golfcphoto

While I primarily focus on stocks and ETFs, today I’d like to highlight the only closed-end fund I hold in my portfolio, the BlackRock Science and Technology Trust (NYSE:BST). Despite the “science” in its name, it primarily invests in public and private tech companies, with heavy exposure to SaaS and semiconductor stocks and medium exposure to fintech and ecommerce. It has a reasonable expense ratio for a CEF of 1.05%, and it is highly diversified for a sector fund at 118 holdings with a maximum position weighting of around 7% .

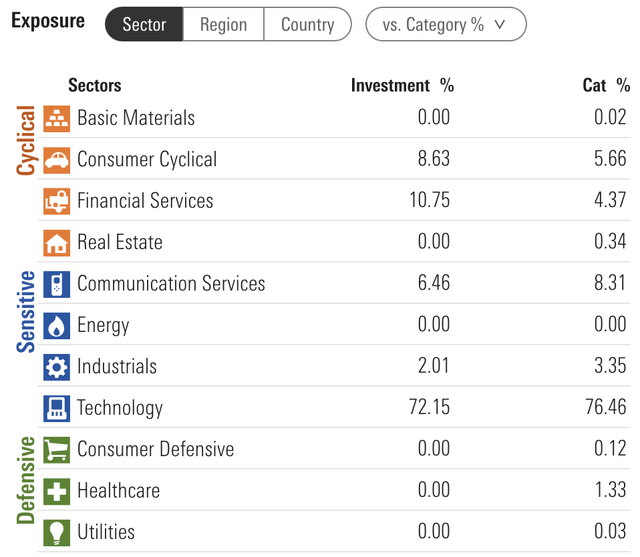

BST Sector Exposures (Morningstar)

A Tech Fund With A VC Twist

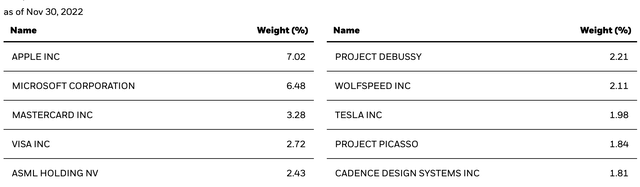

Taking a quick look at BST’s current top ten holdings, we see familiar blue-chip tech and fintech names along with a couple unfamiliar ones called Project Debussy and Project Picasso.

BST Top Holdings 11/30/22 (BlackRock)

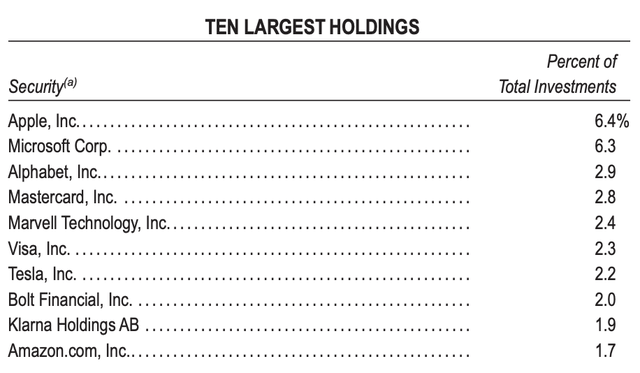

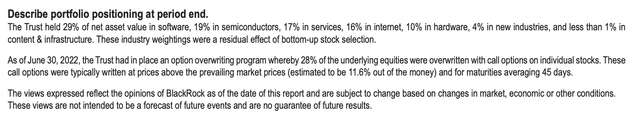

BST and its second iteration BSTZ are somewhat unique because in addition to holding public stocks, the funds also invest in private startups. While BSTZ allocates a significant portion of its assets to private companies, BST has a more modest exposure of around 13-14%. While these companies only appear as cryptic codenames on most of BlackRock’s public-facing communications, with some digging one can discover that the actual startup names are often revealed in BST’s semiannual reports.

BST 1H 2022 Holdings (BlackRock)

While it’s impossible to know for sure which is which from the above data alone, we can be relatively sure that Project Debussy and Project Picasso are Bolt Financial, a one-click online checkout software developer once valued at $11B earlier in 2022, and Klarna, a leading “buy now, pay later” fintech company that happens to be quite popular here in the Netherlands.

Depending on your risk tolerance, these could be welcome or very unwelcome additions to BST’s portfolio. Klarna has been firing on all cylinders and has no doubt proven to be a hugely successful investment for BlackRock, but Bolt Financial has been fraught with controversy this year, ranging from settling a $150M lawsuit by its largest customer to accusations of misleading investors to a failed crypto acquisition to a dubious employee stock-option loan program.

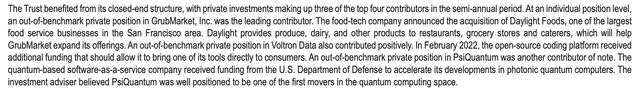

The downsides of private venture capital investments are many: they are rarely liquid, their value may fluctuate wildly, and they can go to zero before the fund can realize any actual gains for investors. On the other hand, early- and mid-stage startups often have high-growth trajectories that are less correlated with the overall stock market, and this asymmetry can help to bolster fund performance during market downturns. According to BlackRock, this was the case for BST during the first half of 2022 with its private investments in GrubMarket, Voltron Data, and PsiQuantum outperforming as noted in the fine print below.

BST 1H 2022 Report (BlackRock)

Of course, it is often unclear as to how gains on these private positions are realised by BlackRock and BST, whether shares are sold to other VCs on the secondary market, whether they’re simply valuation gains on paper until the companies are either acquired by a private equity firm or IPO, or whether there is some other type of bond, dividend, or share redemption scheme in place.

As with any actively managed fund, investors are beholden to the decisions of the fund’s managers for both public and private equity choices and entry/exit timings. On this score, I find it comforting that BST is run by the head of BlackRock’s entire technology equity team, Tony Kim. Mr. Kim has been with BlackRock since 2013 and has nearly 30 years of continuous experience in tech sector fund management, analysis, and M&A dating back to 1994.

Recent Performance & Yield

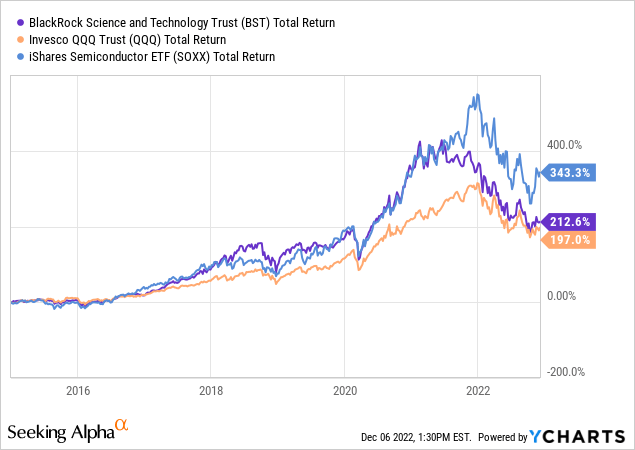

Given its subsector exposures and holdings, I view BST as a cross between QQQ and SOXX, and its long-term performance reflects a risk/reward profile somewhere between the two. Since 2015, BST has significantly outperformed QQQ most of the time and even kept pace with SOXX until its rapid spike in 2021.

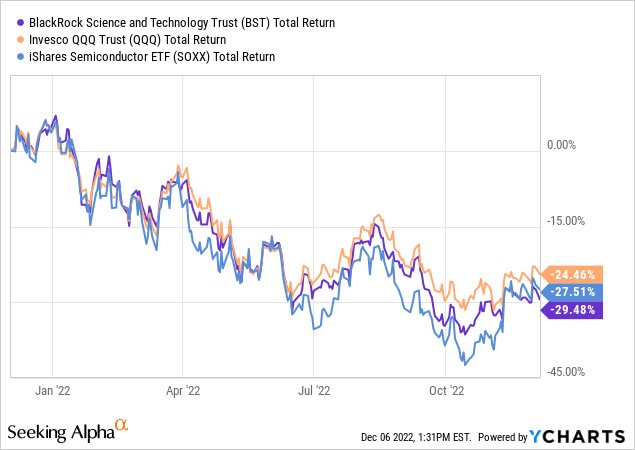

Over the last year, BST’s performance has mostly stayed between QQQ and SOXX as well, falling below them in total return only a couple brief times including this past month:

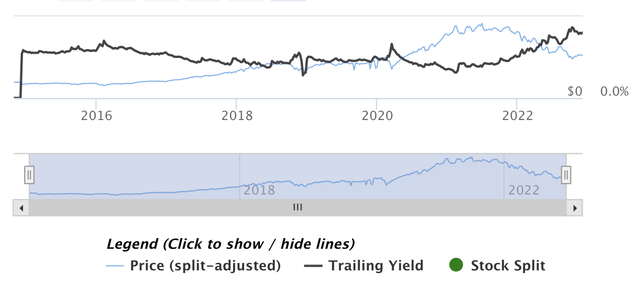

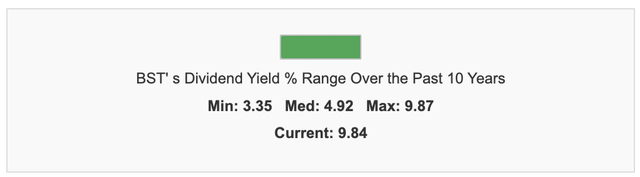

The current market decline has hit rate-sensitive tech stocks particularly hard, leaving BST’s distribution yield at elevated levels not seen since its inception in 2014. Based on its highly attractive yield and its top holdings including Apple (AAPL), Microsoft (MSFT), Mastercard (MA), Visa (V), ASML (ASML), Tesla (TSLA) and Cadence Design Systems (CDNS), I think BST will follow its historical pattern of significantly outperforming QQQ after a market bottom is reached as investor demand pushes its yield down closer to its historical average. Looking at its top holdings, management is clearly betting that wide-moat, economically resilient tech and fintech stocks will help BST to weather this recessionary bear market and capture most of the upside when the downtrend reverses.

BST Historical Yield (Dividend.com)

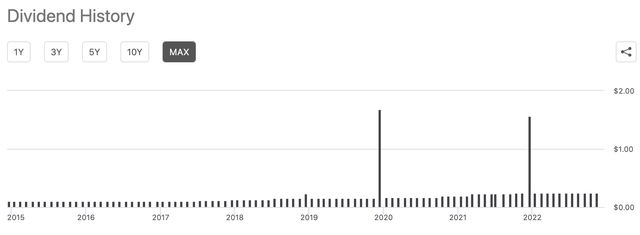

A 9-10% CEF yield might not mean much for a CEF with average management, lackluster share appreciation, or an inconsistent record of distribution growth. But BST has managed to grow its monthly distributions consistently since its inception in 2014 without missing a beat. This is quite a feat in a volatile sector like tech, and it also speaks to how disciplined management has been in returning gains to its income investors in a sustainable, reliable way. This isn’t to say that BST’s distribution hikes are predictable — sometimes the distribution is raised twice in one year and sometimes not at all — but its distribution has averaged a remarkable 14% CAGR since inception, or 12% if calculated from the end of this year. In dollars, it has risen from $0.10 per month in 2014 to $0.25 per month currently for an overall distribution increase of 150% since inception.

Should BST’s “dividend” growth streak continue at its lower 8-year CAGR of 12% over the next 10 years, an investor buying BST at today’s roughly 10% yield would end up with a staggering yield-on-cost of over 30% in a decade. Caution leads me to be skeptical that the fund will be able to maintain such an impressive distribution growth record combined with market-beating total returns for that amount of time, but even at a much lower distribution CAGR, BST makes for a powerful wealth compounding machine over time for those who don’t mind the annual tax bill.

With an average historical yield under 5%, an opportunity to pick up BST at a double-digit yield may not come again for a long time, unless and until China invades Taiwan or some other worldwide event causes tech stocks to plummet.

Income Generation & Tax Implications

Normally 100% of BST’s monthly distributions are classified as long-term capital gains for tax purposes, which helpfully allows them to be taxed at the lowest possible rate. But investors concerned about CEF tax implications should also note that BST’s current 9.9% forward yield does not take into account the large special distributions it paid at the ends of 2018, 2019, and 2021. Distributions like this are to be expected, especially in years of good performance, as all CEFs are required by regulators to pay out nearly all of their net realised investment gains to investors each year in order to maintain their tax-free status.

BST Dividend History (Seeking Alpha)

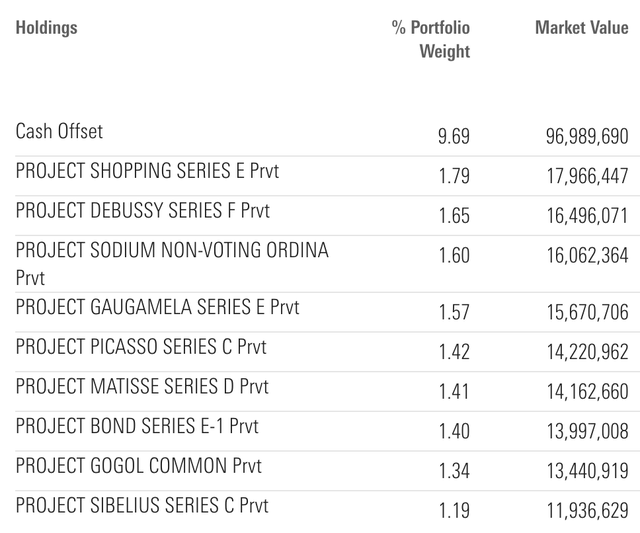

Unlike many CEFs, BST does not use leverage to generate additional income or amplify its performance, but rather writes (sells) covered calls against approximately 30% of its equity holdings at any given time. One of the reasons I like BST is that the fund managers are quite transparent about their options approach in their semiannual reports. Their latest report revealed that the fund had written calls against 28% of its equity holdings at a strike price roughly 11% above the market price and with an average expiration time of 45 days.

BST Options Description (BlackRock)

In my opinion, selling calls is the safest strategy to generate additional income as there is no downside risk for investors, but it can result in limited upside as well as forced realised gains in years like 2019 and 2021 when stocks are on a bull run. This is because as share prices rise past the strike prices of BST’s calls before expiry, those shares are called away (sold to the options buyers) and most likely re-purchased by the fund at higher prices. We can see from its non-equity holdings that BST maintains a large cash position of almost 10%, both to facilitate this type of options activity and also as a market hedge.

BST Non-Equity Holdings (Morningstar)

If the call overwriting strategy is repeated and prices continue to climb quickly, it can result in lumps of forced realized gains as each call option is exercised, thus requiring the fund to pay a large capital gains distribution at the end of the year. This can result in larger-than-expected tax obligations for investors who might not be familiar with CEFs — especially those who automatically reinvest their distributions — and it is one of the main advantages of using ETFs instead.

Conclusion

Although its private investments give me some pause, I still view BST as one of the best actively managed tech funds among ETFs, mutual funds, and CEFs. Its income-generating options strategy is relatively conservative, its public equity holdings tend to be blue-chip quality and highly diversified for a sector fund, and its strong record of distribution growth and favorable tax treatment since inception speaks to seasoned management with a long-term outlook.

It appears that tech stocks are in the midst of another leg down as the economy inches toward a recession and the duration of high interest rates remains uncertain, so although I rate the BlackRock Science and Technology Trust a buy at current levels, I would recommend that investors cost average into BST with the expectation that it could fall to an 11-12% yield before reaching a final bottom in this cycle. I think income and dividend growth investors who catch it during this phase will be extremely glad they did when the market finally rebounds and the Fed pivots on interest rates.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment