tortoon

YCharts

Best Ideas

Each year, I highlight one top position as a best idea for the subsequent year. This year, the idea has been Renren (NYSE:RENN), one of my top three holdings. How do I pick? I look for three things: Something safe, lucrative, and uncorrelated with the overall markets.

Bottoms up!

I look for ways to make money in any market – up, down or sideways. Macro prognosticators are far greater in quantity than quality.

What I don’t do: Macro

I stay out of the whole discussion of which way the stock market will go. I have no idea. I doubt many of the people who make bold macro calls get it right a statistically significant percentage of the time.

What I do: Events

Instead I focus on discreet corporate events that unlock shareholder value and do detailed firm-level analysis to find and exploit them to make money in any market. What kind of events? Mostly litigation, M&A, and in particular merger securities (which overlaps quite a bit with litigation).

What are we really doing here?

Counterparty selection. Avoiding being the patsy. Narrowing down who you’re competing against due to narrow mandates and complexity.

Renren

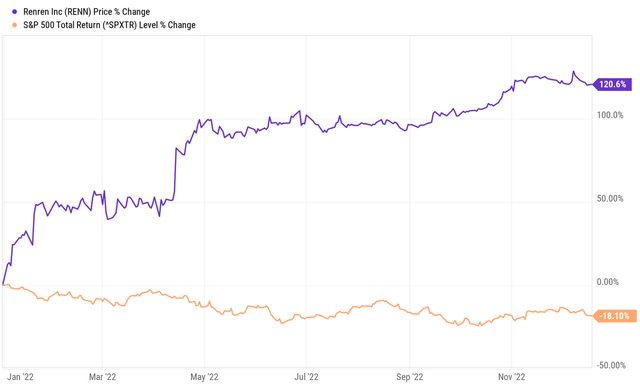

My best idea for 2022 was Renren. The year is not yet out but with the S&P 500 down 18%, RENN is up over 120% year to date. It started the year under $15. It will end the year with a $31.62 cash distribution. This was the result of a complex litigation that I was intimately involved with for a long time. It was safe, lucrative, and had absolutely nothing whatsoever to do with what the overall stock market did – it just happened to be publicly traded. When first presented, I estimated the probability of its upside scenario at 90%, now that’s 100%. Excluding the cash distribution, I estimated that equity stub would be worth at least $1 and maybe as much as $4. Today, it costs under $1. It’s exactly what I look for when sizing a top position and picking an annual idea.

Spectrum

As I approach the decision on what to name my best idea for 2023, I’m looking for another case that will be safe, lucrative, and uncorrelated with the stock market. One candidate is Spectrum Brands (SPB). It finished this past quarter under $40 per share, has recovered a bit but still trades for under $60 and is worth over $80. The kicker, as with Renren, is litigation. The US Department of Justice sued to block a transformative asset sale that would pay SPB in cash more than their entire market cap. It’s a great deal but the current administration is quite wary of deals and claims this would be monopolistic. My view is that the case is weak, especially after the companies named a strong buyer for the entire overlapping product lines. The deal will probably get done by the middle of next year, which could catapult SPB shares regardless of what the rest of the market is doing.

Antitrust

I blurted out two edgy, actionable ideas – a favorite recent one and upcoming one. But now let me back up to discuss M&A heading into 2023 more generally. This category is a great solution for capital if you don’t know what the market is going to do next. But the solution has a few problems worth highlighting.

First the aforementioned antitrust agencies: They’re particularly hostile at the moment and will bring a lot of suits to block deals, especially customer-facing deals in tech or healthcare. I like cases such as SPB that are already in front of a judge. The FTC and DoJ can bring cases, but they have to make their case. I prefer to avoid getting hit with the stock price reaction to such suits and then load up when the government brings dumb ones likely to lose.

Financing

A second problem: The credit market for deal financing is quite weak. If buyers need to raise a lot of debt from banks for their deals, those deals are not likely to get done. While antitrust has been making life hard for strategic deals, the credit market has been making life particularly hard for private equity’s leveraged buyouts. In fact one of the best places in the market for short ideas in 2022 has been in speculated takeover candidates. Many of these made it into the press without making it to definitive merger agreements. So I like M&A but I’m wary of both antitrust risk and financing risk – what kind of deal does that leave me? Looking back at 2022, that left me Twitter, my biggest and best risk arbitrage position ever.

Activision

Looking forward, here are some of the opportunities. Microsoft (MSFT) is buying Activision (ATVI) in a deal that the FTC is trying to block on dubious antitrust grounds. They can delay it and even interfere enough to stop it, especially if they get an assist from foreign regulators such as the UK’s CMA. But the deal price is $95, as of this writing the shares cost about $77 and they aren’t worth all that much less than they cost even without the deal. So this was not worth it before the antitrust problems were fully priced in but is increasingly interesting since then. This may be one of the best definitive merger arbs at the moment, so is another I have my eye on.

Amplify

In terms of deal financing, eventually the credit market will stabilize. It doesn’t even need to strengthen as much as just settle down so participants know where to price debt. That’s why I’m focusing on situations for 2023 that need a few more months anyways. One in particular is Amplify Energy (AMPY). It costs about $7 per share and is worth at least twice that. The value is likely to be unlocked well before the end of next year. First, they have a damaged pipeline that needs fixing. Then, they have commodity hedges that can be rolled off. They will be able to use the repaired pipe for the cash flow necessary to completely deleverage their balance sheet. At which point, this wildly undervalued and undersized oil and gas company will be a layup of a sale candidate to a larger strategic buyer. This is safe, lucrative, uncorrelated, and likely to be a one-decision investment from here. If you can buy any under $10 per share, you will probably get a significant premium to that price in a sale. Ideally, the timing could work out so that it closes late enough in 2023 to get long-term tax treatment on what could be a monster gain. This is my biggest and favorite position at the moment (a best idea candidate, but it’s volatile, so no decision until closer to Year End so I can see the starting price).

Abiomed

This one will actually be over (in terms of the window for taking advantage of it) by month end. It’s a merger security that avoids any antitrust or financing risk. You could lose a little over a dollar (depending on the specific price you get) or make over $33. Johnson & Johnson (JNJ) is buying Abiomed (ABMD). It has already secured all regulatory approvals including the US, Germany, Austria, and Japan. Then by the end of this week they will tender for shares and send you $380 in cash per share, returning approximately your entire cost basis. That leaves you with, at worst, a tie. Then what? Then you get a non-tradable contingent value right worth up to $35. Sometimes these pay out, sometimes they don’t, and often they settle years later when holders sue the issuers over their treatment. You’re paying just over a dollar (I paid less than nothing) for a ticket that could settle or payout many times that. Details from the offer:

Each CVR represents a non-tradable contractual contingent right to receive the following cash payments, in each case without interest and less any applicable tax withholding (the “Milestone Payments”) if the following milestones (the “Milestones”) are achieved:

• $10.00 per CVR, payable upon earliest to occur of the following (the “Clinical Recommendation Milestone”):

• results from the STEMI DTU study undertaken by the Company contribute to the publication of a Class I recommendation in the Clinical Practice Guideline (as defined in the Merger Agreement) recommending the use of any device in the Impella Product Family (as defined in the CVR Agreement) in patients presenting with ST-Segment Elevation Myocardial Infarction (“STEMI”) or Anterior STEMI, without cardiogenic shock, if such milestone is achieved prior to the earlier of (i) four years following the publication of results relating to the secondary clinical endpoint in the STEMI DTU study and (II) December 31, 2029 (the “STEMI Recommendation Milestone”);

• results from the PROTECT IV study undertaken by the Company contribute to the publication of a Class I recommendation in the Clinical Practice Guideline recommending the use of any device in the Impella Product Family in high-risk patients with complex coronary artery disease and reduced left ventricular function, if such milestone is achieved prior to the earlier of (i) four years following the publication of results relating to the primary clinical endpoints in the PROTECT-IV study and (II) December 31, 2029 (the “HRPCI Milestone”); and

• results from the RECOVER IV study undertaken by the Company contribute to the publication of a Class I/1 recommendation in the Clinical Practice Guideline recommending the use of any device in the Impella Product Family in patients with STEMI-Cardiogenic Shock, if such milestone is achieved prior to the earlier of (i) four years following the publication of results relating to the primary clinical endpoints in the RECOVER-IV study and (II) December 31, 2029 (the “Cardiogenic Shock Milestone”);

• $7.50 per CVR, payable upon the occurrence of approval by the U.S. Food and Drug Administration of a premarket approval application or premarket approval application supplement for the use of any device in the Impella Product Family in patients with STEMI, or Anterior STEMI, without cardiogenic shock (the “FDA Approval Milestone”), if such milestone is achieved prior to January 1, 2028 (the “FDA Approval Milestone”); and

• (i) $17.50 per CVR, payable upon achievement of aggregate worldwide Net Sales (as defined in the CVR Agreement) of $3.7 billion during the period from the first day of Parent’s second fiscal quarter of 2027 through the last day of Parent’s first fiscal quarter of 2028, or (II) if clause (i) is not satisfied, $8.75 per CVR, payable upon achievement of aggregate worldwide Net Sales of $3.7 billion in any four consecutive fiscal quarters during the period from the first day of Parent’s third fiscal quarter of 2027 through the last day of Parent’s first fiscal quarter of 2029 (the “Net Sales Milestone”).

Willis Lease

Willis Lease (WLFC) costs less than $60 and is worth over $100 per share. Management has been uglifying it in preparation for an MBO. They offered $45 and could easily offer $60-70 per share. They will get most of its value. While engines that they buy and lease out actually typically increase in market value early in their lives, they mark them at the lesser of their appraised and depreciated value, so always downward. That leads to a stock trading at a big discount to book value and book that is massively understated.

Why is this a great opportunity just sitting there to be picked up? Public majority owned companies have been good places to look even in this terrible year for takeover candidates. We have exploited many for safe and lucrative investments and this one is our next big priority among minority investments with a majority, following Turquoise Hill (TRQ), Continental, and a basket of publicly traded MLP subsidiaries.

2023

Which one will be my No. 1 pick for 2023? It may be none of the above but will share their most salient characteristics – massively undervalued with a route to getting that value in this next year. It will be a top position and one I first disclose, along with all my best ideas, first on StW. Then, once we get into the New Year, I’ll subsequently release it to the general public.

Conclusion

I don’t know what the market will do in 2023. But I do know that with enough work, you can uncover and understand corporate events that can make you money in any market. Some of my favorites at the moment involve complex litigation and M&A, especially focused on public subsidiaries.

TL; DR

RENN is still a top position. The equity stub could double, triple, or quadruple from here following the imminent cash distribution. Want one last one for December? ABMD. Buy SPB, WLFC, and AMPY for 2023. Have longer to wait? Maybe some ATVI.

Be the first to comment