Stephen Brashear

Boeing (NYSE:BA) provided its September order and delivery numbers not too long ago, which I analyzed in a separate report. With these numbers also in, we can try to estimate what Boeing’s third quarter results might look like, which I will do in this report. As part of this report, I will be estimating the Boeing Commercial Airplanes revenues based on the delivery data for the third quarter accompanied with estimates for Boeing Defense, Space & Security, Boeing Capital Corporations and Boeing Global Services.

Before I start sharing my estimates, I want to address two items. The first one is that estimating revenues as well as profits is extremely difficult at this point in time. While demand for aircraft seems high, previous quarters suggested significant pricing pressure on the Boeing 737 MAX in the range of 15% also bringing down the profit margins. Therefore, in this analysis, I will be using estimates including the pricing pressure as well as excluding the pricing pressure to get to a range. Further complicating the process of estimating profits are the abnormal cost which cannot be known beforehand and supply chain challenges.

What Analysts Expect From Boeing

For the third quarter, the consensus among 16 analysts is that Boeing will be reporting $18.11 billion in sales and $0.08 in earnings per share. A year ago, Boeing booked $15.28 billion in sales and a $0.60 core earnings loss. So, a significant improvement in revenues and profitability is expected and that is mostly driven by the Boeing 737 and Boeing 787 program.

Boeing Commercial Airplanes: Dreamliner Is Back But Offsets Are Present

For Boeing Commercial Airplanes (BCA) revenue estimates, I will be using two pricing scenarios. In one scenario, I use the most recent current market values, and in the second scenario, I use the following assumptions:

- Reduced pricing on Boeing 737 MAX in the range of 15% compared to base values.

- Reduced pricing on the Boeing 767-300F and Boeing 777-300ER.

- Margin pressure on the Boeing 737 MAX and Boeing 777 program.

Implementing this pricing model, we get to $6.4 billion in estimated revenues. Despite the Boeing 787 deliveries, which add over $1 billion in revenues, the sequential improvement in BCA revenues is expected to be just 2% higher sequentially because the Dreamliner delivery revenue bump is partially offset by lower MAX deliveries. In the second scenario, BCA revenues are estimated to be $6.85 billion. So, the revenue estimate for BCA is between $6.35 billion and $6.85 billion.

Modeling R&D at approximately $370 million, SG&A at $465 million and abnormal production costs at $300 million BCA is expected to generate a loss of between $45 million and $360 million, and I am hoping to see that number being closer to a $129 million loss than to a $360 million loss.

Boeing Defense, Space & Security: Challenging On Top And Bottom Line

Boeing Defense, Space & Security is having quite a challenging time with delivering on top and bottom lines. As a result, my expectations are not quite high for the segment with estimated revenues between $6 billion and $6.25 billion, with expected margins of 10%.

Boeing Global Services: A Growth Segment

As demand for travel revived, more aircraft need to be serviced and that should be an overall positive for the services segment with estimated revenues of between $4.2 billion and $4.65 billion on margins of 14 to 16 percent at minimum where passenger-to-freighter aircraft conversions could provide support to the segment.

Putting The Earnings Puzzle Together

Putting it all together, I would estimate revenues from the core segments to be between $16.55 billion and $17.75 billion. It could of course be that I am underestimating MAX revenues as I applied lower unit prices or I am underestimating the revenue at BDS.

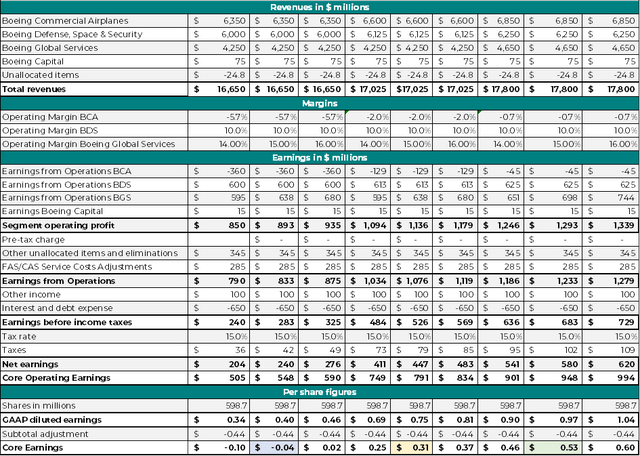

We can put this into the model to get to an estimate for the earnings per share:

Revenue and margin combinations for EPS computations (The Aerospace Forum)

By doing so, the total earnings estimate is between $16.65 billion and $17.8 billion, falling short of the consensus. I also worked my way through various margin scenarios, which return earnings per share estimates between a core loss of $0.10 and a core profit per share of $0.62. However, I do believe that the higher pricing and margin scenarios are not realistic at this point. That would mean that in the table, we should really be focusing on the first three columns with calculations. These calculations would indicate core earnings per share between -$0.10 and $0.02 with a core loss of 4 cents per share at the midpoint. So, the consensus of a $0.08 loss per share falls within the range that my model provides.

Conclusion: Boeing Stock A Buy, EPS Improvement Expected

Boeing is finding its way back slowly. For Q3 2022, BCA revenue growth driven by the Dreamliner is somewhat dampened by lower MAX deliveries. For BDS, things are quite unclear as the segment has been dealing with cost growth and supply chain challenges. On the other hand, the services unit is performing well with growing revenues and margins. Overall, I would be OK with anything that indicates a core loss of 10 cents per share, and a loss of 4 cents per share or better at this stage would be strong.

For the longer term, I remain bullish on Boeing as the MAX deliveries effect has yet to be reflected on annual level and the same holds for the Dreamliner program. At some point, supply chain challenges should dissolve at which point Boeing could also further hike production rates to meet demand.

Be the first to comment