We Are

I believe NILE offers a unique opportunity at the moment since the company plans to issue a dividend for each of its spun-off businesses. Two businesses – Gresham and TurnOnGreen – are already operating independently however BitNile is still deciding the record date to issue shares of these companies.

Investors have the opportunity to buy NILE shares in order to receive shares of its subsidiaries which I believe will be more successful as standalone businesses. NILE has historically overly diversified its operations, leading to a lack of oversight and efficiency. Under new management, these stocks could run on catalysts – offering an opportunity to sell the distributed shares at a profit in the future. For this reason, I believe NILE stock is a buy upon the company’s record date announcement.

After the dividend NILE will see a further drop since it will have spun off its businesses. As a BTC marketplace, I have reservations about NILE’s future and do not believe in holding it past the ex-dividend date.

Gresham Worldwide

Gresham Worldwide was spun off through a business combination with Giga-tronics Incorporated (OTCQB:GIGA) which operates in the defense sector. Currently trading at $1.22, GIGA has been downtrending since the start of the year but appears to have found support at $1.00.

Prior to the business combination, GIGA was a producer of radar and electronic threat emulation systems as well as radio frequency filters. Meanwhile, Gresham was providing purpose-built electronic solutions to militaries and defense companies across the world. Both Gresham and GIGA have more than 500 customers around the world including 40 leading defense industry prime contractors and 20 defense ministry programs.

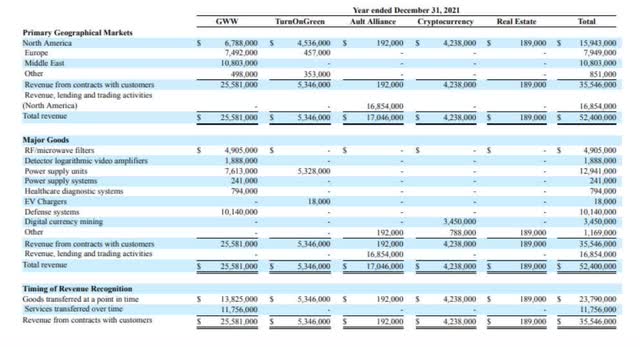

Considering that Gresham generated $25.5 million in 2021, I believe GIGA could see additional revenue growth in the near term now that both companies are combined. This could offer an attractive upside to NILE shareholders who will receive shares of GIGA according to NILE’s statement.

TurnOnGreen

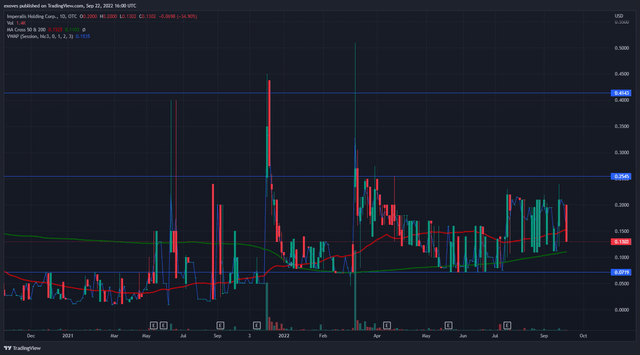

Another recent spin-off was NILE’s EV charging subsidiary – TurnOnGreen – which was the result of NILE divesting its subsidiary into its other subsidiary – Imperalis Holding Corp. (OTCPK:IMHC). IMHC currently trades at $.13 but is now in a very attractive sector thanks to TurnOnGreen.

TurnOnGreen is a supplier of power products offering EV charging stations for homes and businesses. I expect this sector will see increasing demand given California regulators’ ban on the sale of new gasoline-fueled cars by 2035 as well as President Biden’s Executive Order setting the target for EVs to become 50% of all new cars sold in the USA by 2030.

Since these targets would allow for faster adoption of EVs, IMHC has the opportunity to see growth thanks to the influx of business through TurnOnGreen. As is, the market for North American EV charging stations is expected to reach $30.62 billion by 2029 and the opportunities for IMHC to benefit from Federal funding thanks to Biden’s Infrastructure Law is another catalyst for the stock. This law provides $5 billion in funding for states to install EV chargers along interstate highways. While TurnOnGreen is by no means a major player, it has the benefit of being a small player in a rapidly growing market.

IMHC ran 290% in March, reaching its 52-week high of $.50 on the announcement that it would be acquiring TurnOnGreen. The acquisition was completed on September 9th, but as IMHC pursues its name change and begins releasing updates on TOG Technologies Inc. and Digital Power Corporation, the stock could retest its 52-week high.

The terms of the dividend dictate that the dividend for TurnOnGreen will include 140 million shares for NILE shareholders and warrants for the purchase of an additional 140 million shares. For this reason, the dividend will likely be 1 for 3 or 1 for 2. NILE has shared that it anticipates setting the record date for TurnOnGreen’s dividend and I believe that more news will be released at the October 17th meeting.

Ault Alliance

Now, the remaining business left to spin off is Ault Alliance which NILE plans to make a public company in the first half of 2023. The resulting entity will include all of NILE’s operations related to bitcoin mining, oil & gas, lending, hotel and data center operations, as well as its other commercial real estate holdings. Despite being in their early growth stages, NILE realized $34.2 million in revenues from these ventures – excluding the oil and gas business – for the first half of 2022.

I believe this could be the most promising entity resulting from the spin-offs since NILE has an agreement with Bitmain to deliver 20.6 thousand BTC miners for installment at the Michigan data center. The company has recently entered into another agreement with Bitmain for the purchase of an additional 1,325 miners with a processing power of 100 terahashes per second. As a result, Ault Alliance will be operating with nearly 22 thousand miners once all the deliveries are completed.

Despite Bitcoin’s 60% drop since April, NILE has been taking advantage of the reduced blockchain pressure. The company shared in its August BTC mining report that its operations generated an annualized run rate of 787 BTC which would translate to around $19.2 million at BTC’s current price. This was accomplished with only 12 thousand miners – a little over half of what Ault Alliance will have by the time of the spin-off.

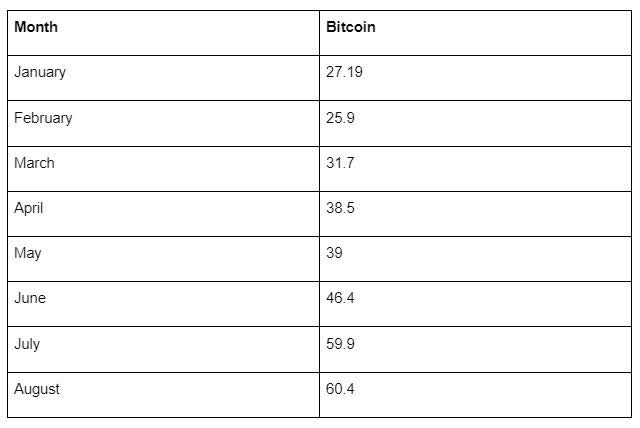

BitNile Bitcoin Mining Reports

NILE has been steadily increasing the number of BTC mined MoM and I believe it will continue to do so leading up to the spin off – putting Ault Alliance in a good position to mine 1,442 BTC annually, generating annual revenues of $27.8 million by the time of the spin-off.

On this note, I am bullish on BTC and believe that crypto will rally in the near term. BTC touched a strong support near $17.6 thousand in June but has traded above this low since. Given BTC’s volatility, I believe that crypto will rally in tandem with the stock market since BTC generally moves in correlation to the stock market as shown in this comparison of the QQQ and BTC.

While it may not regain its all-time high of $68 thousand in the near term, I anticipate that BTC will recover as quantitative tightening comes to an end. If BTC regains its support at $28.6 thousand then Ault Alliance would be generating considerably higher revenues in the range of $41.8 million.

NILE has also secured a hosting agreement with Compute North which Ault Alliance will benefit from after the spin-off. The agreement allows for the operation of 6,500 BTC miners in its Texas facility. Of those miners, NILE has already installed 3,920 miners and expects to install the rest by October 1st. This will result in lower energy costs, reducing Ault Alliance’s OPEX after the spin-off. Considering that this business generated $8 million in the first half of 2022 with minimal miners, I see a potential upside for Ault Alliance’s stock after the spin-off.

Valuation

TurnOnGreen

Now that TurnOnGreen (TOG) has spun off and is trading under IMHC, I believe IMHC should be valued higher since for the year ending June 30, 2022 IMHC did not report any revenues as its businesses remained dormant. While investors may have priced in some of TurnOnGreen’s value starting with the acquisition announcement in March, the current market cap does not reflect its growth potential.

TurnOnGreen reported $7.5 million in revenues over the last year and a half. For the twelve months ending June 2022, TurnOnGreen generated $4.3 million in revenue, and given IMHC’s market cap of $32.3 million, TurnOnGreen has a P/S ratio of 7.5.

For comparison, during the twelve months ending June 2022, Blink Charging Co. (BLNK) brought in $35.64 million in revenue. Given its market cap of $1.01 billion, BLNK has a P/S ratio of 28.3. Additionally, EVgo (EVGO) has a market cap of $2.32 billion and generated 30.08 million in the 12 months ending June 2022. This gives EVGO a P/S ratio of 77.

However, neither of these companies is profitable. On this note, the EV charging sector is still developing and its industry leaders like ChargePoint (CHPT), EVgo, Plug Power Inc. (PLUG), and Blink Charging Co. are valued at very high multiples despite their revenues and lack of profitability. In comparison, TurnOnGreen’s growth potential is undervalued at the current market cap.

Giga-tronics

In 2021, Gresham generated $25.5 million in revenue while Giga-tronics generated only $770 thousand for the year ending March 2022. GIGA currently has a market cap of $3.3 million and considering that Gresham brought in $13.7 million in the first half of 2022, it appears that GIGA is now very undervalued at its current market cap.

Ault Alliance

Since the spin-off of Ault Alliance will combine NILE’s real estate holdings, cryptocurrency ventures, and other operations, I estimate the revenue from these operations at $21.4 million. This is based on the reported revenue from the real estate, crypto, and Ault Alliance operations for 2021. However, for the first half of 2022, these operations combined have brought in $34.2 million.

Right now, the company expects its average daily mining production to reach 4.7 BTC per day by the end of this month and increase to 9.33 BTC per day by the end of December. While this estimate is based on current market conditions, for the sake of comparison Riot Blockchain, Inc. (RIOT) – a Bitcoin mining and data center hosting company – had an aggregate hash rate of 3 EH/s with the capability of mining 16-17 BTC per day at the start of this year.

While NILE had a hash rate of 1.091 EH/S as of August, it expects that after all the miners are fully deployed and operational, it will have the mining capacity of approximately 2.3725 EH/S – allowing it to mine 9.33 BTC per day.

In comparison to Marathon Digital Holdings (MARA) which has a hashrate of 3.2 EH/S as of August and is pursuing the goal set out in its guidance of 23.3 exahash per second (EH/s) in 2023, Ault Alliance would still be a very small player. But these projections give a rough prediction of what Ault Alliance could be valued at after its spin-off.

Risks

While I am proposing that NILE’s dividend plans offer an opportunity for investors to benefit from exposure to the three resulting companies, I do not believe that NILE itself holds long-term value after spinning off its most valuable operations. In the past, NILE has also significantly diluted its shareholders and there is a risk that it could dilute shareholders leading up to the dividend.

Another risk is the timeline for this dividend. In its initial statement the company shared that:

The spin-offs, whether completed or planned, will upon completion result in the distribution of substantially all of the Company’s nearly $600 million assets to its shareholders, who will become owners of four public companies.”

However, NILE has not proactively communicated the terms of the dividend with its shareholders since. I expect a dividend update at the company’s October 17th meeting, but it is not guaranteed.

As for the spin-offs themselves, there is no guarantee that GIGA, IMHC, and Ault Alliance will become profitable companies. As independent public companies, they present their own risks of dilution and mismanagement which investors should be aware of as well.

Conclusion

Overall, I believe that investors should watch NILE for news regarding its dividend at its October 17th shareholders meeting. I expect that upon the expected announcement NILE stock could have a run-up similar to Vinco Ventures (BBIG) which ran 60% after announcing the share dividend for its spin-off of Cryptyde (TYDE) in May.

I believe that investors should hold off on purchasing NILE shares until the record date for the dividend is announced to limit any risk of dilution. However, once the dividend details are released investors will have the opportunity to gain shares of these three companies which could be sold at a profit.

Be the first to comment