marchmeena29

Blackstone Mortgage Trust, Inc. (NYSE:BXMT) reported third quarter earnings in late October, and the trust easily covered its dividend with distributable earnings.

Even though dividend increases are unlikely in the near future, BXMT is a high-quality passive income stock that will continue to provide investors with predictable dividend income.

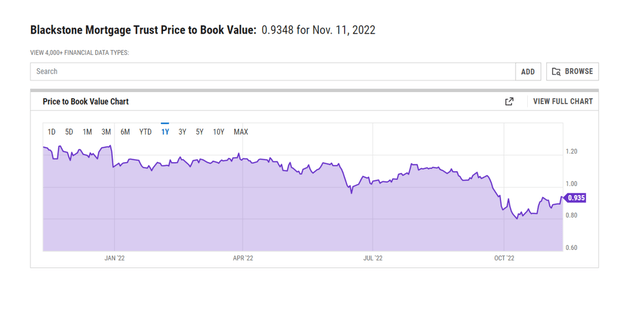

Furthermore, BXMT continues to trade at a 6% discount to book value.

Why Would You Want To Earn The Trust

Blackstone Mortgage Trust owns a portfolio of high-quality senior loans that are performing well, and the trust is exposed to floating right interest rates, which is clearly becoming a bigger issue for the commercial real estate market.

To combat inflation, the central bank raised interest rates by another 75 basis points in November. Because Blackstone Mortgage Trust’s loans all have floating interest rates, rising interest rates benefit the real estate investment trust.

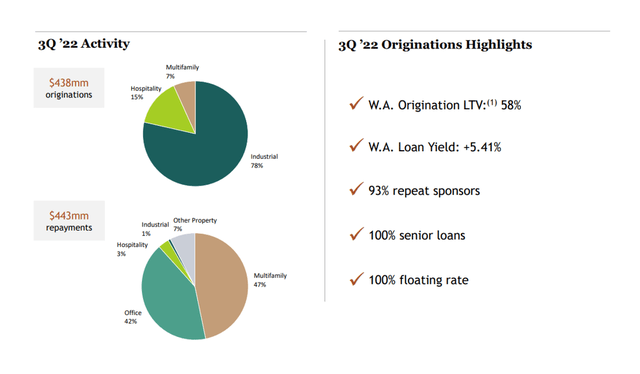

In the third quarter, Blackstone Mortgage Trust originated $438 million in new loans, primarily in the industrial sector. In Q3’22, 78% of new senior loans were backed by industrial assets, and all new originations were 100% senior loans and 100% floating rate.

The total loan portfolio of the real estate investment trust was valued at $26.1 billion at the end of the September quarter, and it continued to exist solely through floating rate senior loans.

3Q’22 Portfolio Activity (Blackstone Mortgage Trust)

Dividend Covered By Distributable Earnings, Low Pay-Out Ratio

One of the best reasons to invest in Blackstone Mortgage Trust is the company’s covered dividend, which provides passive income investors with a consistent stream of high-quality dividends that, in my opinion, could even be sustained during an economic downturn.

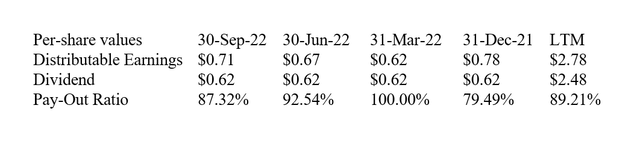

In the third quarter, Blackstone Mortgage Trust earned $0.71 per share in distributable earnings, which was more than enough to cover the $0.62 per share dividend payment.

The dividend pay-out ratio in the third quarter was 87%, compared to 89% in the previous 12 months. Blackstone Mortgage Trust’s pay-out ratio improved QoQ due to higher distributable earnings. As a result, I believe the dividend payout is very secure, which should make it easier for passive income investors to decide whether to invest in the trust for the long term.

Investors should avoid planning for a dividend increase because Blackstone Mortgage Trust has paid the same quarterly dividend rate of $0.62 per share for years. BXMT currently has a stock yield of 9.7% based on a quarterly dividend of $0.62 per share.

Dividend And Distributable Earnings (Author Created Table Using Trust Information)

BXMT Is Still Available At A Discount To Book Value

Until recently, Blackstone Mortgage Trust traded at a premium to book value, but if the stock trades at a discount, I will not waste time and will increase my investment in the commercial real estate company.

In my opinion, there is still time to purchase Blackstone Mortgage Trust stock at a 6% discount to book value.

Why Blackstone Mortgage Trust Could See A Lower Valuation

Blackstone Mortgage Trust has considerable exposure to the commercial real estate market. If the real estate market in the United States enters a severe recession, the real estate investment trust is likely to suffer from declining originations and possibly lower distributable income, which could result in a lower book value multiple.

However, I believe that Blackstone Mortgage Trust’s senior loan focus provides strong protection against a commercial real estate market correction and that the trust would not be forced to reduce its dividend payout.

My Conclusion

Inflation is currently at 7.7%, and investors have no choice but to invest to protect themselves from the effects of inflation.

Blackstone Mortgage Trust continues to be a solid choice in the commercial real estate market, with the real estate investment trust benefiting from strong originations in the third quarter. In the third quarter, Blackstone Mortgage Trust also covered its dividend with distributable income, and the pay-out ratio actually improved QoQ.

Because the stock of the real estate investment trust is still trading at a discount to book value, I will continue to recommend BXMT to passive income investors seeking a long-term opportunity to generate predictable dividend income.

Be the first to comment