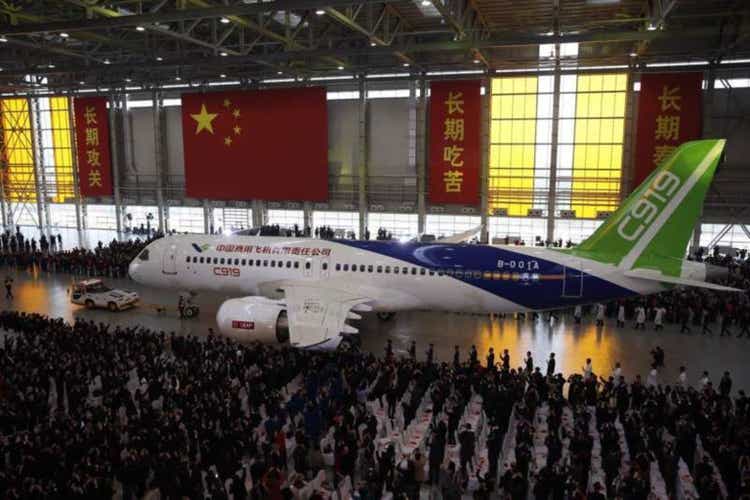

VCG/Getty Images News

As the Chinese protests continue to gain momentum and dominate the headlines, there was another major development, which would more than likely have a negative impact on the American aircraft manufacturer The Boeing Company (NYSE:BA). Just a couple of days ago, the Chinese aviation regulator gave a production license to its national corporation COMAC to begin the mass manufacturing of its narrow-body airliner C919, after granting it a certification back in September. This news is a major blow to Boeing, which to this day has 138 737 MAXs in its inventory that it can’t deliver to its Chinese clients due to the fact that the Chinese regulatory body hasn’t recertified the plane after grounding it back in 2019.

On top of that, the worsening of Sino-American relations along with the decision of China to grant Airbus SE (OTCPK:EADSY) a major contract to deliver over 300 planes to its state-run airliners in the following years indicate that Boeing is about to lose a dominant share in one of the biggest aviation markets in the world due to geopolitics. What’s worse is that it appears that Boeing still hasn’t remarketed any of its planes that are designated to its Chinese clients to customers from other countries, as the hopes of reentering the Chinese market are waning with each year. As a result, we could safely assume that Boeing would continue to struggle to reinvent itself, since the grounding of the 737 MAX due to safety issues in the past continues to haunt the business to this day.

Hope Is Not A Strategy

In late October, Boeing revealed its Q3 earnings results, which disappointed lots of investors. While the company’s revenues during the period were up 4.5% Y/Y to $15.96 billion, they were nevertheless below the estimates by $1.95 billion. At the same time, the business’s non-GAAP EPS was -$6.18 against the estimates of $0.07, primarily due to the losses that were caused by the defense development programs. In addition, despite the record backlog of $381 billion at the end of September, Boeing continues to have a relatively weak balance sheet, as at the end of Q3 it had $50.6 billion in long-term debt and only $14.3 billion in cash reserves.

What’s worse is that in addition to the relatively weak performance during the recent quarter, Boeing is also failing to gain any ground in China to this day. Since 2017, Boeing hasn’t signed any major deals with the country’s airliners in part due to the Sino-American trade war that began in 2018. At the same time, things began to severely deteriorate in 2019 after China became the first country in the world to ground its 737 MAX planes due to safety issues. This resulted in the decrease of its Chinese revenues in 2020 by 68.3% Y/Y to only $1.8 billion.

To improve the situation, Boeing management urged the Biden administration to improve the Sino-American relationships more than a year ago, as the company believed at that time that orders from China are going to be key to its overall business development. In part, this is correct, as China is a lucrative market that is expected to account for one-fifth of global airplane deliveries in the following decades. If things don’t improve, Boeing is risking losing a dominant position there, which would negatively affect its growth prospects for years to come. Even though Boeing executives met with Chinese officials back in September to discuss the recertification of the 737 MAX in China, the plane is still not recertified to this day.

Another major problem for Boeing is that out of around 270 planes that Boeing had in inventory at the end of Q3, 138 of them are 737 MAXs that were designated to clients in China. Boeing’s CFO Brian West during the latest conference call stated the following about their deliveries:

Based on our latest assessment of China and the -7, -10 certification time lines, we now expect most of the inventoried airplanes to deliver in 2023 and 2024 with some moving into 2025.

However, there’s no guarantee that the Chinese regulatory body would recertify those planes in the first place. From listening to the conference call, it appears that the company’s management is only hoping that things will improve and is not sure about the future of the 737 MAX in China as well. Here’s what Boeing’s CEO Dave Calhoun said when asked about the return of Boeing’s planes to China and the potential political roadblocks:

So, I’ll start with my hope. My hope is that these two big geopolitical forces get together and endorse free trade again and COVID policy ultimately lightens sometime in the future in China so that they can take more deliveries of airplanes. So, we’re going to keep supporting our customers, keep supporting their regulator every step of the way.

The problem here is that hope is never a good strategy, but it seems that Boeing’s management hands are currently tied, as here’s what the company’s CEO Dave Calhoun said when asked about whether any of the 737 MAX planes have already been remarked to other clients from other countries:

Well, there’s active discussions with customers about that topic. More to come in terms of things getting finalized, but it’s an active discussion, so that we can no longer defer that decision and actually start to think about how we liquidate that in terms of working capital improvement and cash flow. More to come, and we’ll keep you updated.

Considering this, it’s safe to say that those planes would remain on Boeing’s books for a considerable amount of time, as none of them have been sold to other customers, while the possibility of delivering them to China decrease with each day mainly due to geopolitics since China is the only country that hasn’t recertified the planes.

Beijing Sends A Message

In addition to the inability to deliver the existing 737 MAXs to China, Boeing’s overall future in China is in question as well. Let’s not forget that back in July, Airbus was granted a $37 billion deal with the biggest state-run Chinese operators to supply them with 292 airlines in the following years. Then, in September, Airbus signed another $4.8 billion deal to supply additional planes to Xiamen Airlines and China Southern, who had been running a Boeing-only fleet in the past. Both of those developments marked the end of the split jet deals era, in which China granted contracts to supply a nearly equal number of planes to both Boeing and Airbus in the past.

Considering that Sino-American relations significantly deteriorated after the visit of the Speaker of the U.S. House of Representatives Nancy Pelosi to Taiwan earlier this year, and after the implementation of the new chip export restrictions by the Biden administration in September and October, it seems that Boeing is unlikely to sign major deals with Chinese companies anytime soon.

On top of that, back in September, the Chinese regulator granted certification to COMAC’s narrow-body airliner C919, which has been under development for more than a decade. Then on Tuesday, COMAC got a production license for the mass manufacturing of C919, which is expected to be used in commercial operations next year by China Eastern Airlines and others. Whether C919 would be successful is yet to be seen, as it’s more than likely that at first it would be used on domestic routes only. However, what’s clear is that Beijing aims to decrease its reliance on the United States, which is more than likely to continue to negatively affect Boeing for years to come.

The only major upside for Boeing at this stage is that it’s a crucial part of the American military-industrial complex. As such, it would be able to remain afloat and help the Department of Defense to extend its capabilities in air and space. At the same time, Boeing is also likely to perform well at home when the demand for air travel returns to the pre-pandemic levels, while the domestic airliners extend their horizons.

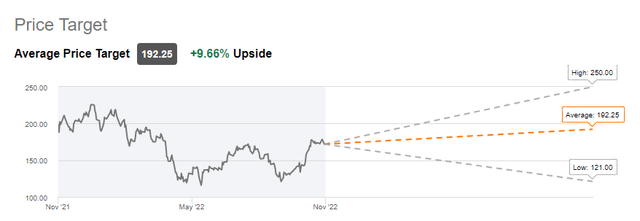

However, all the major upside ends there. While Boeing is more than likely to capitalize on the domestic opportunities, its weak performance in recent quarters along with the potential loss of one of the most attractive aviation markets in the world indicates that the company’s global ambitions are limited. As such, it’s hard to justify a long position in the company at this stage, especially since the street believes that the upside for its shares is fairly limited at this stage, while the negative sentiment that surrounds its Chinese business could prevent the shares from greatly appreciating anytime soon.

Boeing’s Consensus Street Price Target (Seeking Alpha)

The Bottom Line

Boeing has been one of the major beneficiaries of globalization in recent decades. Together with Airbus, it has formed a global duopoly that dominated the commercial aviation market for years. In the past, both companies greatly benefited from the growth of the Chinese aviation market by expanding their presence there and supplying their planes to state-run airlines. However, it appears that era is coming to an end.

The worsening of the Sino-American relationships amidst an ongoing trade war that began years ago already made Boeing a casualty of the changing geopolitical landscape. As Beijing and Washington decouple from each other, Boeing’s future in China is now in question, as the possibility of the recertification of the company’s 737 MAXs there decreases with each year. This is more than likely to continue to negatively affect The Boeing Company’s performance in the future, as no deal to sell the stored planes to other customers from other countries has been finalized to this day as well.

Be the first to comment