Scott Olson

Thesis

We present a timely update to our post-earnings article on The Boeing Company (NYSE:BA), urging investors to be wary about joining the summer rally as its valuation was no longer attractive then.

As such, we de-rated BA to Hold and encouraged investors to wait for a significant pullback first. Accordingly, BA has retraced nearly 25% from our previous article, underperforming the broad market significantly. The market had used the optimism stemming from the resumption of its 787 deliveries to draw in buyers rapidly, before digesting those gains.

Notwithstanding, the collapse had also sent BA down below our initial buy rating in June, as the sellers eviscerated the bulls who chased its upward momentum.

Our analysis suggests that the initiative remains with the sellers, but the selling momentum could reach a nadir soon. Therefore, it could create another fantastic opportunity for patient investors to load up on BA, leveraging its robust support zone to add exposure.

As such, we revise our rating on BA from Hold to Buy.

BA’s Valuation Is Relatively Attractive

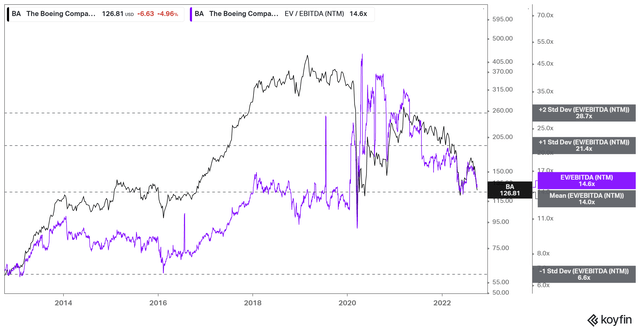

BA NTM EBITDA multiples valuation trend (koyfin)

As seen above, BA’s NTM EBITDA multiples have fallen back to its 10Y mean due to its recent pullback. Some bears could argue why we would consider it attractive when it seems to be relatively well-balanced.

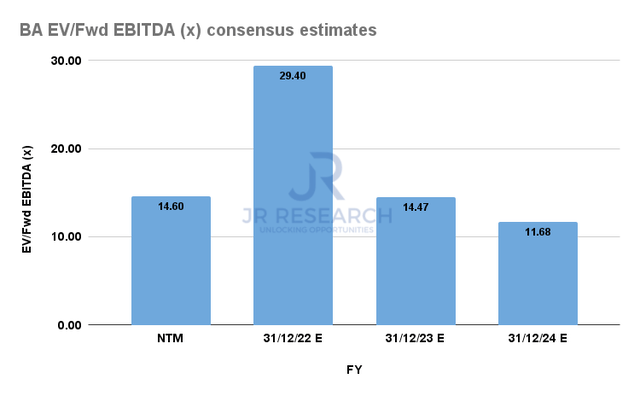

BA Fwd EBITDA multiples consensus estimates (S&P Cap IQ)

We believe it’s critical for investors to consider that Boeing remains in a recovery mode. Its operating metrics remain well below its pre-COVID highs, with its recovery hampered by supply chain disruptions.

Therefore, with the projected recovery in its revenue and profitability profile through FY24, BA last traded at an FY24 EBITDA multiple of 11.7x, well below its 10Y mean.

As we believe the market is forward-looking, we postulate that buyers would likely continue to support BA at the current levels if Boeing can execute a recovery competently.

Boeing Is Confident In Its Recovery

Management accentuated at a recent conference that it has not gleaned significant demand headwinds that could impact its ability to meet its free cash flow (FCF) positive target in 2022. CFO Brian West articulated:

Passenger traffic is 75% of what it was in 2019, about mid-80s for domestic, and high 60s for international. So closing that gap is still a pretty big opportunity, regardless of whether there’s a pullback or not. I think that’s what gives people a little bit more confidence that they might be able to see through some economic clouds to focus on how we can continue to get back to where we were. We [still] expect to be free cash flow positive this year. Nothing has changed [on] that front. I will tell you, as we think about next year and beyond, we expect to generate free cash flow for next year. (Morgan Stanley 10th Annual Laguna Conference)

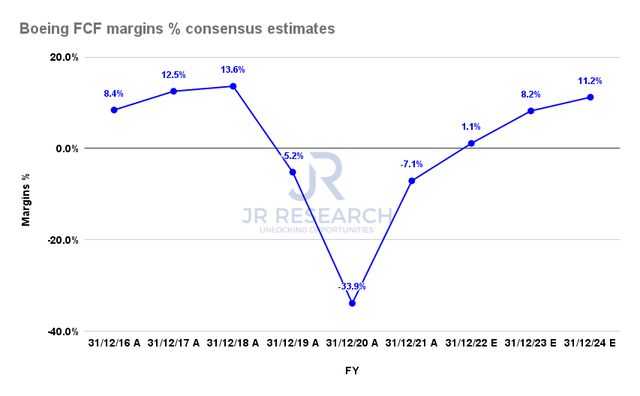

Boeing FCF margins % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) concur with management’s confidence, seeing continued recovery in its FCF margins through FY24.

Therefore, it places tremendous emphasis on Boeing to deliver its recovery amid the threat of a global recession. Given the worsening macroeconomic headwinds, we postulate that the market has likely discounted Boeing’s recovery trajectory to factor in some potential demand headwinds.

However, the recent battering has likely reflected its near-term challenges and de-risked Boeing’s ability to execute through the cycle.

Is BA Stock A Buy, Sell, Or Hold?

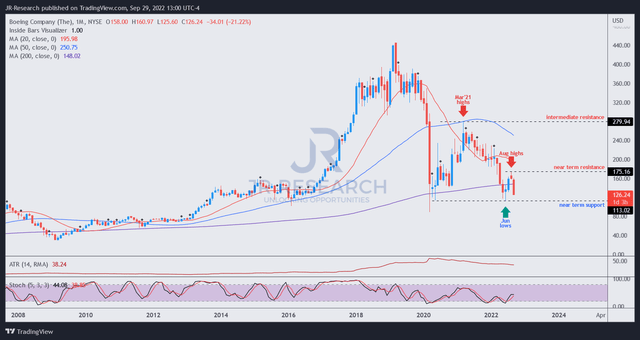

BA price chart (weekly) (TradingView)

Despite the pessimism on BA, it remains supported along its critical 200-month moving average (purple line). We believe that the support zone is robust, which also helped stanch the massive selling downside at its March 2020 COVID lows.

Furthermore, BA’s June lows were also supported along similar levels, indicating the market’s confidence in BA at these levels.

Therefore, we believe the steep pullback toward its June lows represents another fantastic opportunity for investors who missed the June bottom to add exposure along BA’s long-term support.

Accordingly, we revise our rating on BA from Hold to Buy with a medium-term price target (PT) of $150, implying a potential upside of 19%.

Be the first to comment