serts/E+ via Getty Images

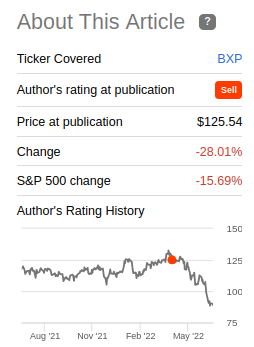

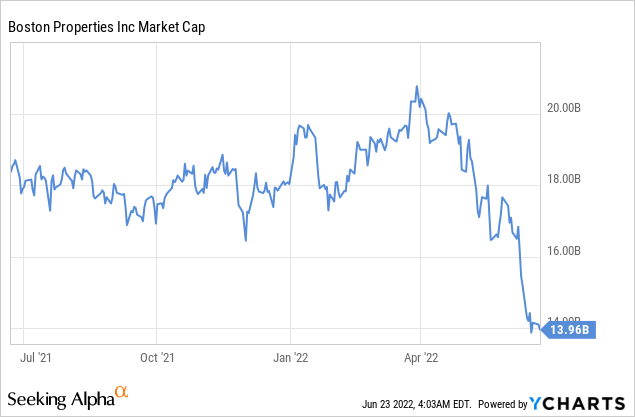

Boston Properties (NYSE:BXP) has gone from overvalued to somewhat undervalued in the space of just a few months. We published an article about the company recently where we argued that Boston Properties is a world-class REIT, but was overvalued. Since then, shares have underperformed the market by a factor of ~2x, taking the overvaluation away.

Seeking Alpha

We remain a little concerned about the “return to the office” trends, which at this point seems more to be a matter of workers not wanting to return because they like working from home, over fear of COVID. It will be really interesting to watch, and critical for companies like Boston Properties, how much companies accommodate this desire of workers to no longer go to the office every day, and whether companies will continue renewing their leases or if they will reduce the space they lease.

Remote Work

As per Kastle systems weekly work barometer, the average physical building occupancy of office buildings in the US remains around 45% of pre-pandemic levels as of June 20, 2022. It is likely that occupancy rates will continue to improve with time, but it seems it will take a very long time to reach pre-pandemic levels.

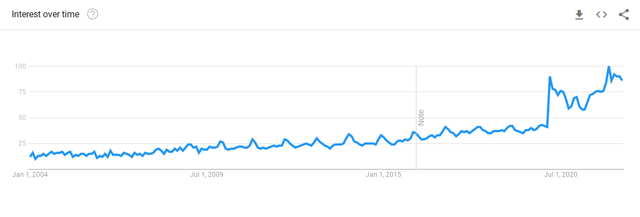

Another indicator that we use to track the return to the office is searches for “remote work”, which skyrocketed at the start of the pandemic, and are now even higher. This tells us that workers are increasingly looking for full-time remote or at least hybrid work when they look for new positions.

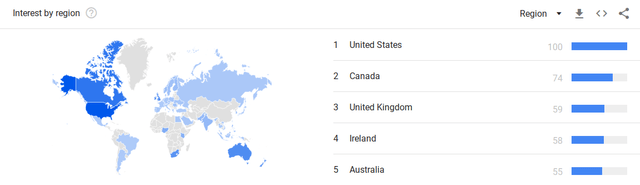

This trend appears particularly strong in the US, Canada, and UK as can be seen in the list below. This is not great news for office REITs with a US focus like Boston Properties.

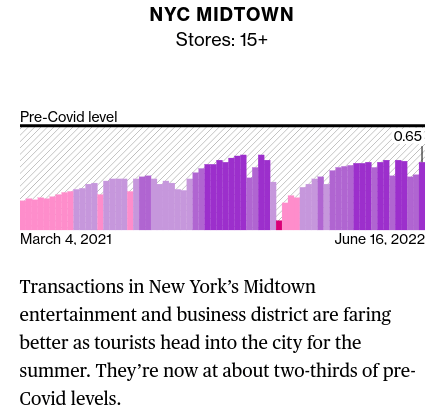

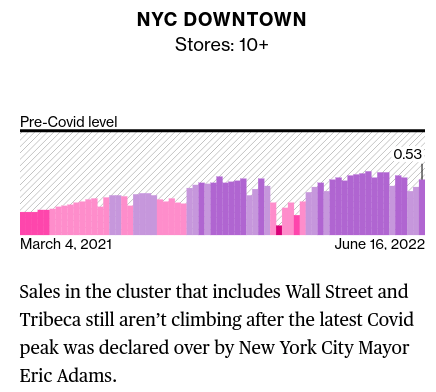

Another good indicator to estimate how the return to the office is going is the Pret index, which is available on Bloomberg, and gives an idea of the foot traffic around different Pret A Manger shops. Pret is providing weekly data to Bloomberg about its sales across major business hubs on an exclusive basis. The figures give a global perspective on whether demand for breakfast and lunch items is returning to shopping centers, financial districts and airports.

Currently, New York City financial/business areas are still far from recovered. For example, NYC Midtown is at roughly 65% of pre-COVID levels, and NYC downtown at only ~53%.

Bloomberg Pret Index Bloomberg Pret Index

Financials

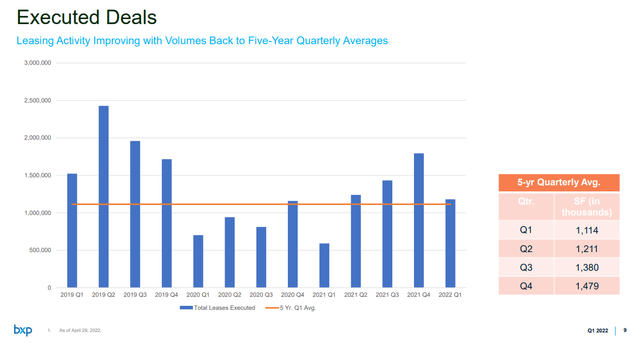

There are some encouraging signs for Boston Properties when looking through their financials. One particular thing that gives us hope about the company is that its leasing activity remains robust. We interpret this as meaning that most companies have not given up on having an office, and that Boston Properties will likely be able to renew most of their expiring leases on relatively good terms. After a few weak quarters during the worst of the pandemic leasing was very low, but the last few quarters leasing volumes are again back above five year averages.

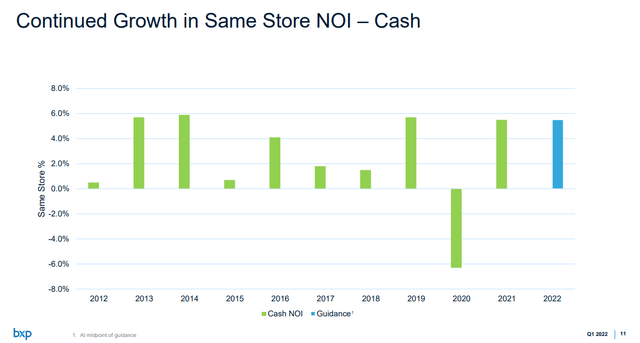

Another positive sign is that the company delivered same store NOI growth in 2021, and is guiding for same store NOI growth in 2022 as well. This is much healthier than the ~6% decline in same store NOI the company suffered in 2020.

Finally, the company is showing faith in its business by continuing with its development pipeline, which the company projects will add ~4.0% growth CAGR. The company is expected to deliver several projects in 2022, and several others in 2023-225.

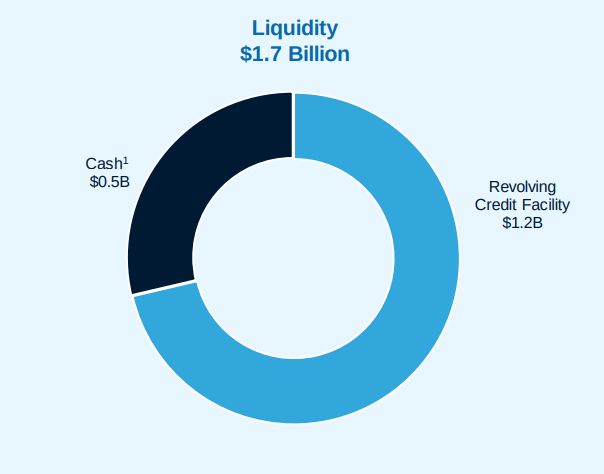

Balance Sheet

Fortunately for Boston Properties, it has a good amount of liquidity to be able to finance its development properties, and to wait for better times in case the office market experiences another downturn. It has ~$1.7B liquidity between ~$500 million in cash and ~$1.2 billion from its revolving credit facility.

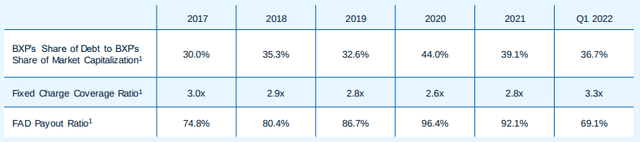

BXP Investor Presentation

Other signs of a stronger Boston Properties is the improved fixed charge coverage ratio which now stands at ~3.3x, and the dividend is a lot better covered with a Funds Available for Distribution Payout Ratio of ~69%.

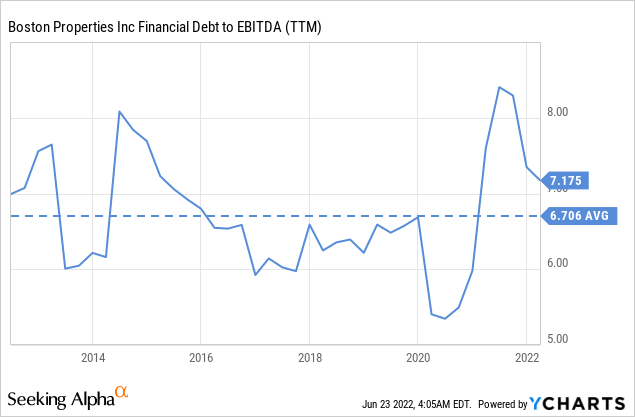

As EBITDA has recovered the debt/EBITDA ratio is almost back to normal, and that is despite some revenue yet to be recovered. For example, ~$43M of parking/retail revenue and hotel NOI remains to be recaptured to return to pre-COVID levels.

Valuation

According to a recent investor presentation, management estimates $992 million in Annualized Funds Available for Distribution. Comparing that figure to the current market cap, we can see that Boston Properties is trading at roughly 14x that figure. For such a high quality REIT, which has decent growth prospects, we consider it relatively cheap. Of course, the big caveat is the impact remote work will ultimately have on the company, and that is something we cannot quantify today. On the one hand it is clear many workers are resisting going back to the office, on the other hand companies continue to sign new leases. That is why we cannot make up our minds if the current margin of safety in the valuation is enough, but at least there is a margin of safety now relative to historical valuation multiples.

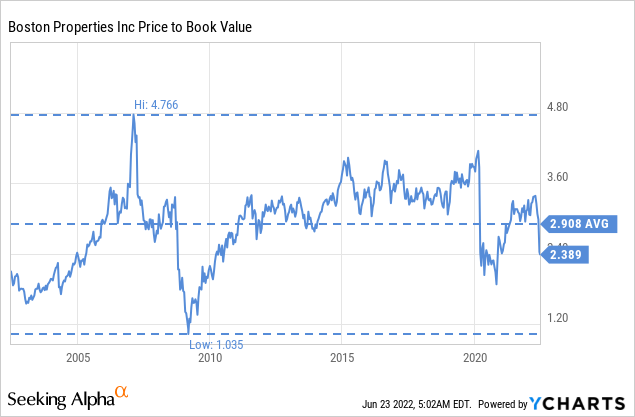

For example, price to book value is now below its 20 year average for Boston Properties, after spending 2015 to 2020 trading significantly above this average.

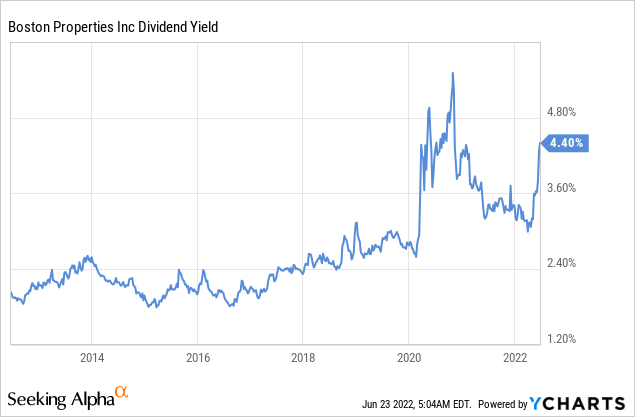

Similarly, outside the worst part of the COVID crisis, the dividend has rarely been this high, at least compared to the last few years. And it is well covered as we saw previously, with a FAD payout ratio of ~69%. It could be argued that there is even room for dividend increases, but we believe the company will be conservative with the raises given the uncertainty of the remote work effect.

Risks

In the short term we do not see reasons for concern, with the company having ample liquidity, a strong balance sheet, and a 7.8 years weighted-average lease term. It is longer term that we worry more, with the impact from remote work still uncertain, and employees and companies giving contracting signals as to the future of work at the office.

Conclusion

Boston Properties’ shares have gone from overvalued to undervalued very quickly, and we now believe shares are a buy with a caveat. The caveat being that the investor has to believe the impact from remote work will dissipate or moderate over time. As we saw, there are still places with very low office occupancy, and while there are encouraging signs from the signing of new leases, we are not fully convinced the office property will fully recover. At least now some of that risk is incorporated into the valuation now. Shares are therefore a ‘Buy’ for investors convinced that there will be a full return to the office eventually.

Be the first to comment