Joe Raedle

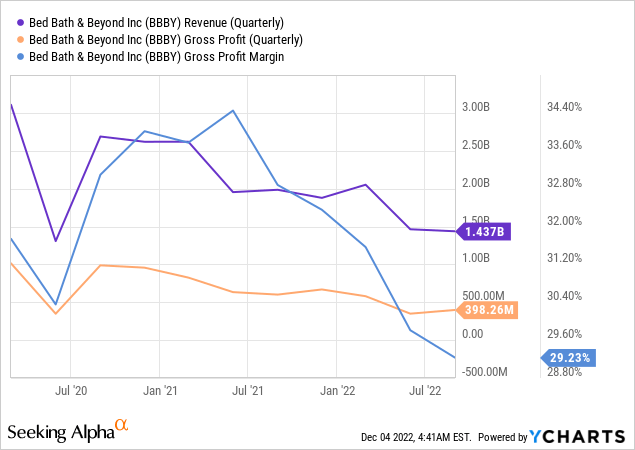

The financial situation of Bed Bath & Beyond (NASDAQ:BBBY) has deteriorated materially since I last covered the company in the summer. The Union, New Jersey-based firm has since released fiscal 2022 second quarter earnings that saw revenue come in at $1.44 billion a decline of 27.6% over its year-ago quarter and a small miss of $10 million on consensus estimates.

Gross profit margins declined by around 600 basis points year-over-year with net losses during the period of $366.2 million, up from a loss of $73 million in the year-ago comp.

The period was inherently transitory as management seek to execute a blunt turnaround plan anchored around store closures and job cuts of around 20% across its corporate and supply chain functions. Bed Bath & Beyond expects to close a minimum of 100 stores by the end of 2022 as part of a wider plan to close about 150 lower-producing Bed Bath & Beyond banner stores.

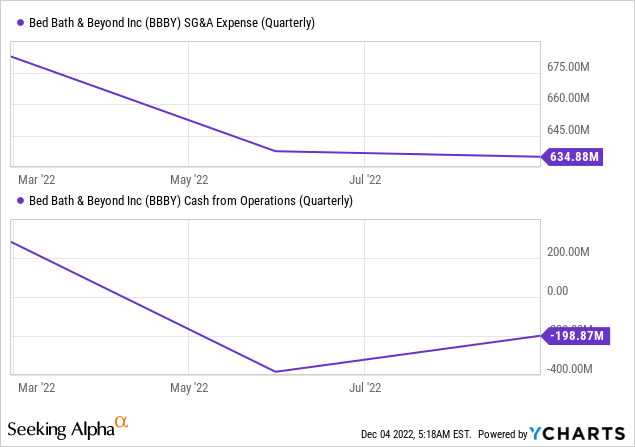

The plan is to reduce SG&A expenses by around $250 million by the end of fiscal 2022 and there are signs that the efforts are already bearing fruit. SG&A expenses during the second quarter of $634.9 million was a marginal improvement from $655 million in the year-ago period. Bears would be right to state that SG&A still increased sequentially and that the decline is immaterial against the extent of the revenue decline. This of course continues to place pressure on the company’s balance sheet.

A Poor Housing Backdrop

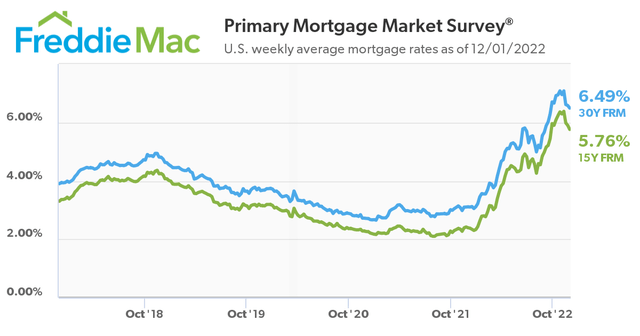

Bed Bath & Beyond faces broader macroeconomic headwinds from rising mortgage rates as the Fed continues to hike interest rates to combat high inflation.

Primary mortgage rates, whilst pulling back from recent highs of over 7%, are still at their highest level since 2002. Critically, the demand for home goods from bedding, kitchen appliances, furniture, and home decor are all fundamentally driven by the demand and growth of new housing. Homeowners are less likely to undertake home renovations if there is a material level of uncertainty around the value of their homes.

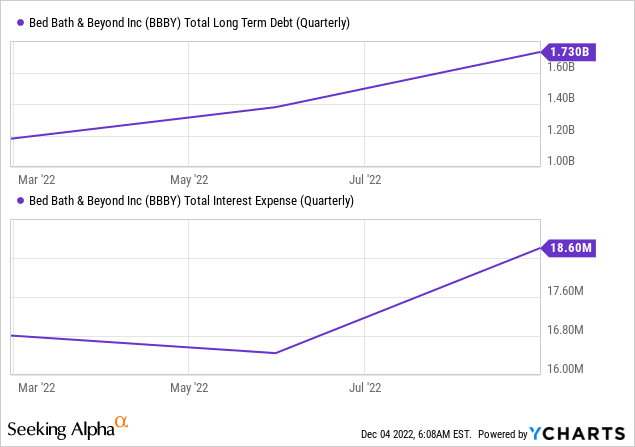

This sets the backdrop for the company’s poor balance sheet going into calendar 2023. Bed Bath & Beyond’s cash, cash equivalents and restricted cash declined sequentially during its second quarter by $304.2 million due to working capital investments in inventory, $43.2 million in share repurchases, and capital expenditure of $226.5 million. The company exited the quarter with an overall cash position of $166.7 million and had to borrow $550 million under their asset-based lending facility to bridge the liquidity gap widened by nearly $200 million in cash burn from operations. Around $690 million in borrowing capacity is still available to the company post-period end as it chases significant cost-cutting to reduce dependency on debt that looks set to swell its quarterly interest expenses.

2023 Might Heighten The Pullback

Interest expense which has been relatively low compared to long-term debt is now on the rise. This will continue to ramp up as the company’s current quarterly operational cash burn rate exceeds its cash on hand to force Bed Bath & Beyond to depend on more debt to bridge its liquidity gap. Large-scale layoffs also have a near-term impact of increasing expenses as severance payments get aggregated and paid out within a short time frame.

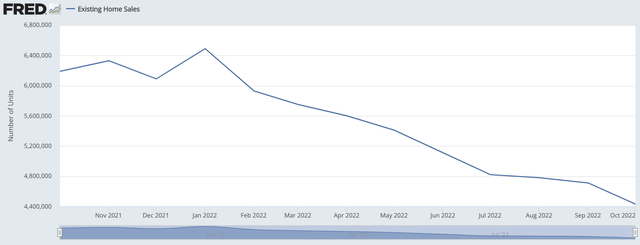

With the FOMC set to hike rates by a further 50 basis points when they meet in a few weeks, US housing is set to face further headwinds. Existing home sales have been dropping since January with no near-term sign of this trend going in reverse.

The combination of continued macro headwinds, year-over-year revenue weakness, and well-entrenched cash burn cloud the outlook for the company in the new year. Apes are betting that the turnaround will help lift sentiment, but the largely cost-cutting endeavour will not be enough to induce much-needed demand. Demand for domestic wares in the current Christmas shopping period will likely be among the weakest on record and could act as a catalyst for further downside when results are released later next year.

This raises the question of what exactly the bull case is for Bed Bath & Beyond. Indeed, bulls would be right to flag near-term bankruptcy as unlikely as a result of the currently immaterial quarterly interest expenses on long-term debt. These were mainly issued back in 2014 at materially lower rates than the company would have been able to access today. However, the ABL facility will add to the company’s quarterly interest expenses at a time when progress against operational cash burn is needed. The $150 million at-the-market offering program further adds to the headwinds facing common shareholders as dilution is heightened against shares trading at record lows. The Apes would be well placed to exit their positions before the new year as it’s hard to see where any near-term positive sentiment will come from.

Be the first to comment