Grafissimo/E+ via Getty Images

Boeing (NYSE:BA) is a fascinating company. The aerospace giant shares a global duopoly with its European counterpart Airbus (OTCPK:EADSF). However, Boeing also has a significant defense segment and a growing services business. Unfortunately, due to numerous managerial mishaps, Boeing’s business suffered, and its stock price got obliterated during this transitory slowdown phase. Nevertheless, Boeing is a unique, dominant, market-leading company in a recovery process. Next, Boeing’s revenue growth should accelerate, leading to higher-than-anticipated profitability. As the economy improves, Boeing’s recovery should resume and strengthen, enhancing Boeing’s bottom line, and enabling its stock price to go higher.

Boeing: The W-Shaped Double Bottom

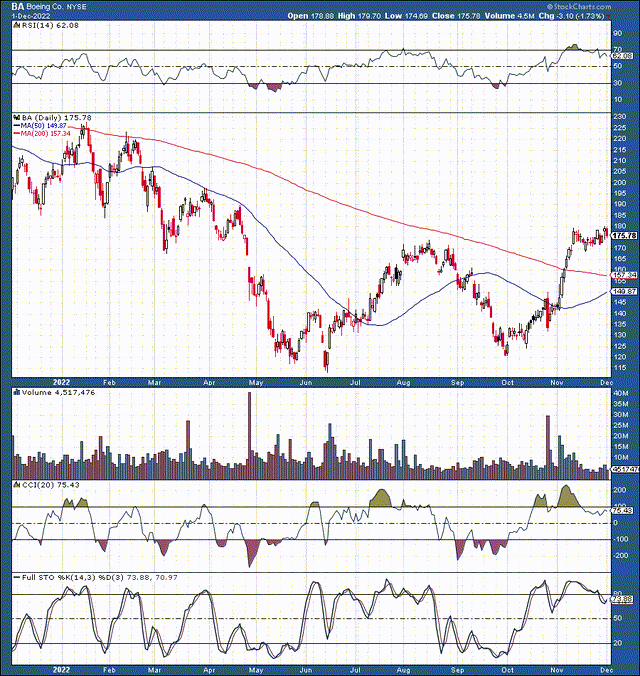

BA (StockCharts.com)

Boeing’s stock probably bottomed around the $100-120 level. Remember that Boeing topped at around $450, illustrating a 75% decline through its bear market period. The recent double bottom w-shaped pattern is highly encouraging. We see some consolidation around the crucial $175 level now, likely leading to a move toward the $200 zone in future sessions.

Money Talks…

Money talks and Boeing is selling many planes. Moreover, as we move forward, the company should experience robust demand in its commercial business segment. By the way, do you know how much a Boeing plane costs nowadays? It may sound ludicrous, but some of Boeing’s passenger jets, like the 747-8 series, cost around $420 million a piece. Boeing’s 787 Dreamliners will set you back about $250-$340 million.

Nevertheless, Boeing recently sold more than 51 planes in one month, and its commercial airplane sales growth should continue. Out of the 51 jets, Boeing delivered 14 widebody versions and seven Dreamliners. The company also landed new orders in September for 96 aircraft, including 51 Boeing 737 MAX orders. You may remember the 737 MAX as the plane model experiencing some “turbulence” in recent years. However, Boeing is on the right track, and the famous plane is experiencing a pickup in demand lately. As uncertainties fade, Boeing’s 737 sales should boom again. In addition, Boeing has significant growth prospects in the widebody jets and the higher-end Dreamliner jet segments.

A Transitory Drop in Revenues

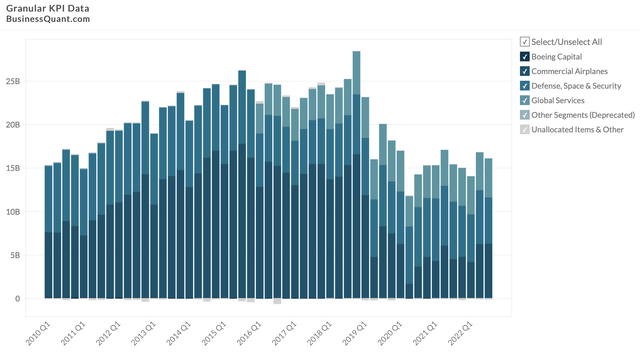

Quarterly Revenues by Segment

Revenue by segment (Businessquant.com )

We see that following Boeing’s 737-MAX fiasco, and revenues fell off a cliff. Subsequently, the company’s reputation and profitability suffered. However, the revenue drop-off was also COVID-19 related, and the company faces macroeconomic challenges. Nevertheless, these factors are transitory, sentiment is strengthening, and Boeing should see significant advancements in sales as we move forward. The giant expects free cash flow to be between $3-$5 billion next year.

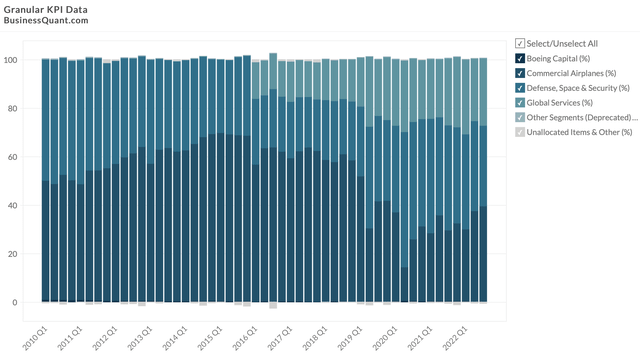

Segment Revenues %

Segment revenues (Businessquant.com)

We see that Boeing’s commercial segment has suffered, dropping from nearly 70% of revenues in 2015 to below 40% today. However, we see robust growth in the commercial segment since the low 14% share of revenues in 2020. Commercial airplane revenues increased to $6.26 billion last quarter, a 40% YoY increase. Therefore, we should continue seeing robust double-digit sales growth from Boeing’s commercial segment in future quarters.

Boeing – The Defense Company

Boeing remains a prominent player in the defense industry. With continuing conflicts in Ukraine, Russia, and other parts of the world, defense contractors should benefit. Boeing’s defense division brought in more than $5.3 billion in revenues last quarter.

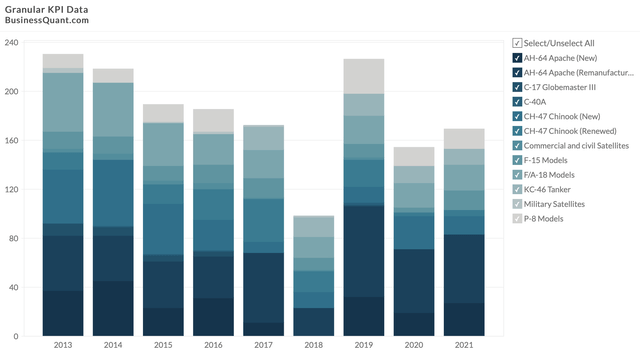

Defense Aircraft Deliveries

Aircraft deliveries (Businessquant.com )

While we saw some post-COVID weakness, sales are trending higher again. Boeing should be one of the primary companies to benefit as military spending increases in future years. Boeing has government contracts worth billions, including this nearly $24 billion DoD transport aircraft support contract. In addition, Boeing has an expanding services business, which accounted for 28% of total revenues ($4.43 billion) last quarter.

Boeing – The Money-Making Machine

Boeing has enormous profit potential due to its economies of scale and unrivaled aviation industry experience. The company went through a challenging phase, and consensus estimates may be too low due to overly pessimistic expectations. Therefore, Boeing’s revenues could accelerate faster than anticipated, leading to higher-than-expected profitability in the coming years.

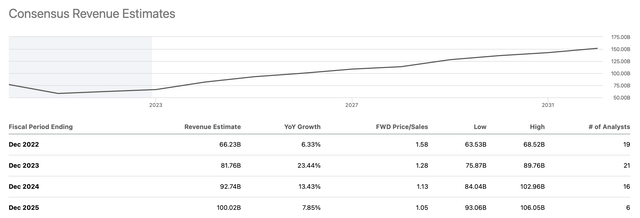

Significant Revenue Growth Ahead

Revenue estimates (SeekingAlpha.com )

Boeing’s revenues bottomed at $58 billion in 2020. This year, the company should deliver around $66 billion and roughly $82 billion in 2023 (consensus estimate figures). With its current stock price, Boeing is trading at about 1.25 times forward sales estimates. This valuation is relatively cheap as Boeing should deliver solid double-digit revenue growth in future years, eclipsing $100 billion in sales by 2025.

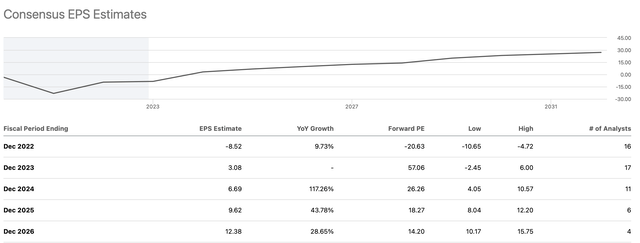

Exceptional EPS Growth Potential

EPS estimates (SeekingAlpha.com )

We all know about the company’s recent low point, but EPS growth could explode in future years. Consensus estimates are for around $10 in EPS in 2025, but Boeing can do better, potentially earning $12 in EPS by then (in line with higher-end estimates).

Here is where Boeing’s stock price could be in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $66 | $85 | $97 | $107 | $118 | $128 | $139 |

| Revenue growth | 6% | 28% | 14% | 10% | 10% | 9% | 8% |

| EPS | N/A | $5 | $10 | $12 | $15 | $18 | $22 |

| Forward P/E | 35 | 27 | 25 | 23 | 22 | 20 | 18 |

| Stock Price | $175 | $270 | $300 | $345 | $396 | $440 | $500 |

Source: The Financial Prophet

Risk to Boeing

Despite my bullish outlook, there is a chance that Boeing’s revenues will expand slower than expected. The company’s profitability may also lag for longer than some estimates imply. Additionally, Boeing may be plagued by future issues with its 737 MAX or other airplanes. There is also the risk of a slowing economy and other transitory factors. Investors should consider these and other risks before committing capital to an investment in Boeing.

Be the first to comment