SKapl/iStock Editorial via Getty Images

Bitcoin (BTC-USD) fell sharply after the 2022 Bitcoin Miami Conference where over 25,000 Bitcoiners joined together in South Florida to learn more about how the world’s oldest cryptocurrency will change the world forever.

It’s been a tough few months for Bitcoiners ever since BTC reached all-time highs in November 2021. As of lately, Bitcoin has a strong correlation to the stock market and we’ve witnessed a crypto selloff alongside stocks over the past few months.

There are several global headwinds that have contributed to the recent bearish trends including:

- Rising inflation

- Russia-Ukraine War

- Shanghai Covid-19 outbreak

- Higher bold yields

- etc

If you bought Bitcoin during the recent all-time highs then you are probably wondering if BTC will rise to all-time highs again in 2022.

As much as I believe in Bitcoin, I don’t think 2022 will be a positive year for Bitcoiners. Historical trends indicate cryptocurrency will continue selling off to as low as $30,000 (or even lower) based on the current position in the Bitcoin halving cycle.

It’s important to understand that fiat currency is driven by military and politicians while Bitcoin is driven by math. If you understand how the Bitcoin halving cycle works then you accurately determine the best time to buy and sell your coins.

Keenan Mell wrote an excellent article on Bitcoin halving cycle but I want to dig a bit deeper into the specific reasons why Bitcoin will go lower in 2022 and how you can profit from this information.

Understanding the 3 Stages of the Bitcoin Halving Cycle

When Satoshi Nakamoto wrote the Bitcoin code, he wanted to reduce the supply of available Bitcoin over time to increase demand and prevent price dilution in a decentralized manner.

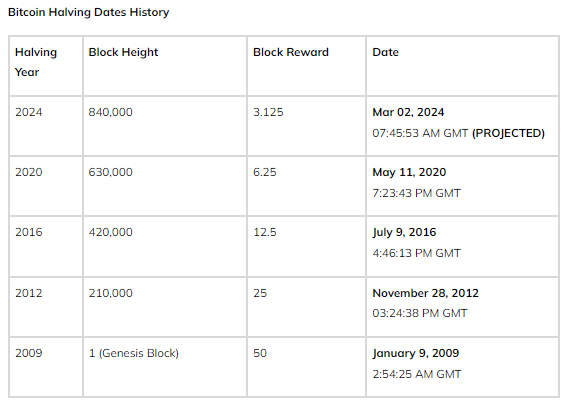

The first Bitcoin genesis block produced a reward of 50 Bitcoins and that number gets cut in half every 4 years (or 210,000 blocks).

Bitcoin Halving History (DeltecBank.com)

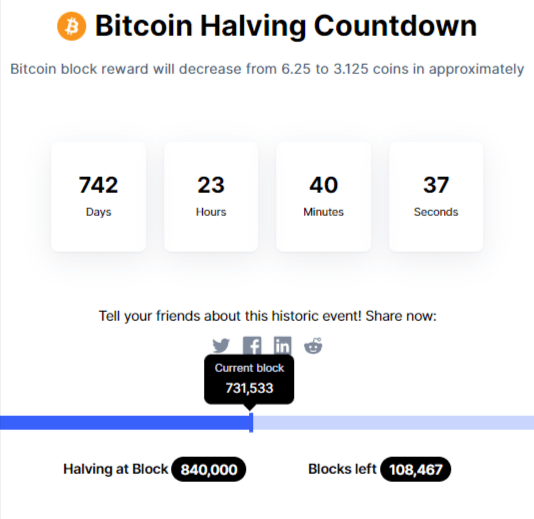

The next halving is scheduled at block height #840,000 or approx. March 2nd, 2024. Right now, the current block reward is 6.25 BTC and we are currently sitting at block #731,533 as of writing this article.

Current Bitcoin Block Number (Coinmarketcap.com)

Bitcoin introduces a new block every 10 minutes but how does this help predict the direction of Bitcoin’s movement?

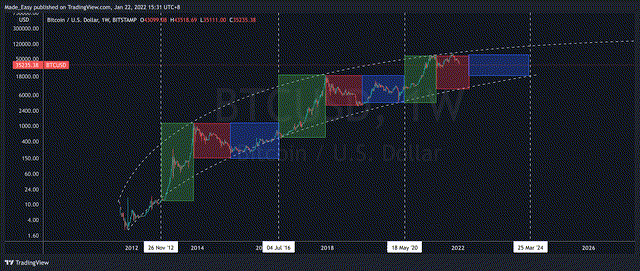

Let’s take a look at the 3 stages of every Bitcoin cycle:

- Bullish uptrend post halving (green area)

- Bearish selloff (red area)

- Accumulation and recovery moving towards the next halving (blue area)

Bitcoin Halving Cycles (SeekingAlpha.com)

The 4th halving started at block #630,000 so we are currently in the bearish trend of the currency Bitcoin cycle. We won’t reach the end of this current stage until Bitcoin reaches the block height of 770,000 or approx. January 11th, 2023.

Bitcoin Could Bottom in Price During January 2023

From a historical standpoint, Bitcoin will continue trending much lower throughout 2022 but could bottom in January of next year.

Other Seeking Alpha authors have backed up this claim but realize most retail investors aren’t aware of the currency cycle. So many people put all of their hopes and dreams into Bitcoin pumping every year but this just isn’t the case.

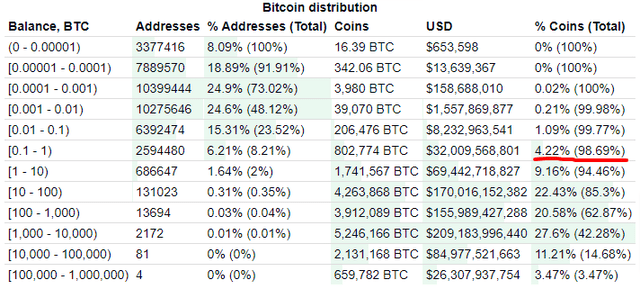

The top 2% of all Bitcoin holders control nearly 95% of the coins and they are able to control price action over the short term.

Bitcoin Rich List (Bitinfocharts.com)

Don’t obsess over the short term but brace yourself mentally for a bigger price drop.

Bitcoin Could Approach Key Support Levels of $30,000

Bitcoin currently trades at around $40,000 but I wouldn’t be surprised if BTC dropped to as low in $30,000 in the next few months. We are currently in the downswing of the cycle plus dealing with mounting global headwinds too.

MicroStrategy (MSTR) holds 129k Bitcoin with an average purchase price of $30,700 per coin, which serves as a huge level of support moving forward.

MicroStrategy CEO Michael Saylor onboarded thousands of institutional investors since 2020 and Wall Street is well aware of his entry price.

The good news is Bitcoin has never dipped lower than its previous high during the preceding cycle. Bitcoin reached $18,000 during the 3rd cycle so we shouldn’t experience a massive 50% selloff according to previous historical data.

$25,000 is a possibility but I expect a lot of smart investors to buy the dip in a hurry. By then, most retail investors will have sold at a loss and only institutional whales will begin accumulation. As much as I want to trade Bitcoin for profits, I still believe in forgetting about the price and holding long term.

Think in Terms of 4-Year Cycles

Bitcoin moves in 4-year cycles so investors should think in terms of “Do I want to hold Bitcoin for at least half a decade or more?”

First off, you avoid paying capital gains taxes (for US investors) if you refrain from selling and just hold. Historically, Bitcoin has soared every 4 years and reached higher highs and higher lows.

Documenting Bitcoin published a powerful tweet that shows just how much Bitcoin can soar if you think in terms of 4-year cycles.

The tweet above shows 3 news articles where Bitcoin dipped below key levels:

- $400 on April 10th, 2014

- $4,000 on November 25th, 2018

- $40,000 on January 10th, 2022

Bitcoin could repeat history again in 2026 and we may news articles about BTC dipping below $400,000. The point is don’t let price action cloud your long-term thinking. Bitcoin is a wonderful store of value that made a lot of investors rich if they simply held and did nothing.

Conclusion

Millions of baby boomers should be preparing for a relaxed retirement but instead are contemplating a return to the workplace in their senior years.

Bitcoin offers Generation X, Millennials, and Generation Z an alternative to relying on the government and our employers as we age.

I fully believe Bitcoin will reach $400,000+ by 2026 and exceed $1 million by 2030 as Bitcoin adoption takes over the globe.

Just owning even a fraction of 1 coin in safe cold storage could provide a substantial nest egg along with your 401k, IRA, and other investments.

We live in a period of hyperinflation and it’s too risky to rely on just the S&P 500 and the government to take care of us in the future.

Do your own research and consider allocating a percentage of your portfolio into Bitcoin as a hedge against fiat currency uncertainty.

You may be frustrated now but will thank yourself later for exhibiting patience and conviction as we move towards a global Bitcoin standard.

Be the first to comment