AnVr/E+ via Getty Images

Boston Properties, Inc. (NYSE:BXP) has been on a spree to acquire new office properties across the U.S., with significant property acquisitions in Seattle and Boston. My thesis mainly focuses on the expansion in the office space by BXP through acquisitions and development of prime properties, which will help them improve profit margins and occupancy rate in the coming years. BXP’s acquisition of Madison Centre in Seattle, a 760K square feet of Class A office space and the development of several properties are the main highlight of my thesis. BXP has seen a steep correction in its price YTD and looks very attractive in valuation and dividend yield at current price levels. Given the attractive valuation of the firm and consistent dividend yield with a vast scope of growth, I assign BXP a buy rating.

Company Overview

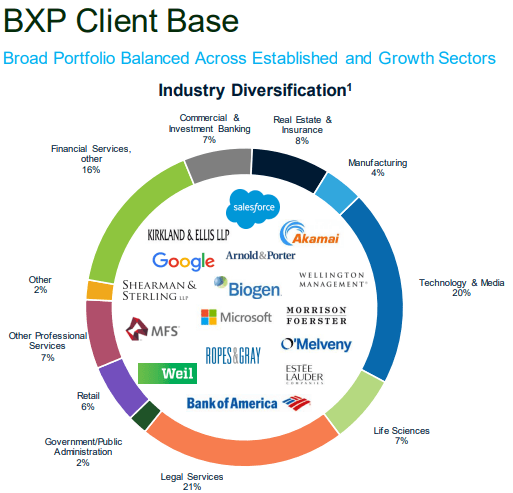

BXP is a leading Real Estate Investment Trust (REIT) that develops and manages Class A office spaces in the United States. The company operates in six major cities: Boston, Washington, D.C., Los Angeles, New York City, San Francisco, and Seattle. The company currently has 202 properties across the U.S. with 53.9 million square feet of space. BXP has 88.8% of the total owned space currently leased and in operation, with a weighted average lease term of 7.8 years. The company has a diversified client base to manage risk exposure across its properties. BXP plans to expand its operations with a few under-development properties in Boston and San Francisco and acquisitions in Seattle. In late 2021 the company saw a revival in demand with back-to-office initiatives by many organizations in the market. BXP is experiencing pre-pandemic occupancy levels with a scope of growth in FY22.

Acquisition of Madison Centre and Multiple Development Projects

BXP acquired Madison Centre, an office tower with 37 floors and 7,60,000 square feet of Class A office space in Seattle, for $730 million. This was a long-awaited acquisition by BXP to expand its operations in Seattle and improve its capacity with premium office space in Seattle. The Madison Centre is currently 93% occupied with an average lease duration of 7.1 years. BXP estimates 98% occupancy in this property by the end of FY 2022. I believe this deal will benefit BXP in diversifying its risk as the tower currently has 20 different occupants and also help improve its profit margins as Seattle has seen a substantial increase in the rent prices in the last few years. My analysis suggests that the purchase will also enhance the firm’s asset quality as the Madison Centre Tower is LEED-Platinum certified.

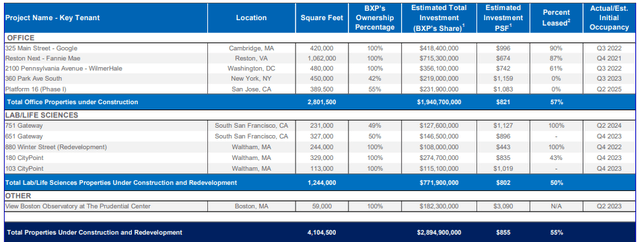

BXP currently has 4.1 million square feet of active development projects, with more than 50% of the total area being pre-leased. Out of the total 4.1 million square feet, 2.8 million square feet is the office development project, and 1.2 million square feet is under development as science lab projects. Many of these projects are estimated to be completed and occupied before the end of FY2023. Office development projects are 57% pre-leased, whereas the science lab projects are pre-leased in the range of 43%-100%, depending on different projects. I believe the pre-leasing absorbs and mitigates the project development risk to a great extent, and in the case of BXP, the pre-leased projects take a majority chunk of its under-development projects. My analysis suggests that with an increasing number of companies returning to work from office mode, the increased office space will significantly benefit BXP in the coming years in meeting the increased demand.

I believe the projects will increase the firm’s leasing capacity in the medium term and help increase revenue in the near future, supporting my thesis of growth and expansion for BXP. The client base of BXP consists of some of the top names across the industry, namely Google (GOOG), Bank of America (BAC), Salesforce (CRM), Microsoft (MSFT), WeWork (WE), and many out top tier companies. This diversification of the client base limits the risk exposure of BXP and provides long-term sustained growth.

Strong Features of BXP

High Dividend Yield

BXP being a REIT, has been very consistent in dividend payment over the past 25 years. Since the COVID-19 pandemic, the dividend growth saw a stagnation at $0.98 per quarter, but with improving revenue, the dividend payment is set to increase and resume its pre-pandemic dividend growth rate. As per the current share price of $90 the dividend yield stands at 4.35%. I believe the dividend payment has scope to improve from current levels. Still, if we consider that BXP is an S&P 500 and better managed than the other REIT companies, the 4.35% dividend seems attractive with the safety and consistency that BXP provides.

Investor Relation

Diversified Client Portfolio

The client base of BXP is highly diversified both in terms of clients and the industry they classify into, with limited dependency even on its biggest clients in terms of revenue. The client base includes many S&P 500 companies and is on an average lease agreement of 7.8 years with BXP. My analysis suggests that this diversification of client portfolio will prove as a hedge against unforeseen circumstances like the COVID-19 pandemic, which saw a rise in work from home model for many firms. This feature of the firm strengthens my thesis of growth in future with limited risk exposure even with rapid expansion.

Financials

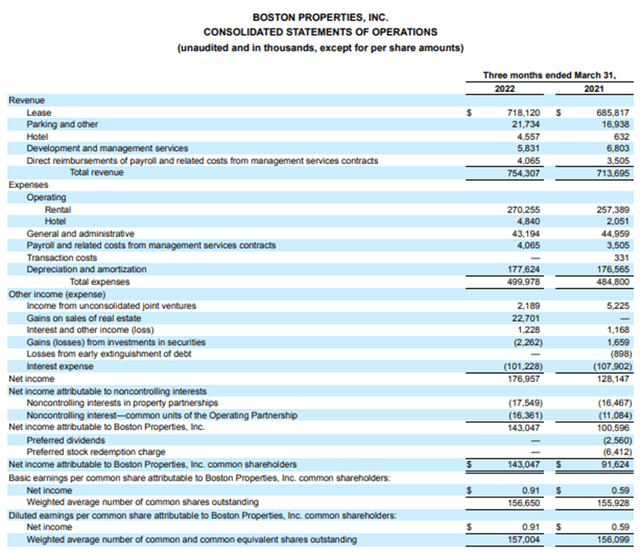

Recently, Boston Properties reported the results for its Q1 2022. The company reported revenue of $754.30 million which is a growth of 6% YoY as compared to Q1 2021. The most significant chunk of the revenue comes from the lease, which has grown by 4.7%. Net income has shown substantial growth of 56% compared to $91.6 million in Q1 2021. BPX has reported an EPS of $0.91 and funds from operation of $286.1 million or $1.82 per share.

Both EPS and FFO surpassed the average of the previous guidance of the company due to enhancement of $0.07 per share of the portfolio performance, re-establishment of accrual basis of accounting for some tenants, which contributed $0.01 per share growth, and a decline in general and administrative expenses contributed $0.01 per share growth. The last quarter’s EPS also has $0.13 per share from a gain on the sale of an asset that cannot be considered a recurring boost.

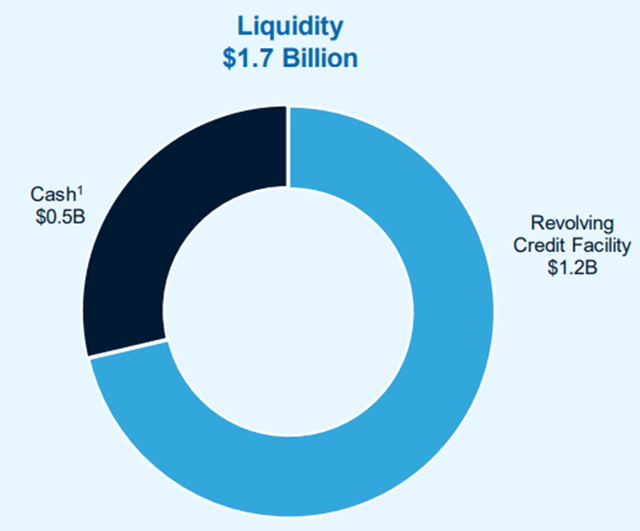

BPX ended the quarter with a cash position of $436.3 million. The company has healthy long-term debt and strong liquidity of $1.7 billion, including a $1.2 billion revolving credit facility.

In Q1 2022, the company signed a lease agreement of 1.2 million square feet with an average agreement term of more than seven years. These long-term agreements guarantee regular dividend payments for the shareholders. The company acquired the office tower in Seattle for $730 million and sold one office location in Waltham for $37.7 million. BPX has also commenced the redevelopment of the one location in South San Francisco, which has 50% ownership of BXP.

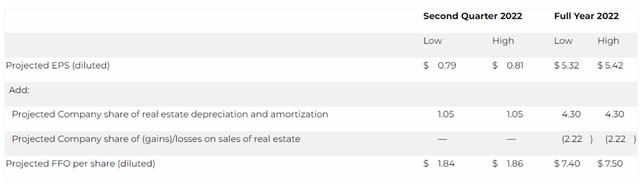

After the solid EPS and FFO growth, the company has reiterated its guidance for FY2022. The company is estimating the EPS to be in the range of $5.32-$5.42, and FFO is in $7.40-$7.50 per diluted share. I believe the growing EPS will translate into an increasing dividend for the shareholder. I estimate the dividend yield to be more than 5% as per the current share price.

Risk Factor

The economic slowdown in the economy and the increasing probability of recession has clearly impacted the rent gains in the U.S. Forecasts by various agencies suggest a mere 0.3% gain in average office rent in the U.S. But the NYC and San Francisco markets posted an even worse picture with a decline in office rent costs as compared to 2021. Even with the demand in place, the pricing power is currently out of REIT’s hands, but BPX estimates a substantial rise in rents in FY23 as the rent prices will show adequate improvement in the long term.

Valuation

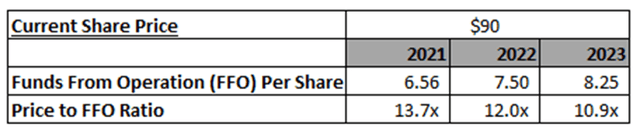

I believe that with the new acquisition BPX’S valuation is inexpensive compared to its peers, and the company will trade at a higher multiple than its current valuation. I believe the current share price to FFO multiple is a better valuation method for REITs as compared to the DCF model and PE multiples. To keep this model simple, I am using only annual funds from operation. As stated in the above table, the trailing price to FFO (FFO of 2021) multiple is 13.71x. I estimate the price to FFO multiple to be 14.4x with 2022 EPS, which will give a price target of $108. That is 20% upside from the current market price.

Conclusion

After considering all the expansion plans and growth strategies of the firm, I believe BXP is a great growth opportunity for the long term with stable and significant dividend payments. The company has given a strong outlook for FY 22 and plans on increasing dividends payout to reflect its confidence in the firm. The company’s fundamentals are in line with future growth prospects, and at its current valuation BXP is a great investment opportunity. My FFO to price analysis suggests 20% upside from the current price level. Therefore, I assign a buy rating to BXP.

Be the first to comment