Khanchit Khirisutchalual

For high yielding investments, there is a clear dip-buying opportunity, and BlackRock Capital Investment Corporation (NASDAQ:BKCC) is a business development company that investors may want to consider purchasing.

The BDC is well-managed, but its stock price has recently dropped significantly, despite the fact that the portfolio has shifted towards higher quality First Liens.

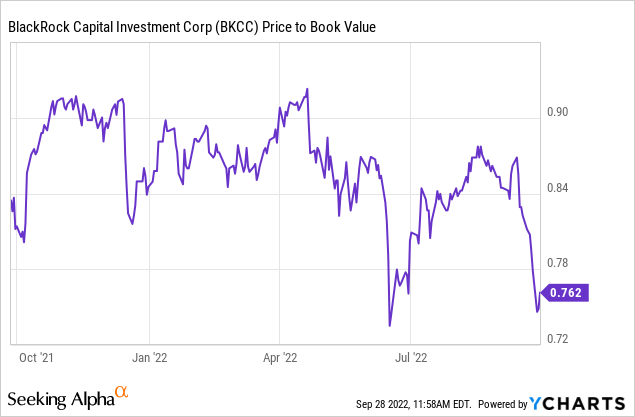

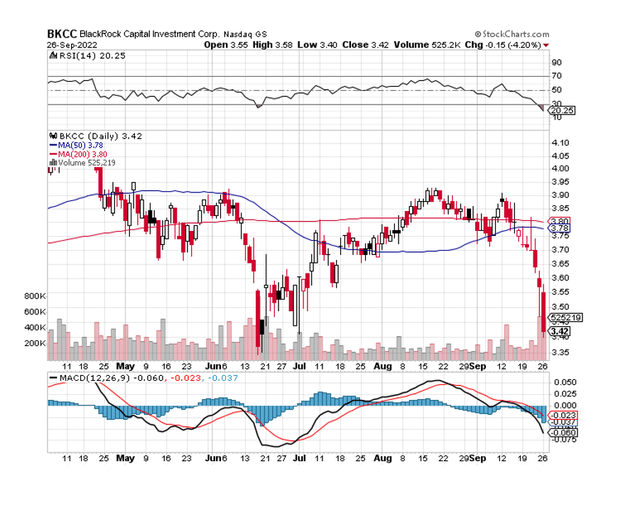

The stock is now trading at an unjustified 25% discount to net asset value, and the Relative Strength Index indicates that it is oversold.

Time To Buy The Selloff: BKCC Trading At A Steep Discount

Many business development companies are seeing lower net asset value multiples as a result of the recent market and BDC sector pullback.

The BDC’s stock is now trading at a 25% discount to its net asset value. BlackRock Capital Investment’s net asset value has risen significantly in recent days, and the RSI value of 20.25 indicates that the stock is now oversold.

BlackRock Capital Investment already sold at a discount to net asset value prior to the recent pullback, but I believe this makes the BDC more appealing in terms of income and yield.

Investors can now profit from a high margin of dividend safety at a 25% discount to net asset value, owing to the business development company’s well-performing investment portfolio.

BlackRock Capital Investment provides investment capital to middle-market companies and has developed a focus on First Lien loans that are highly secured and thus have a very low probability of default.

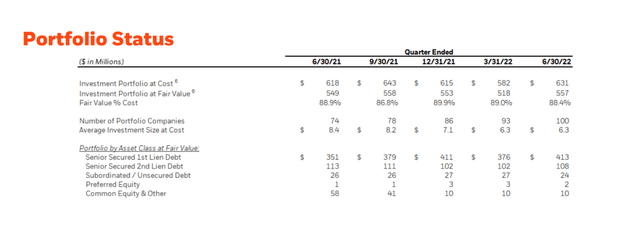

The debt portfolio of BlackRock Capital Investment had the following investment distribution: 74% of the funds were invested in the highest quality debt (First Liens), 20% in Second Lien debt (also secured), and 6% in various forms of unsecured debt and equity (both common and preferred).

The portfolio itself was made up of 100 portfolio companies, with a total investment value of $557 based on fair value.

Portfolio Status (BlackRock Capital Investment Corp)

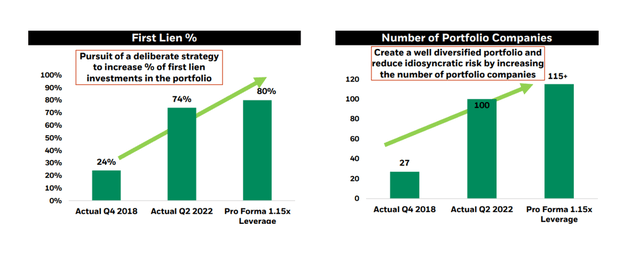

BlackRock Capital Investment has shifted its portfolio focus and emphasized investments in high quality First Liens over the last four years, resulting in a more stable portfolio and lower loss risks for the business development company.

I particularly like the First Lien emphasis because recession risks are increasing, and BDCs with lower portfolio risk may outperform other business development companies with a greater emphasis on equity.

Shift In Portfolio Focus (BlackRock Capital Investment Corp)

The Dividend Is Not Covered By Net Investment Income

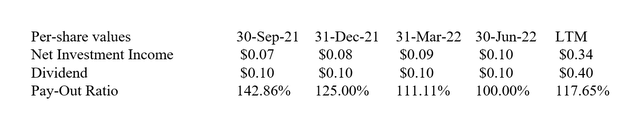

The dividend is currently not covered by net investment income. The pay-out ratio was approximately 100% in the most recent quarter, but 118% in the previous twelve months, indicating that the business development company is currently not earning its dividend.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Because BlackRock Capital Investment is not covering its dividend, the market may expect a dividend decrease in the near future. Since BKCC already trades at a large discount to net asset value, I think the possibility of a lower dividend is already reflected in the BDC’s valuation.

Why BlackRock Capital Investment Could See A Higher Valuation

The markets have been quite volatile in recent weeks, but there is no reason why valuations cannot recover, particularly if economic growth resumes and inflation is brought under control.

Having said that, given the risks outlined here, I believe the risk/reward tradeoff is not too bad, considering that BlackRock Capital Investment’s stock is available at such a high discount to net asset value.

My Conclusion

Fear has returned to the market, and long-term income investors who want to buy a decently-priced BDC should consider BlackRock Capital Investment, but only as a higher risk BDC alternative due to its high pay-out ratio.

I believe the business development company has a stronger portfolio than in the past, thanks to its focus on First Liens, which protects against downside in the U.S. economy.

The nonsensible 25% discount to net asset value is BKCC’s main selling point. Buy.

Be the first to comment