USD/JPY ANALYSIS

JAPANESE YENFUNDAMENTAL BACKDROP

The BOJ announced last week that it would make purchases of an unlimited amount of 10-year JGB’s at 0.25% to avoid yields rising above this target level. This morning, Japanese 10-year yields have slipped to 0.219% (see chart below) despite no actual purchases from the BOJ – due to no offers at the 0.25% level. This comes in an effort by the Japanese central bank to curb rising borrowing costs and maintaining an ultra-accommodative stance – displaying an openness to allow for currency weakness.

Source: Refinitiv

In stark contrast to a hawkish Federal Reserve, the dynamic remains heavily skewed towards long-term USD/JPY upside.

Currently, risk aversion and investor shift to safe-haven assets including the Japanese Yen have kept Yen depreciation under control but should Russia/Ukraine tensions abate, there is significant scope a USD/JPY rally.

The deviation in monetary policy viewpoints between the Fed and BOJ makes the Yen the favored funding currency (low yielding currency that is used to purchase higher yielding currencies) giving support to the bullish outlook.

USD/JPY TECHNICAL ANALYSIS

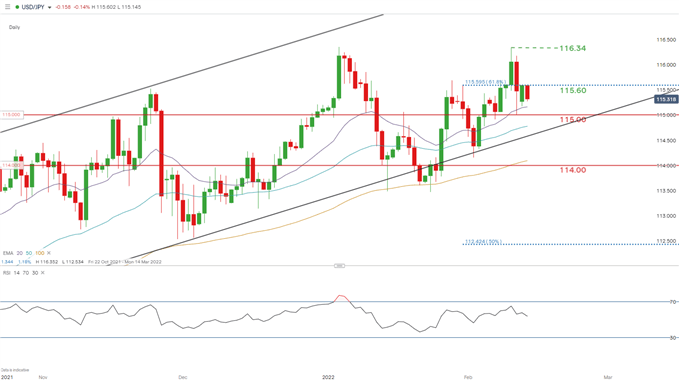

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

USD/JPY continues on its path within the longer term channel (black) with momentum firmly to the upside as evident by price action trading atop all three EMA levels, while the Relative Strength Index (RSI) prints well above the 50 midpoint level.

Despite fundamentals and technical favoring bulls, there is room for a pullback towards the 115.00 psychological handle based on the aforementioned geopolitical risk and investor flight to safety. This may be a good entry point for medium/long-term traders looking to buy the dip as I forecast USD /JPY closer to the 119.00 resistance zone by the end of 2022.

A break and candle close above the key area of confluence at 115.60 (61.8% Fibonacci) could prove to be impactful as markets may see this as a confirmation of further upside.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT HESITANT

IGCS shows retail traders are currently net short on USD/JPY, with 69% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment which suggests further upside on the pair however, the net change in long and short positioning results in a tentative disposition.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment