M. Suhail

I’ve written it before, and no doubt I’ll write it again. Those people who’ve had the misfortune to see me dance know that my timing isn’t always perfect. With that in mind, I want to write about Bed Bath & Beyond Inc. (NASDAQ:BBBY) again. In February of this year, I took a small, speculative position in the company at a price just under $16. About five months later, I abandoned the stock at a price just over $5, as my view of the company deteriorated from “troubled” to “very troubled.” People sell stocks at losses all the time, though. It’s been said that the world’s greatest investors are correct barely more than 50% of the time. The situation here became downright insulting for me, though. Immediately after I sold my shares, the stock rocketed to just over $23, before crashing back to the current price of ~$6.65. Had my timing been much better, and had I waited five weeks, I could have sold my tiny stake at a nice profit.

There are three ideas that I want to explore in this article, so I’m about to explore three ideas in this article. The first of these involves using stock price as proof of anything. The second involves trying to now work out whether Bed Bath & Beyond is a good buy or not. The third involves me droning on, yet again, about how short put options are great at reducing risk and enhancing returns.

It’s time, yet again, for me to offer up my “thesis statement” paragraph for my readers. I offer this service to readers as a way for them to save time. The thesis statement paragraph offers them the highlights of my arguments at the beginning of the article, which then gives them the option to avoid wading through my weaselly justifications for a given decision. There’s no need to thank me or throw around words like “hero” and “saintly” for this. Knowing that I’m making the lives of my readers just a bit brighter is thanks enough for me. That written, I wouldn’t object to a bronze statue commissioned in my honor. I’m of the view that it’s very common for investors to use stock price itself to justify a position, and that is a very flabby argument, especially on a site such as this. Bed Bath & Beyond is even less compelling an investment now than it was when I abandoned the name some months ago. I could be persuaded to buy back in, but I’d need to see some significant improvements in the overall economy. In particular, I’d need to see inventory levels come down, as I think the probability of a write-down increases by the day. This will sink the already terrible earnings here. Finally, the put options I wrote previously did less badly than the stock. This highlights the fact that even in the case of what was obviously an unmitigated disaster, puts are the safer instrument.

Does Price “Prove” Anything?

We are a very diverse crowd of people who come to this website. Some of us are young, some of us are much more advanced in years. Some of us are “outdoorsey” and the some among us are very much “indoorsey.” Some of us like playing football, and the coolest among us prefer playing Dungeons & Dragons. Some of us like one very popular carbonated soft drink, others prefer a slightly different tasting carbonated soft drink, and so on. Forgive the tautology, but the one thing that we all have in common is that we’re here, on this site, to “seek alpha.”

The foundational philosophy of this site is that a stock’s price is often “wrong.” The whole point of this enterprise, the thing that attracts upwards of a dozen readers to my articles, for instance, is that we’re trying to spot discrepancies between “price” and “worth.” Given that you’re on a site that has this as a foundational principle, dear readers, you’re on very shaky rhetorical ground when you use price to try to prove the rightness or wrongness of a given call. I’ve experienced this in my writings a few times over the years. You put out a call on a given stock, the price moves against you, and the crowd starts roaring about how naive you were for buying/selling prematurely.

The crowd eventually goes silent, either when your views are vindicated, or when subsequent articles displace yours. The troublesome thing about this phenomenon, in my view, is that when readers use price itself as “proof”, they’re doing themselves a disservice. This is because what the market giveth, the market taketh awayeth just as quickly. This was the case with the stock of Bed Bath & Beyond when it “roman candled” to the mid-$20s, only to crash back down again. So, lesson one to readers on this site would be: you’re on a site that is philosophically opposed to the idea that price proves anything, so act accordingly. There’s a decent chance that a call can be wrong, but price change demonstrates nothing.

Bed Bath & Beyond Update

The company hasn’t reported financials since I last wrote about them, so there’s no real financial update this time. For those who missed my latest missive on this name, I’ll offer the highlights of my take on the financials:

-

Sales and net income evaporated during the most recent quarter. Revenue was off by about 25%, and net income fell from a loss of $50.8 million to $358 million.

-

The comparison year (2021) wasn’t anomalously good, so the recent results were abnormally bad. As of the latest financial reports, the company is making about 43% less money than it did prior to the pandemic.

-

The capital structure, too, has deteriorated massively, with long-term debt up by $197 million, or 16.7% relative to the same time last year.

-

Merchandise inventory was about 12.5% higher than the same time last year, and sat at about $1.76 billion, raising the specter of a fairly massive write-down.

Now that we’re all up to speed about the most recent financial performance, it’s time to review the valuation. As I’ve written many times on this site, I’m very comfortable buying a so-called “cigar butt” if the valuation is right. Put another way, a very troubled company like this one can be a great investment if you pick it up at a sufficiently cheap price.

The Stock

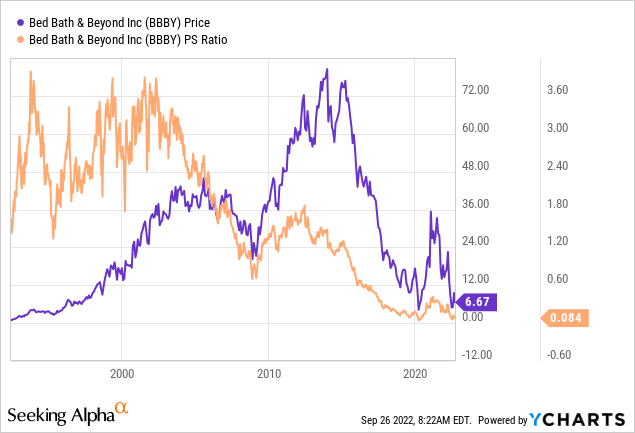

When I got out of this stock previously, the shares were trading at a price-to-sales ratio of ~.064. Obviously, I couldn’t review the price to earnings or price to free cash flow, because those are both distant memories at this point. Anyway, fast-forward to the present, and I’ll admit that the shares are very near the lowest in history, which is compelling. The market is paying less for $1 of future sales than they ever have. That said, the shares are actually about 31% more expensive than they were when I left the stock during the summer.

The day I sold my shares, the market capitalization of this company was about $407 million. It’s now $531.4 million. The capitalization has increased by about 30% over the last few months, in spite of the fact that there’s little evidence that things are improving here.

A stock can keep reaching all-time lows on the way down, and that doesn’t make it a compelling investment. A stock can go on to make lower and lower lows. In order to get excited about this stock again, I’d need to get excited about the business again, and there’s nothing on the horizon to get me excited about that I’m afraid. The fact remains that this is a business that is dependent on a robust economy, and there’s growing evidence that the economy is actually rather soft. For that reason, I’m going to keep watching this company, but I’m not going to plow back in until I see some evidence of a turnaround in the business, or at least a reduction in losses.

Options As Alternative

My regular victims know that I’m a very big fan of selling deep out of the money put options on companies that I would like to buy at prices that I consider to be very attractive. My history with Bed Bath & Beyond puts was singular in that these were the first I recall ever selling at a loss. While that’s not a great outcome for obvious reasons, I did relatively much better with the short puts than I did with the stock. Specifically, I lost $4.15 per contract and lost $10.88 per share on the stock, so I did much less badly on the puts than the stock. “Less bad” is hardly a ringing endorsement, but in my experience, the investing game is mostly about preserving capital, so limiting losses is very decent in my view.

Again, my short put trade on Bed Bath & Beyond was unique in that it was the first and only time I ever closed out a short put trade at a loss. Normally I sell deep out of the money puts at very attractive strike prices and accept whatever happens. The fact that this, my worst ever short put trade, was still superior to the performance on the stock speaks volumes in my view. If investors aren’t familiar with the risk-reducing, yield-enhancing potential of short puts, I would recommend they do so. They are often a much better way to “play” a company than the stock.

Be the first to comment