Joe Raedle/Getty Images News

Investment Thesis

Block, Inc. (NYSE:SQ) was one of our favorite FinTech stocks from the pandemic bear market bottom. However, the dramatic collapse in FinTech peer multiples has also battered SQ stock over the past six months. As a result, the company’s growth has also slowed markedly from the heady days of 2020/21. But, it should not be surprising, as it’s unrealistic to expect SQ to notch triple digits growth continuously.

Nevertheless, the stock trades at a premium against FinTech leader PayPal (PYPL). While Jack Dorsey & Team has made significant inroads into the critical consumer and seller ecosystems, profitability is still relatively uninspiring. But, we think the SQ story looks interesting as we observed strong penetration in its target market segment among Gen Z and Millennials. Furthermore, the company’s early focus on emerging technologies and digital assets such as Blockchain and Bitcoin has been meaningful for its growth.

Nevertheless, we believe the company’s valuation is predicated on Dorsey & Team executing well moving forward. As a result, there’s still a significant emphasis on its optionalities, and investors must be prepared to hold for the long-term to let the story play out.

Block Is A Long-Term Play, But At Least It’s Profitable

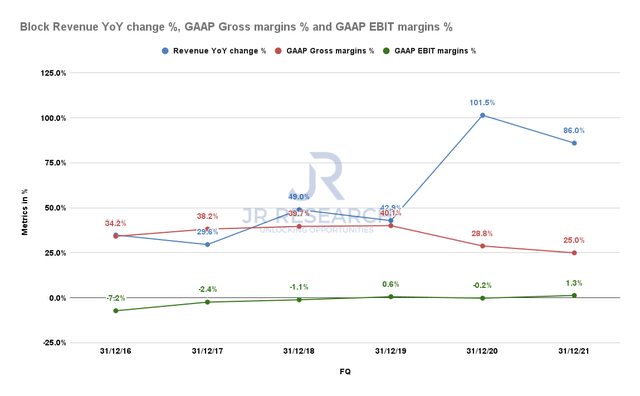

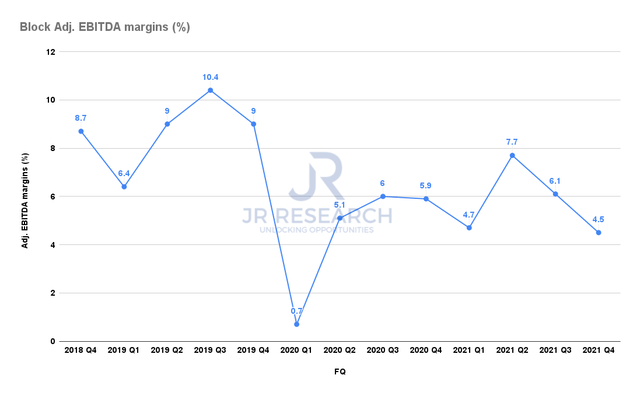

Block revenue and profitability metrics % (S&P Capital IQ) Block adjusted EBITDA margins % (Company filings)

Block’s revenue grew 86% in FY21, which was front-loaded in H1’21. Notably, its FQ4 revenue only increased by 29.1% YoY, as tough comps came to the fore. As we highlighted earlier, investors cannot expect Block to continue posting the phenomenal growth pulled forward by the pandemic. The pandemic is over, and we need to return to reality. But that doesn’t mean Block is doomed.

Management has consistently focused on its gross margins as a basis to discuss profitability. Otherwise, it would refer to its adjusted EBITDA margins, as shown above. However, we highlighted before in other articles that investors must be circumspect about using adjusted margins. Notably, if the adjusted and GAAP margins are significantly different, they must investigate further through their non-GAAP reconciliations disclosure.

In Block’s case, we noticed a marked drop in its adjusted EBITDA margins, corresponding with its GAAP EBIT margins trend. Notably, Block was still GAAP profitable on an FY basis, even though the margins were relatively low.

However, Block’s ecosystems are still nascent in their penetration. Block is also still focused on penetrating the SMBs and the younger consumer cohorts. Therefore, its take rates are expected to be lower compared to more mature consumer finance companies. Furthermore, its Bitcoin segment attracts much lower gross margins. Its Gross margin in FQ4 was 2.4%. But, Bitcoin exposure is a critical lever in attracting Gen Z and Millennials to partake in its ecosystem.

Weak Profits & Growth Premium Could Impact SQ’s Valuation

Block stock NTM FCF yield % (TIKR)

Despite the collapse in its stock price, SQ stock still traded at a premium against its peers. Its NTM FCF yield of 1.09% was way below PYPL stock’s 4.96%. Furthermore, it was well below Visa (V) stock’s 3.6% and Mastercard (MA) stock’s 2.9%.

Nonetheless, SQ stock is FCF profitable. Based on S&P Cap IQ data, its FCF margin in FY21 was 4%, which improved from FY20’s 0.4%.

Consensus estimates expect Block to remain FCF profitable through FY23, despite the integration of Afterpay’s BNPL model. We have been wary of pure-play BNPL players like Affirm (AFRM). We prefer to invest in companies where BNPL is not a standalone product but backed by a robust ecosystem for cross-selling opportunities.

Still, Block would need to execute well moving forward, improve its FCF metrics, and demonstrate robust topline growth. Otherwise, it would be highly inadequate to justify its FCF yield of 1% if the execution is weak.

Is SQ Stock A Buy, Sell, Or Hold?

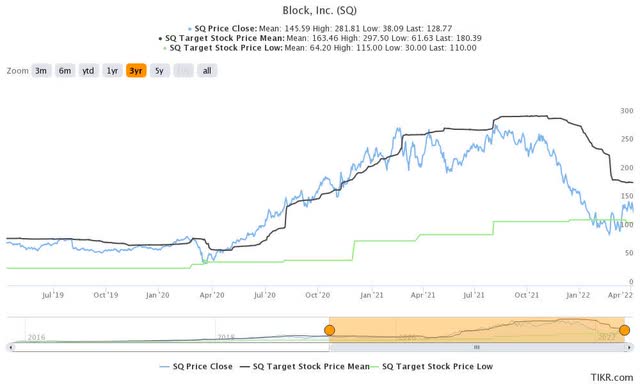

SQ stock consensus price targets Vs. stock performance (TIKR)

We can easily observe the dramatic de-rating of SQ stock since late 2021. However, we think the market has gotten it right. The pandemic tailwinds have worn off. Coupled with difficult comps in FY22, it could continue to impact Block stock in the near term.

Notably, consensus estimates suggest that Block stock’s FY22 revenue growth could decline to 7.5% before improving to 23% in FY23. Therefore, the heady days of 2021 should be over moving forward.

Nevertheless, we think that SQ stock’s growth premium has been sufficiently digested. As a result, SQ stock seems to be consolidating in line with the most conservative price targets (PTs), which supported the stock in its COVID-19 bear market bottom.

As such, we reiterate our Buy rating on SQ stock. However, we would like to highlight that it’s only appropriate for long-term investors with a horizon of at least five years.

Be the first to comment