Justin Sullivan

Given renewed shakiness over rates and the ensuing risk-off attitude that splashed into the markets this week, it’s not a bad idea to start anchoring for safety again. In the growth tech stock world, there are few stocks that are more stable and reliable as Box (NYSE:BOX), the enterprise file storage and collaboration company that was one of the first mainstream SaaS names.

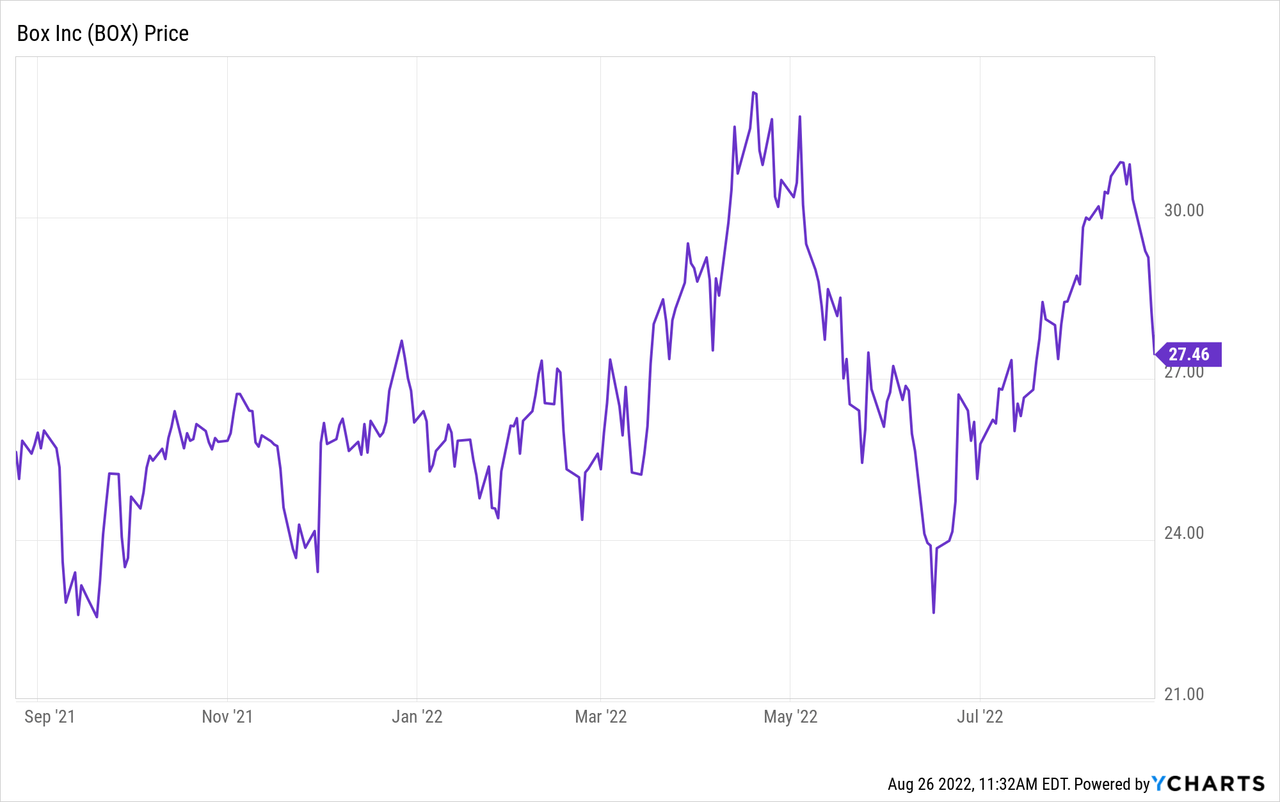

As a deep value stock, to begin with, Box’s performance this year relative to other SaaS peers was quite admirable. Year to date, shares of Box have actually gained roughly 4%, while many other SaaS peers have lost 40% or more of their value. Box may not be the most exciting stock on the market as it’s no longer growing like a lightning rod, but its consistent margin gains may be the bigger appeal in today’s market. In my view, this outperformance is set to continue.

Shares of Box are down, however, since reporting Q2 results – despite maintaining its full-year guidance in spite of FX headwinds and even raising its EPS outlook. It’s a good time, in my view, for investors to continue nibbling on this stock.

I remain bullish on Box, especially amid volatile times. In particular, I think Box’s steady march toward profitability is admirable.

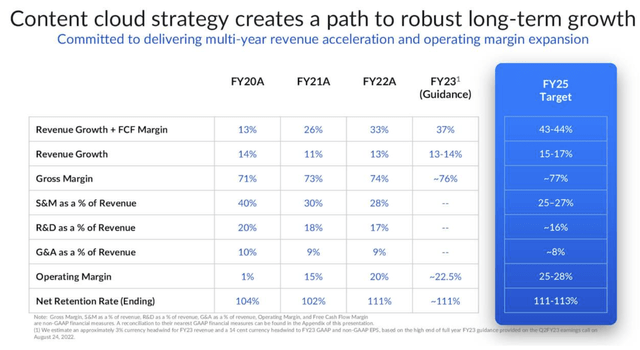

We can review Box’s long-term plan in the chart below. Box’s main target for growth/profitability balance is revenue growth plus FCF margin, which has been steadily growing each year (in a break from most other maturing tech companies, Box has actually accelerated the revenue growth piece of this formula as well as enriched FCF margins). In FY22, the company hit a 33% growth + FCF margin figure. That is expected to grow to 37% this year and hit as high as 44% in two years (FY25).

Box long-term targets (Box Q2 earnings deck)

Most of these gains are expected to come from gross margin boosts (driven by lower infrastructure costs as Box’s revenue scales), as well as operating efficiencies on sales and marketing – much of which is already being realized in FY23.

Here’s a full rundown of what I consider to be the key long-term bullish drivers for Box:

- Box’s product portfolio expansion has led to a $74 billion market – Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Founder-led – Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Enterprise orientation – Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

- Growth plus profitability in one package – Box touts “growth + FCF margin” as its key metric for balancing revenue and profitability; and this has marched steadily upward to 33% in FY22. Box hopes to hit 44% by FY25.

- Possibility of an acquisition – Buyout speculation started brewing for Box in 2021, and chatter on Dropbox picked up in 2022 as well. Though a deal may not be imminent, the company’s product fits neatly into one of the other software giants’ portfolios (Salesforce (CRM) or Oracle (ORCL)) and its free cash flow also makes it an accretive target.

From a valuation perspective, Box remains quite a steal. At current share prices near $27, Box trades at a market cap of $3.94 billion. After we net off the $393.5 million of cash and $368.4 million of debt on Box’s most recent balance sheet, the company’s resulting enterprise value is $3.92 billion.

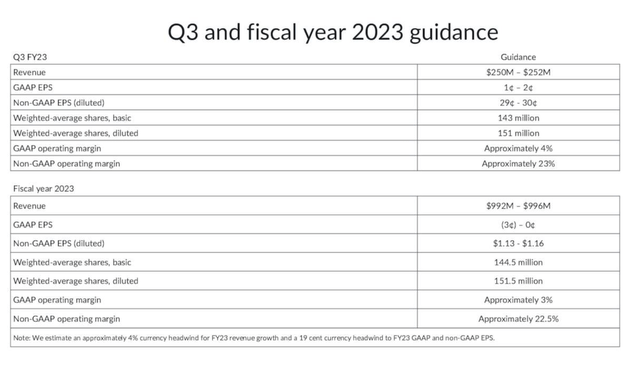

For the current fiscal year, Box has held its revenue guidance at $992-$996 million, representing 14% y/y growth. This is in spite of FX headwinds and macro-related sales pressure, which is causing many other SaaS stocks to pull down their guidance for the year. In addition, Box even lifted its pro forma EPS guidance slightly to $1.13-$1.16, up from a prior view of $1.11-$1.15.

Box FY23 outlook (Box Q2 earnings deck)

This puts Box’s valuation multiples at:

- 3.9x EV/FY23 revenue

- 23.7x forward P/E

Given the expectation of consistent mid-teens revenue growth and multiple levers to margin expansion, I’d say this is still a great entry point for Box. Stay long here and use any dips to buy.

Q2 download

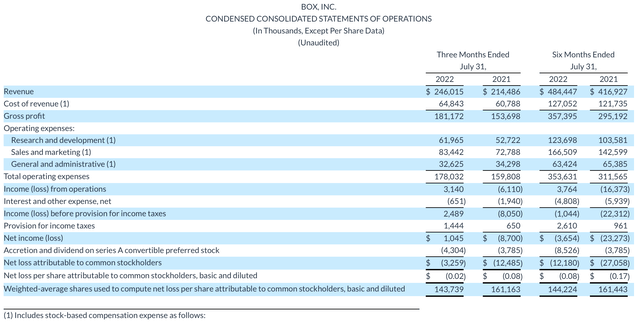

Let’s now cover Box’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Box Q2 results (Box Q2 earnings deck)

Box grew revenue in the second quarter at a 15% y/y pace to $246.0 million, in line with Wall Street’s expectations for the quarter. Now, on an as-reported basis, it looks like Box’s revenue decelerated markedly from 18% y/y growth in Q1. However, the company noted that FX headwinds accounted for three points of growth this quarter; in constant-currency terms, growth would have been 18% y/y.

Ditto here for billings. Billings in the quarter were $235.0 million, up 10% y/y – but there were six points of FX headwind here. It’s important to note that in spite of these severe FX headwinds across both revenue and billings, the company still expects full-year growth of 14% y/y to exceed last year’s 13% y/y growth rate.

Strong customer expansion was another highlight in the quarter. Dollar-based net retention rates hit 112% in the quarter, substantially higher than 106% in the year-ago quarter. Box Suites is making up a greater portion of the company’s new wins, encompassing a gamut of Box products. The attach rate of Box Suites in new deals is now 72%, and the number of Suites deals above >$100k in Q2 is 62, up 15% y/y.

Recall that Box is no longer just a simple file-storage service, but also a content management, e-sign, and security solution as well. Here’s some further anecdotal commentary from CEO Aaron Levie on the company’s traction across several product lines, taken from his prepared remarks on the Q2 earnings call:

In Q2 we rolled out additional capabilities to Box Relay, Box Sign and API enhancements. These capabilities are included in Box core subscriptions and bundles, allowing customers to benefit from getting new value from the Box platform instantly and provide additional upside as customers move up to higher tier plans for more features.

We are very pleased with the momentum we are seeing in customer adoption and use of Box Sign. Second quarter customers include; a real estate development and management company who purchased Box in a six-figure deal as the key technology in its content management strategy. As part of this strategy the company purchased Box Sign Premier Services to support the signing and collaboration around new development properties […]

As we look at the second half of FY 2023, we are going to continue to rapidly extend our platform by doubling down in security and compliance with major Box Shield and Governance advancements, workflow and collaboration with Box Sign, Relay, Notes and the roll-out of Box Canvas, and our open platform and partner integrations.

And critically, we will continue to scale our infrastructure in the cloud so we can continue to help serve customers globally with their most complex use-cases. At BoxWorks, this October, we will be making a number of announcements around major product updates and further share our vision for where the Box Content Cloud is heading.”

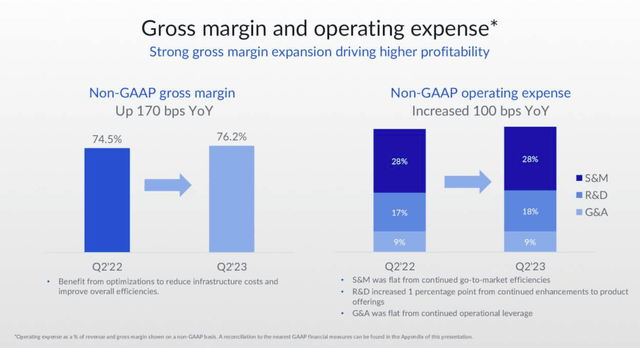

Box’s revenue scaling and multi-product customers are helping the company to grow margins. Pro forma gross margins jumped 170bps to 76.2% in the quarter, only partially offset by a one-point increase in R&D opex:

Box margin trends (Box Q2 earnings deck)

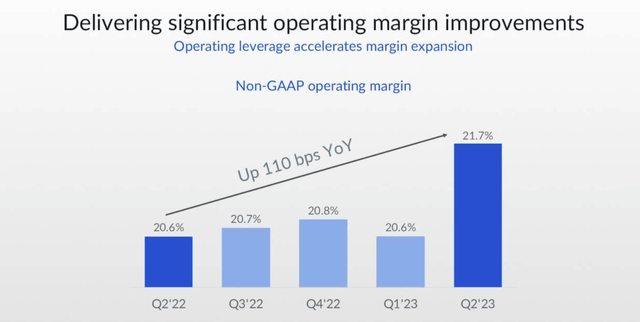

It’s worth noting as well that Box is one of the few software companies to actually improve operating margins in this inflationary, FX-challenged environment. Box grew pro forma operating margins in the quarter by 110bps to 21.7%, while pro forma operating income grew 21% y/y to $53.3 million.

Box operating margins (Box Q2 earnings deck)

Key takeaways

When market sentiment is this nervous, a company like Box that continues to grow consistently while also nudging up its margins is a great asset to hold. Stay long here and use any dips as buying opportunities.

Be the first to comment