Unfortunately, one of my favorite ideas going into the year turned out to be a dud as the COVID pandemic came like a storm. These are business development companies which are found under the VanEck Vectors BDC Income ETF (NYSEARCA:BIZD).

These companies are usually levered 2-3X and lend at high yields to smaller businesses. They usually pay very high dividend yields (BIZD’s is currently 16% TTM), which are a great source of income when times are good. Unfortunately, times are not great today, which makes them a risky proposition.

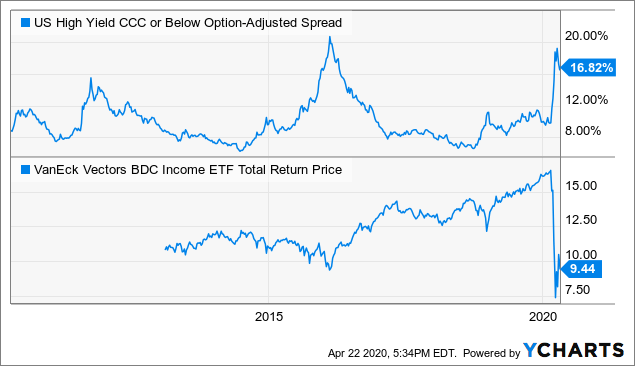

As you can see below, BIZD has erased most of its gains over the past few years and, unlike many others, has yet to see a recovery:

When I had first covered the ETF in September in “BIZD: Attractive 9% Yield, But Widening Credit Spreads A Risk,” I noted that high-yield rates were rising which made the fund a risky proposition. By the end of the year, financial signals of a recession (like high-yield spreads) had faded which made BIZD appear to be a strong opportunity.

Unfortunately, high yield spreads have blown out, which has caused the increasingly levered BDC space substantial declines:

Data by YCharts

Data by YCharts

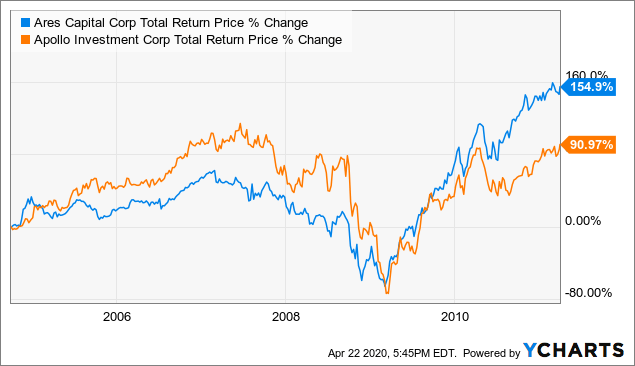

With most BDCs 30-60% below their February peak and paying double-digit yields, we must ask if it is worth buying the dip. During the past recession, buying the dip was an extremely profitable prospect. Major BDCs such as Ares Capital (ARCC) and Apollo (AINV) had lost over 80% of their value but quickly saw complete rebounds thereafter. Those who had bought the dip likely saw gains in the multiples.

See below:

Data by YCharts

Data by YCharts

However, the situation today is not equal to that of 2008. Like 2008, it is bearish for the economy, and 2020 will most definitely be a recessionary year that will see a substantial rise in defaults. However, it is still very unclear how far we are from the bottom. Problematically, this is (at least initially) a self-inflicted recession, so the answer partly lies in the decisions of policymakers.

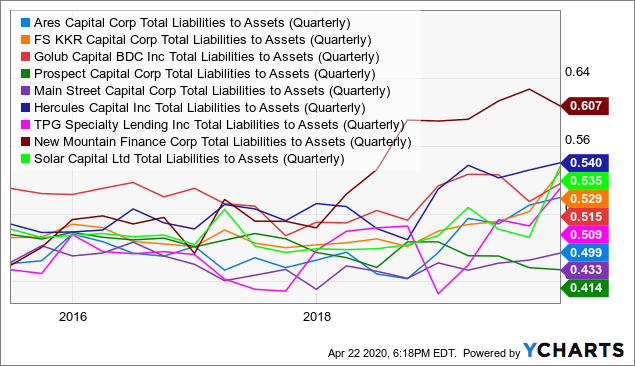

Further, BDCs generally have higher leverage today than in the past. The 2018 Small Business Credit Availability Act increased the maximum leverage BDCs could use to 2:1 (debt to equity) from 1:1. Not many BDCs have levered up to the maximum level, but this does not give them much room to fail in case of defaults.

Most BDC debt is usually secured, which gives the companies very low borrowing rates. Of course, these low borrowing rates are also problematic because it increases foreclosure risk in a recessionary environment. Lately, BDCs like Ares (ARCC) and Goldman Sachs BDC (NYSE:GSBD) have turned to the bond market to refinance their own debt loads. This could allow a further increase in leverage and/or a decrease in dividends, but it may lower the risk of forced asset sales.

The Need for Due Diligence

Importantly, not all BDCs are equal, particularly in a recessionary environment. With a fund like BIZD, investors gain exposure to just about all BDCs on the market. Some with low leverage and high-quality investments, and others with high leverage and poor-quality investments.

As one example of the latter category, we have TriplePoint Venture Growth (NYSE:TPVG). This BDC only makes up 1.5% of BIZD, but it exemplifies much of the risks in the BDC space. While TPVG has an attractive TTM dividend yield of 21%, it has high leverage. Problematically, it invests in unsecured loans to unprofitable “unicorn”-type startups, many of which were recently forced to lay off a large percentage of their workforce. It will take time before TPVG’s portfolio is adjusted according to its heightened risk, but when it does, I believe it is very likely TPVG will find itself above BDC leverage requirements.

See “Assessing Survival Potential: TriplePoint Headed Lower Due To Mass Startup Layoffs” for more information. Obviously, TPVG could be saved and its high dividend yield is attractive. That said, it seems that many investors are too enamored by dividend yields that they forget to realize obvious potential balance sheet pitfalls.

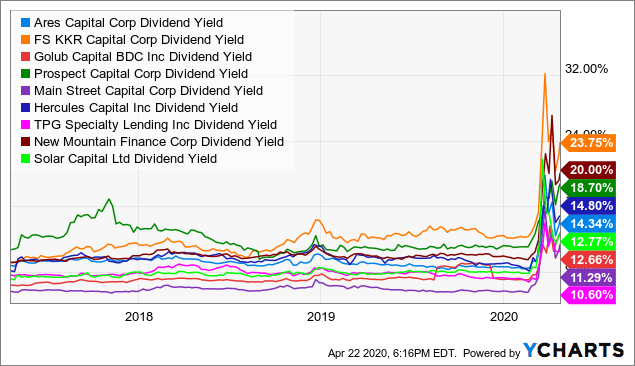

As attractive as 20%+ dividend yields may be, they likely carry a substantially higher risk of going to zero or failing to recover. As you can see in the two charts below, the BDCs (from BIZD’s holdings) which have higher dividend yields do not always have higher leverage:

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

At the highest leverage, we have New Mountain Finance (NMFC) which has the second-highest dividend yield of the group. However, the lowest levered, PSEC, has the third-highest dividend yield and the second-highest levered, HTGC, has a mid-range dividend yield. Obviously, leverage is not the only risk a BDC can have, but this goes to show that the best bets are likely found through due diligence that is not available in an ETF like BIZD.

The Bottom Line: Watch the Federal Reserve

If it were not for the Federal Reserve’s aggressive response, I would say investors should avoid BDCs in their entirety. Without financial stimulus, this recession has a high chance of being worse than 2008 (which was only stopped by stimulus) given the substantial rise in unemployment and the buildup of unsecured corporate debt.

However, the Federal Government has made an effort to protect BDCs. This will allow eligible BDCs to borrow directly from the Primary Market Corporate Credit Facility at low interest rates. BDCs may also be able to sell eligible assets to the Secondary Market Corporate Credit Facility. This will undoubtedly boost liquidity and reduce BDC balance sheet risk.

Obviously, it is very unclear the extent to which the Federal Reserve will go to protect financial markets. Personally, I am not of the view they can be the superhero to all investors that many seem to hope. That said, they do have a specific goal to avoid a 2008-style liquidity crisis which means they will likely protect banks and other lenders like BDCs.

Still, I am not yet convinced BDCs are a buying opportunity. Most are heavily invested in ultra-high-yielding assets that carry substantial default risk. While the Federal Reserve is creating money at the fastest pace ever, the economy is paused and many small-to-medium businesses have essentially no cash flow with high overhead. Unless a seemingly unlikely “V-shaped” recovery occurs, it will take substantial quantitative easing and legislation to offset this occurrence.

If anything, opportunities will be found by selecting individual BDCs with a high-quality portfolio, not a fund with high systemic exposure like BIZD.

Interested In More Alternative Insights?

My fellow contributor BOOX research and I run the Core-Satellite Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios designed using the academically-backed Core-Satellite approach. This involves creating a base long-term portfolio (the core) and generating alpha using unique well-researched tactical trades (the satellite).

As an added benefit, we’re allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they’d like. You can learn about what we can do for you here.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in TPVG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment