helloabc

It has been a downright brutal stretch for just about all China-domiciled stocks. Many of them peaked well before the S&P 500’s early January all-time high, and even in advance of meme stock mania during the first half of last year. Still, there have been some glimmers of hope among earnings reports from some significant players in that region. Earlier this week, Pinduoduo (PDD) reported a strong quarter, and shares surged. Will the momentum keep up with a Communication Services stock next week?

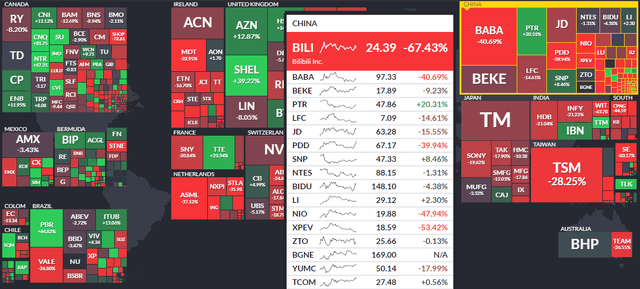

A Chinese Trainwreck YoY

Finviz

According to Bank of America Global Research, Bilibili (NASDAQ:BILI), which originated as an ACG content community in 2009, has evolved into a full-spectrum online entertainment platform with targeted users from Generation Z (those born between 1990 and 2009). Bilibili attracts users with engaging PUGC which combines creative user-generated content and high-quality professionally generated content. The stock is down 67% over the last year.

The Shanghai-based $9.8 billion market cap company in the Entertainment industry within the broader Communication Services sectors has negative earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal. Importantly, ahead of the Q2 earnings date next Thursday before the open, 9.8% of the shares are sold short.

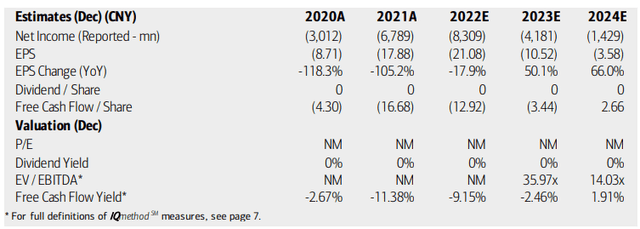

On valuation, BofA analysts see earnings upside despite significant negative EPS this year and looking ahead. Its free cash flow is also solidly in the red. Investors have clearly punished this foreign company as the demand for cash flow generation has been a theme this year. BofA has a very high price objective, north of $50, as the firm diversifies its revenue streams toward live broadcasting outlets. Free cash flow is seen as turning positive in 2024. Overall, though, Seeking Alpha rates BILI’s valuation as a sour D-.

BILI: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

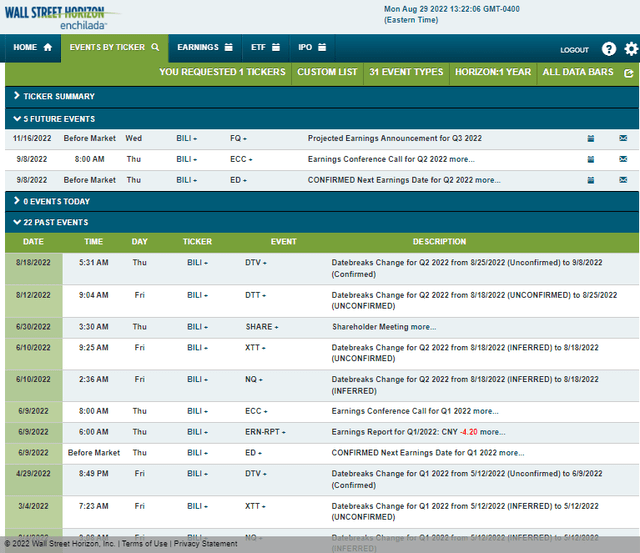

Bilibili’s corporate event calendar shows its Q2 2022 earnings date as Thursday, Sept. 8 (before the open) with a Q4 report projected to be released Wednesday, Nov. 16, according to data from Wall Street Horizon.

Bilibili Corporate Event Calendar: Earnings On Tap

Wall Street Horizon

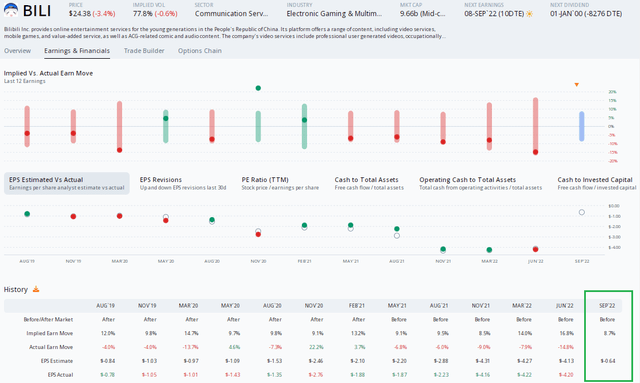

Option Research & Technology Services (ORATS) reports that BILI shares are expected to move just 9% immediately after the earnings release, using the nearest-expiring at-the-money straddle. ORATS also reports that the consensus EPS estimate is $-0.64 which would be a strong improvement from a major EPS loss in the same quarter a year ago. The research firm finally says that there have been three analyst upgrades since the previous earnings release, despite a massive stock price decline in the last 18 months.

Options Angle: A Historically Cheap Straddle?

ORATS

The Technical Take

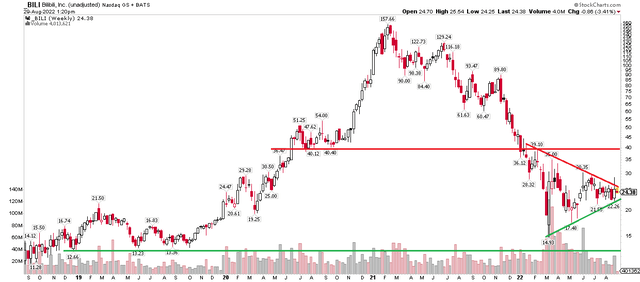

Like so many speculative Chinese tech stocks, BILI shares peaked early last year. The stock fell a whopping 90% from the February 2021 peak to the March 2022 low. Interestingly, the shares bottomed well in advance of the global market’s low in June.

Technicians will quickly notice the symmetry of the current triangle consolidation pattern. Typically, these patterns are merely pauses in the trend of larger degree, implying a move down is in the works. BILI tried to bust through resistance earlier this month, but then dropped back last week toward $25. I’d like to see a weekly settlement above $28 before getting long. There’s also resistance near $40.

On the downside, if we see a weekly close below $22, look for an eventual move toward the $12 to $13 range – the late 2018 to mid-2019 lows. Overall, the trend appears bearish, but we have to wait for a bullish breakout or bearish breakdown. The earnings reaction could be a trend catalyst.

BILI: Support Near $13, Resistance At $40. Symmetrical Triangle In Progress

Stockcharts.com

The Bottom Line

BILI shares are in a consolidation pattern that is thought to often resolve in the broader trend – down in this case. Given the consolidation and relatively small expected earning swing priced in by the options market, I think being long volatility here with a straddle makes sense. Long-term investors should be ready to buy if we see a drop to the $13-$17 range.

Be the first to comment