Galeanu Mihai/iStock via Getty Images

As I pointed out in a previous article, ESG has become a prevailing social movement of our time. An intelligent investor will not let such a secular societal change go un-invested. To that end, I constructed a do-it-yourself ETF that caters to value investors who want to take advantage of the decarbonization movement.

In this piece, I’d like to further examine one of the holdings of the afore-mentioned do-it-yourself ETF, namely, Star Royalties Ltd. (STRR.TSX-V)(OTCQX:STRFF), from an ESG vantage point.

Carbon offset credits

The Paris Agreement was adopted by 196 nations and entered into force in 2016, with the purpose of reducing global greenhouse gas emissions. The Paris Agreement reaffirms the goal to limit global temperature increase to <2°C above pre-industrial levels, with a secondary aggressive target of limiting that increase to 1.5°C.

In order to achieve these levels, various governments have dialed up their commitment to reducing GHG emissions, many having since committed to significantly reducing GHG emissions by 2030 and achieving carbon-neutral by 2050. Canada announced in December 2020 to raise the federal carbon price from the current C$40/ton of carbon dioxide equivalent or CO2e to C$170/tonne CO2e by 2030, through stepwise annual C$15/ton CO2e increments starting in 2023.

Carbon offsets can be generated from the prevention or reduction of carbon emissions (e.g., renewable energies), or carbon sequestration (such as reforestation, or direct carbon capture technology). Carbon offset credits are effectively a measurable net benefit from an activity versus the status quo. Carbon offset credits have a unit measured in tons of CO2e, meaning one carbon offset credit is equal to one ton of CO2e emission reduction.

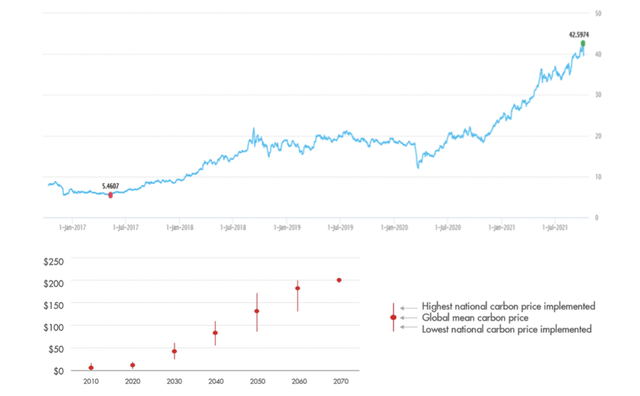

- Since the Paris Agreement, carbon credit prices have taken off and are projected to continue to rise secularly (Fig. 1).

Fig. 1. IHS Markit global carbon index (global weighted-average carbon credit price (upper), and Shell carbon price forecast in various compliance scenarios (lower), both in US$/ton CO2e. (Star Royalties)

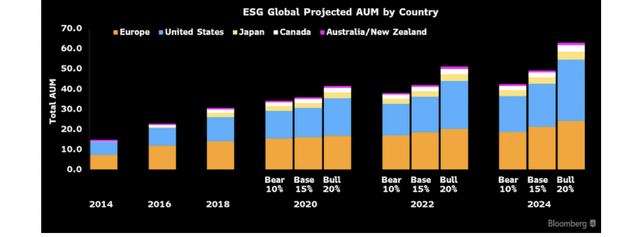

There exists an under-met demand for ESG assets including carbon offset credit. Global ESG assets may surpass $41 trillion by 2022 and $50 trillion by 2025, according to Bloomberg Intelligence (Fig. 2). However, economically-promising ESG investment opportunities are limited. This is where Star Royalties sees a business opportunity.

Fig. 2. The projected AUM of ESG funds by country. (Star Royalties)

Green Star Royalties

Since I first presented Star Royalties, in which I primarily focused on the gold royalty business, the story has gotten better and better especially on the carbon offset credit front. The company reached a series of key milestones and continued to broaden the scope of its green royalty business, as discussed below.

Green Star Royalties founded

On October 18, 2021, Star Royalties created a wholly-owned subsidiary – Green Star Royalties – to pursue pure green initiatives.

As the first mover in originating carbon offset credit royalty in a backdrop of rising carbon credit pricing, Star saw numerous origination opportunities that promise a superior potential return, specifically in bio-sequestration (e.g., improved forest management and regenerative agriculture), renewable energies (solar, wind, geothermal, biomass), biofuels and green technology opportunities (diesel usage displacement), and battery metals investments (copper, nickel, lithium). The start-up of Green Star gives the company the second growth engine.

Forestry

On the founding of Green Star Royalties, Star transferred to Green Star Royalties two existing forest carbon offset credit royalties:

- The 16% gross revenue royalty on AurCrest Gold Inc. (OTC:TBMIF)’s working interest in the carbon offset credits from the Lac Seul Forest Pilot Project in Ontario, Canada (and a right of first refusal on any forest carbon sequestration within the overall Lac Seul Forest Management Unit in Lac Seul First Nation), which is expected to generate ~2,500 attributable carbon offset credits per year under a compliance regime.

- The 13.5% gross revenue royalty on the revenue share from the carbon offset credits from forested lands in Elizabeth Metis Settlement in Alberta, Canada, which is expected to begin to generate ~3,000 attributable carbon offset credits per year under a compliance regime. In January 2022, an additional 27% gross revenue royalty on the same forest project was acquired.

Regenerative agriculture

- Regenerative agriculture aims to benefit farmers and enhance their crop yields by rebuilding soil organic matter and promoting topsoil health regeneration while improving water management, reducing or eliminating nitrogen-based fertilizers, increasing biodiversity, and implementing low tillage and cover crop practices.

- Regenerative agriculture also promises to sequester a significant amount of atmospheric CO2 into soils than would have occurred by utilizing current farming practices.

On December 13, 2021, Star Royalties signed a pioneering agreement with leading carbon offset project originator Blue Source, LLC whereby Star will provide up to C$5 million in cash to finance pilot regenerative agriculture projects managed by Blue Source that use the award-winning microbial soil “probiotic” technology developed by Locus Agricultural Solutions.

- Blue Source and Locus will recruit farmers with cash payment to participate in Locus’ CarbonNOW program until the program has included 320,000 acres of farmland across the Midwestern United Sates. The pilot project is for a term of 11.5 years.

- Blue Source will generate verified carbon offset credits by quantifying the amount of carbon sequestered into the farmlands. Farmers will not only benefit from improved crop yields and reduced operating costs but also stand to split the revenue from monetized carbon offset credits with Blue Source and Green Star Royalties. The program is expected to generate revenues from >500,000 carbon offset credits per year under a voluntary regime starting in 2023, of which Green Star Royalties is supposed to get a net amount of ~100,000 carbon offset credits annually.

The above program was subsequently expanded to 1.32 million acres of farmland, with first carbon credits expected from the 2023 growing season. The enlarged program is expected to generate >2 million carbon offset credits per year on average over a term of 11.5 years, or 400,000 carbon offset credits per year net to Green Star. The four-fold expansion of the program demonstrates the exceptional scalability potential of regenerative agriculture, considering there are 896.6 million acres of prospective farmland in North America.

- Green Star will invest up to C$20.6 million in cash, including C$5 million in 2022 and the remainder in 2023. Green Star expects to generate cash flow equivalent to >200,000 attributable carbon offset credits in 2024, and increasing to >400,000 attributable carbon offset credits per year beginning in 2025.

Off-grid diesel displacement

MOBISMART Mobile Off-Grid Power & Storage Inc. develops mobile and portable solar power generators that can be easily deployed to off-grid construction, mining, military, natural disaster, and telecom tower sites. Such trailerized and containerized power generation and battery storage solutions reduce the need for traditional diesel power generation and ensuing CO2 emission, which is why it is a rapidly growing niche.

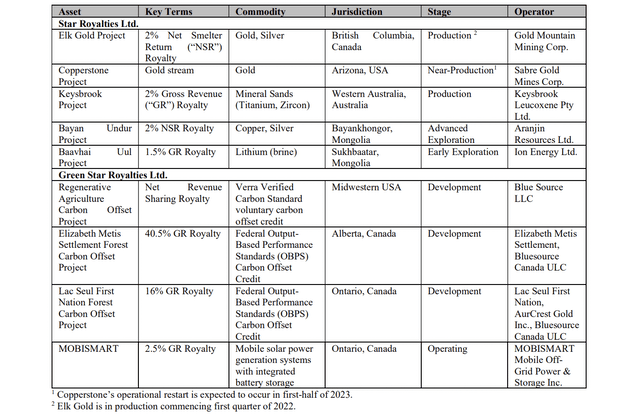

On January 27, 2022, Green Star Royalties signed a definitive agreement to purchase for C$300,000 in cash a 2.5% gross revenue royalty on all current and future gross revenues and any potential business divestment revenues generated by MOBISMART (Table 1).

- The royalty has a 15-year term, with the first royalty payment to occur no later than January 2023. MOBISMART may buy back the royalty for C$10 million in cash or partially on a pro rata basis on its IPO.

Table 1. A summary of assets of Star Royalties. (Star Royalties)

Agnico JV

The pioneering work Green Star did in originating carbon credit royalties went under-appreciated until March 31, 2022, when it was learned that senior gold producer Agnico Eagle Mines Ltd. (AEM), a US$30 billion company, invested C$14.13 million in Green Star Royalties. Upon the announcement of Agnico’s strategic investment, the share price of Star Royalties surged some 38%, speaking volumes for the significance of the transaction (Fig. 3).

- Agnico paid purchase of 14,134,620 Green Star share at C$1.00 per share, while the management and directors bought 1,250,000 shares (3.1%), thus giving Agnico a 35% shareholding and certain rights to co-invest alongside Green Star.

Fig. 3. Stock chart of Star Royalties, in relation to the strategic investment of Agnico. (Modified after Barchart)

Upside and risk

Although Star Royalties has gone up a lot since I first presented the idea in a Seeking Alpha article, I believe we ain’t seen nothing yet.

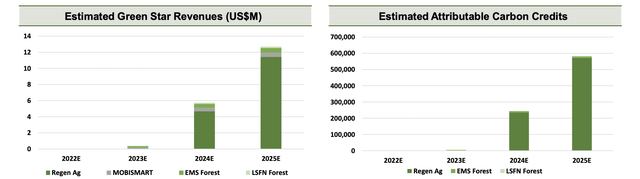

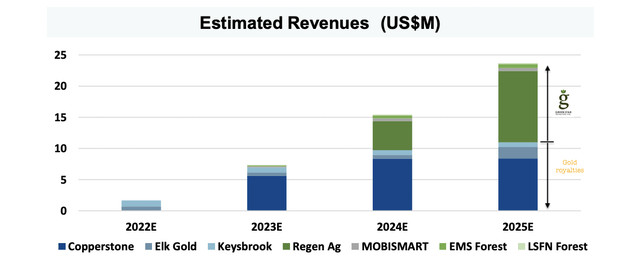

From the above-discussed green royalty projects, Green Star Royalties anticipates its attributable carbon credits to grow from nil in 2022 to 570,000 carbon credits per year by 2025, generating >US$12 million of annual revenue (Fig. 4). By 2025, Green Star Royalties will contribute as much gross revenue as the gold royalty assets (Fig. 5).

Fig. 4. The estimated attributable carbon credits (right) and projected green star revenues in US$ million (left). (Green Star Royalties)

Fig. 5. Projected revenue of Star Royalties, including gross revenue from Green Star Royalties. (Modified from Star Royalties)

- Judging from the most conservative P/Revenue multiple captured by comparable junior royalty stocks (7.9X to 91.0X), Green Star Royalties may grab a market cap of at least US$95 million by 2025 if it becomes a publicly-listed company, or US$58.8 million net to Star Royalties’ 61.9% stake. Adding the value of the gold royalties, Star Royalties is poised to capture at least US$152 million in market cap by 2025. Assuming a P/Revenue multiple of higher than 7.9X, i.e., with rerating factored in, Star Royalties may be worth significantly more than US$152 million.

- Today, Star Royalties has a market cap of US$60.9 million on a fully-diluted basis, in which the market is clearly yet to give credit to Star Royalties’ 61.9% ownership of Green Star Royalties that is valued at C$25 million (or US$19.8 million) by Agnico, C$14.13 of cash proceeds to be received from Agnico, and C$4.2 million of cash on Star’s balance sheet. Star Royalties is thus deeply undervalued and it may potentially deliver a 7-bagger in the next 3 years if the projected revenue growth materializes.

The afore-mentioned upside comes with a slew of risks. Even though decarbonization seems to have become a secular trend, the pace of energy transition is uncertain. The ongoing energy crisis may have an impact on project execution at, as well as the eventual spin-off and IPO of, Green Star Royalties. The anticipated progress of both the gold royalty and green royalty projects is beyond the control of Star Royalties management; each of those projects may be postponed or even cancelled, although that is quite unlikely considering the momentum of the decarbonization movement.

The management team strikes me as technically resourceful and shareholder-friendly. CIO Kevin MacLean is a natural resource fund manager who had won some 13 Lipper awards for best risk-adjusted returns in the gold mining sector and seven Brendan Wood International Top Gun awards in the gold mining sector. MacLean chose to be paid in options, to conserve cash and better align his personal interest with that of retail investors. The management and board holds 7.5% of the shares, giving them skin in the game.

- Star Royalties trades on TSX-V with adequate liquidity. However, the stock does not trade on a major U.S. exchange, and it trades on OTCQX with limited liquidity. Investors need to be aware of the risks associated with investing in small-cap natural resource stocks, which I discussed elsewhere.

Investor takeaways

Star Royalties distinguishes itself with its pioneering initiatives in carbon credit royalty origination. Its business model has received strong endorsement from senior gold producer Agnico, which just became a strategic investor in Green Star Royalties. I believe Star Royalties is the best stock for ESG investors who are in the game for capital appreciation and have a >3-year time horizon.

Star Royalties by itself is a solid investment idea because it checks all critical boxes. It is projected to post explosive growth in revenue in the next three years, from both its green royalty projects and gold royalty assets. As with other royalty stocks, Star Royalties is supposed to be a high-margin, inflation-resistant business, which is ideal for the current investment environment. Importantly, the stock is deeply undervalued relative to its forecast revenue.

Be the first to comment