BP Or Shell The Better Buy?

I own shares in Shell, which I have held for some time. At current prices, I do not think that there is a vast difference between these two. Shell has lower debt levels and is the larger, more diversified company. BP has a slightly higher dividend yield and trades at a lower forward earnings multiple. BP also seems to be the company that could be more aggressive with buybacks this year, which could create a lot of long-term value. I view both as solid investments at current prices. Whether one prefers one or the other depends on factors such as whether one wants to focus on maximizing dividend proceeds, whether one wants to reduce risks by going with the lower-debt pick, etc.

Be the first to comment