Klaus Vedfelt/DigitalVision via Getty Images

Investment Thesis

BYND 3Y Stock Price

Beyond Meat (NASDAQ:BYND) has effectively lost -$10.47B of its enterprise value thus far, due to all the unsustainable hype during the pandemic. It is no wonder that the stock has been called a meme trade by certain analysts, due to its lack of moat and profitability thus far. Things are unlikely to improve in the short term as well, given the minimal successes in its food service partnerships and weaker retail demand for premium plant-based products through the worsening macroeconomics. There is no need to hold on to this burning coal through FY2025, when the company is speculatively expected to report a Free Cash Flow (FCF) positive of $40M. Free yourself and your portfolio of this cash burn.

BYND Continues To Burn Through Debt

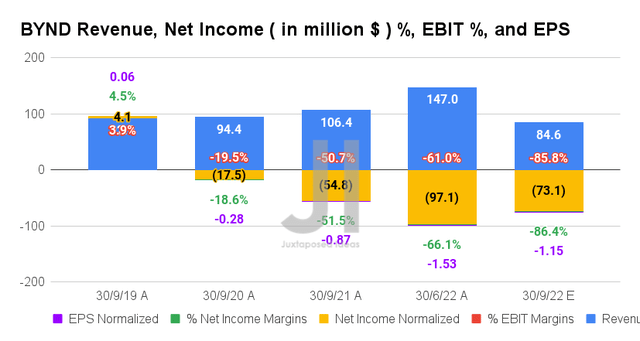

In its upcoming FQ3’22 earnings call, BYND has guided revenues of $82M though the consensus is a little more optimistic with an $84.6M estimate. Nonetheless, with the projected -85.8% in EBIT margins and -86.4% in net income margins for the next quarter, it is apparent that the company continues to suffer from compressed margins, significantly worsened by the rising inflation. By FQ2’22, it reported languishing gross margins of -4.1% against FQ1’22 levels of 0.2%, FQ2’21 levels of 32.1%, and FQ2’19 levels of 33.8%. Combined with the continued cuts in its top and bottom line guidance thus far, we are not sure if there is any floor here, since the company has disappointed through the past three consecutive quarters.

On the other hand, BYND has also embarked on a drastic cost-cutting strategy by planning to lay off 22% of its staff by the end of 2022. Despite the one-time $4M charge, investors may potentially see an excellent reduction in its annual operating expenses by $39M through FY2023. Thereby, speculatively achieving its goal of positive cash from operations by H2’23, compared to FQ2’22 levels of -$85.38M, assuming improved pricing, of course.

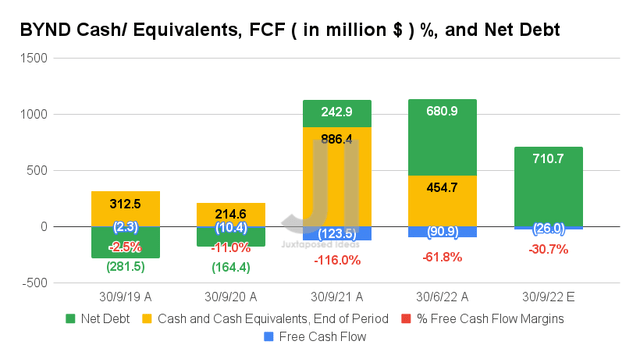

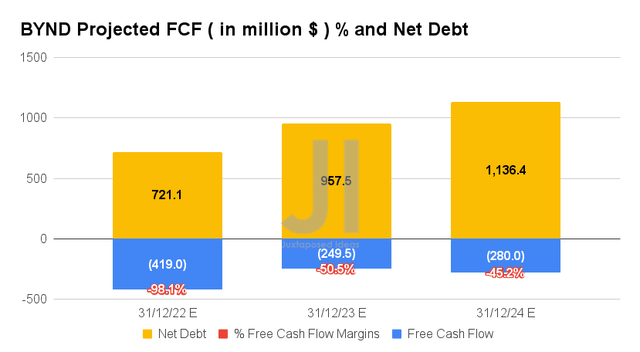

BYND’s balance sheet showed minimal improvement as well, with long-term debt of $1.13B, annual interest expenses of $4.14M, and reduced liquidity of $454.7M by FQ2’22. Furthermore, the company is still expected to report a negative FCF of -$26M and elevated inventory levels of approximately $220M by FQ3’22. The company’s continuous cash burn and lack of profitability thus far, thereby, warrant additional debt leveraging by sometime H1’23. This is not the greatest news in today’s uncertain economic climate with higher interest rates.

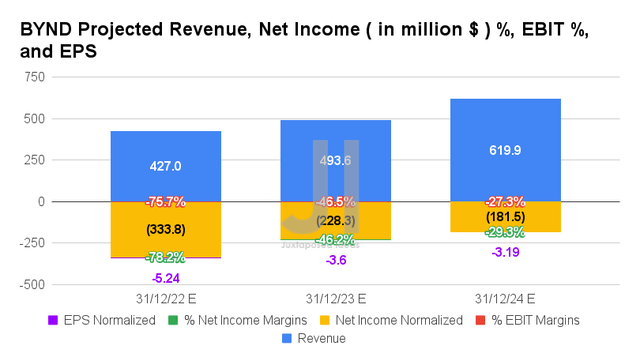

Over the next three years, BYND is also expected to report a tragic deceleration in revenue and net income growth at a CAGR of 10.1% and 0.1%, against hyper-pandemic levels of 24.9% and 387.9%, respectively. It is evident that consensus estimates remain unconvinced about its forward execution, given the top-line downgrade of -44.16% since our previous observation in December 2021.

For FY2022 revenues, BYND has also lowered its guidance twice from $620M to $520M in its previous FQ2’22 earnings call, and again to $425M in October 2022, indicating a tremendous -31.45% reduction from original guidance and -27.74% from original consensus estimates of $588.23M. With analysts projecting FY2022 EPS of -$5.24, representing another drastic YoY decline of -82.57%, it is no wonder that the stock has been free-falling by -64.61% since its FQ2’22 earnings call. Otherwise, a catastrophic -78.56% plunge YTD.

The situation is significantly worsened, since BYND is not expected to report GAAP profitability even by FY2026, with some analysts ambitiously predicting FCF positive of $40M only by FY2025. The company also continued to report elevated Stock-Based Compensation of $32.06M in the last twelve months (LTM), indicating an increase of 10.62% sequentially or 250.27% from FY2019 levels. This has directly triggered more share dilution of 62.66% since its IPO in May 2019, despite the $6.13M spent in share buybacks thus far.

Combined with its aggressive $126.51M of capital expenditure over the LTM, representing a massive increase of 28.34% sequentially, it is apparent that BYND will continue to burn through debts through the difficult recession ahead. Thereby, further reducing the chances of its stock recovery through 2024.

So, Is BYND Stock A Buy, Sell, or Hold?

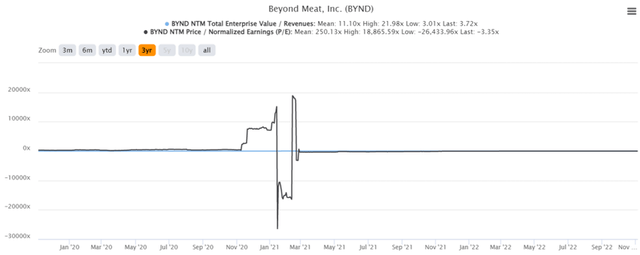

BYND 3Y EV/Revenue and P/E Valuations

BYND is currently trading at an EV/NTM Revenue of 3.72x and NTM P/E of -3.35x, massively compressed against its 3Y mean of 11.10x and 250.13x, respectively. The stock is also trading at $13.91, down -87.02% from its 52 weeks high of $107.20, nearing its 52 weeks low of $11.90. Nonetheless, consensus estimates remain bullish about BYND’s prospects, given their price target of $18.00 and a 29.40% upside from current prices.

However, things will be even more painful moving forward, since the worst of the recession has yet to hit us, with the BYND stock already decimated by -92.57% since hitting the peak at $187.42 in October 2020. With September CPI reporting rising food prices by 0.8% sequentially and 11.2% YoY, it is no wonder that consumers have been tightening their belts and forgoing premium food products thus far. The plant-based product continues to struggle meeting price parity with real meat as well, since its most recent Beyond Meat steak offering costs 16% more than real beef steak tips. That is a massive difference for American households indeed, who are still looking at a massive 19.8% YoY increase in energy bills through the difficult winter ahead.

Combined with its lack of meaningful profitability through FY2026, the BYND stock will likely continue underperforming with minimal catalysts for recovery ahead. Therefore, we rate BYND stock as a sell at the next pop. Investors, recoup your losses and do not look back. This alternative meat product stock is not going anywhere near a green pasture anytime soon.

Be the first to comment