Paul Morigi

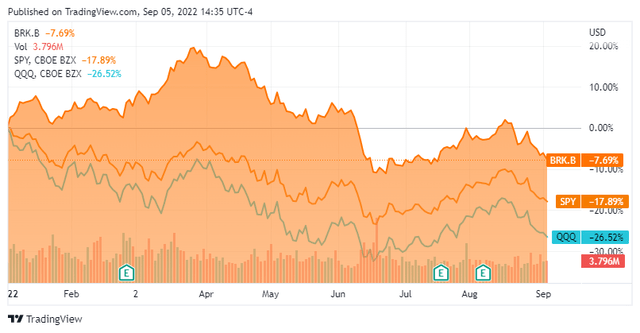

It’s unlikely that there will ever be another Berkshire Hathaway (BRK.A) (NYSE:BRK.B). BRK.B may be the most revered company throughout the investing community as its CEO, Warren Buffett, may go down in history as the most accomplished investor ever. To recreate what the Oracle of Omaha has built is unlikely as it’s not just a holding company with billions of dollars worth of publicly traded stock on its balance sheet, but BRK.B outright owns dozens of companies that make up its business operations, including Geico, Duracell, and Dairy Queen. In March of 2022, BRK.B topped out around $362.10 per share and has fallen -23.32% ($84.43) to $277.67. While BRK.B has fallen over 20% since its 2022 high, it’s currently outperforming the major indices in 2022. BRK.B has handled market volatility, and uncertainty much better than the indexes as the SPDR S&P 500 Trust (SPY) has declined -17.89% YTD, while the Nasdaq has declined -26.52% YTD compared to BRK.B, declining -7.69%. I will examine BRK.B’s latest 13F filing and financials to determine if there could be a long-term opportunity to add BRK.B near its 52-week lows.

Examining and recreating Berkshire’s latest 13F filing

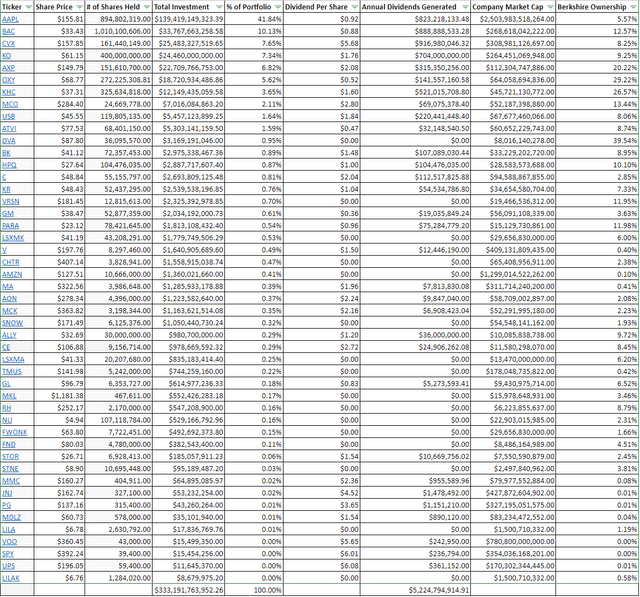

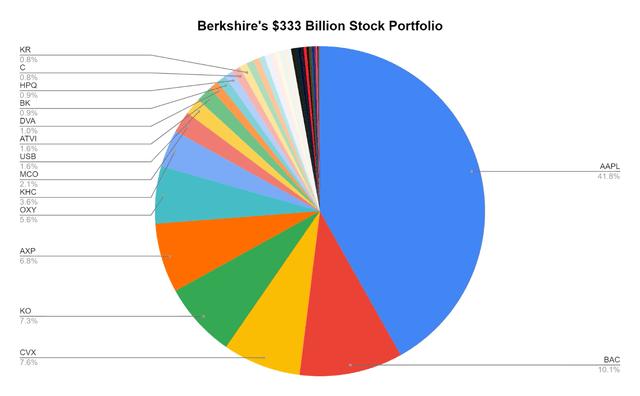

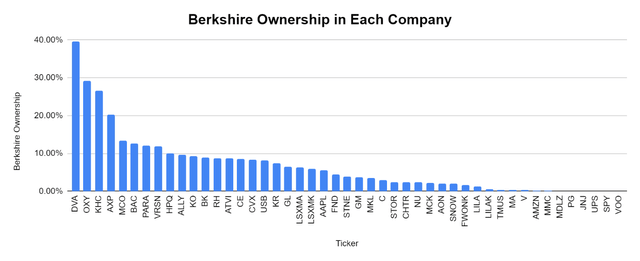

What BRK.B has amassed within its holdings is truly amazing. After looking through its latest 13F filing, BRK.B has 47 different public investments worth $333.19 billion. I will recreate the 13F filing, and examine BRK.B’s largest holdings, how much dividend it generates, and how much of each company BRK.B owns.

Above is my recreation of BRK’B’s investment portfolio. In my table, I have outlined the following data points:

- How many shares of each investment are held

- Total value of the investment

- % of BRK.B’s portfolio the position represents

- The dividend that each position pays

- BRK.B’s annual dividend income per position

- Each company’s market cap or ETF’s total assets

- BRK.B’s total ownership of each asset

After reviewing BRK.B’s holdings, its portfolio is certainly interesting. BRK.N has 47 individual investments, with Apple (AAPL) being its largest holding. BRK.B owns 894.8 million shares of AAPL with a total investment value of $139.42 million. BRK.B owns 5.57% of AAPL. While owning 12.57% of Bank of America (BAC), 8.25% of Chevron (CVX), 29.22% of Occidental Petroleum (OXY), 26.57% of Kraft Heinz Company (KHC), and 9.25% of The Coca-Cola Company (KO).

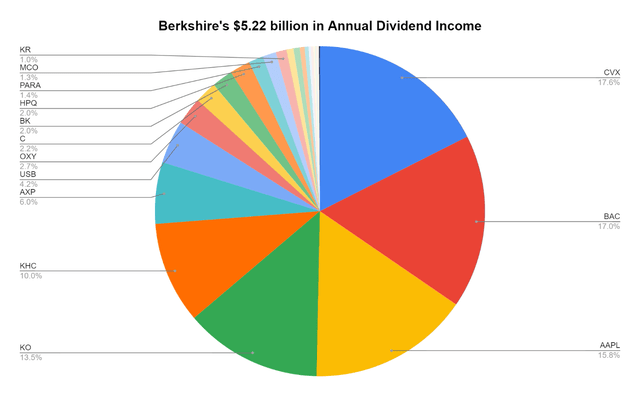

Of BRK.B’s investments, 31 positions pay dividends. Before BRK.B’s actual operating businesses generate a single dollar of revenue, the 31 dividend-paying positions in BRK.B’s portfolio are projected to generate $5.22 billion in annual dividend income. BRK.B’s position in CVX is projected to generate $916.98 million in annual income, while BAC generates $888.88 million, AAPL generates $823.22 million, and KO generates $704 million in dividend income. These 4 companies alone generate $3.33 billion of projected annual income for BRK.B. Many investors believe BRK.B is the ultimate hybrid company due to a large amount of dividend income its holdings produce. BRK.B can continue to reinvest these dividends and organically increase its future cash flow or can take the dividends as cash and allocate that capital toward acquiring new operating businesses or making new investments.

Steven Fiorillo, Seeking Alpha, Whale Wisdom

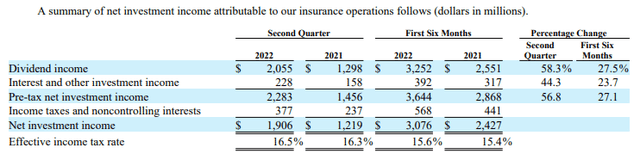

BRK.B’s Q2 report shows that in the 1st half of 2022, BRK.B has generated $3.25 billion in dividend income, which is an increase of 27.5% YoY. In Q2 alone, BRK.B increased its dividend income by 58.3% YoY. To think that BRK.B generates this level of income from its passive investments is a bullish factor. Many companies don’t generate $5 billion in net income annually, let alone from their invested capital.

Berkshire’s financials and operating metrics

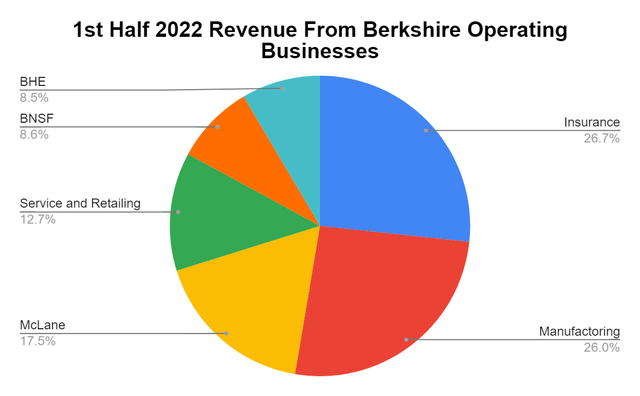

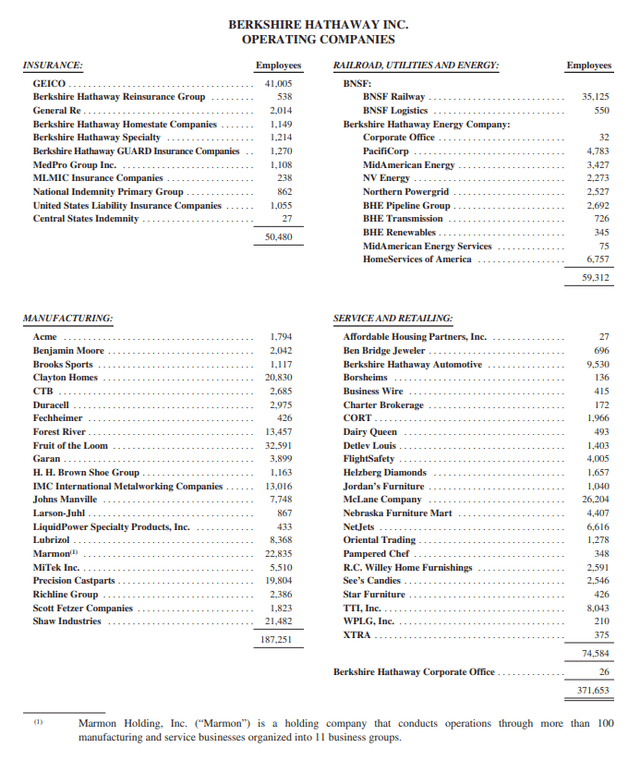

BRK.B is made up of 6 operating businesses on its consolidated financial statements, which include insurance, BNSF, BHE, manufacturing, McLane, and service & retailing. For anyone interested, BRK.B’s annual report can be found here, and its operating companies are toward the end on page A-6. Looking through BRK.B’s operating companies, many people would probably be surprised that GEICO, Acme, Benjamin Moore, Duracell, Dairy Queen, Helzberg Diamonds, NetJets, and See’s Candies are owned by BRK.B.

From an operational standpoint, BRK.B has generated $289.37 billion in revenue in the TTM. BRK.B has generated $35.22 billion in cash from operations which have led to $20.78 billion of FCF. BRK.B has produced $26.52 billion of EBITDA and $11.7 billion of net income in the TTM in the TTM. BRK.B is on pace to have its largest revenue-producing year in 2022. Compared to 2021, BRK.B has produced an additional $13.28 billion (4.8%) of revenue in the TTM. Looking at the 1st half of 2022, BRK.B has produced an additional $13.28 billion (9.93%) of revenue from this period in 2021. From an Earnings Before Income Taxes (EBIT) perspective, BRK.B has produced an additional $1.16 billion YoY.

Steven Fiorillo, Berkshire Hathaway

BRK.B has a fortress of a balance sheet with $105.41 billion in cash and short-term investments, equivalent to 17.22% of its current market cap. BRK.B has $461.21 billion in total equity on its balance sheet. Under long-term liabilities, BRK.B has $116.84 billion in long-term debt, and $0 of this is due in 2022. BRK.B has not diluted shareholders, as there are 1.5 million shares outstanding, which is down from 1.6 million in 2019.

BRK.B has a forward P/E of 19.36 as the street estimates that BRK.B will generate $14.34 in EPS for 2022 and $15.57 in 2023. The street is also projecting that BRK.B will generate $335.27 billion in revenue for 2023, up from its revenue projections of $269.04 billion. The market has placed a 29.45x multiple on BRK.B’s FCF, a P/S ratio of 2.14, and a forward P/E of 19.36. The question is are shares of BRK.B undervalued at these levels? It’s hard to say that BRK.B is overvalued as it has a history of generating profits hand over fist, with tens of billions being produced annually of FCF. I believe a better entry point could be on the horizon, and would be much more interested in a $519.5 billion market cap as this would put its price to FCF at 25x. BRK.B’s market cap would need to decline by $92.52 billion or 15.12% for this to occur. For as operationally proficient as BRK.B is, it’s hard for me to justify paying a larger FCF multiple for BRK.B than I would for AAPL, and AAPL has an FCF multiple of 23.28x ($2.5T / $107.58B).

Conclusion

BRK.B is one of the most interesting companies in the market as its allure is unlike any other company I can think of. Countless books have been written about Warren Buffett’s investing accomplishments and style, and we may not see another investor rise to his level of prominence. BRK.B is one of the most impressive companies as it is working on breaking $300 billion of annual revenue; it produces tens of billions in FCF, has over $100 billion in cash on its balance sheet, and is projected to generate over $5 billion in dividend income throughout 2022. I think BRK.B is a great long-term investment and could look attractive at these levels. I am waiting to see if I can reenter this position at a lower valuation. If you own BRK.B, I have the same philosophy as owning AAPL, just buy it and hold it. Depending on how BRK.B utilizes its cash, I don’t see it having the same growth potential as AAPL, so I am waiting for a lower price to FCF valuation before pulling the trigger.

Be the first to comment