sgame/iStock via Getty Images

In investing, there are different types of leverage. The most common type is leverage on a firm’s balance sheet, that is taking on debt to finance operations of the company. If managed well, said leverage can be used to help enhance profit and returns for the firm and shareholders; if mismanaged, too much leverage can be disastrous.

There is also operational leverage, which is how sensitive a firm’s profitability is to changes in sales. A firm with a high proportion of fixed costs must work very hard to ensure that total sales are in excess of their fixed costs. For firms with low operational leverage, a drop in sales can result in negative profitability if not managed well. A firm with low fixed costs, and variable costs that scale with sales, can maintain some profitability should sales decrease.

There is of course portfolio leverage – taking on margin, or borrowing to purchase securities. Provided the returns of the portfolio are well in excess of the interest costs of the margin/borrowed funds, then portfolio leverage can help “juice” returns. Again, in a market sell-off, this can be a very difficult situation, particularly at time of a margin call.

These forms of leverage have one thing in common, and that is the double-edged sword nature of leverage. Managed well, leverage can do wonders, however under less ideal conditions it can also bite.

The subject of this piece is another form of portfolio leverage which is often overlooked, that has the same benefit/risk profile as the other forms of leverage described above.

Position Sizing – The Unspoken Leverage

Whether you are an indexer or have a portfolio(s) of 30 stocks, then your portfolio contains multiple holdings.

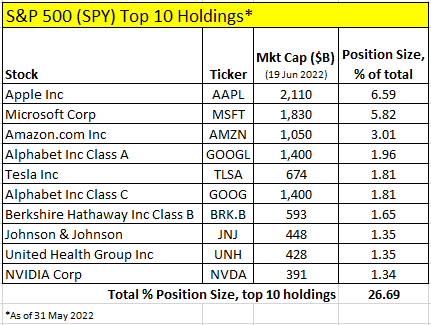

Many index funds are market cap weighted, meaning the size of the positions are scaled based on the market cap of the stocks within. Take the S&P 500 ETF, SPY, which is market cap weighted. The larger the market cap of the stock in the universe, the higher the weight in the portfolio of ~500 stocks. Below is a list of the top 10 holdings of the SPY as of 31 May 2022:

Apple (AAPL) is the largest holding, and is also the largest stock with a market cap of just over $2 trillion. Other holdings follow suit, the largest firms enjoying a corresponding higher weight in the SPY. The top 3 firms, Apple, Microsoft (MSFT) and Amazon (AMZN) make up 15% of the return of the entire SPY of 500 firms. The next 11% are held by 7 firms, ranging from tech to more mature firms: Alphabet (GOOG, GOOGL), Tesla (TSLA), Berkshire Hathaway (BRK.B), Johnson & Johnson (JNJ), UnitedHealth (UNH) and NVIDIA (NVDA).

If positions within SPY were weighted equally, the nominal weight of each stock would be 1/500, or 0.2%. Compare this to Apple, which is roughly 33 times larger than that.

What we have here is what I refer to as “position size leverage”. In the case of SPY, 2% of the holdings (top 10) are responsible for over 26% of the index’ return.

Is this a good or bad thing? Like all forms of leverage, position size leverage cuts both ways. When our top 10 holdings above (most of which are tech) are in favour and outperforming, then this will benefit the overall return of the SPY. When these stocks become out of favour (which we are seeing at time of writing), this high weight will have the opposite, outsized impact on the return.

The ETF RSP covers the S&P 500, but is equally weighted rather than being market cap weighted. As noted above then, each stock has a nominal weight of approximately 0.2%.

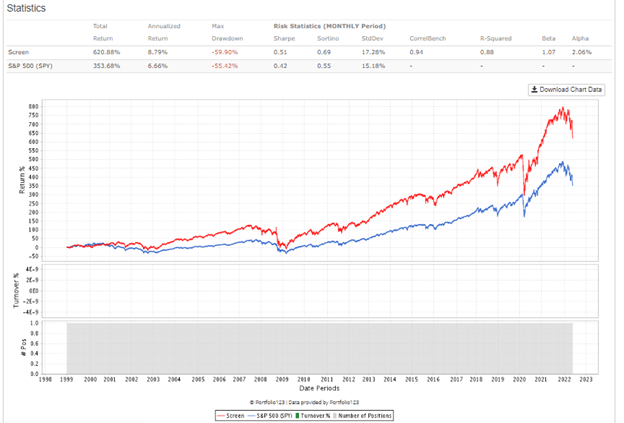

To get an idea of the difference in long term performance of the two, we can compare the two equity curves of both SPY (blue curve) and RSP (red) below:

Portfolio123 data

Since 1999, RSP, the fund with little to no position size leverage has nearly doubled the total return of the SPY. Alpha is positive (2.1%), with higher risk adjusted returns (Sharpe ratio of 0.51 vs. 0.42).

In this simple buy and hold ETF strategy, the portfolio with significantly less position size leverage has come out ahead over the long term. That said, there may be other factors at play here as well, with the RSP holding higher weights of smaller stocks, which over time have outperformed larger cap stocks.

Does this mean that a SPY investor should sell today and buy RSP? No, but rather investors should be aware of how the return of their portfolio is determined, and to better understand the reasons when it is both under and outperforming.

Position Size Leverage – Stock Picking

We can also see a similar impact of position size leverage in smaller stock picking portfolios.

I have often found that it is one thing to think about a particular finance subject in retrospect, but it is a completely different matter to experience it in real-time. For example, reading about past market drawdowns is very different than experiencing a 30% loss to your portfolio in real-time. The same goes for position size leverage. For this reason I’ll discuss an example of position size leverage that I experienced recently.

For my own investing, at any given time I am usually invested in 5 to 7 strategies, each with 18-30 holdings each. All of these strategies are equally weighted by definition; for a 25 stock strategy, then the nominal weight of each holding is 4%.

Over time weights will vary as stocks increase and decrease in value. I rebalance weekly, so as long as the ranking system is effective at predicting winners and losers on average, then positions vary from roughly 2% to 6%. In Portfolio123 for example, you can set the maximum size of positions to control this. In my example, I did not specify any limits to maximum position size, as it has not typically been an issue.

In August of 2021 I purchased RCM Technologies (RCMT), a research and consulting firm. Since then, the stock has returned more than 350%, and peaked even higher before the recent market sell-off (I sold this position recently). The stock continued to be ranked highly, so it was not sold at rebalance for several months. Just before selling, RCMT made up over 18% of the portfolio (4.5x the nominal weight of positions).

In this 25 stock, equally weighted portfolio, each stock has a nominal weighting of 4%. For each 10% of stock return, each holding contributes 4% * 10% = 0.4% of total portfolio return. Vice versa, a -10% stock return results in each stock contributing to -0.4% portfolio return.

A 10% return to RCMT results in 18% weighting * 10% stock return = 1.8% portfolio return, or -1.8% return in the negative stock return scenario. It was these types of price swings that I was experiencing to the overall portfolio.

Having this type of leverage can provide some serious gains to the portfolio, but also introduces volatility and high concentration risk. Were the stock to hit an earnings miss, the impact to the overall portfolio would be significant.

This overweight positioning also has the side effect of limiting sizes of new positions at times of rebalance. The objective of rebalancing is to sell those stocks no longer passing the ranking criteria and buying new stocks that do. While the nominal size of each position is 4%, having a large position limits the room available for new positions. On average, it is these newer, high-ranking stocks that have the potential for the largest gains, so their position size should be such to benefit the portfolio. This touches on the subject of variable weighting, but more on this in a future piece.

To Sum Up

Position size leverage is an often overlooked form of leverage. Like any type of leverage, it is a double-edged sword, providing both benefit and exposing the portfolio to risk, depending on the situation. Because of this double-edged nature, position size leverage can be both a good and bad thing, and therefore should be managed accordingly.

In a future piece we will look at how using variable weighting of positions can benefit portfolios.

Until then, Happy Investing!

Be the first to comment