Stanislav Ostranitsa/iStock via Getty Images

Introduction to Benson Hill

Benson Hill (NYSE:BHIL) is a difficult company to understand at first glance. While from some angles, the company is a plant-based products distributor, which is not very interesting. From other angles, the company is an AI and Cloud-based plant analytics platform that uses gene-editing and big data to optimize the agriculture industry, and this is far more interesting. While the company is certainly leveraging the hype around plant-based products such as soy protein and feedstock. As a fairly new company that only IPO-ed in September 2021, I believe there is still time to determine the long-term viability of the company prior to investing. However, as I discuss in this article, the company certainly has many interesting qualities to consider.

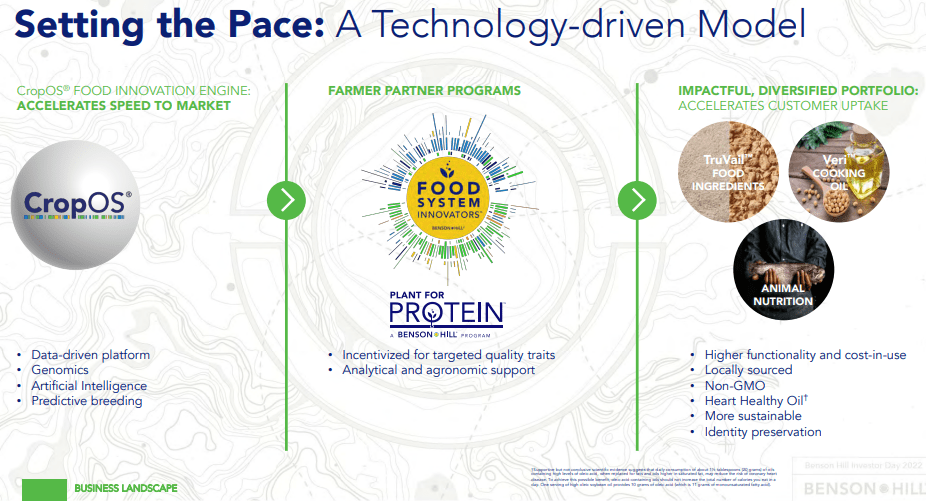

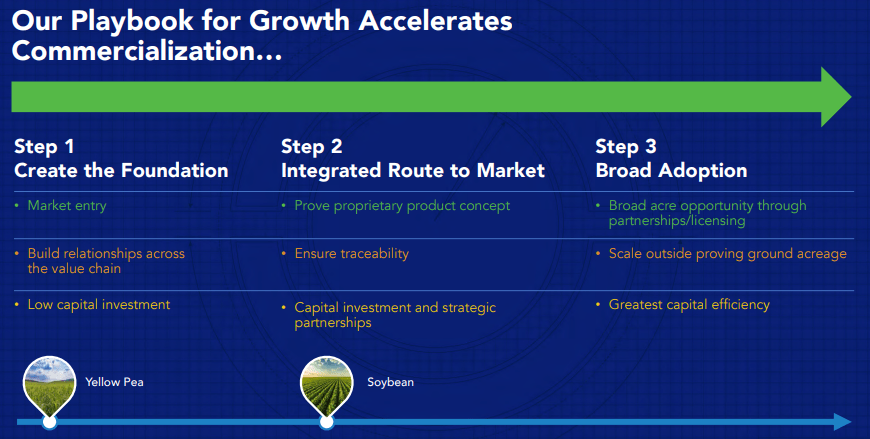

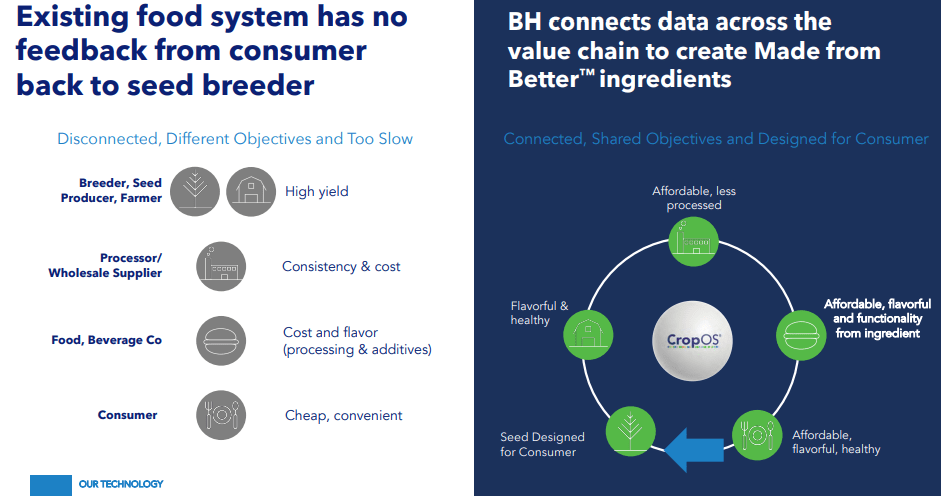

To start, I will introduce Benson Hill’s unique platform. Firstly, the company is looking to integrate the entire food industry onto a single platform to drive data-driven product development. This relates to three main data points: customer enjoyment or preference, production efficiency, and plant optimization. The customer analytics include leveraging the demand for healthier food options, but of a quality that could compete with legacy options. This may include plant-based meat, soy protein, or soybean oil. At this stage, soybeans are the main agricultural staple that BHIL is basing their work on. All the data that is accumulated is able to drive development of new plant strains through either breeding or gene editing practices. Essentially, Benson Hill looks to establish a positive feedback loop across the entire industry to have a competitive advantage over other producers.

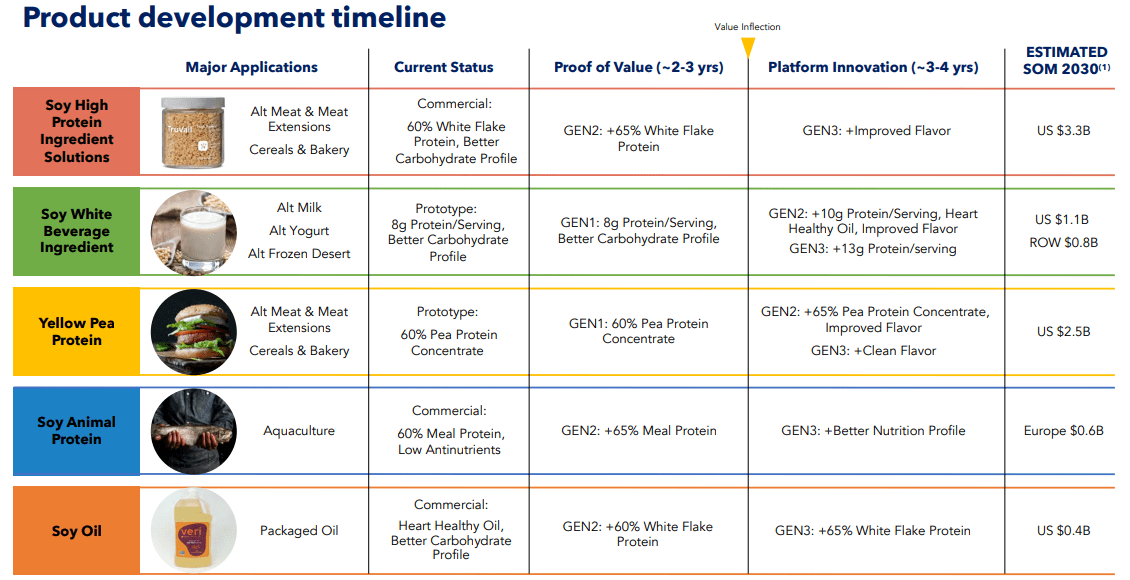

BHIL

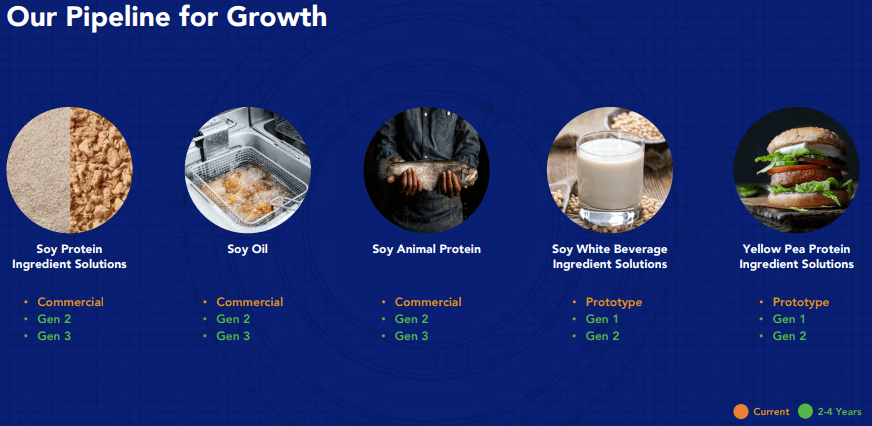

While Benson Hill is developing a cloud-based platform, the company remains an ingredient producer. At the moment, the main commercial products are raw soy protein (tofu, soy sauce, etc.), soy oil, and soy animal protein. In the next few years, the company hopes to introduce soy beverage and yellow pea protein segments, along with further development in their current offerings. Current applications that BHIL is targeting for growth are meat alternatives that remain niche but may lead to high growth, the larger processed meat market that offers less growth, and the scoop-able proteins market that is a mix between portfolio fit and growth. The diversity of offerings is important because BHIL needs products on the market to begin aggregating customer data that will feed back into their plant growing and manufacturing processes.

BHIL BHIL

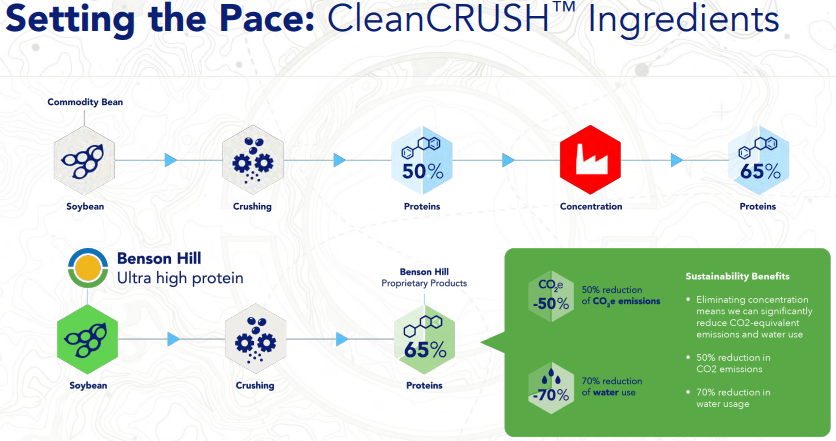

The main goal of the plant-optimization segment is the ability to derive in-house food crops that are engineered to produce higher yields, grow faster, and require less water. An example is the company’s ultra high protein soybeans that require no concentration step to meet the market level 65% protein concentration. This contrasts with commodity soybeans that are only 50% protein concentration and require processing. This extra step reduces costs, CO2 emissions, and water usage. BHIL hopes that their platform allows for an advantage over competitors thanks to higher yield & consistency, lower consumer costs, and better flavor and preference. Further, the company is also moving into other health foods thanks to their subsidiary, J&J Family Farms. This segment has expanded the CropOS platform into other fresh ingredients and may be a further growth path in case consumers frown upon plant-based meat replacement.

BHIL BHIL

Financials

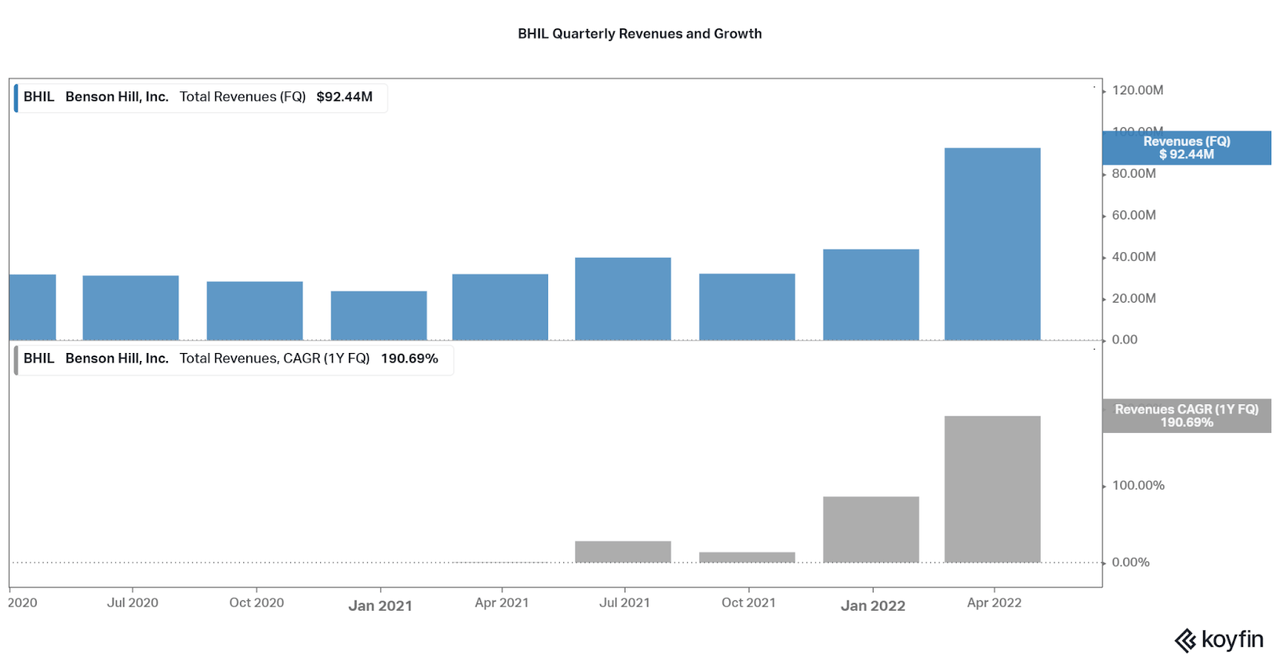

There are both positives and negatives to Benson Hill’s current financial state. The first major consideration is strong revenue growth of over 50% for the past two quarters. In fact, the last quarter was extremely strong as revenues jumped to $92 million, up 190% YoY. This is thanks to the acquisition of a production facility in Iowa for the TruVail soy ingredient line of products. With this, BHIL guides for $315-$350 million in revenues in the soy ingredients revenue segment for 2022. Currently, the platform remains non-proprietary as the cloud platform gets underway, but the company expects ~80% of revenues to be fully in-house by 2025-2027. By that time, we should be able to analyze the initial benefits of full vertical integration. While growth will be strong until that point, I would not fault investors for waiting until the financials are more transparent, especially as I bring up some weak points next.

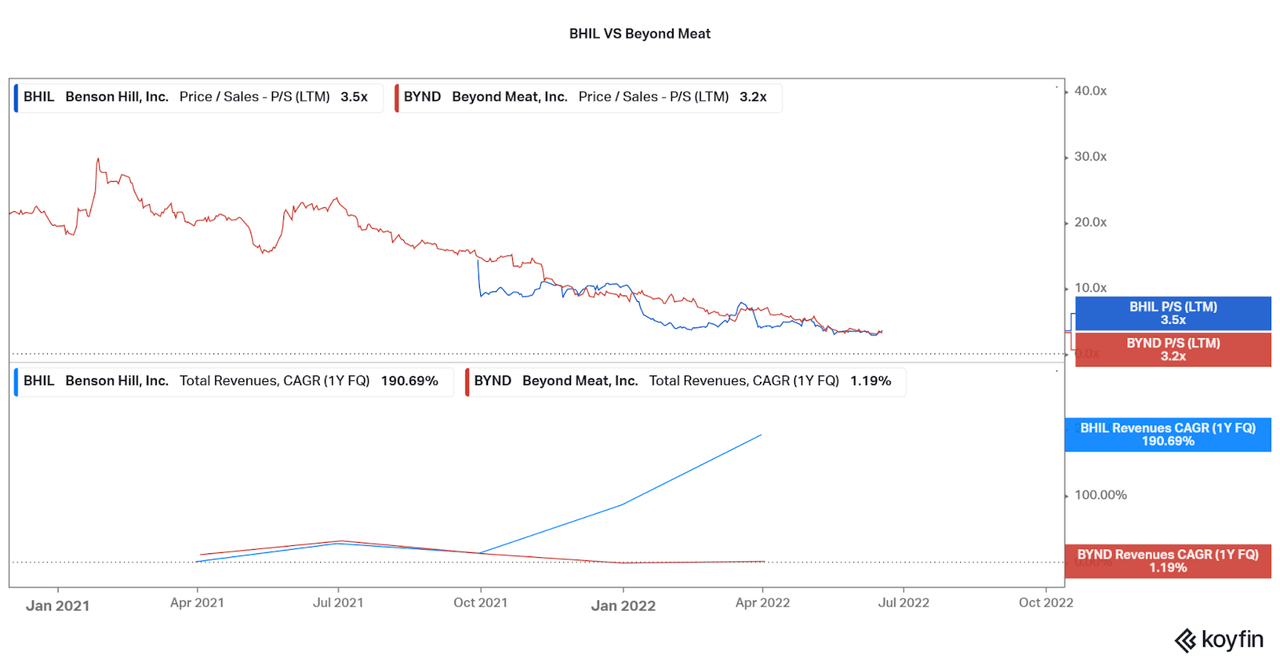

Koyfin

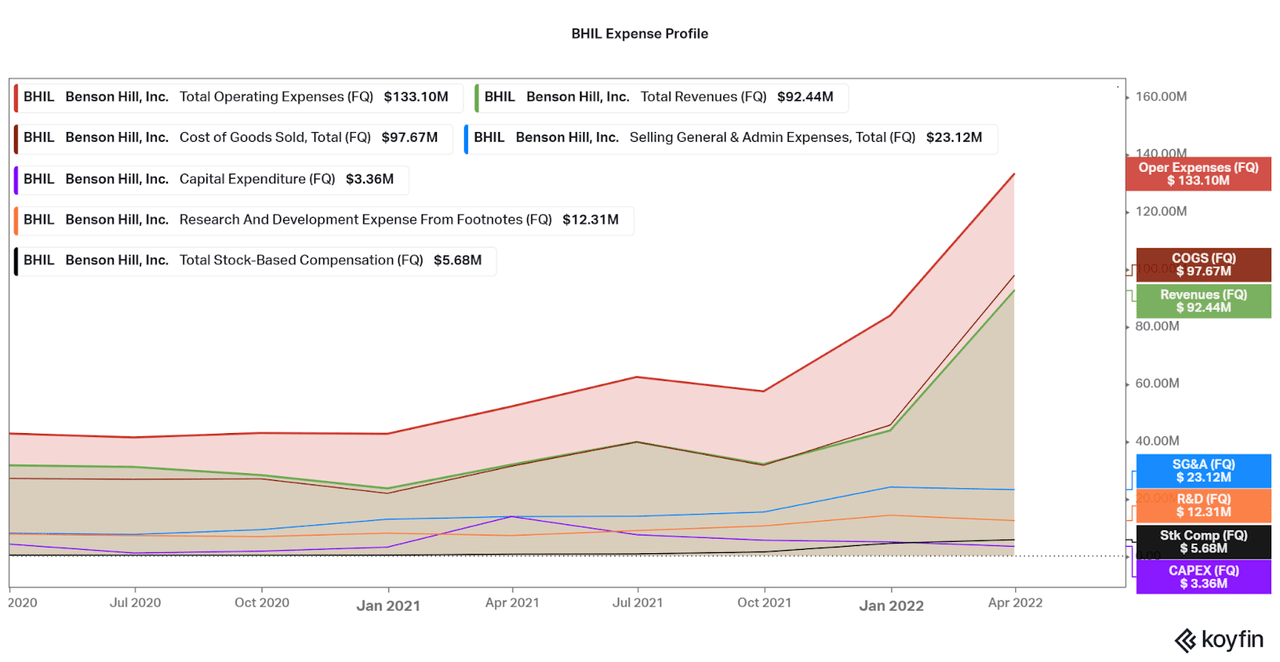

With fast revenue growth comes steep losses. However, this is a necessary part of an early growth cycle. The problem would be if the expenses are unnecessary or excessive in nature. While losses are reaching up to $50 million per quarter on $90 million in revenues, the chart below highlights how this is mostly based on the cost of goods sold (revenues). While we do not know the exact factors going into the COGS, it is favorable to see that revenues are able to rise in line with the metric.

Total operating expenses are then tempered thanks to SG&A, R&D, and other metrics remaining in a far less impactful linear growth rate. As the company pulls back from increasing production and investing in growth, we should see revenues rise above COGS, and then total operating expenses in time. Over the next five years, the company expects to increase gross margins to 35-35% as the cloud platform innovations and economies of scale kick in. Of course, this remains speculation, so we will have to see how the financials pan out.

Koyfin

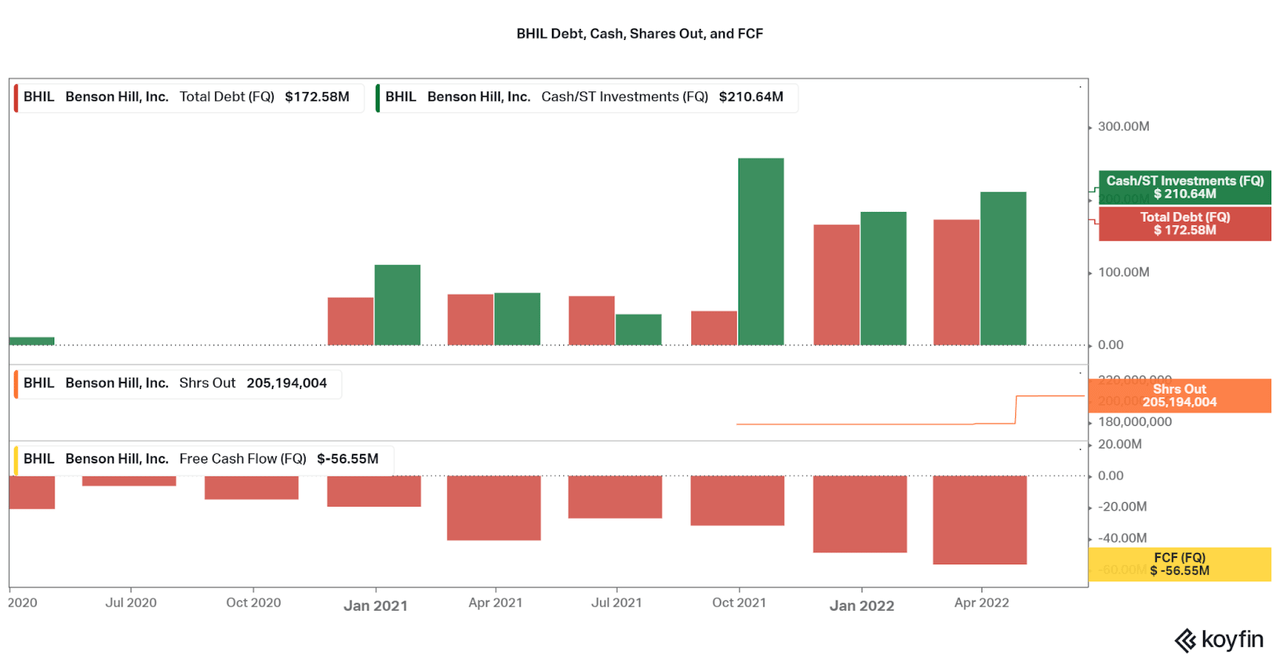

Benson Hill IPO-ed in 2021 to gain cash to further their development. While this brought on plenty of cash to utilize, the company also issued long term debt. At current quarterly losses, current cash on hand only supports up to a year of operations, although the company did state a desire to both dilute, as seen with the increase in shares, and issue more debt. As a result, I find the balance sheet is quite weak and we would have to see significant margin improvements over the next few quarters before I find the company to be healthy.

Koyfin

While profitability and the balance sheet are weak points that must be thought about carefully, a strong point in my eyes is the current valuation. At a 3.5x trailing P/S, significant amounts of risk and a lagging market are priced in. This can be seen by the relation in share price to larger peer, Beyond Meat (BYND). While Beyond has stagnated in growth over the past year, it trades at the same valuation as Benson Hill. I find this to be a chance for BHIL to outperform peers as revenues continue to increase as the company scales in size. However, I am sure that continued weakness in Beyond Meat will weigh heavily on BHIL’s valuation as investors are betting on the plant-based meat market rather than the individual companies’ performance. Thankfully, BHIL investors have the strong revenue growth, diversity of platform/applications, and access to the larger soybean market (Beyond does not seem to use soy) and this may allow for outperformance as BHIL expands product lines over the next few years.

Koyfin BHIL

Conclusion

While the plant-based foods industry offers poor investor sentiment at the moment, mostly driven by the poor performance of Beyond Meat, at the same time, Benson Hill is not attempting to replace meat directly or alienate consumers. It seems BHIL is attempting to become a leader in already established soy-based segments and then use operational and production excellence to drive profitable moves into other segments. This can only be possible with the success of the AI and Cloud-based platform optimizations, and only time will tell. However, early success in soybean protein content boosts may be a good signal for the future. At the moment, I will remain wary of the segment, but will be keeping a careful eye on BHIL’s progress. For those who are interested in investing in the plant-based food market, I will say that BHIL seems like the best long-term bet, along with Where Food Comes From (WFCF), which I covered here. Certainly worth further consideration.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment