JHVEPhoto

I don’t know about you, but when I think about the big box retail chains that have a ‘club’ warehouse approach to them, the first two that come to mind are Sam’s Club, a subsidiary of Walmart (WMT), and Costco Wholesale Corporation (COST). But for investors who want a stake in a smaller player in this market, a player that is growing at an attractive rate and that is trading at a discount to its larger rivals, one firm to consider is BJ’s Wholesale Club Holdings (NYSE:BJ). In recent years, the financial performance achieved by the enterprise has been impressive. Add on top of that how attractive shares are priced today, and I do believe that it warrants a solid ‘buy’ rating at this time, reflecting its potential to outperform the broader market moving forward.

A small player in a big market

According to the management team at BJ’s Wholesale Club Holdings, the company operates as a leading warehouse club operator that delivers value to its members by offering significant discounts on a variety of goods. These discounts are often 25% or higher and apply to manufacturer-branded groceries and other related offerings. Examples include perishable products, general merchandise, gasoline, and various services that would be ancillary to the products they provide. At present, the business has 229 large-format, high-volume warehouse clubs spread across 17 different states. Geographically, they tend to focus on the east coast of the US, catering to states ranging from as far South as Florida to as far North as Maine. Its largest focus happens to be on New York, where 46 of its stores are currently in operation. This is followed by Florida, Massachusetts, New Jersey, and Pennsylvania, all in that order.

Although the company operates a warehouse club business model, it does also provide goods through other channels as well. Through various websites that it owns, customers can order and review products, digitally add coupons to their membership cards, and view their annual member savings. Typically, a membership to its warehouses comes in at $55 per year, with the opportunity to add others at a discount. On top of this, the company also has a robust perks rewards program for its higher tier members that provides 2% cash back on most in-club and online purchases in exchange for $110 per year. It’s also worth mentioning that the company has other value-added operations. For instance, it has its own consumer-focused private-label products that it sells under brands such as Wellsley Farms and Berkley Jensen. During the 2021 fiscal year, private label products comprised 23% of the company’s merchandise sales. In addition to this, the company also has no fewer than 157 gas stations at or near its clubs.

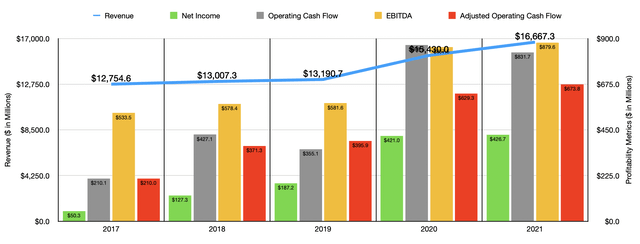

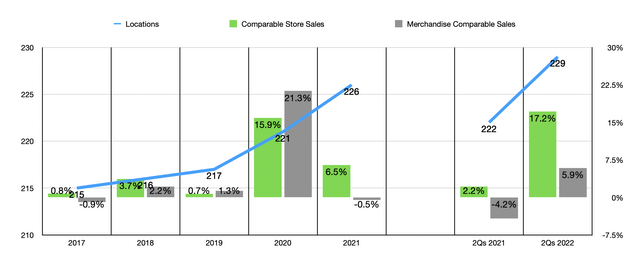

Over the past few years, management has done a really good job growing the company. Revenue has increased from $12.75 billion in 2017 to $16.67 billion in 2021. It’s important though to dissect this growth. For instance, it’s clear that the company benefited from an increase in the number of locations it has in operation. In 2017, the company had only 215 clubs nationwide. By the end of 2021, that number had grown to 226. Comparable store sales are also another component of the equation. But as you can see in the chart below, there is a meaningful difference in some years between total comparable store sales and merchandise comparable sales. In short, the merchandise comparable sales exclude the changes caused by fuel revenue. Given that fuel is largely a margin-based business and revenue itself does not matter all that much, it’s appropriate to keep these separate when evaluating the health of the enterprise.

With revenue rising, profitability has followed suit. Net income at the business rose from $50.3 million in 2017 to $426.7 million last year. Operating cash flow has followed a similar trajectory, rising from $210.1 million to $831.7 million. If we adjust for changes in working capital, the trajectory it has taken has been even clearer, rising from $210 million to $673.8 million, with each year coming in better than the year prior. A similar trend there can be seen when looking at EBITDA, with that metric rising from $533.5 million to $879.6 million.

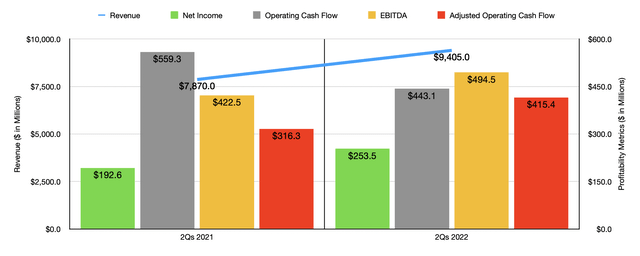

For the 2022 fiscal year, we have seen growth for the company continue. Revenue in the first half of the year totaled $9.41 billion. That’s 19.5% higher than the $7.87 billion generated the same time last year. While the company did benefit from an increase in location count from 222 to 229, the big driver was a 17.2% increase in comparable sales. But stripping out fuel revenue, the increase was a more modest, but still very impressive, 5.9%. Just like in prior years, this increase in revenue brought with it improved profitability. Net income rose from $192.6 million to $253.5 million. Operating cash flow did fall, declining from $559.3 million to $443.1 million. But if we adjust for changes in working capital, it would have risen from $316.3 million to $415.4 million. And over that same window of time, EBITDA for the company increased from $422.5 million to $494.5 million.

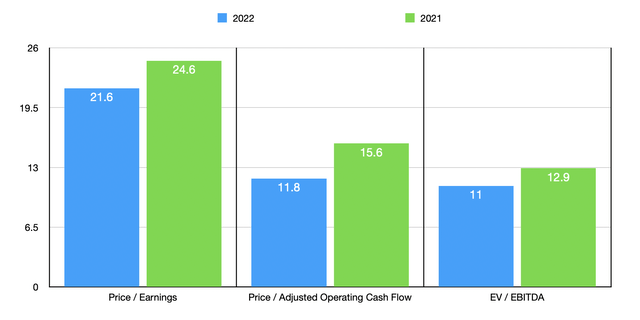

When it comes to the 2022 fiscal year in its entirety, management expects comparable club sales to climb by between 4% and 5%. Meanwhile, earnings per share should be between $3.50 and $3.60. At the midpoint, that would translate to net income of $484.8 million. If we apply that same year-over-year growth rate to other profitability metrics, we should get adjusted operating cash flow of $884.9 million and EBITDA of $1.03 billion. Based on these figures, the company is trading at a forward price-to-earnings multiple of 21.6, a forward price to adjusted operating cash flow multiple of 11.8, and a forward EV to EBITDA multiple of 11. By comparison, if we were to use the data from the 2021 fiscal year, these multiples would be a bit higher at 24.6, 15.6, and 12.9, respectively. As you can see in the table below, the company is cheaper in all three categories than either Walmart or Costco. Of course, those firms are far larger and, by definition, far more capable of operating efficiently than BJ’s Wholesale Club Holdings could hope to be. So a case could be made that they deserve to trade it something of a premium to this particular business. Be that as it may, acquiring stock at a discount when the company that stock represents is growing at a nice clip and is trading at levels that look fundamentally attractive, may yield some attractive results down the road.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| BJ’s Wholesale Club Holdings | 21.6 | 11.8 | 11.0 |

| Walmart | 28.2 | 18.7 | 13.7 |

| Costco Wholesale Corporation | 39.0 | 30.9 | 22.5 |

Takeaway

Based on what I know from my research, BJ’s Wholesale Club Holdings seems to be a really solid operator and its space. For investors who retired the two big players in the market and who want something a bit smaller that has potentially more upside, I would argue that shares of this particular company are cheap enough to warrant consideration. Due to these factors, I feel comfortable rating the enterprise a ‘buy’ at this time.

Be the first to comment