Main Thesis

The purpose of this article is to evaluate the BlackRock Corporate High Yield Fund Inc. (HYT) as an investment option at its current market price. This is a fund I recommended in 2019, yet turned to a more neutral stance on it as we entered 2020. Simply, I believed the valuation was not nearly as compelling, and compressed yield spreads in the junk bond market made me believe there was limited upside left.

In hindsight, that outlook was correct, but I certainly did not forecast such a dramatic drop in prices. While the move has caught me by surprise, I see opportunities opening up in riskier products, such as HYT. As the sell-off intensifies, HYT is sitting with a discount to NAV above 20%. Further, the income stream is high enough now that it can withstand a distribution cut and still be attractive. This is especially true when we consider how low interest rates are around the globe. Finally, HYT is light on the Energy sector, which I view positively because this is an area I expect to continue to face considerable headwinds going forward.

Background

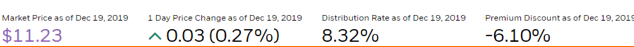

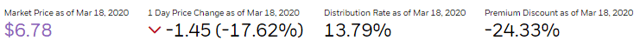

First, a little about HYT. The fund’s primary objective is “to provide shareholders with current income,” with a secondary objective to “provide shareholders with capital appreciation.” The fund invests the majority of its assets in high-yield bonds, corporate loans, convertible debt securities and preferred securities which are below investment grade quality. Currently, HYT is trading at $6.78/share and pays a monthly distribution of $.0779/share, which translates to an annual yield of 13.79%. I had been bullish on HYT for a while, although I downgraded my outlook back in December. While this downgrade was timely, it was not nearly bearish enough, as the fund has been hit hard by the recent sell-off, as shown below:

Source: Seeking Alpha

Going forward, I continue to believe we will be operating in a volatile market. However, I truly believe the worst has passed, and investors need to begin thinking about how best to prepare for a turnaround. With that in mind, I see HYT as offering an attractive entry point right now. While I would caution investors to only begin positions now, whether in HYT or any other asset, if they can handle more downside, I see HYT trending higher in the short term. Therefore, I am increasing my rating for the fund back to “bullish”, and I will explain why in detail below.

HYT’s Discount Helps Limit Downside Risk

To start, I want to touch on the primary reason why I find HYT attractive right now. This is the fund’s market price valuation, which has reached an extremely cheap level based on its current underlying value. For CEFs, the premium or discount to NAV is an attribute that should always be considered, and HYT is a fund that regularly trades at a discount. Therefore, simply having a discount does not make HYT an automatic buy in my book. However, the discount has widened considerably since my last review, especially over the past couple of weeks. In fact, the current discount is above 24%. While this is clearly a large discount, it is markedly higher than what we saw in my December review, as shown below, respectively:

Source: BlackRock

Clearly, HYT offers a relative value at the moment, especially when compared to its trading history. A 24% discount would look compelling in most circumstances, unless the fund had a history of always trading at those levels (which would be unusual). In fairness, HYT does have a history of trading near double-digit discounts, but a discount in excess of 20% is not common for this fund. Therefore, while I would not expect a sudden reversal back to par, or even a single-digit discount, the current valuation suggests a very good chance of an upward move from here.

My takeaway here is quite positive. HYT seems priced for Armageddon, and I don’t believe that is appropriate. While further selling could occur, I see a 24% discount level as keeping a lid on further downside, and feel comfortable recommending this particular fund as a way to generate exposure to a riskier asset class given our current market climate.

Investors Are Finally Being Compensated For Risk

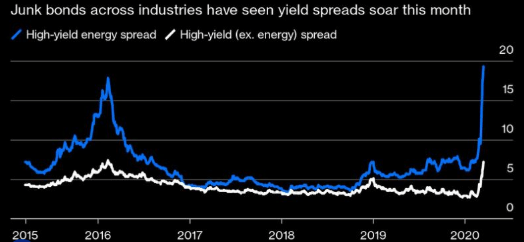

Expanding on the point about valuation, I now want to touch on the yield offered by HYT. As I noted, HYT has seen a sharp drop in share price, to the point where the fund is sitting at a market price and a NAV that are well below where they were a few months ago. While this is not good news inherently, a positive that comes out of this is the fund’s current yield has shot up dramatically. In fact, this has been the case for the below investment grade sector as a whole, as prices across the market have been sent sharply lower. Since yields move inversely with price, the current yields in junk bonds have seen their spreads rise considerably against investment grade bonds.

While there is no guarantee spreads will narrow any time soon, I do see this as an opportunity. While spreads could absolutely widen further, the current levels are at multi-year highs, as shown in the graph below:

Source: Bloomberg

As you can see, this is an aggressive widening, especially in the Energy high-yield space. But even for the broad junk bond corporate market, spreads are near their five-year high.

My takeaway here is that while buying HYT does expose investors to plenty of risk, the compensation for this risk is finally being priced in. I noted in my December review that I turned cautious on HYT because spreads had narrowed to the point where I did not believe the compensation for the risk investors were taking was adequate. Now, with spreads near multi-year highs, I am more confident that the risk is worth the reward. My sentiment here is positive for high yield bonds in general, but especially for HYT when we also consider the discount the fund trades at.

Negative Yielding Debt A Tailwind For High Yield

My next point considers why I believe investors will be willing to take on some credit risk now, even on the backdrop of a very volatile stock market. As the last few weeks have indicated, investors are fleeing asset classes of all types. While riskier plays, such as high yield corporate debt, are coming under the most pressure, even sectors generally thought of as safe havens – such as utilities, investment grade corporate and municipal bonds, and mortgage debt – are all sharply in the red. At this point, no area has really been safe, and this suggests to me a period of irrational selling, as opposed to concerns about particular areas.

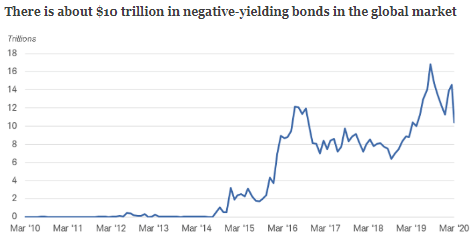

With this in mind, I believe some of the riskier funds, such as HYT, will be due for a comeback. The flight to cash has been dramatic and volatile, and once the dust settles, investors will be looking to get back in to the funds that have been disproportionately impacted. I would consider HYT in this category, given its rather absurd 24% discount. Further, I believe that income producing assets are going to be high on the shopping list for many investors, especially foreign investors. The reason behind this belief is that the amount of negative yielding bonds out on the market today continues to sit at a historically high level. While the amount has come down a bit in the very short term, as shown below, I expect this figure to rise as countries around the globe have recently cut interest rates in response to the COVID-19 virus:

Source: Charles Schwab

On this backdrop, the outlook I have is that low yields, and even negative yields, appear set to be with us for quite some time. While many investors will prefer the relative safety of these assets, even when earning very little in terms of compensation for holding them, I see this as a tailwind for high yield products. Even investors who are buying negative yielding bonds will need to balance out their portfolio with yield elsewhere, and a fund like HYT is priced favorably to do so.

Energy Debt Concerns Me, But HYT Is Light On Exposure

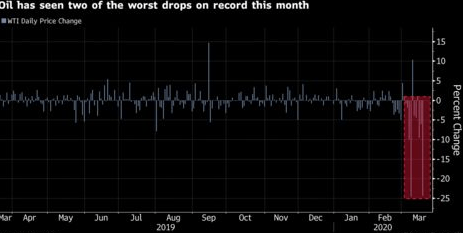

While I just discussed my positive outlook for HYT, I do want to raise some concerns about high yield corporate debt in general. Clearly, the market is quite volatile right now. While I see the recent sell-off as a bit overblown, I would not presume to ever “call a bottom” in stock or bond prices. If the risk-off mode continues, or if defaults start to increase rapidly, funds like HYT could see plenty of downside left. Further, the Energy sector is going to continue to come under pressure for some time. With historically low oil prices, margins are are rock bottom levels, and weak producers are going to have a difficult time making their interest payments. These are companies rated in the junk bond category, so financial constraints in this sector will clearly impact the broader high yield space, including HYT.

And the bad news is the pain may only be just beginning. While the sector has been contending with historically low prices for a while, this past week has seen crude prices drop at rates that are very abnormal, as seen below:

Source: Bloomberg

My point here is that even if Energy companies have been able to cope with their debt levels at the onset of this volatility, the dramatic short-term decline in prices will exacerbate this and could be too much for some to bear.

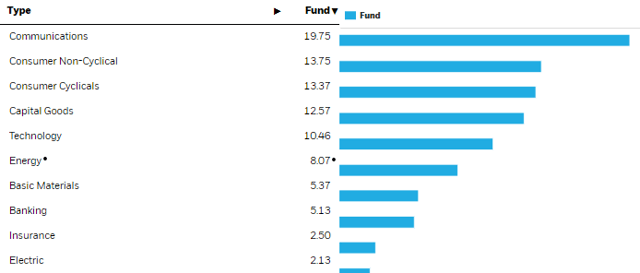

With this in mind, investors may be be wondering why I would recommend HYT. While a valid question, a key reason why I like HYT over alternative options, aside from its discount and current yield, is the fact that the fund has minimal Energy exposure. In fact, this sector makes up only 8% of total fund assets, as shown below:

Source: BlackRock

While the Energy sector’s recent pain could tempt investors to buy in, I am personally avoiding the space for the time being. While I expect oil prices to rebound off their current levels, I see limited upside as long as economic growth concerns linger. With HYT having only a small amount of exposure to this sector, I believe this will help the fund’s recovery, rather than hinder it.

Bottom line

HYT looks like a compelling value opportunity to me right now. That said, I must reiterate that this investment class is not for the faint of heart, as the recent sell-off has indicated. Investors need to be prepared for further downside from here, especially if bond defaults tick up. However, I believe HYT’s high income stream will remain attractive as interest rates around the globe sit at historic lows. With a hefty spread over investment grade corporates, and a very large discount to NAV, I believe investors are being properly compensated for the risk they are taking.

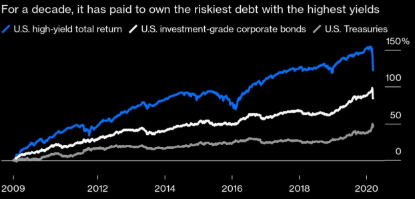

Further, while high yield is undoubtedly risky, it is worth noting that this is an asset class that has delivered alpha over the past decade, as shown below:

Source: Bloomberg

While the next decade will not necessarily deliver similar results, the story tells us that investors willing to take on riskier U.S. corporate debt have been rewarded for it. While the short term has been painful, I believe this story offers support for holding HYT. Therefore, I have increased my outlook on this fund to “bullish” and recommend investors consider positions at this time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in HYT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment