Big risk, tiny reward Buena Vista Images/DigitalVision via Getty Images

Background/Thesis

For a brief background, the BP Prudhoe Bay Royalty Trust (NYSE:BPT) was formed in 1989 with the sole purpose of administering the Royalty Interest. The Royalty Interest entitles the Trust to a royalty on 16.4246% on the first 90,000 barrels in the Prudhoe Bay Field from the working interest of BP Alaska. After subtracting expenses which mostly consist of a chargeable cost multiplied by a cost adjustment factor (inflation protection), production taxes, and administrative costs then the per barrel royalty is calculated and paid out to unit holders each quarter as a distribution. Every quarter the Royalty Interest resets which means it won’t carry a debt even if the per barrel royalty was negative. Its important to know there is no management team, there are no additional assets, the trustee merely passes on the cash flow generated by the Royalty Interest.

How Trusts Trade

After a decade of trading O&G trusts there are two facts I’ve learned. The first is that retail investors make up much of the unitholder base. The second is that these unitholders rarely understand what they own. To truly know an oil and gas trust an investor needs to read through the prospectus and annual reports. There are many variables that can substantially change the value of the trust. Those variables include, but are not limited to, the royalty interest, operator(s), location of assets, transportation cost, ability to drill more wells, any current lawsuits, and the termination clause. It can take tens of hours of research to fully understand a single trust. It is far easier for investors to trade trusts solely on the yield which is exactly what they do.

In BPT’s case, the most important variables today are the chargeable cost and cost adjustment factor. Between inflation and an ever increasing chargeable cost the per barrel royalty needs higher oil prices to pay out distributions. Previous Seeking Alpha articles have gone into detail on this and I suggest reading the annual report and all attached notes to understand how it works. The retail investing base mostly ignores this crucial aspect and instead opts to trade BPT based on its expected future yield for the next 2-4 quarters. Historically, BPT unitholders demand anywhere from 10% to 30% yield. When there is no yield, it trades under $5 as a call option on oil. In this article I want to focus on that future yield and why BPT is looking over the edge of a cliff.

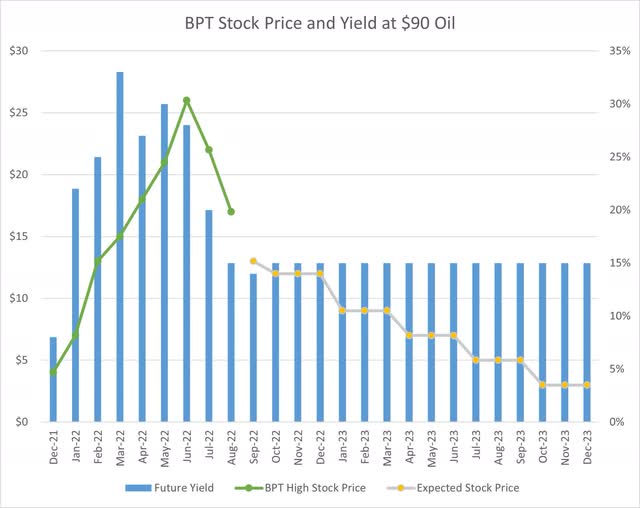

What $90 Oil Means For BPT

Due to high inflation, the break even oil price continues to rise for BPT. At $90 oil, to maintain an average 15% yield the trust needs to go from $15 to $5 over the following twelve months. At that point, it should go back to trading as a CALL option on oil. Adding in distributions, it’s a 50% hair cut on capital if oil doesn’t move higher from today’s price. The chart below shows previous months based on old monthly oil prices to show the correlation between the future yield and unit price. For the first half of 2022, the future yield fluctuated between 15% to 30% as the monthly price for oil went from $83.22 to $114.84. For BPT to maintain a 15% future yield at $90 oil, the unit price needs to fall 40% by the end of the year.

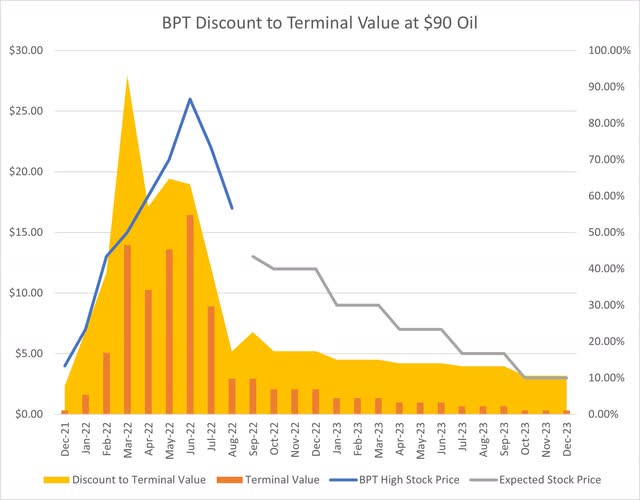

In a more efficient and logical investing world, BPT would trade on its discounted future cash flow. Even though the recent correlation is weak, I wanted to include the chart to inform unitholders of the expected capital they will get back if they hold at $90 oil. The expected stock price is based on the 15% yield so it slowly retraces down toward the total expected payouts. In early 2022, the total payout was almost even to the unit price. By July, the units traded 50% higher than its expected payout. Today, the discount is hovering around 25% which means BPT trades at a massive premium.

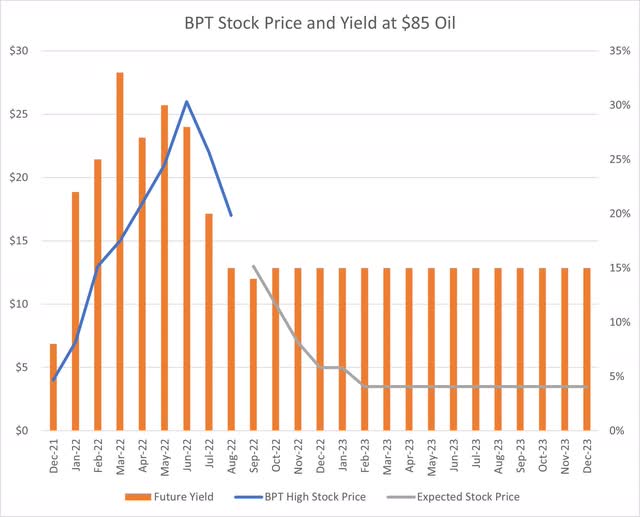

What $85 Oil Means for BPT

Most people search for investments that are leveraged to the upside. Sadly for BPT unitholders, this is the opposite of that. With a less than 10% drop in oil BPT’s price would need to drop to $5 to get a future 15% yield after the October distribution. For the expected distribution of $1, investors today are risking $10/unit or over half their capital. Below is a chart showing the future expected unit price at $85 oil and a 15% yield. Notice the difference in how steep the sell off would need to be to achieve a similar yield to today.

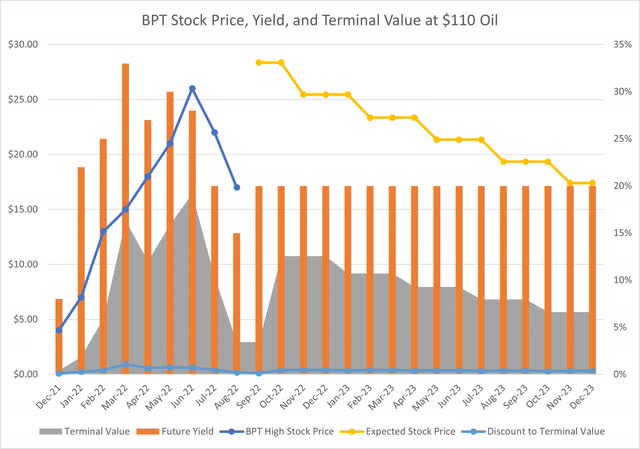

What $110 Oil Means for BPT

There is certainly a possibility that oil heads higher which will cause the future yield to go up. In this scenario, BPT owners will likely have a chance to sell at a profit as long as they don’t make their investment a long-term hold. However, this scenario is short lived unless oil continues to outpace the chargeable cost. Below is a chart showing what BPT would do at $110 oil and a future 20% yield. The final expected price does not include the approximate $6 in distributions over the next 4-5 quarters. I also included the terminal value to show the downside at $110 for anyone holding beyond 2023. In my opinion, the upside would be limited to a short-term burst in the stock price and only last a year.

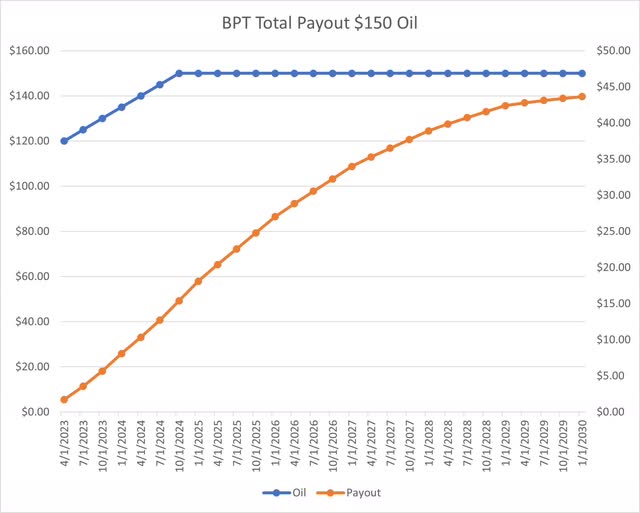

What $150 Oil Means for BPT

If you are ultra bullish on oil and believe $150 oil is attainable, I included the expected payout from 2022 to 2030. The amount received would be around a 300% return or a 56% IRR. After 2030, the payouts are pennies each quarter.

Alternatives for BPT Longs

There are many O&G companies, due to their free cash flow generation, that would equal BPT’s 300% return at $150 oil. The major difference is that these companies can continue to cash flow at $80 oil while BPT would face termination starting in 2023. And even at $150 oil, termination comes in less than a decade. For a long term alternative, I would suggest sidling Buffett with Occidental Petroleum (OXY) or if you need income try Pioneer Natural Resources (PXD). If you want to play it safe and prefer the royalty model then look at Sitio Royalties (STR). Lastly, a well structured options bet on $150 oil could yield anywhere from 10x to 20x return for the more daring. No matter the price of oil, the BPT buy-and-hold crowd will be giving up massive opportunity cost by not choosing a more sound investment.

The Siren Has Been Sounded

I’ve seen many trusts collapse and terminate fail over the last decade. It can be wells that no longer perform, an old lawsuit that drops a bombshell, or a termination clause triggered in a down cycle. Almost always the retail base is caught unaware, their blissful ignorance turns into a nightmare. Due to inflation and a rising chargeable cost, BPT is setting up for a major sell off in the coming 1-2 quarters unless oil rallies back up toward $100. Even then, BPT will not reward its long term unitholders over other oil investments.

Be the first to comment