Drew Angerer

As we look ahead to a potential rebound in the stock market toward the end of the year, I continue to emphasize that stock selection is of the utmost importance. Value is the key element to look for here: within the growth space, there are plenty of high-quality stocks that are trading at a fraction of their former values despite no impact to their business fundamentals over the past year. Lean in on these names and avoid the rest.

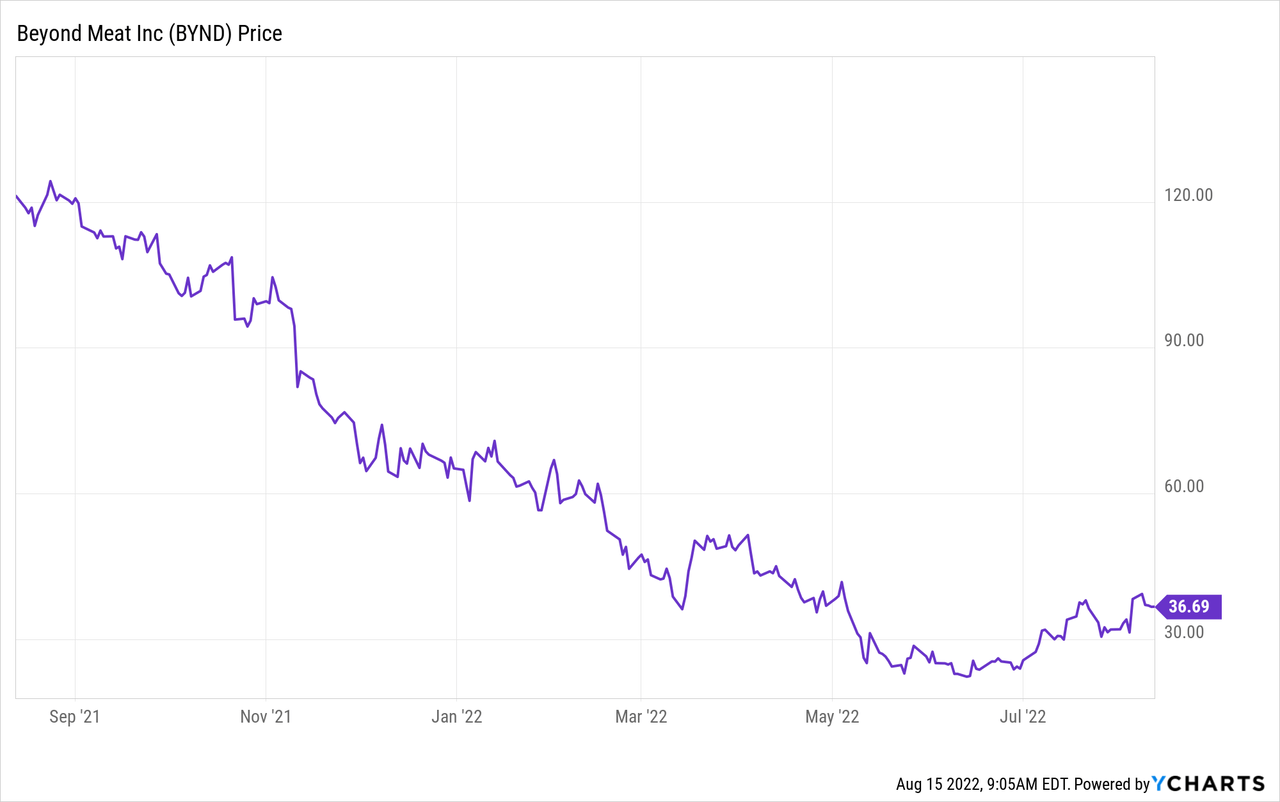

Beyond Meat (NASDAQ:BYND), meanwhile, is an excellent example of a growth stock that thrived based on momentum alone over the past couple of years, but whose correction year-to-date has been a necessary and justifiable reset based on pure fundamentals. Though Beyond Meat has recently rallied above all-time lows and is down only ~40% this year (beating many other growth peers), I think this is a dead-cat bounce that is unlikely to sustain.

I remain very bearish on Beyond Meat and believe further pain is ahead, especially after the company’s recent Q2 earnings release and equally worrying management commentary about the health of its business.

It’s not just Beyond Meat that’s struggling – it seems that the entire plant-based meat category is receding, which underlines my original thesis on Beyond Meat in the first place: that this is just one of a number of passing dietary fads.

Here’s the worrying snippet from CEO Ethan Browne’s prepared remarks on the Q2 earnings call:

The second quarter of 2022 saw a sequential contraction in US household penetration for plant-based meat for the first time in over four years. According to numerated data even as a number of brands and SKUs expanded by roughly 60% and 70%, respectively, over the past two years. As consumers are expressly seeking value, we believe that high inflation in the sector’s premium pricing relative to animal protein is largely, if not fully determining.

Despite intense competitive pricing in the category by existing and new entrants on the one hand, and rising animal protein prices on the other, the category remains a premium one relative to animal meats. As such, it is subject to the same trading down behaviors that one sees during inflationary periods.”

Aside from a crunch in demand, we’re additionally worried about profitability. Beyond Meat actually experienced negative gross margins in Q2, driven by liquidations of inventory and a mark-down of inventory reserves. Given the existing debt on its balance sheet, it’s unclear how much longevity Beyond Meat has left.

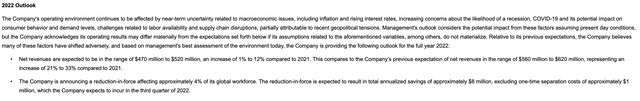

Note as well that Beyond Meat recently guided 2022 far below consensus expectations. Its revenue range for the year is now expected at $470-$520 million, representing a relatively wide growth range of 1-12% y/y growth and substantially below Wall Street’s hope for $561 million.

Beyond Meat outlook (Beyond Meat Q2 earnings release)

All in all, Beyond Meat has an uphill climb ahead of it. There is little incentive, in my view, to stay invested in this name. Continue to steer clear and watch Beyond Meat crumble from a safe distance.

Q2 download

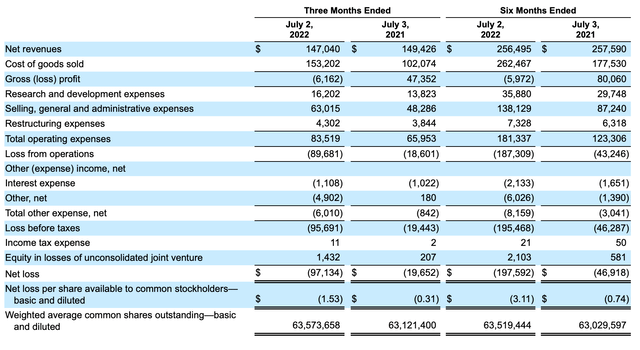

Beyond Meat’s second quarter, which the company released in early August, may be the most concerning quarter in the company’s entire history due to the appearance of negative margins plus management’s aforementioned commentary that the plant-based meat category seems to be receding.

Take a look at the Q2 earnings summary below:

Beyond Meat Q2 results (Beyond Meat Q2 earnings release)

Beyond Meat’s revenue of $147.0 million declined -2% y/y and missed Wall Street’s expectations of $149.1 million (approximately flat y/y). Revenue also continued a multi-quarter trend of deceleration, down versus 1% y/y growth in Q1.

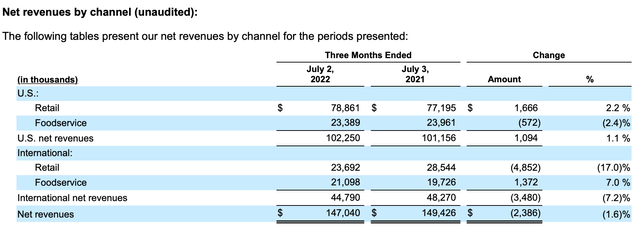

By channel, revenue in the U.S. grew 1% y/y, with slight growth in the retail channel offsetting slight declines in the foodservice (restaurant) channel. The opposite trend was true overseas, where a -17% y/y decline in international retail outweighed 7% y/y growth in international foodservice.

Beyond Meat channel breakdown (Beyond Meat Q2 earnings release)

And of course, the major red flag was negative gross margins, which hit -4.2% in the second quarter. The company attributed this loss to liquidation of old inventory through discount channels as well as an increase in inventory reserves, which together amounted to ten points of gross margin impact. It stressed the fact that it has made manufacturing improvements to boost gross margin – but even if these ten points of unnatural margin headwind from aging inventory were removed, a single-digit gross margin is nothing to brag about either. Beyond Meat just doesn’t have the scale to grow profitably, and with demand headwinds expected to linger alongside inflation, it’s unclear if Beyond Meat can ever achieve this.

Beyond Meat Jerky was another drag on gross margins. The company had hoped that additional product categories would re-spur growth, but instead this new product has only increased to supply chain complexity. The company estimates that the margin impact of the Jerky product was 670bps on the quarter.

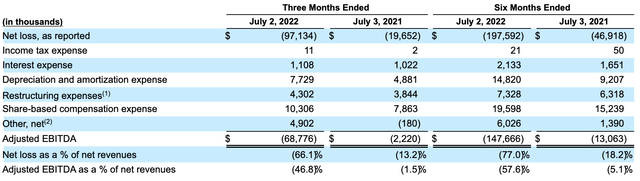

Adding insult to injury, Beyond Meat also grew all components of its operating spend in Q2 year over year. When coupled with the erosion in gross margins, this led to an adjusted EBITDA loss of -$68.8 million, representing a -47% margin – versus a near-breakeven -1.5% margin in the year-ago Q2:

Beyond Meat Q2 adjusted EBITDA (Beyond Meat Q2 earnings release)

In response to sinking profitability, Beyond Meat is slashing roughly 4% of its global workforce. Yet it’s unclear if this will be enough. Note that Beyond Meat already has very little breathing room on its balance sheet, which as of the end of Q2 had $454.7 million of cash against $1.13 billion of debt.

Key takeaways

The red flags for Beyond Meat are numerous: decelerating growth, management commentary on a chill in the plant-based meat industry, sinking margins and a substantial debt pile. I don’t see any turnaround catalysts in the works for Beyond Meat, and its very slight headcount reduction will be no match if plant-based meat sales continue to contract. Continue to stay away from this stock.

Be the first to comment