Md Babul Hosen/iStock via Getty Images

Investment Thesis

Bionano (NASDAQ:BNGO) shares recovered quickly after an earnings miss that sent its shares down 9% last week following Q2 results that showed widening losses despite rising revenue. Shares continued to advance through the week, mirroring meme-traders hype after these dynamics attracted the Reddit crowd as shown in the graph below.

BNGO mentions on Reddit in the 24 hours after Q2 earnings (Apewisdom.com)

This coincided with a press release from BNGO, citing a recently published paper on the use of optical genome mapping “OGM” to diagnose cerebellar ataxia, complementing traditional cytogenetics tests, namely the Southern Blot test. However, I don’t believe that the publication was the driver of last week’s share performance, as reported by some news media, since this is not the first publication nor the best-designed one to highlight the advantages of OGM over Southern Blot. For example, the company cites a similar study in its 2021 annual report.

Each year, around 200 papers are published citing OGM, and by default, Saphyr, the only product utilizing the technology on the market today. OGM has limited literature coverage, offering an attractive exploration ground for researchers wanting to stand out and increase their chances of getting published in academic journals as they build their careers. It is not necessarily a sign of market acceptance, and the good news is that many of these papers praise the device. Still, I believe the recent volatility mirrors market adjustments to information relayed in the Q2 results, as discussed below.

Revenue Trends

Several factors distorted the year-over-year “YoY” revenue comparison this quarter, contributing to the inflated topline growth, which stood at 73%. The most obvious one is the BioDiscovery acquisition, which added 26% to this quarter’s revenue growth. Second, last year’s meme-trade bonanza, which allowed management to raise capital, fundamentally changed its financial position, transforming BNGO from a company on the verge of bankruptcy to a multi-billion unicorn. This transformation carries fundamental changes in operations, including expanding the sales team and, subsequently, sales. It is safe to say that BNGO today is different than it was 12 months ago. This is a paramount distinction, given BNGO’s disruptive investment proposition, promising to introduce a new technology to the market to replace traditional cytogenetic tests. I believe these dynamics contributed to the majority of the YoY revenue growth, inflated by the low revenue base, rather than a momentum that reflects product acceptance.

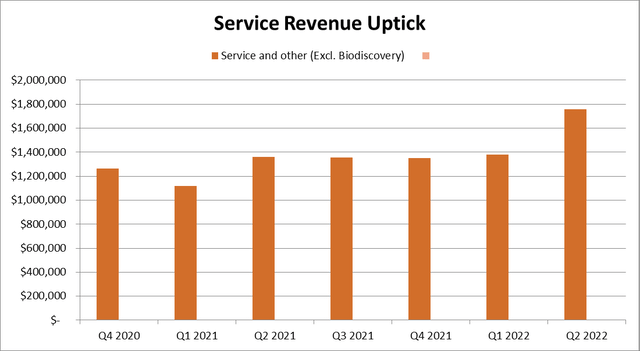

Beyond these dynamics, we see a mixed bag regarding organic performance. We see an uptick in services revenue beyond the BioDiscovery inorganic growth, stemming from increased demand for diagnostic testing. In absolute terms, the change is small, equal to nearly $400,000 QoQ, but it is a break from what can be described as a stable revenue stream, often immune from seasonality, enhancing our confidence in the materiality of the QoQ increase and supporting our conclusion that it mirrors an uptick in activity beyond inorganic factors.

Service revenue, excluding BioDiscovery sales (Author’s estimates based on company filings)

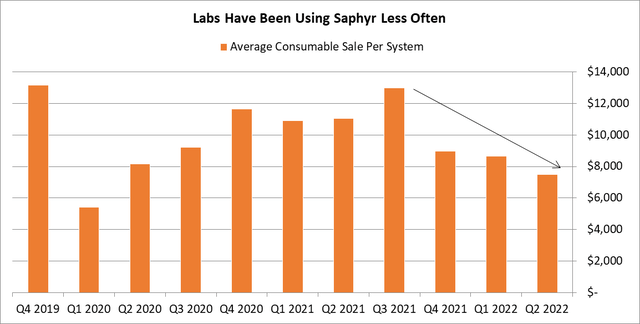

As mentioned above, not all is rosy in the BNGO world. Data show that labs have been using Saphyr less. The decline is more noticeable than appreciation in services revenue, as shown below.

Average consumables revenue per Saphyr installed (BNGO)

First-Mover Disadvantage

As a part of the Securities and Exchange Commission “SEC” IPO approval process in 2018, an attorney for the federal agency asked BNGO’s leadership:

Given your extensive disclosure regarding the attributes and functionality of your product relative to competing products, please explain the reasons for your current level of sales and share of the market in which you compete?

This question remains on the minds of many. BNGO’s organic growth is inflated by a low revenue base in a broad market, making small fluctuations translate to high growth figures, often misleading shareholders about its market position. For example, its service segment’s 28% QoQ organic growth (excluding BioDiscovery) is a mere $400,000 of additional revenue, a small number in the biotech industry where grad student research budgets reach tens of millions in some cases, not to mention the Research and Development “R&D” expenses from commercial biotech companies.

The main obstacle facing BNGO is the biotech industry herd mentality, manifested in a small number of opinion leaders setting the standards, methods, and direction of research. For now, it doesn’t seem that it has been able to penetrate the hearts and minds of this group, and the Golden standards of genome testing in the clinical and research industries haven’t changed. This is primarily due to the lack of adequate literature around OGM and Saphyr, as manifested in the FDA’s decision to turn down the company’s application for Current Procedural Terminology “CPT” codes offered to healthcare providers to streamline reporting and record-making, paving the way for more streamlined insurance reimbursement for clinical labs using Saphyr, which for now, struggle to pass the expenses from patients to insurance companies, hindering BNGO’s sales. The FDA specifically asked for more data on the use of Saphyr.

In response to these challenges, BNGO is investing heavily in four comprehensive clinical trials to compare its device with other cytogenetics methods and hiring leading figures in the biotech sector to supervise the project, thanks to its newly-found riches from last year’s meme-trade bonanza, allowing it to attract management talent who helped organize the project, including PerkinElmer alumni Alka Chaubey. The company also sponsors academic research projects that utilize Saphyr.

These initiatives cost a lot of money. Operating expenses more than doubled compared to last year, and there is much more work left to market Saphyr, creating a first mover disadvantage. First, there is a risk that the company’s efforts will fail, a chance highlighted by its stagnant position in the product introduction stage for almost two decades now. Even if it establishes a market, BNGO lacks a technological moat to benefit from a first-mover advantage. Once a market is developed, it would be easy for its deep-pocketed peers to leverage their platforms to enter the market, including Thermo Fisher Scientific (TMO), Pacific Biosciences (PACB), 10x Genomics (TXG), NanoString (NSTG), Oxford Nanopore (OTCPK:ONTTF), and Illumina (ILMN).

Summary

BNGO’s topline growth comes from a low revenue base; making small changes translate to inflated growth figures and don’t necessarily mirror a market acceptance momentum. The company still faces multiple challenges around creating enough literature for its products, which potentially will help it gain market and regulatory approvals. These challenges are mirrored in the FDA’s decision to turn down the company’s CPT application.

However, from a fundamental perspective, I believe that the company has a solid product that could add value to genome analysis, enjoying a market position placing it favorably to profit from expanding genetic medicines and research market when and if its product gain acceptance from biotech’s opinion leaders.

Be the first to comment