Tilegen/iStock via Getty Images

Investment Thesis

A few weeks ago, one of my readers suggested I should take a look at U.S. bowling center operator Bowlero (NYSE:BOWL). I was surprised to hear this considering I haven’t bowled for over a decade and none of my friends has either. Bowling just isn’t a popular sport or entertainment activity in my country. Yet, I learned that it’s pretty popular in the US as more than 67 million people bowl during a year, according to the United States Bowling Congress. In addition, 1.2 million people compete regularly in league play certified by this organization.

Looking at Bowlero, it’s the largest bowling center operator in the US and it has the best operating margins in the industry. Moreover, the company seems to have a good management team and solid development strategy as it’s on a path to achieving its ambitious revenue and EBITDA targets. Let’s review.

Overview Of The Business And Financials

Bowlero was established in 2013 through the merger of Strike Holdings and AMF Bowling Worldwide. AMF was a major player in the industry with over 250 bowling centers that filed for bankruptcy in 2012. The company blamed its financial issues on failing to adapt to a shift in the market to non-league bowlers. Strike Holdings, in turn, was a New York-based operator of upscale bowling centers that operated under the Bowlmor brand. When Bowlero was born, it was the largest bowling center operator in the world with a total of 272 facilities and about 7,500 employees.

Over the past nine years, Bowlero has been focusing on offering a premium consumer experience to non-league bowlers. In 2019, the company bought the Professional Bowlers Association which I think was a good move as it enhanced its brand and also delivers free marketing and advertising through television broadcasts of competitions.

Bowlero

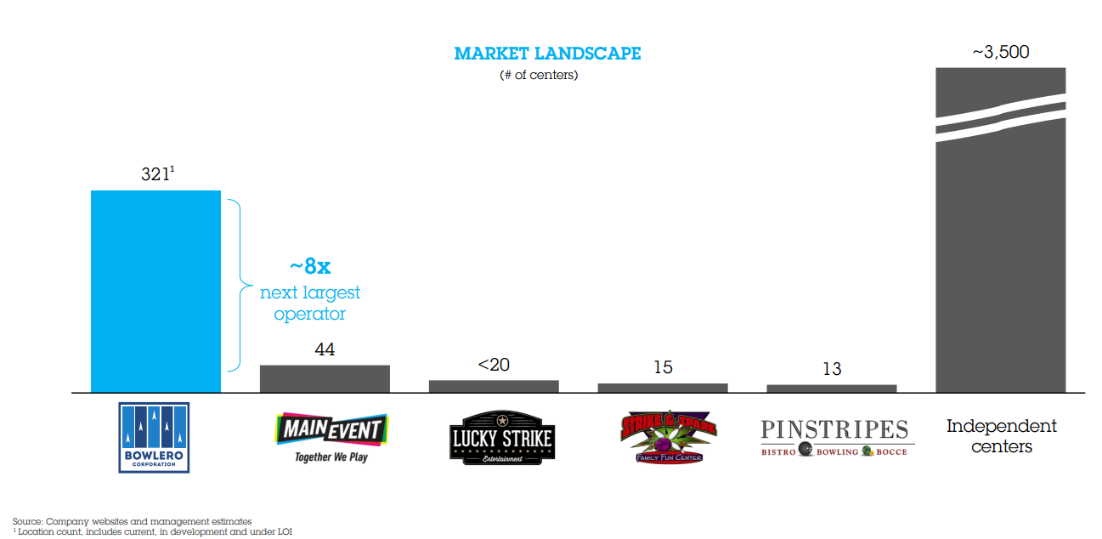

Today, the company has more than 300 bowling centers that serve more than 26 million customers per year and its brands include Bowlero, Bowlmor Lanes, and AMF. Overall, opening the bowling center business doesn’t have high barriers to entry and this is why it’s no surprise that the market is highly fragmented, with about 3,500 independent centers across the US.

Bowlero

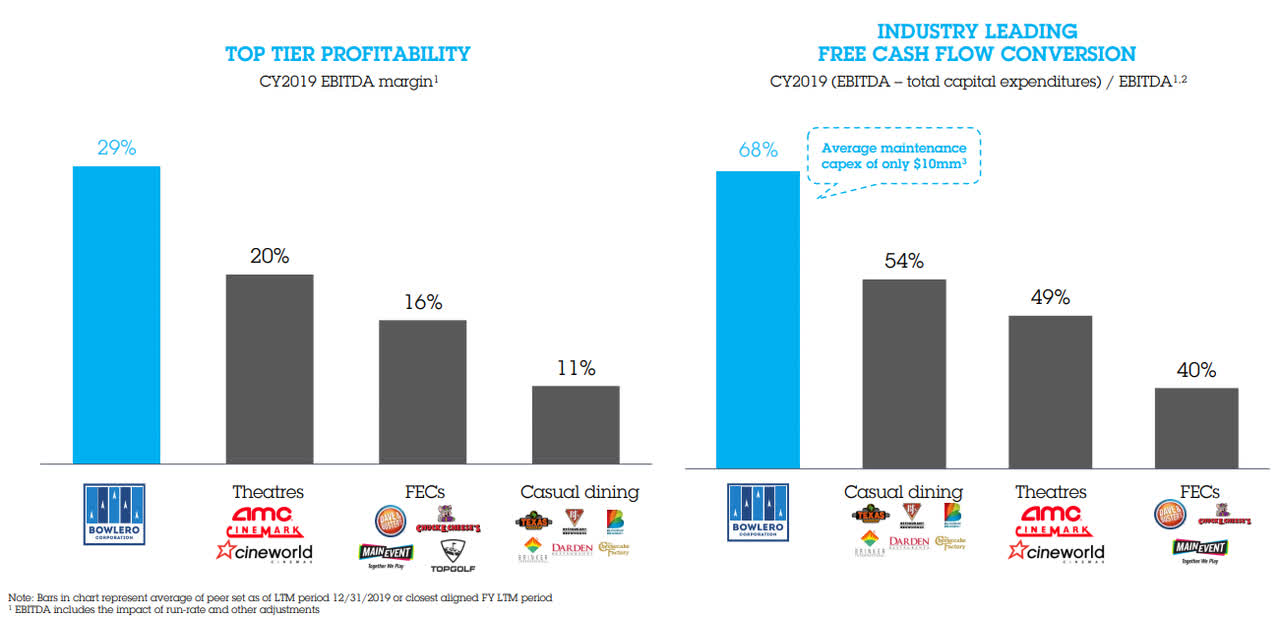

Yet, Bowlero has the best EBITDA margin and free cash flow conversion rate in the U.S. bowling center industry, and this is why I think the company has a good moat.

Bowlero

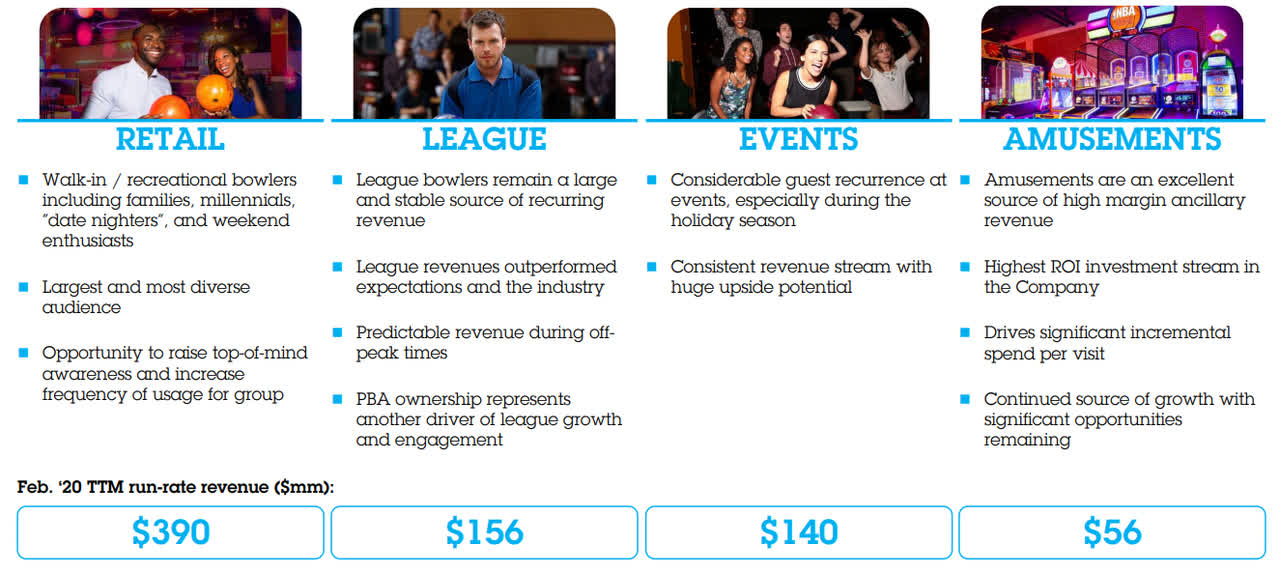

Some of the main reasons Bowlero is able to achieve this seem to be its strong brand, economies of scale, geographic positioning (about 75% of revenues generated in or adjacent to the top 25 metropolitan statistical areas), and revenue stream diversification. You see, a significant part of Bowlero’s revenues come from league bowlers, events, and amusements.

Bowlero

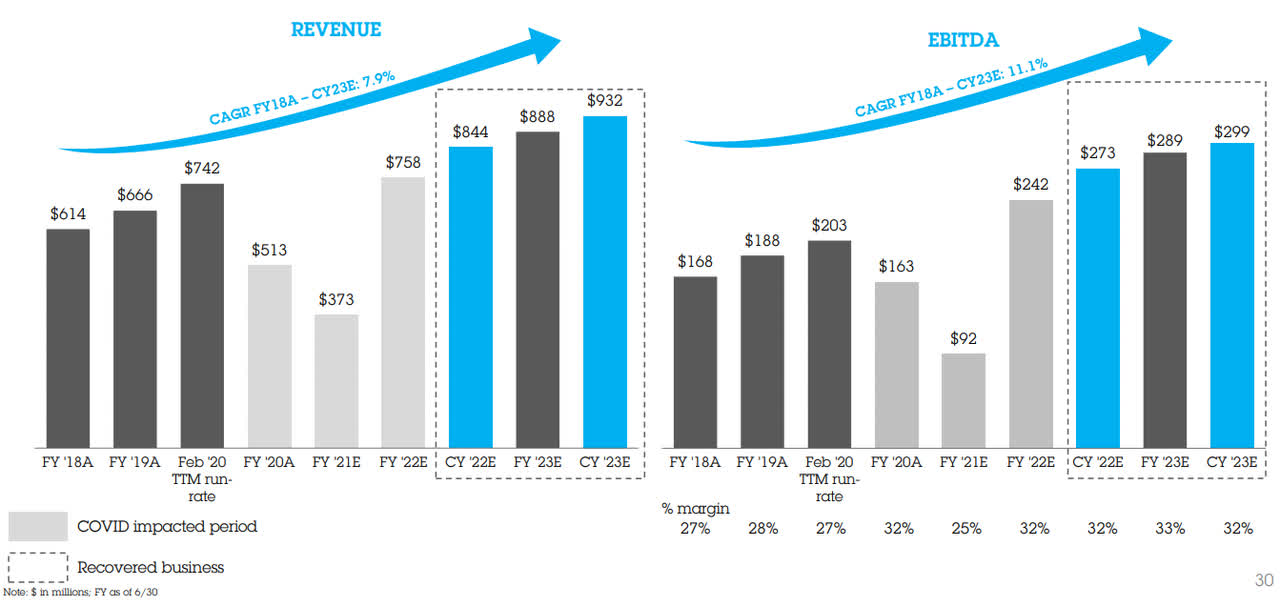

At this point, you might be wondering – if Bowlero’s business model is so good, then how come I’m showing figures for FY19 and FY20? And the answer is the COVID-19 pandemic. Bowlero was hit hard by lockdown measures and revenues and EBITDA declined significantly over the past two years.

Bowlero

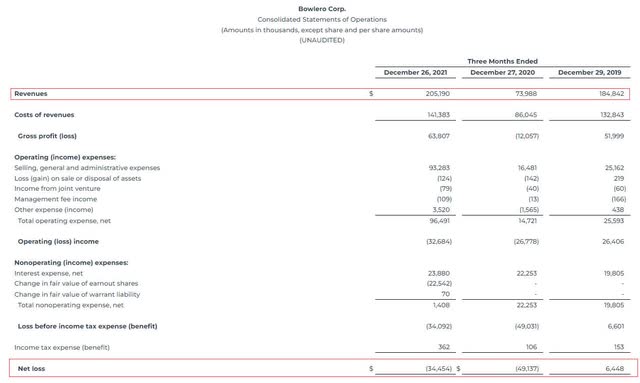

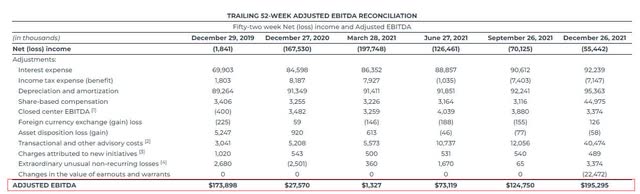

In December 2021, Bowlero listed on the NYSE following a merger with a special purpose acquisition company (SPAC) named Isos Acquisition Corporation, and as you can see from the chart above, it expects its financial results to recover rapidly to pre-pandemic levels. When I first saw these projections, I thought they seemed overly optimistic considering the pandemic still hasn’t ended and that customer preferences might have changed during the past two years. However, Bowlero posted strong results for Q2 FY22 which showed that the projection might be too conservative. The company finished the period with revenues of $205.2 million, which is 11% higher than pre-pandemic levels. Adjusted EBITDA, in turn, rose to $66.8 million which is 26.2% higher than pre-pandemic levels. And this was achieved despite Halloween and Christmas falling on weekends.

Bowlero

Bowlero

Sure, Bowlero closed Q2 FY22 with a net loss of $34.4 million, but don’t pay too much attention to this number as the SPAC deal resulted in $29.1 million in transactional expenses and $42.2 million in share-based compensation. Normalized net income for the period stood at $14.4 million.

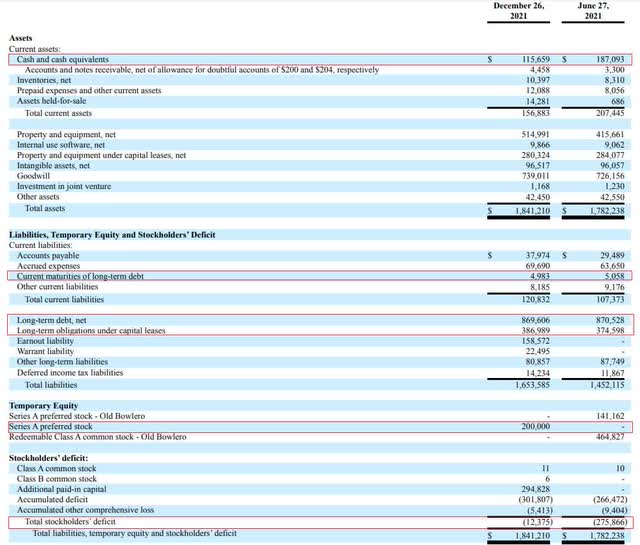

However, I have some concerns about the strength of the balance sheet. As of December 2021, Bowlero had net debt of $1.34 billion (I’m counting the preferred shares here too) and its shareholders’ equity was negative. Most of the debt is long term and the company is well funded at the moment but I’m not particularly comfortable investing in companies with such a high debt burden.

Bowlero

Looking at the risks for the business, I think the most significant one for the short term is a return of the COVID-19 pandemic in the US. If this results in lockdowns, the revenues and EBITDA of Bowlero will be severely affected and this could strain the relationship between the company and its creditors. Looking at the long-term risks, perhaps the most significant one is changes in culture and consumer tastes that result in declining interest in bowling in the US.

Investor Takeaway

Bowlero is staging a remarkable comeback to pre-pandemic levels, and I think its business has a good moat thanks to its strong brand, economies of scale, geographic positioning, and revenue stream diversification. The company owns nearly eight times as many bowling centers as its next competitor. However, I’m concerned that the company has a lot of debt on its books and a return of lockdowns could create significant issues from a financial point of view.

At the moment, Bowlero is trading at 12.3x projected EBITDA for 2023 which I think is not expensive considering the company has a strong moat and good financial track record. Excluding growth capex, the free cash conversion rate is above 60% which should help Bowlero pay off debts rapidly unless COVID-19 returns. Overall, I view this stock as a speculative buy and I think Bowlero’s shares should be worth maybe around $15.

Be the first to comment