Investment Thesis

Bed Bath & Beyond (NASDAQ:BBBY) is not worthwhile investing at this valuation of $600 million. Because, even though it has more than $1.4 billion of cash and equivalents on its balance sheet, it is offset by $1.4 billion in debt.

Meanwhile, its net sales for its quarter-to-date results are down 42% year over year. Furthermore, Q1 2020 has not yet finished, and its stores remain closed throughout Q1 2020, which finishes at the end of April.

The underlying dynamics for this retail store were difficult before the present pandemic, but now, they are going to get even more challenging. For now, the stock still prices in too much optimism.

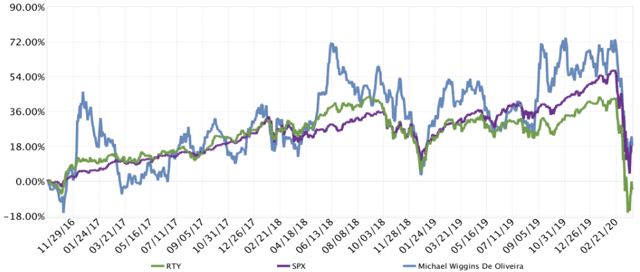

Brief Background to My Position

I was previously LONG BBBY for roughly two years from $21 per share to about $12 per share. I was fortunate to have aggressively averaged down at $9.xx, so I came out at breakeven. I bring this point up only to declare that I know and understand the dynamics here at play incredibly well and to be open, candid, and transparent with you.

This is my opinion only, and while I hold a total lack of emotion towards this (or any stock), and while I’ll attempt to objectively report reality, I’ve been wrong in the past and will be wrong again.

The Critical Trend

Below is Bed Bath’s most critical aspect, its same-store sales:

Source: author’s calculations, press statements

The most important aspect to realize here is that, if back in 2017-2018, as the stock sold off dramatically and then during 2019, there was the semblance that things might not be so bad after all, the graph above does away with that illusion.

Bed Bath’s business model continues to be challenged throughout the whole of 2019, irrespective of what the share price was leading investors (myself included) to believe. But what about looking ahead?

Sales Down; Dividend Cut; Buybacks Cut; Capex Cut; Executive Compensation Cut

Here’s what Bed Bath’s management offered in terms of looking ahead:

For the March period, we’re able to share preliminary unaudited financial performance data. Overall, net sales across all banners were down approximately 31% versus the prior year March period.

[…] For the first two weeks of April, the fiscal quarter-to-date overall decline in our total net sales was around 42%.

Having said that, as one of the analysts on the call noted, this implies that April’s first two weeks are probably down close to 60% year over year.

Given this sort of declines, management has absolutely no choices left asides from cutting back on all cash outgoings.

The company is now playing for survival at least over this present year. Next year, comparisons will be really easy, but will investors be willing to hold on and hope that there’s a bargain at $600 million market cap? Nope, they will not. But, is there any value here?

Valuation – The Most Important Question

I’m a deep value investor, and I was invested in this stock for a considerable amount of time, so I know better than many investors that even a bad company at the right price can be profitable.

But the company needs to have a way of releasing value back to shareholders. Companies with strong cash positions in tough businesses are very unlikely to liquidate, as management has nil incentive to get out of a job. Management manages. Management’s incentives are directly and blindly to plow ahead irrespective of the company’s prospects.

Having said that, I have no question that, once everything calms down and consumers are once again confident enough to rub shoulders with each other, Bed Bath will continue to exist.

My whole assertion though is that there is very limited upside potential here at $600 million market cap. Even if there is likely to be some upside potential, there’s a lot more downside too.

Ultimately, when it was all said and done, Bed Bath did generate close to $590 million of cash flows from operations. However, consider this, of this $590 million, there was $506 million that came on the back of liquidating inventory.

Also, there’s was an additional $27 million in cash that was added back from the loss on sale-leaseback transaction that together bolstered cash flows from operations up by close to $530 million.

Looking ahead, these cash flow entries are non-recurring, they are one-off in nature. Indeed, looking ahead, we know that Bed Bath has aggressively cut back on its capex, but it can’t do away with deploying $250 million towards essential plans.

These can be argued as being important for long-term growth, but if a company keeps deploying ”growth” capex and, at the same time, it keeps reporting revenue declines year over year, at some point, investors have to question whether this ”growth” capex is indeed being wisely deployed.

Upside Potential?

Bed Bath’s inventory is getting liquidated as much as it reasonably can. After the markdowns on the obsolete and seasonal merchandise, Bed Bath still holds $2 billion worth of inventory at cost, which is worth more than its market cap.

However, at this moment in time, Bed Bath is simply attempting to ”control” its cash burn. And given that its stores remain close for another few weeks, this puts the company on a challenging path ahead. Given this overall uncertainty, management decided it was prudent to draw down the $236 million of revolver still available.

The Bottom Line

Bed Bath is likely to see significant volatility in its share price, given that its shares are 57% shorted. Nonetheless, at least over the next twelve months, this investment has significantly more downside potential than its $600 million market cap valuation implies.

Even though its balance sheet carries more than $1.4 billion in cash, it is presently burning through cash flows, and it carries $1.4 billion of debt, too.

Furthermore, its net sales are down for the quarter more than 40% year over year. On balance, this investment is too speculative for now, and this stock is best avoided for at least twelve months.

Did You Find This Article Helpful?

Investing is about growing our savings and avoiding risky investments. Investing is about being selective when choosing a diversified portfolio of opportunities.

Are You Pressed For Time?

I do the hard work of finding a select group of value stocks that grow your savings.

- Honest, helpful and reliable service.

- Invest by avoiding losers.

- I’m very hardworking and make balanced arguments for my stocks.

- Help you consider the importance of a balanced portfolio

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment