Justin Sullivan/Getty Images News

Boston Beer Company (SAM) will announce 2021 Q4 earnings on February 16, having previously pre-announced downward on January 13. The company provided earnings per share guidance of -$1.00 to $1.00 for the year, down from already reduced Q3 guidance of $2.00 to $6.00 per share. Shareholders hope that the company can stanch the flow of bad news that has come in recent months.

Decelerating Hard Seltzer Sales

Boston Beer Company provided guidance for revenue growth for the year of 20%, driven in large part by Truly hard seltzer. Hard seltzer gained market share in the beer category over the last few years, and Truly represents the number two brand in the category, behind privately held White Claw. The rapid growth in an otherwise stagnant beer category has attracted numerous competitive products, leading to a fragmented market.

The company estimated that they currently have 24% of shelf space dedicated to hard seltzers and expected to gain shelf space in 2022 as retailers trim lower volume brands. Sam Adams expects Truly to be a beneficiary of the consolidation, which they believe drive Truly growth above the overall category growth of 0 to 10% in 2022.

Boston Beer invested heavily to assure sufficient supply of Truly in 2021 after failing to keep pace in 2020; however, the growth rate declined throughout the year and the company found itself with excess inventory and commitments to contract manufacturing partners that were no longer needed. The oversupply caused the company to write down inventory in Q3 and also led to the pre-announcement for Q4.

The slowdown comes as pre-mixed cocktails are experiencing rapid market acceptance. The concern for Boston Beer Company is that the uptake of pre-mixed cocktails may lead to a long-term decline in the hard seltzer category, turning a growth driver into a headwind. The $133MM charge in Q3 indicates the scale of the problem. The impact of pre-mixed cocktails may be leading to similar declines in hard cider (Angry Orchard) and craft beer (Dogfish Head and Samuel Adams).

Right Decision, Poor Outcome

Founder and current Chairman C. James Koch and his wife still own a significant stake in the company and maintain control through voting rights of class B shares, so it is reasonable to assume that Boston Beer is being run with long-term shareholder benefits in mind. The decision to invest heavily was one the company felt they had to make to be one of the winners in a rapidly evolving category. Boston Beer Company doesn’t have the clout and scale of Anheuser-Busch InBev (BUD), so they have to use their agility to offset their disadvantages. Moving fast adds risk, and in this case it didn’t happen to pay off. Koch and Dogfish Head founder Sam Calagione have a passion for the industry and the have consistently shown a willingness to take risks to drive innovations.

Declining category sales are not without precedent, as Boston Brewing saw a decrease in barrels sold in 2016 and 2017 before resuming annual volume growth in 2018. Even if hard seltzer sales ebb, Boston Beer will still benefit from being one of the category leaders. The innovation is set to continue, with Hard Mtn Dew debuting in the coming weeks. There has been a lot of social media buzz around the release, some of which has led Pepsi (PEP) and Boston Beer to add Baja Blast to the original three-flavor lineup.

| Year | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Barrels Sold | 7,368 | 5,307 | 4,286 | 3,768 | 4,019 | 4,256 | 4,103 | 3,416 | 2,746 |

Growth Will Continue in 2022

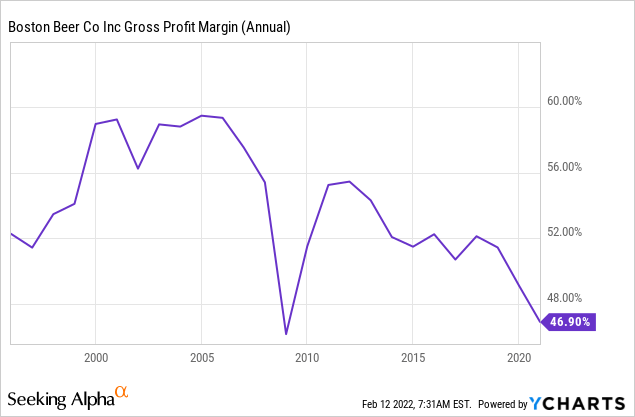

Boston Beer gave preliminary 2022 guidance of mid-single digit growth in volume depletion, and Hard Mtn Dew will likely be a key driver. The company projects that prices will increase by 3-6% this year, but that will not be enough to offset continued margin pressures. The company projected gross margins of 45% for 2022, which continues a multi-year trend of declining margins. Boston Beer only increased net revenue per barrel by 11.5% in the eight years from 2012 to 2020, lower than the ~14% inflation over the same period. While this might be viewed as weakness in pricing power, some pricing theorist believe companies should split cost increases with consumers to promote brand loyalty. I think Boston Beer has been conservative with price increase, which makes the potential for a 6% price increase in 2022 notable.

| Year | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Revenue Per Barrel | 235.67 | 235.51 | 232.30 | 229.05 | 225.55 | 225.55 | 220.08 | 216.35 | 211.30 |

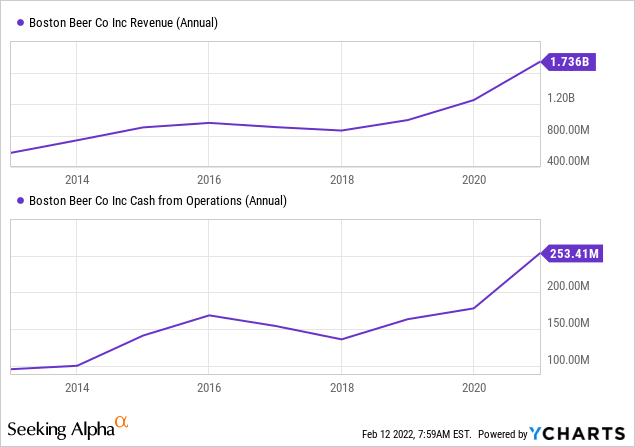

Despite slowing sales and declining margins, Boston Beer has delivered tremendous growth in revenues in the last five years. The company will likely end 2021 with net revenue in excess of $2B, more than doubled net revenues from $906MM in 2016. Cash from operations has increased from $154.2MM in 2016 to $253.3MM in 2020.

The company will continue to invest in the business, with capital spending expected to be in the $140-$190MM range in 2022. Boston Beer spent $85-$95MM more in advertising and promotion in 2021 and expects to increase spending in the category by an additional $10-$30MM in 2022. Clearly the company is focused on investing for the long-term, not trying to squeeze pennies to hit quarterly numbers.

Boston Beer has other innovations in the works as well, with a cannabis-based product in development and new products co-developed with Beam Suntory (OTCPK:STBFY) due in the middle of 2022. The company also launched the Bevy Long Drink at the end of 2021. While it is expensive to support numerous product lines, it does give the company many opportunities to succeed in a market where tastes frequently change.

Is It A Buy?

Shares of Boston Beer have more than doubled from their 2016 high of $204.25 to $432.52 at Friday’s close, but they are significantly lower than the all-time high of $1,349.98 reached on April 23 last year. Shares are likely to continue to be under pressure in the coming months as input costs increase, and interest rates start to rise before the tailwind from Hard Mtn Dew hits the bottom line in Q2.

The company continues to grow and has a management team that is looking at the long-term health of the company. With Sam Calagione on board, the company will likely continue to have innovation and a long-term mindset long after C. James Koch steps away from the company. The balance sheet is solid, with $434MM in total liabilities at the end of 2021 Q3 versus $431MM in current assets.

The company currently has a $5.3B market cap, trading at ~20.9x 2020 operating cash flow. The company provided 2022 guidance of 45% gross margins and a 26% effective tax rate. Coupled with the sales and pricing projections, that equates to a forward PE ratio of around 23. With PE ratio compression likely across the market with interest rate increases ahead, I view the shares a little overpriced at present. I plan to wait until shares dip below $400 before adding to my current position, but I believe Boston Beer is a solid long-term holding.

Be the first to comment