paitoonpati/iStock via Getty Images

Introduction

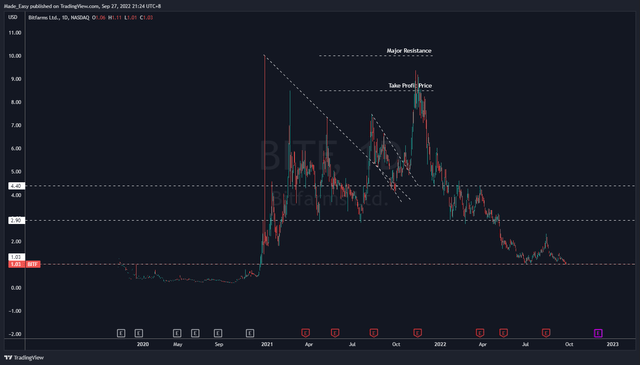

Let’s recollect our journey so far. In June 2021, we first propose a 5x upside potential for BITF on the basis that its all-in business cost per BTC was around the $20,000 level and was lagging the overall crypto market. We entered our positions at around $3.25 per share. 5 months later, BITF finally caught wind and spiked up to as high as $9.36. As BITF was approaching the $9.00 level, we updated our action plan to sell call options. We eventually sold out all of our BITF positions in January 2022 as we issued warnings against investing in Bitcoin (BTC-USD) mining companies amidst a Bitcoin bear market.

Since then, we’re long Bitcoin with 33% of allocated capital deployed at $30,000 Bitcoin, another 33% at $20,000 Bitcoin, and the remaining 33% at $10,000 Bitcoin. These actions align with the 5 sequences of events in a Bitcoin halving cycle. Right now, we’re still waiting on the sidelines.

2022Q1 performance wasn’t optimistic where BITF saw a decline in Bitcoins mined and a 9% increase in direct cost (electricity and hosting) per BTC. Prior to the Q2 quarterly report, BITF also liquidated about 3,352 Bitcoins (~50% of Bitcoin reserves).

Fast forward to today, BITF now trades at a $200mil market cap or $1.00 per share, a price level representing a very strong support level (Fig 1). Hence, the main objective of this article is to determine whether there’s a comeback to be had. If not, what it’ll take for us to get invested.

Fig 1. BITF trading at major support level (Author, TradingView)

BITF’s Positive Operating Cash Flow Not A Significant Matter

As interest rates rise, businesses that can generate positive operating cash flow will be perceived to be more valuable because they’re self-sustaining and will be impacted less by the higher cost of borrowing. BITF made its positive operating cash flow (OCF) its 2022Q2 press release opening statement. On the surface, it seems impressive and significant. However, this isn’t anything new for BITF.

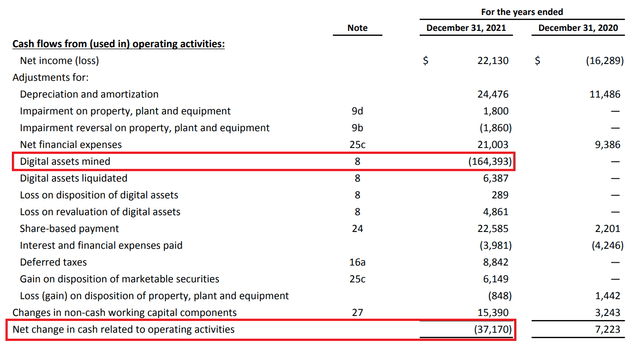

For the year ended 2021, BITF’s operating cash was negative $37.17mil only because the Bitcoins mined weren’t sold for cash. BITF could’ve sold its Bitcoins mined for $164.393mil and realized a positive operating cash flow of $127mil. This was made possible by Bitcoin trading significantly above BITF’s all-in business cost, with depreciation cost included (very important).

Fig 2. BITF was actually operating cash flow positive for 2021. (BITF)

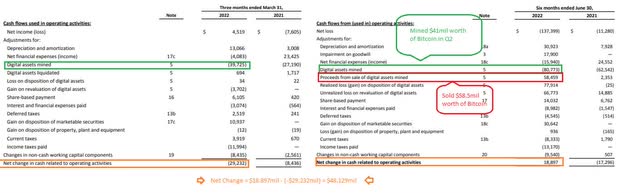

To makes things worse, BITF’s Q2 positive OCF wasn’t contributed by selling the Bitcoins mined in Q2. Bitcoins worth $58.5mil were sold while Bitcoins mined in Q2 were worth only $41mil. Hence, BITF’s operation isn’t really cash flow positive.

Fig 3. BITF wasn’t actually operating cash flow positive in Q2 (BITF)

Another reason why BITF’s cash flow isn’t really positive is because BITF’s depreciation should be interpreted as a cash expense. The Bitcoin mining business is heavily reliant on its mining rigs and infrastructure to stay profitable and competitive. The wear and tear due to the heavy usage of the infrastructures and mining rigs mean that Bitcoin mining businesses have to replace them periodically to stay in business. These mining rigs have a lifespan of 3-5 years, after which Bitcoin mining businesses must realize the depreciation cost by spending money to purchase new mining rigs.

Moreover, when newer, more powerful, and more efficient rigs are introduced into the market, older mining rigs will no longer be viable because of energy cost per Bitcoin mined, property space management, and loss of share in the Bitcoin network.

All this simply means that depreciation is an actual cash cost that will be realized after 3-5 years.

BITF’s Q2 depreciation cost was $17.9mil, which is more than half (55%) of its cost of sales (cost of mining). This represents a 37% QoQ increase. This is to be expected as BITF continues to acquire more mining rigs and expand its mining footprint. As of the end of August 2022, BITF’s capacity has exceeded 4 EH/s and is expected to expand to 6 EH/s in Q4.

Negative Gross Profits And Bitcoin Mining Viability

BITF’s may have positive gross profits in Q2, but we expect it to be negative in Q3 if BITF continues to mine Bitcoin at the current pace. This is because Bitcoin’s Q2 average price ($35,000) is still higher than BITF’s cost of sales (mining) per BTC ($25,700) in Q2.

- BITF Q2 Cost of mining = $32.292mil

- BITF Q2 Bitcoins mined = 1,257

- BITF Q2 cost of mining per BTC = ~$25,700.

We expect BITF’s Q3 cost of mining to be around $43.2mil or $27,000 per BTC, which is far higher than Bitcoin’s Q3 average price so far ($21,900). Based on BITF’s July and Aug updates, BITF is on track to mine 1,600 Bitcoins in Q3. BITF’s direct cost (electricity and hosting) was $9,900 per BTC in Q2, a 14% QoQ increase from $8,700. We expect BITF’s Q3 direct cost to be slightly above the $10,000 per BTC level which implies a total of $16mil direct cost. Adding in about $2,000 per BTC infrastructure cost and $24mil of depreciation cost, this brings us to $43.2mil or $27,000 per BTC cost of mining in Q3.

Depreciation, Energy, and infrastructure are the core mining cost. What this implies is new entrants (whether personal, private, or public) are not expected to mine Bitcoins profitably for several reasons.

Firstly, the mining cost of new entrants is expected to be higher than existing incumbents. For instance, BITF is a relatively big (although not the biggest) Bitcoin mining company with about 2% share in the entire Bitcoin network. This means this BITF can secure the latest mining rigs, secure power supply, and operate with economic of scale.

Currently, we couldn’t identify any existing publicly-traded Bitcoin mining companies that gross profit-positive in Q3 (Table 1). What more should we expect from new entrants?

Table 1: Q2 Cost of Sales per BTC Mined (Depreciation + Electricity + Infrastructure + Hosting)

Does This Mean BITF Should Stop Mining Altogether?

Not yet. This is because more than half of BITF’s cost of sales is realized upfront (we’re referring to depreciation cost). As long as BITF’s cost of revenue excluding depreciation is lower than the Bitcoin price, BITF should still mine Bitcoin to minimize the loss. BITF’s Q2 cost of mining per BTC excluding depreciation was $12,000 per BTC while Bitcoin is currently trading at $18,500.

Recall our thesis on Bitcoin. We expected Bitcoin to carry out 5 very specific sequences of actions beginning in May 2021. These actions are:

- Reversal pattern -> Double Top [Checked @ Nov 2021]

- 50% decline from peak -> Reach $34k [Checked @ Jan 2022]

- Rebound back to 20% from peak -> Reach $54k [Checked @ September 2021, Missed slightly by 10%]

- Another decline to 70% from peak -> Reach $21k [Checked @ June 2022]

- Bottom out at 85% from peak -> Reach $10.5k

While many defended Bitcoin’s bull case that it’ll never break below its previous bull market high (which is $20,000), we expect and reasoned that it is more probable for Bitcoin to follow through its 5th sequence of events which is to bottom out near the $10,000 price level. We highly recommend that you read for yourself how we came to this conclusion.

Hence, overall, it is more probable for Bitcoin to complete its final leg down to $10,500 than to bottom out above its previous peak at $20,000.

In short, BITF risks halting mining Bitcoin operation altogether should bitcoin really follows through with the 5th event. This is because even electricity/hosting ($12,000) would cost more than mining a Bitcoin ($10,000).

This is why we think that new entrants should just buy Bitcoin instead. By investing in all the PP&E and incurring $21,000 to $25,700 per BTC to mine an $18,500 Bitcoin, new entrants would be losing $2,500 to $7,200 per BTC mined. This is assuming new entrants can achieve the same economies of scale as the publicly traded Bitcoin mining companies.

Verdict: What Does It Take To Get Us Invested?

Despite the pessimistic outlook, BITF (market cap: $200mil) is actually trading well below its $303mil adjusted net asset value ($46mil cash + $229mil PP&E + $104mil deposits + 3,111 BTC x $20,000 Bitcoin reserve value – $138mil Total Liabilities). This could justify some investments into BITF.

For us, the margin of safety we require to invest in BITF is the adjusted net asset value at 50% PP&E and Deposits ($137mi = $46mil cash + $229mil PP&E + $104mil deposits + 3,111 BTC x $20,000 Bitcoin reserve value – $138mil Total Liabilities). We use this model because BITF could be at risk of insolvency should Bitcoin fall below BITF’s $9,900 direct cost per BTC. In such a scenario, the assets we are entitled to are expected to be worth more than our capital loss.

Be the first to comment