mattjeacock

When looking at the most disappointing companies over the last decade, Canadian technology company BlackBerry (NYSE:BB) has to make the list. It’s been more than nine years since John Chen took over what was then a smartphone giant, only to gut the business to a small software and services platform. As we get ready for another earnings report later this month, it appears analysts are yet again reducing their expectations.

Recently, investors have been worried about a slowdown in the tech sector as many companies have announced layoffs to cut costs due to slowing growth. Just last week, we had weak current quarter guidance from cloud giant Salesforce (CRM), for example. Additionally, partial BlackBerry cybersecurity competitor CrowdStrike (CRWD) announced its smallest quarterly revenue beat since the early stages of the pandemic, while also uncharacteristically providing weak guidance.

When we look at BlackBerry, the cybersecurity segment has been the weak link at times in recent quarters. When the company announced its Q2 results back in September, the $111 million revenue figure reported was down $9 million over the prior year period. Gross margins also declined, as did key metrics such as billings an annual recurring revenue (“ARR”). Management said back then that cybersecurity ARR should return to growth early in the next fiscal year, but we’ve heard plenty of comments about revenue growth returns from management for years that haven’t come true. An update on this progress will be one of the keys I’ll be watching in the coming weeks.

BlackBerry has not yet announced a set date for the fiscal Q3 earnings report, as the November period’s results are estimated to come on December 20th. For the quarter, analysts are currently looking for a more than 8.6% decline in total revenue to $168.14 million. This is expected to be the 9th straight quarter with a declining top line, which is partly due to the transition in the Licensing and IP segment. Investors will be waiting for an update on the company’s major patent sale that’s been in the works for some time.

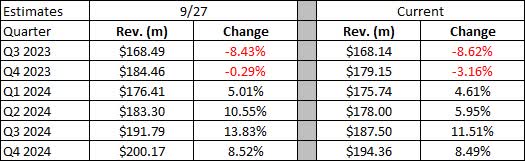

The other item that could hurt the company’s short term revenue picture is the auto sector. With the US possibly entering a recession, and China’s economy teetering based on various covid lockdowns, we could see some pressure on auto sales. This would hurt BlackBerry’s QNX division, as well as the upcoming launch of IVY products. With all of these potential headwinds on the horizon, it might not be a surprise to some that analyst estimates have declined a bit in recent months. The table below shows where quarterly figures stand for the back half of the current fiscal year as well as next year, since late September, along with the change over the prior year period that the current estimate represents.

BlackBerry Revenue Estimates (Seeking Alpha)

Overall, this six quarter period has seen its total revenue estimate decline by almost $22 million in a little over two months, or a bit more than $3.6 million per quarter on average. On an annual basis, it is looking much less likely that BlackBerry will be able to top $700 million in the current fiscal year, which would be its lowest top line number in well over a decade. There are hopes that in about two years BlackBerry can get back over $1 billion. That level would represent about 5% of the company’s peak when this was mainly a hardware driven business.

On the bottom line, I’d like to see the company making some progress on its GAAP expense base. As a percentage of revenues, BlackBerry has been running some pretty large operating losses. Of course, management has taken out a number of key expenses to calculate non-GAAP EPS, which is a key reason why the company hasn’t missed street estimates on the adjusted bottom line in more than five years. Unfortunately, expenses like stock-based compensation are real in a sense, as they are diluting investors by the quarter, so trying to adjust them away really does a disservice here.

BlackBerry still has a fairly healthy balance sheet, although a good portion of it is tied up in either goodwill or intangible assets. The cash pile sits at just under $700 million, and that number would definitely be helped if the patent sale could finally go through. About half of that cash may be needed to repay the company’s debt that’s due in about 11 months, unless the issuance can be refinanced or converted to stock. Currently, shares trade well below the $6 conversion price, so that option may not be available.

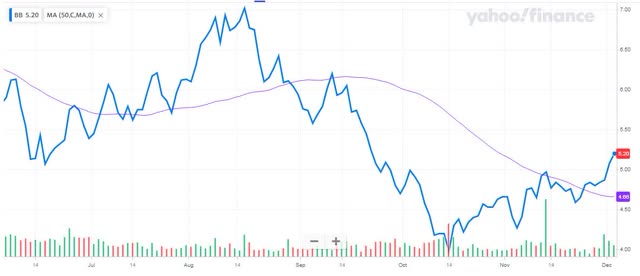

As for BlackBerry shares, they closed Friday at $5.20, which is towards the lower end of their $3.94 to $9.67 range over the past 52 weeks. Right now, there are more sell ratings than buy ratings on the street, although the average price target of $5.81 implies almost 12% upside from last week’s finish. As the chart below shows, the stock recently broke above its 50-day moving average, and this key technical trend line is about to start rising again. If a good earnings report comes in a few weeks, this could start a sizable breakout with a much improved technical picture. However, a bad earnings report could cause the 50-day to roll over and head lower, which would cause a lot of technical damage into early next year.

BB Last 6 Months (Yahoo! Finance)

In the end, we’re about two weeks away from a very important earnings report from BlackBerry. With a lot of fear out there about weakness in the tech and auto space, analyst estimates are on the decline yet again. Recent reports in the cyber and tech services space have shown some troubling signs, which could impact BlackBerry’s hopes for near term revenue improvement. The company is projected to report its weakest revenue year under John Chen at the March quarterly report, but there are hopes that a bottom could finally be coming soon. Investors certainly are looking for some positive commentary, because another disappointing result could send shares back towards their recent lows as they continue to massively underperform under Chen.

Be the first to comment