nycshooter

Shares of The Boeing Company (Boeing) (NYSE:BA) picked up momentum on Friday on news that the airplane manufacturer is about to get a large order from a major American airline. According to the Wall Street Journal, Boeing is said to be in the final stages of securing a large 787 Dreamliners order from United Airlines (UAL) which indicates growing momentum for Boeing’s commercial aircraft division. Boeing is still struggling from the aftereffects of the COVID-19 pandemic which stifled air travel and hurt demand for airplanes. I believe the risk profile for Boeing is still skewed to the upside here as the commercial aircraft business is set to gain momentum and shares are cheap!

Boeing and United Airlines are expected to announce a major 787 Dreamliners deal soon

According to a report from the Wall Street Journal, United Airlines is expected to place an order for a large number of 787 Dreamliners with US aircraft manufacturer Boeing in the near term, possibly in November. Although it is not clear exactly how many airplanes United Airlines is going to buy from Boeing, the airline is likely going to place a larger order, which could be worth billions to Boeing. United Airlines said in the third-quarter that it wanted to overhaul its fleet and considered placing an order of up to 100 wide-body jets with either Boeing or Airbus (OTCPK:EADSY). The Dreamliner competes for orders with Airbus SE’s A350 and a major order from a US airline going to Boeing would be very well received by shareholders.

The deal would come at a very good time for Boeing as the company has started to resume 787 aircraft deliveries and the company needs some good news after it reported a $3.3B loss for the third-quarter due to charges taken in the defense business.

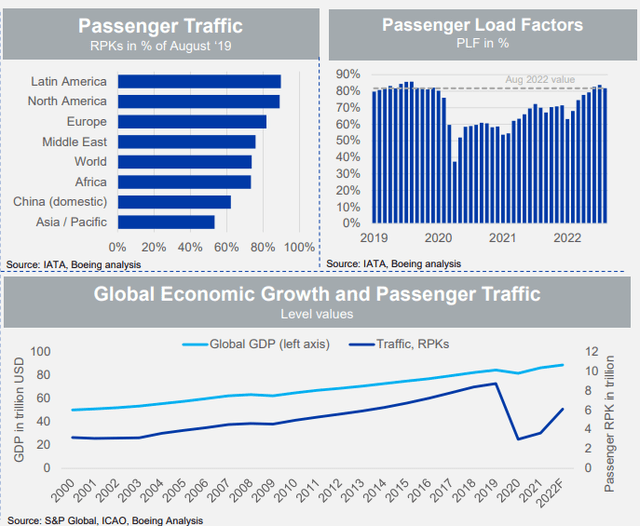

Boeing has been suffering dearly from the down-turn in the airline industry since 2020 which is when COVID-19 triggered an unprecedented decline in air travel. However, air travel is recovering and expected to return to 2019 levels by 2023, assuming that a global economic recession won’t derail the trajectory again. Passenger travel is not quite back at where it was in 2019, but the trend is clearly pointing in the right direction.

Accelerating momentum in the commercial aircraft business

Boeing’s defense segment accumulated operating losses of $2.8B in Q3’22 due chiefly to losses on fixed-priced development programs for the US government as well as higher manufacturing/supply chain costs.

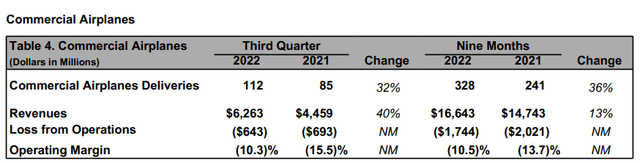

However, the commercial aircraft division, which was a major drag on performance for Boeing during the COVID-19 pandemic, is seeing accelerating momentum, which is largely related to the resumption of aircraft deliveries to customers.

The commercial aircraft division generated 40% revenue growth year over year in Q3’22 which made it the fastest-growing segment as well as the biggest segment with a revenue share of 39%. While Boeing still made a loss of $643M in the commercial aircraft business in the third-quarter, the United Airlines order could not only add materially to Boeing’s backlog, but also help speed up the recovery in the commercial aircraft business. Boeing’s backlog, at the end of September, was valued at $307B and included 4,300 airplanes that are yet to be build and delivered to the manufacturer’s customers.

Boeing has an attractive valuation

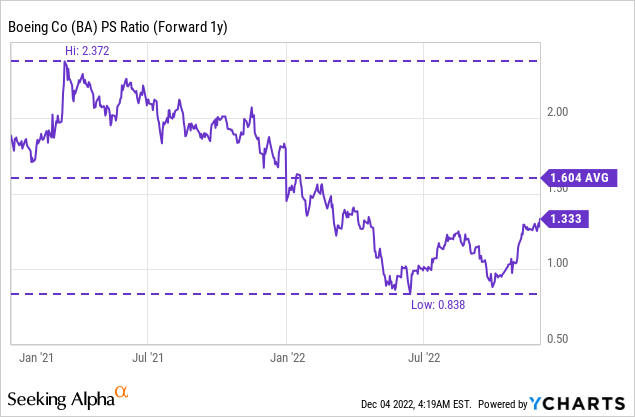

Shares of Boeing are down 9% in 2022 but have initiated a new up-leg in October with Boeing’s third-quarter earnings report not hurting sentiment. Boeing is expected to generate $66.23B in revenues in FY 2022 and $81.76B in FY 2023, implying a year over year top line growth rate of 23%. While Boeing is expected to make a loss for the full-year in FY 2022, the firm is expected to return to profitability next year… and the ramp in deliveries in the commercial aircraft segment will be a big driver to make this happen.

Based off of revenues, Boeing is attractively valued as shares currently trade 17% below the average P-S ratio of 1.60 X. They are also trading materially below the 2021 P-S high of 2.4 X and, I believe, the ramp in deliveries and a return to profitability could push Boeing’s valuation back to where it was in 2021.

Risks with Boeing

As the COVID-19 pandemic has shown, Boeing is subject to the volatility in the air travel industry. A decline in air travel and airplane orders due to uncertainty have negatively impacted Boeing’s largest business, the commercial aircraft division. However, air travel is expected to continue to recover and reach 2019 levels by next year. I also believe that the massive backlog provides some down-side protection for Boeing and the defense business helps stabilize the business due to reliance on government contracts… both reasons, I believe, actually reduce investment risks here.

Final thoughts

Boeing’s turnaround is just beginning. Air travel is coming back and the airplane manufacturer has started to resume aircraft deliveries in 2022 as the company continues to bounce back from the devastating COVID-19 pandemic. A major order from United Airlines would be a massive vote of confidence for Boeing and could attract new investors into the stock. Considering that Boeing’s shares are still cheap and the commercial aircraft division is seeing strong momentum, I believe the risk profile remains skewed to the upside!

Be the first to comment