Dan Rieck/iStock via Getty Images

Investment Thesis – bluebird’s Decade In Gene Therapy

For more than a decade, bluebird bio has helped chart the path for the field of gene therapy and today.

These comments were made by Andrew Obenshain in a press release announcing bluebird bio’s (NASDAQ:BLUE) Q122 earnings in early May. Obenshain has been part of bluebird’s Senior Management team since 2016, and was appointed CEO in 2021.

In many ways it is hard to disagree with the CEO, and yet despite this, over the past 5 years, bluebird stock has declined in value by 95%. Shares traded at an all-time peak of $150 in March 2018, but prior to last week, they had sunk to an all-time low of $3. bluebird’s market cap is currently just $254m.

bluebird – originally founded as Genetix Pharmaceuticals in 1992, was the first gene therapy company to successfully achieve the long-term correction of a human genetic disease, when a patient with beta-thalassemia – a blood-disorder caused by the mutation of the HBB gene that reduces the production of hemoglobin, causing life threatening complications – was “functionally cured”, no longer requiring regular blood transfusions, which is the standard of care treatment for the disease.

Despite this early success, and a listing on the Nasdaq in 2013, a decade later bluebird has not been able to commercialise a single drug in the US. It’s only approvals are in Europe – for its drugs Zyntelgo in patients with transfusion-dependent beta-thalassemia in 2019, and Skysona for cerebral adrenoleukodystrophy in 2021, but Zyntelgo’s commercial launch ultimately failed owing to disagreements over the drug’s list price, set at $1.8m by bluebird, which numerous countries across Europe refused to pay. bluebird has withdrawn both drugs from the European market.

Over the past few years, the emergence of CRISPR technology – genetic scissors that splice DNA, enabling edits or corrections to be made to faulty genes – has put bluebird and its older, lentiviral based gene addition platform somewhat in the shade.

The Rise (& Partial Fall) Of CRISPR

The likes of CRISPR Therapeutics (CRSP), Intellia Therapeutics (NTLA), and Editas (EDIT) have all listed on the Nasdaq since 2016, using their newer, Nobel-Prize winning technology to target the same disease indications as bluebird, and competing for the same shareholder funding. More recently still, Beam Therapeutics (BEAM) has IPO’d, showcasing a potentially next-generation version version of CRISPR, in the form of base editing.

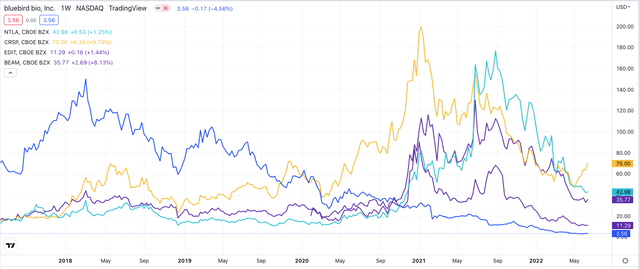

Share price performance of Intellia, Crispr, Editas and Beam versus Bluebird – past 5 years. (TradingView)

Source: TradingView

The chart above showcases how the new generation of gene editing biotechs have shown exceptional share price outperformance at times – richly rewarding investors – but it also shows how, across the past year or so, their valuations have begun to decline, as the promise of CRISPR editing has not translated into either rapid progress through the clinic, or commercial success.

In fact, in a reversal of fortunes, it is now bluebird bio that is perhaps closer to delivering not one, but two FDA approved therapies in 2022, with a third therapy potentially approvable in 2023, when its Biologics License Application (“BLA”) for Sickle Cell Disease (“SCD”) therapy Lovo-Cel is submitted by management.

bluebird’s 2 Approval Shots Endorsed by FDA Adcomm

The two near-term approval opportunities for bluebird are Beti-Cel and Eli-Cel. Beti-cel is indicated for beta-thalassemia, with a Prescription Drug Fee User Act (“PDUFA’) date – when the FDA rules on whether to approve the drug for commercial use – set for June 9th, 2022, whilst Eli-Cel – indicated for cerebral adrenoleukodystrophy, a progressive, irreversible, and fatal disease primarily affecting young children – has a PDUFA date of September 16th, 2022.

The good news for bluebird – and the reason the company’s stock price leapt from $3, to a high of $5.5 on 13th June – was that the Advisory Committee’s (“AdComm’s”) convened by the FDA to discuss whether it ought to approve Beti-Cel and Eli-Cel both voted unanimously in favour of approval, by scores of 13-0, and 15-0.

Such a strong vote of confidence from the FDA’s Cellular, Tissue, and Gene Therapies Advisory Committee (“CTGTAC”) would seem to make approvals for both therapies a formality, and yet, the run on bluebird stock did not last long – by Friday close, bluebird shares traded at $3.6 – up <1% across the past month.

bluebird’s Financial Woes

The reality is that despite last week’s excellent news, bluebird is in the midst of a restructuring aimed at saving the company $160m in costs over the next 2 years whilst reducing its workforce by 30%. Management believes that will extend its cash runway into the first half of 2023, and is banking on cashing in any Priority Review Vouchers obtained from the FDA in relation to Beti-Cel and Eli-Cel, which could be sold to other biotechs for as much as $100m each.

bluebird also spun out its oncology programs and portfolio – which includes ABECMA, a Car-T cell therapy approved for relapsed / refractory Multiple Myeloma (“MM”), in November 2021, into a new company 2seventy bio (TSVT), whose market cap of $450m is nearly 2x larger than bluebird’s.

bluebird has moved its headquarters too – Assembly Row, in Boston, from Cambridge Massachusetts, which it expects will save another $120m. Net loss in Q122 was $122.2m, and in 2020 and 2021 respectively, net losses amounted to a staggering $555.6m, and $819m.

The sheer scale of the losses makes it hard to feel much sympathy for bluebird, whose return has been abysmal in that context, but losses in FY22 are forecast by management to be <$340m, marginally more than the current cash position of $312m (as of Q122), and if Bet-Cel and Eli-Cel are approved, becoming the first curative gene therapies in their respective indications, it will serve as a validation of bluebird’s platform and technology, and perhaps lead the way to more approvals, for Lovo-Cel in Sickle Cell Disease (“SCD”), restoring the company’s reputation, and perhaps giving its share price a boost in the process.

Markets and Competition

The facts are that neither beta-thalassemia nor Cerebral Adrenoleukodystrophy (“CALD”) are large commercial markets and they are not going to solve bluebird’s financial problems long-term. Analysts have forecast peak sales for Beti-Cel of $64m, and $38m for Eli-Cel, which is likely accurate.

The prevalence of CA is ~1 in 10k – 20k, meaning there would be <30k patients in the US, for example, and ~68k people are born each year with beta thalassemia. Bristol Myers Squibb’s (BMY) Reblozyl – $240m sales p.a. – is also approved to treat beta thalassemia. Having withdrawn these drugs from consideration for approval in Europe, the market opportunity is further reduced.

With losses of $340m forecast for this year, and likely <$50m in revenue on the table in 2023 even if Eli-Cel and Beti-cel receive full approval – since bluebird’s commercial launch would be in its infancy – and even with the costs saving plan implemented, bluebird is inevitably going to be loss making in 2023. After factoring in the priority review vouchers, which could extend the funding runway by up to $200m, it is possible that management will look to raise funds via an at the market offering, which will inevitably dilute the value of shareholder’s positions.

I would also expect that approvals for beti-cel and eli-cel will cause a share price spike, however, owing to the added certainty that revenue generating assets have made it to market, and that the priority review vouchers will be issued, so my expectation would be that shareholders would not necessarily lose out in such a scenario.

The validation of bluebird’s technology represents an important intangible asset, and I could see management looking to raise anything up to $250m on the back of it. I suspect that such a figure would still be materially less than that intangible proof-of-concept is worth, and would expect the share price to reflect that. I would take last week’s spike to a share price of $5 as my guide here.

The much larger market potentially in play is Sickle Cell Disease (“SCD”), for which bluebird expects to submit its BLA in Q123. 1 in 365 Black or African American babies is born with the diseases, bluebird’s research indicates, and the market opportunity has been independently estimated to be worth $7.7bn by 2027, growing at a CAGR of 18.5%.

In this space however bluebird faces competition, most notably from the $67bn market cap Cystic Fibrosis giant Vertex (VRTX) and its partner CRISPR Therapeutics (CRSP), who are edging closer to an approval after studies showed their drug CTX001 had “functionally cured” 15 patients using engineered stem cells.

Nevertheless, bluebird claims to have the “largest SCD gene therapy data set in the industry”, showing that all evaluable patients in its pivotal study (n = 25) had complete resolution of severe vaso-occlusive episodes (“VOEs”) up to 36 months after treatment with Lovo-Cel, and for its BLA, management says it will submit data on up to 50 patients with 7 years of follow up, data from the HGB-206 pivotal study which achieved a clinically meaningful primary endpoint, and perhaps most importantly, alignment with the FDA on Chemistry, Manufacturing and Controls (“CMC”) – an element of gene therapy that management says will be the major focus of the agency during its regulatory review.

When we consider that CRISPR Therapeutics – which will only earn 40% of sales of CTX-001, if it is approved, has a market cap of $5.4bn, and that Vertex paid CRISPR $10bn for a 10% larger share of future sales of CTX-001, should bluebird win approval for Lovo-Cel, its share price ought to skyrocket, and management ought to have no problem raising the additional capital it needs to fund a commercial launch and ease its financial problems.

Conclusion – Streamlined and With 3 Shots at Approval In Next 12 Months bluebird Stock Looks Tempting

bluebird bio has experienced more than its fair share of setbacks – besides those discussed above, its SCD study was halted by the FDA in February 2021 due to concerns around cases of acute myeloid lymphoma, before being allowed to resume in June – and the company has burned through billions of dollars of investor’s money – its accumulated deficit stood at $3.72bn as of FY21 according to the company’s 10K submission.

Although the company has looked uninvestable at times, due to its cash consumption, commercial failures in Europe, trial setbacks and the arrival of the CRISPR companies, at this moment in time bluebird stock arguably looks a better buy than it has done in years.

It is my contention that the market remains somewhat sceptical of bluebird and whether it can succeed as a commercial entity, and whether its drugs have the necessary safety and efficacy profiles, but I would expect that attitude to change over time since bluebird appears to have satisfied the FDA’s strict criteria around approval.

If the FDA finds no issues with bluebird’s Chemistry, Manufacturing and Controls, and approves Eli-Cel and Beti-Cel, the company will find itself in a stronger position than many analysts would have anticipated only 12 months ago when management had had to endure clinical holds, and a lack of commercial success in Europe.

The US is a very different market, and if it opens up to these new gene therapies, bluebird will have confounded expectations, and those investors who bought at today’s low price ought to be rewarded for trusting management at a time when there is still risk and uncertainty – plus there is the prospect of an approval for Lovo-Cel, which ought to be transformative since it brings a product to market with genuine blockbuster potential.

Most importantly, the company has been able to show in late-stage clinical trials that its drugs work, and that its lentiviral (“LVV”) platform is not necessarily inferior to CRISPR in terms of efficacy or safety. No CRISPR company has had a drug approved yet, and by the end of 2023, bluebird could have 3 drugs on the market offering functional cures for devastating diseases.

bluebird’s miniscule market cap in relation to CRISPR Therapeutics, Intellia – $3.3bn, Editas – $774m – and Beam Therapeutics – $2.5bn – seems anomalous in that context, and perhaps reflects market scepticism that bluebird could survive in the face of its failure in Europe, limited financial resources, and clinical hold placed on its lead asset.

These problems appear to be behind the company now, and the company now boasts >500 patient years of experience with its therapies. Pricing of its drugs is an area the company will have to look at – gene therapies are notoriously expensive, witness the ~$2.1m Novartis (NVS) charges for its spinal muscular atrophy (“SMA”) drug Zolgensma – but then again, these are “one and done” therapies that offer the promise of a permanent cure.

bluebird has a large enough addressable market even with Eli-Cel and Beti-Cel alone to earn >$100m per annum, the consensus is, which alone ought to support a higher company valuation – let’s say $400m – $500m, or a price to sales ratio of 4.5 – 5x, and with the SCD opportunity offering a potential $500m – $1bn peak sales opportunity, there is a triple-digit share price upside opportunity in play in my opinion.

Naturally there are risks around investing in gene therapies – establishing long-term safety is of paramount importance and any suggestion of a previously undetected issue can result in a drug’s complete withdrawal – but it has to be said that bluebird has as much, if not more data than any other gene therapy company.

Over the past 12 months management has managed to put many of bluebird’s problems behind it, and it seems as though they and their investors can now look forward with a good degree of optimism. I am anticipating a sharp near-term spike in the share price.

Be the first to comment