Klaus Vedfelt/DigitalVision via Getty Images

Description

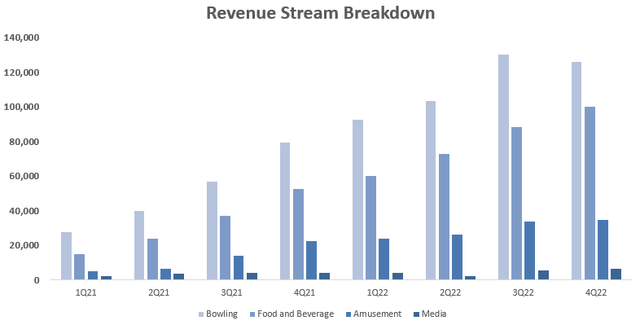

Bowlero (NYSE:BOWL) (“The Company”) is a bowling center operator with a total, as of June 29 – 2022, of 317 centers (vs 291 in 2021) located in the U.S., Mexico, and Canada. The Company’s revenue streams are as follows:

- Bowling revenue, or revenue for providing bowling services

- Food and beverage revenue, or revenue from sales of food and beverages at the bowling centers

- Amusement revenue, or revenue earned through arcades and other games.

- Media revenue, or revenue earned through producing and licensing distribution rights to customers, sponsorships, entry, and host fees.

As you can see, bowling represents the biggest revenue stream and, as of June 29 – 2022, it accounts for 50% of total revenue (down from 52% in 2021). In the same timeframe, the food and beverage stream grew from 32% to 35%.

Customers Review and the Bowling Center Industry

If you have never been to one of the Company’s centers you may be asking yourself: “Do the customers enjoy their centers? What is the added value? etc”. You got me, I was asking myself the same questions and many others. I have never been to one of Bowlero’s centers, so I did some research to address the open questions. Going through a lot of customer reviews I found a lot of positive and negative feedback, however, the kind of feedback I found the most is that customers think that the Company’s services are overpriced, and they don’t feel to get any added value for paying a higher price. The opposite is more likely to be true.

Below, I reported two comments which I believe are representative of the overall customer sentiment:

- “Never understood the hate Bowlero would get when I’d read posts here about their centers…Until now. Today I came to open bowl to get some practice for league tomorrow. What a waste of time. This is my second time coming to the Bowlmore in Chamblee-Tucker of Atlanta for open play. And god will it be the last. The lanes are poorly kept, and the staff couldn’t be any less interested“

- “The Bowlero in my area is $7+/game, no thank you. I hit the roof paying $5/game but that’s the cheapest in my area.”

This is a yellow flag for me. Nonetheless, let’s take a deeper dive.

Next, you may want to know how the industry is doing. According to Statista’s estimates, the market size of the bowling center industry grew at a CAGR of 0.3% in nominal terms, or -2.06% in real terms, over the last 10 years. Moreover, the industry is still well below its pre-COVID level and once we account for squeezed consumers, cutting their spending on non-essential expenditures, more pain may be ahead for the whole industry. Taking a step forward, according to Tecnavio’s estimates, the bowling center industry is expected to grow at a CAGR of 4.45% over the next 4 years. I am a little bit more pessimistic and I don’t expect that kind of growth due to a worsening consumers’ economic position and the net shift we have seen in the last years in the form of entertainment.

Financials

Starting from the Income Statement we can observe a sales growth of 131% YoY (or 35% 2019-2022), a margin expansion with a gross margin of 33% (up from 5% in 2021), and an adjusted EBIT margin of 7% (up from -9.8% in 2021). Basically, the Company seems to have the two key ingredients investors are looking for: sales growth and margin expansion. However, the first yellow flag can be observed once we start analyzing its operative leverage, which is negative (fixed costs have a greater portion of the total cost structure). Definitely, an issue in a recessionary environment since the Company doesn’t have enough flexibility.

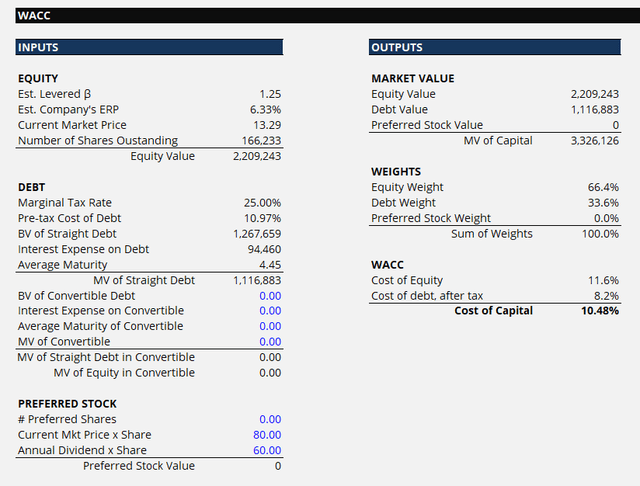

Next, looking at the non-operating expenses, I found another yellow flag, or maybe I should say a red one. I am referring to interest expenses here. As of June 29 – 2022, interest expenses amounted to 10.4% of total sales. In fact, if we take a closer look at the Balance Sheet, we can see how things get worse. The Company has a net debt of $1.13 billion (here I am counting capital leases and I am not preferred shares ) and a net D/EBITDA of 6.65x (vs median peers’ net D/EBITDA of 3.25). Such high leverage may be acceptable and even boost the Company in an expansionary economy, but not in a contracting one. Moreover, this debt is not cheap given Bowlero’s B2 corporate long-term rating and my estimate of a Cost of Capital of 10.48%.

A position that can even get worse if, as stated by Moody:

The ratings could be downgraded if Bowlero’s performance improves slower than Moody’s projects and leverage was sustained above 7x. A weakened liquidity position or the inability to refinance approaching debt maturities in a timely manner could also pressure the ratings.

Moreover, the Company is exposed to interest rate risk since most of its debt presents a variable interest rate structure. An exposure that, as of June 29 – 2022, is no longer hedged:

Under our term and revolving credit facilities, we are exposed to a certain level of interest rate risk. Interest on the principal amount of our borrowings under our revolving credit facility loan accrues at a LIBOR-based rate plus a margin. We previously hedged our variable interest rate exposure to a fixed rate for approximately $650,000 of our debt with interest rate swaps and caps, which expired on June 30, 2022

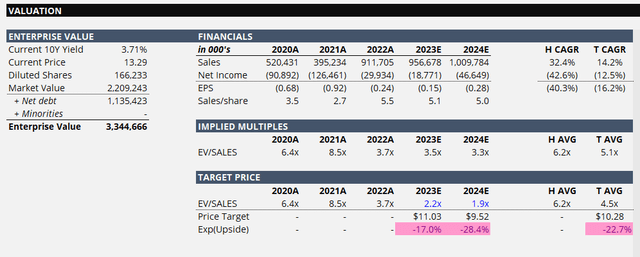

Valuation, Catalyst & Risk

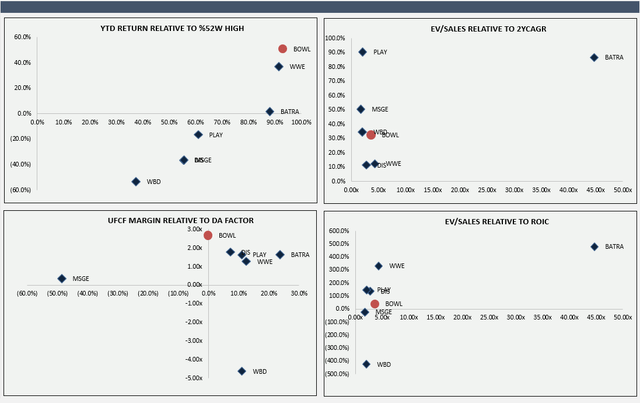

At the moment, Bowlero is trading at an EV/SALES of 3.67x which is quite expensive relative to both the sector median EV/SALES of 2.75x and to its financial position. Here I am doing a comparison against other/similar forms of entertainment, hence, as companies like Dave & Buster’s Entertainment (PLAY), World Wrestling Entertainment (WWE), etc.

As you can see from the chart above, it seems that Bowlero is going on its own path, a path that doesn’t seem to be supported by the fundamentals. For instance, when we consider the EV/Sales relative to the historical 2Y CAGR or relative to ROIC we can see how clearly the price the market is paying for the Company’s earnings is not justified. In my view, the shares of Bowlero are mispriced.

Having said that, I expect convergence to a weighted sector median (ex two extreme tails) EV/SALES of 2.17x.

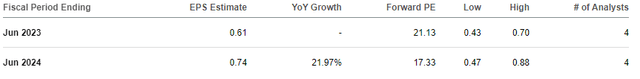

As a catalyst, I see both a multiple compression (driven by an overall bearish sentiment and investors turning to safer assets) and earnings deterioration. The latter, in particular, is driven by lower-than-expected top-line growth, which I expect to fall short by $50M in 2023 and to be in line with the consensus in 2024 (due to the previously stated reasons), and a negative EPS in both 2023 and 2024 respectively of -0.15$ and -0.28$ (driven by the Company’s cost structure and higher non-operating expenses). Below you can see the market’s consensus for the bottom line.

Moreover, I expect investors to be diluted as the Company will seek new funding to keep the machine running.

In terms of upside risks, here are a few:

- Improving macro, hence a change in the direction in the liquidity cycle

- Higher consumer confidence

- Value-productive M&A

Final Remarks

I rate shares as SELL with a fair value of $10.28/share, which implies an expected downside of 22.7% vs. the current price of $13.29. However, I see more pressure in the near term and I am looking for a price level of around $8.0/share in the next 6 months. The rationale behind my target being below the fair value is mainly market-driven. I expect some of the big shareholders’ to start reducing their position and looking for “safer” assets.

What am I doing personally? Well, I started building my short position being aware that we are in a bear market, and even if the overall trend is clear, an ambush is always behind the corner.

——

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment