Sezeryadigar/E+ via Getty Images

Introduction

As a dividend growth investor, I am constantly looking for additional dividend growth opportunities, which I still do not own in my diversified portfolio. In a previous article, I analyzed T. Rowe Price Group (TROW) and found the company to be an attractive investment. I want to take a deeper look into the asset management sector, as I am wondering if other companies are also attractive.

In this article, I will focus on Blackstone (NYSE:BX). Unlike T. Rowe, who focuses on wealth management and liquid assets, Blackstone is focusing on alternative assets, which are not liquid, and the company is aiming for institutional clients who seek extremely long-term investments. Blackstone gives a whole different perspective when it comes to the investment approach.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

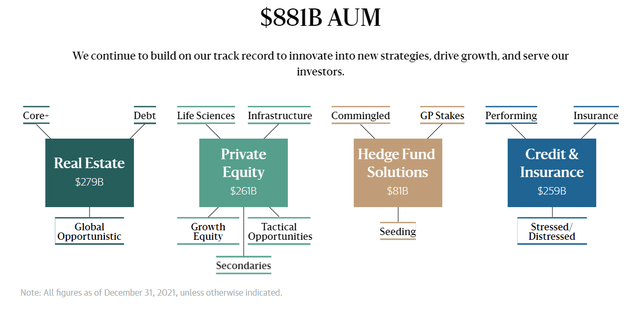

According to Seeking Alpha’s company overview, Blackstone is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity, and multi-asset class strategies. The firm typically invests in early-stage companies. It also provides capital markets services.

Fundamentals

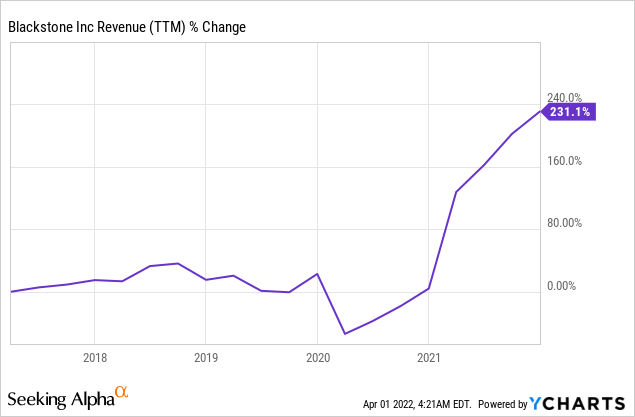

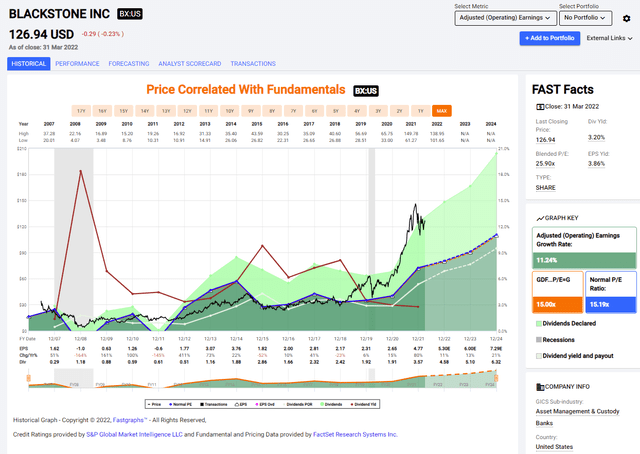

Revenues over the last five years have more than tripled. The most significant growth was in 2021 when the company’s AUM (assets under management) have increased significantly, as institutional investors acquired more alternative assets. The company is growing sales by increasing the AUM, as well as increasing the fees it charges from clients. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Blackstone to keep growing sales at an annual rate of ~10% in the medium term.

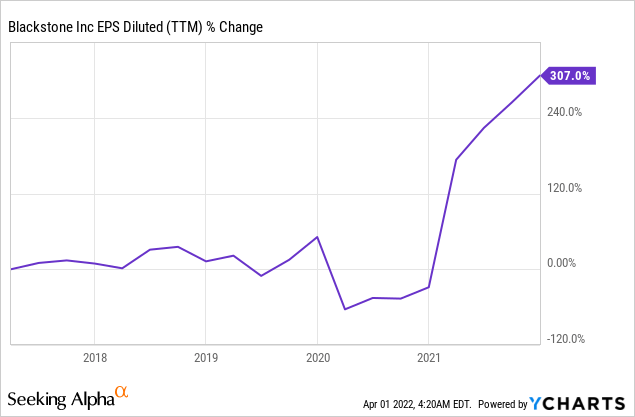

Over the same period, the EPS (earnings per share) has grown at an even faster pace and more than quadrupled. The company’s EPS growth is fueled by sales growth as well as improved margins. As the company manages more assets, the cost of managing every additional dollar is lower, which allows the company to expand its margins. For example, managing a real estate portfolio with five buildings is not more costly if the valuation of the building increases by 10%. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Blackstone to keep growing sales at an annual rate of ~12% in the medium term.

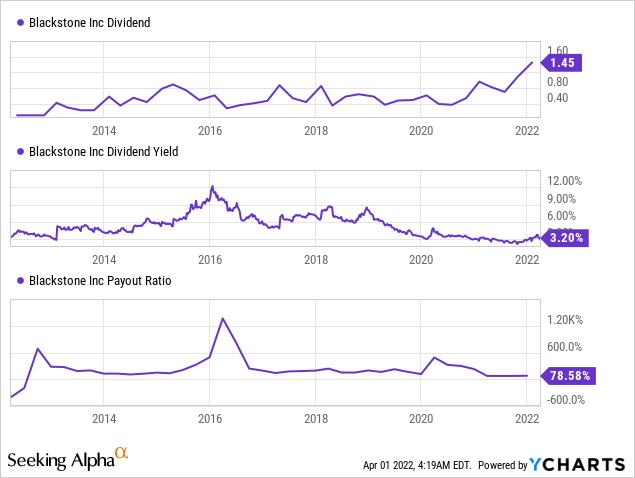

The company is not a dividend growth company, yet it is paying a dividend every quarter, and these dividends have a long-term upward trajectory. The company’s current yield is 3.2%, and it seems safe with a payout ratio of less than 80%. However, investors should take into account that the dividend changes every quarter and in the short term may decline even if it grows in the medium and long term.

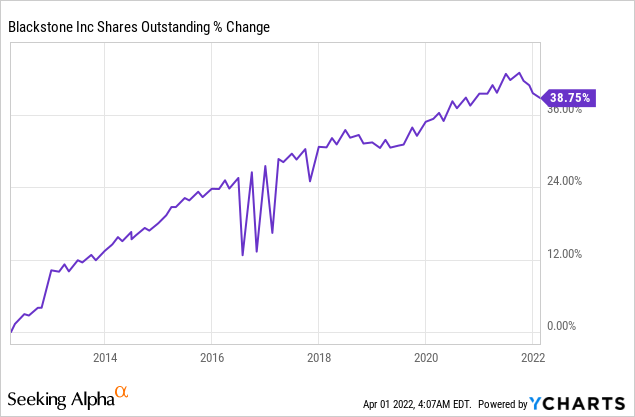

The number of shares outstanding has been growing over the last decade as the company issued shares to fund growth. However, there is some change in the company’s approach since the pandemic and after it has become a C-corp in 2019. The company has begun buying back its shares intentionally. The company intends to buy $2B worth of stocks in 2022, and in 2021, the company bought back ~$1B worth of shares.

Valuation

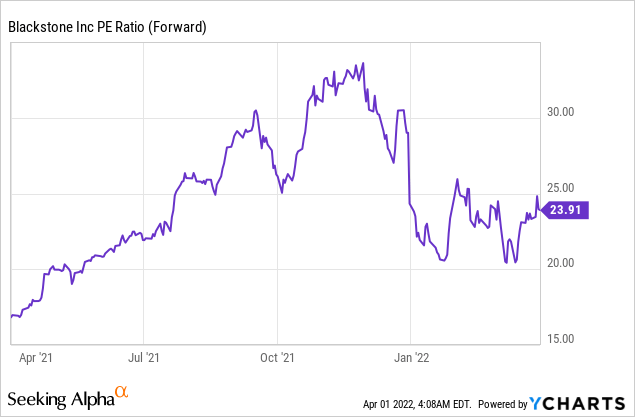

The company’s P/E (price to earnings) ratio is standing at just shy of 24. The company’s valuation is lower than it was just several months ago, yet it is still significantly higher than it was twelve months ago. Paying 24 times earnings for a company that grows at 12% annually is not out of the ordinary if the company has a significant moat and the growth is safe. Still, this valuation leaves investors with very little margin of safety.

The graph below from Fastgraphs.com emphasizes what I wrote in the previous paragraph. Since March 2020, the company’s valuation is detached from its average valuation. The company’s average P/E over the past years was 15, which is significantly lower than today’s valuation. The EPS growth rate on the other hand is similar to the current medium-term forecast. Therefore, it seems like there is very little margin of safety for investors if the company doesn’t manage to grow as expected. If market conditions worsen, the valuation may drop even if the company keeps executing well.

To conclude, Blackstone is a very successful asset manager. It has managed to achieve significant growth overtime in the last decades. Growing sales led to growing EPS which fueled dividend growth and buybacks. The company is trading for 24 times 2022 earnings when it is expected to grow at a double digits pace. This is not an overly expensive valuation, yet it leaves the company with little margin of safety in case the AUM declines.

Opportunities

Alternative investments are hard to find and hard to access. You need to build suitable relationships to start negotiations even if you have the needed capital. Blackstone has a track record and brand which allows it to approach sellers and stakeholders around the world to acquire and participate in real estate, infrastructure, and other large-scale projects. The track record in finding good deals and leveraging access is a key growth opportunity.

Another opportunity for Blackstone is the professionalism needed to buy and invest in alternative assets. This is a much less competitive market compared to the equity and bond markets. Blackstone’s expertise and professionalism allow it to keep growing. If you want to buy stocks and bonds, you can simply buy a market ETF, which invests in an entire market. The alternative assets sector requires professionals to invest, and Blackstone is extremely well-positioned due to its 37 years of history.

Diversification is a key growth opportunity, especially in Blackstone’s business of alternative assets. The company has two types of diversification working on its behalf. First, it is diversified globally with offices worldwide. It allows the company to acquire alternative assets not only in the United States but also in Europe and the emerging markets to increase returns. Secondly, it invests in a wide array of alternative assets. It buys real estate, private equity, credit and invests in hedge funds. It allows the company to maximize returns based on attractively valued assets.

Risks

The first risk for dividend growth investors. The company’s dividend is growing over time, but it pays an inconsistent dividend. The dividend is not halted, but it is not on a constant progressive trajectory. The company’s dividend is changing between quarters and is impacted by the company’s performance. Investors who seek an extremely reliable dividend may prefer to choose a more consistent option such as T. Rowe.

The company’s beta is another risk, especially for dividend growth investors who have high equity exposure, thus usually prefer less volatile stocks. The company has a beta of 1.75, which means that on average for every 1% move of the S&P 500, the company will move 1.75%. Investors in Blackstone should prepare themselves for a roller coaster ride, which doesn’t fit everyone. Not taking it into account may lead to selling at the bottom next time the market slumps.

Alternative assets react slower to the changes in the capital markets compared to liquid assets like stocks and bonds. Stocks and bonds react as soon as news reaches investors who sell and buy these assets. Alternative assets are only re-evaluated every several months, and therefore, if the market is down, it may take alternative assets managers more time until the dent is shown in the number of assets under management. Thus, following the tech-stocks decline, and the effect of the war in Europe, we may see companies like Blackstone realizing the decreasing value of some assets only later this year.

Conclusions

Blackstone is a great company without a doubt. The company has a niche, and it has built an empire around it. Since 1985 the company has been cyclically growing sales and EPS. It has translated into a dividend that is growing over the long run even if erratic in the short term. The company has also started buying back its shares to return additional capital to shareholders.

The company has a great track record that results in growth in the assets under management as clients increase their investments. However, there are several risks including the slower reaction of alternative assets to market changes. At the current valuation, investors have little margin of safety. Therefore, I believe that if they buy shares in the firm, they should do so gradually and over time.

Be the first to comment